(overly optimistic in bull markets, overly pessimistic in bear markets)

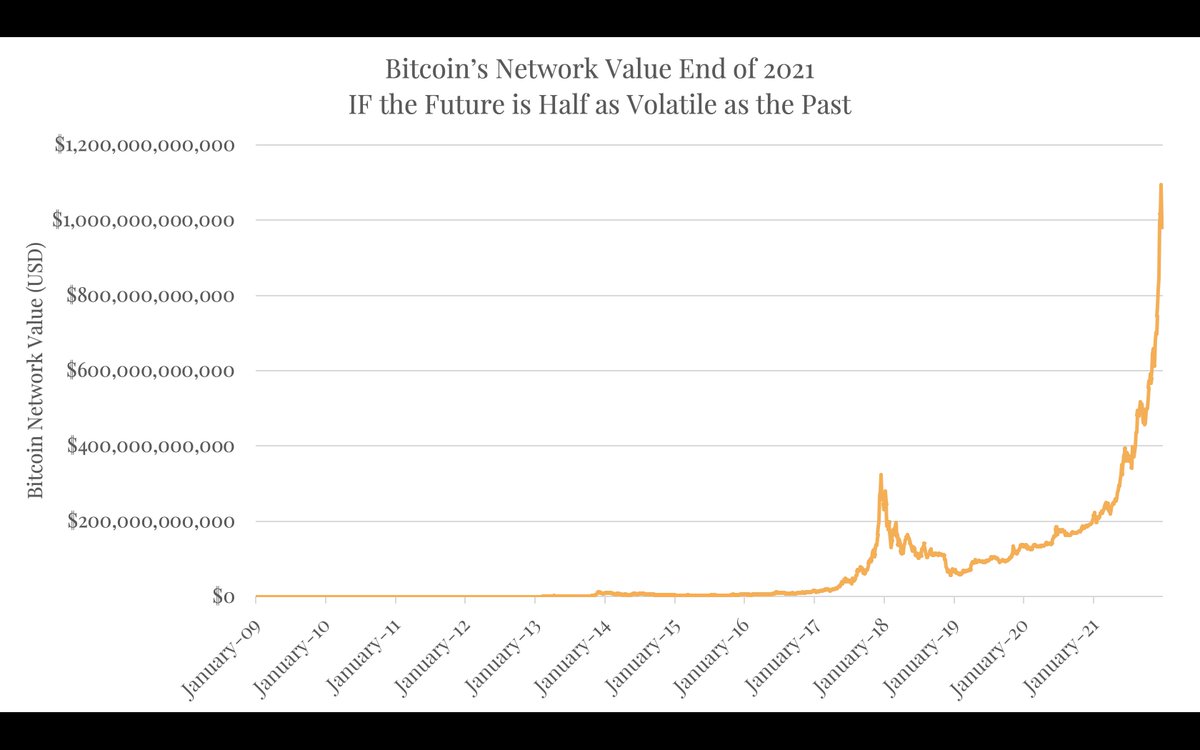

$BTC could do so while being half as volatile as it was from April 2015 to end of 2017.

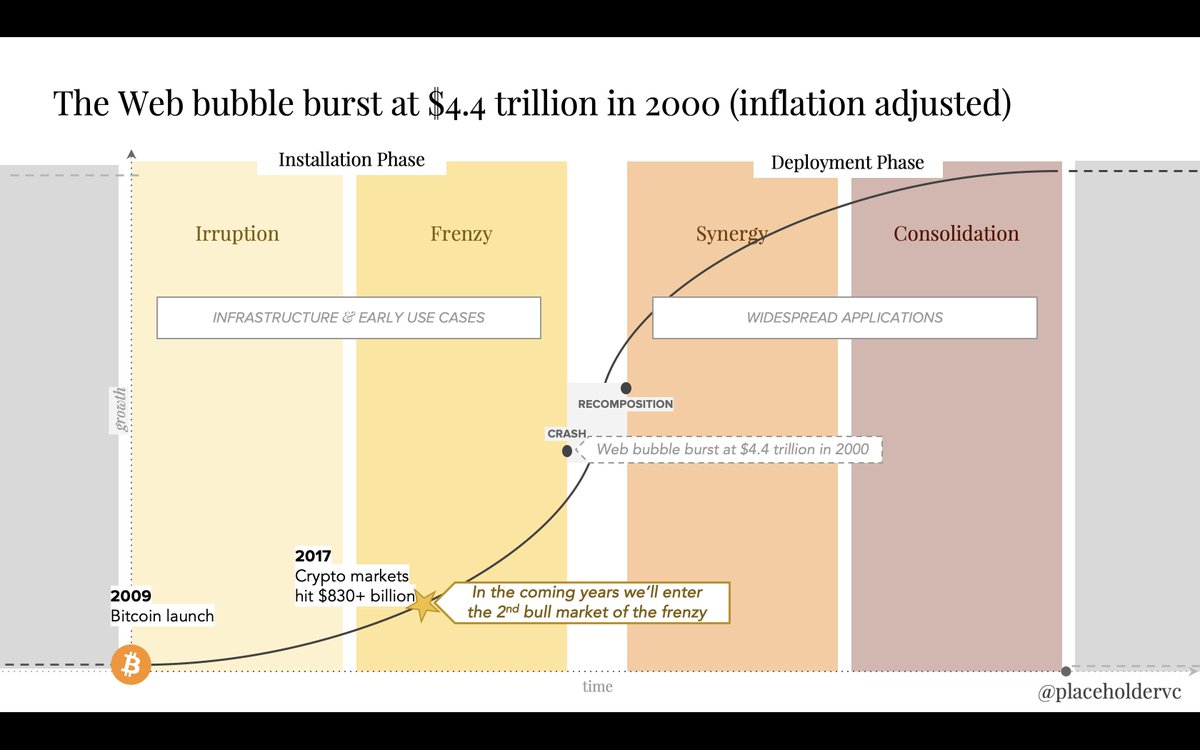

(yes, 50% price inflation for the dollar since 2000!)

+ With the tech & telecom boom we tinkered with the technology and left the structure of finance mostly intact.

In crypto we’re tinkering w/ the technology and structure of finance.

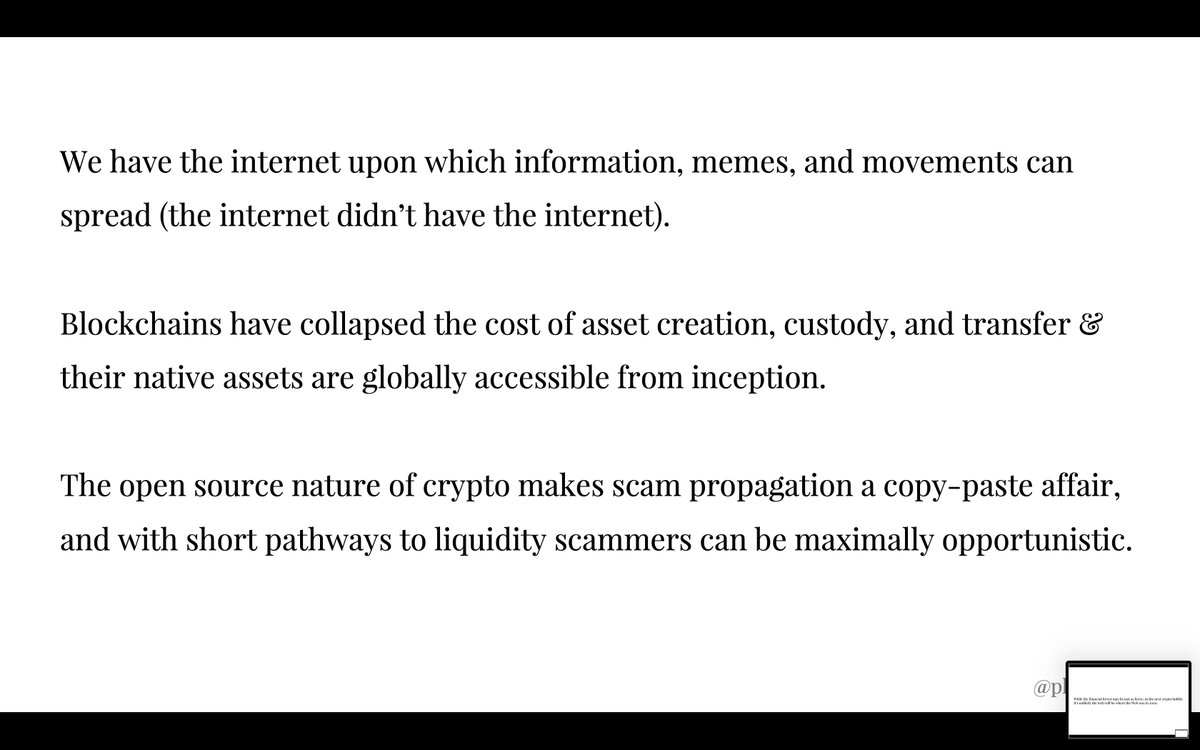

(Yes, a cousin of the "circular economy of eyeballs" that Web companies experienced. Expect boom & bust).