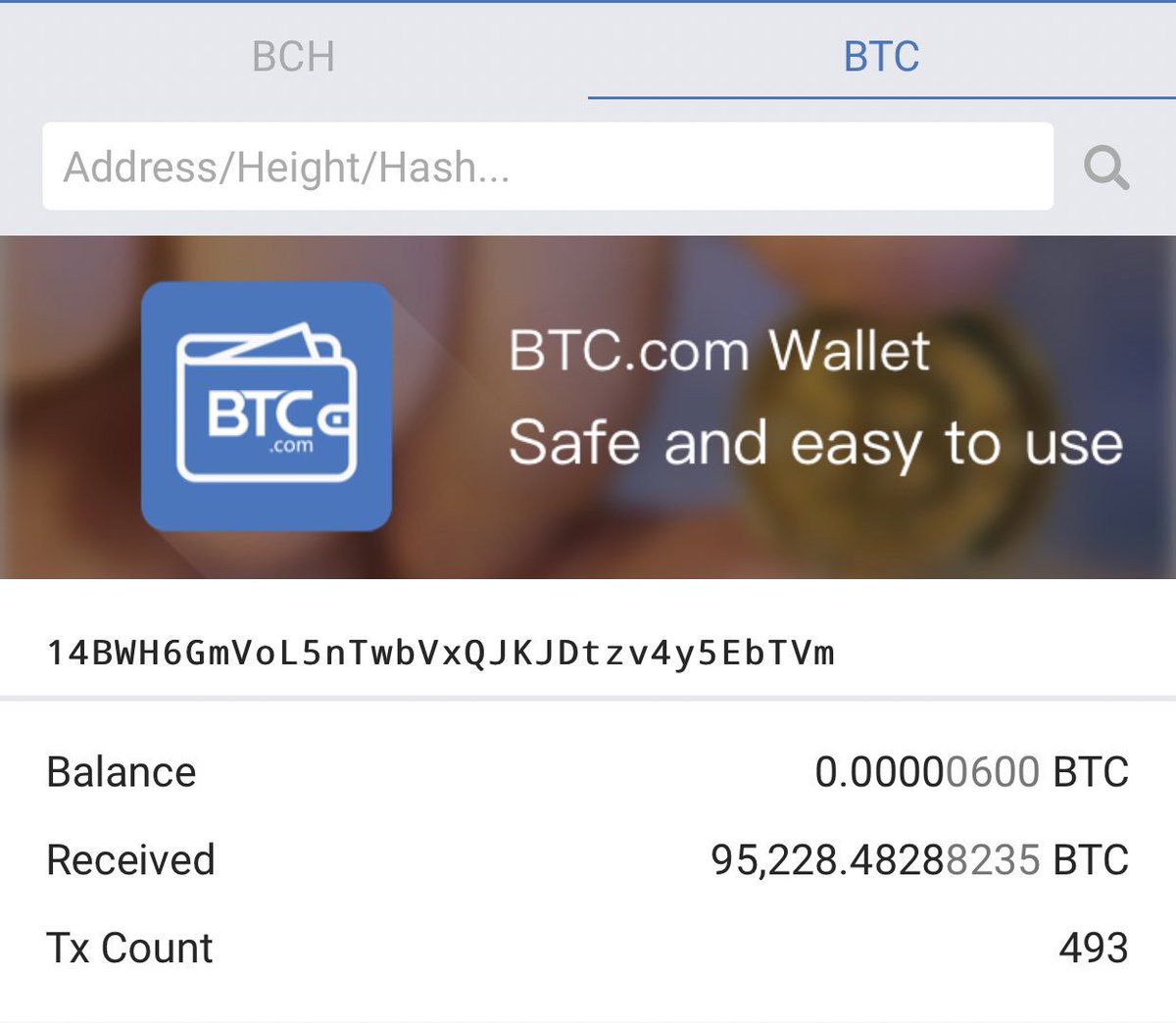

Which they had, before FATF made it costly or impossible

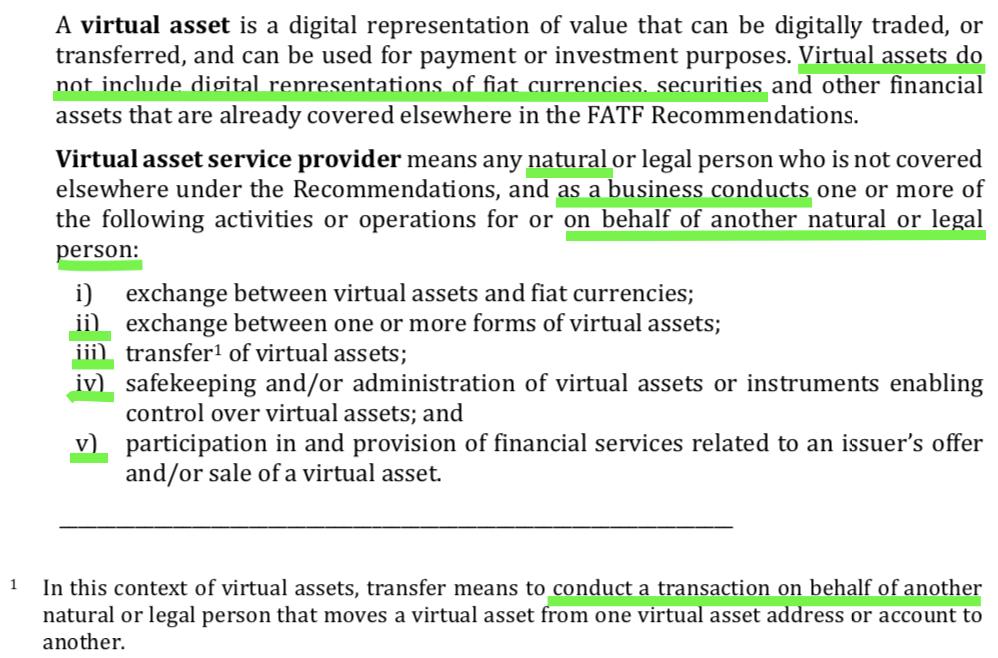

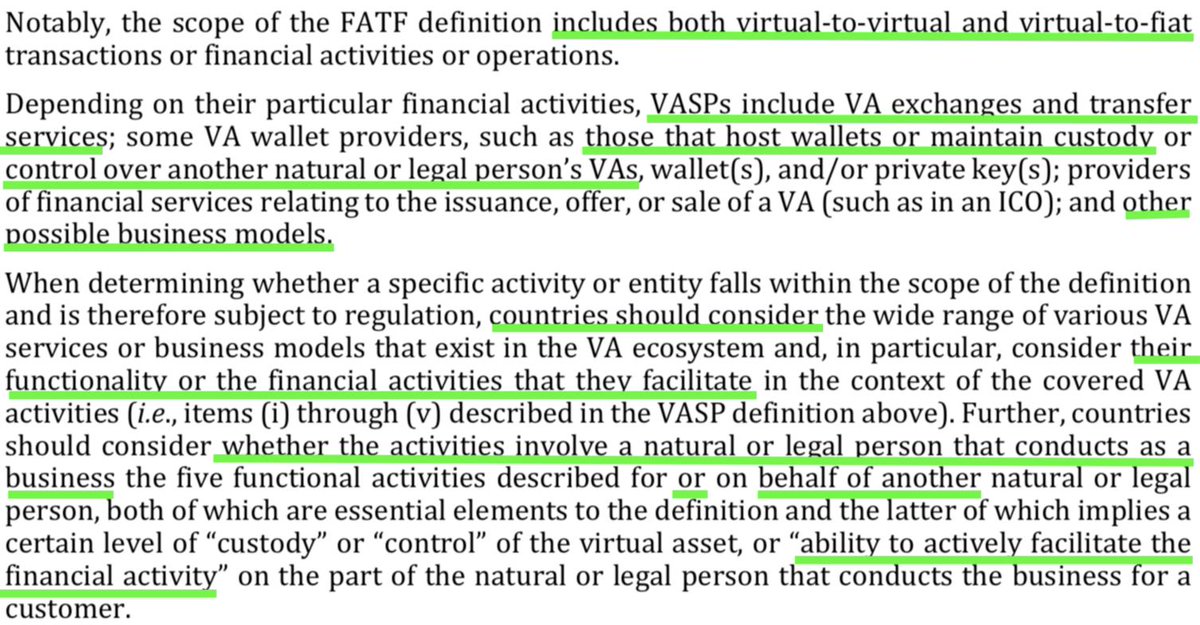

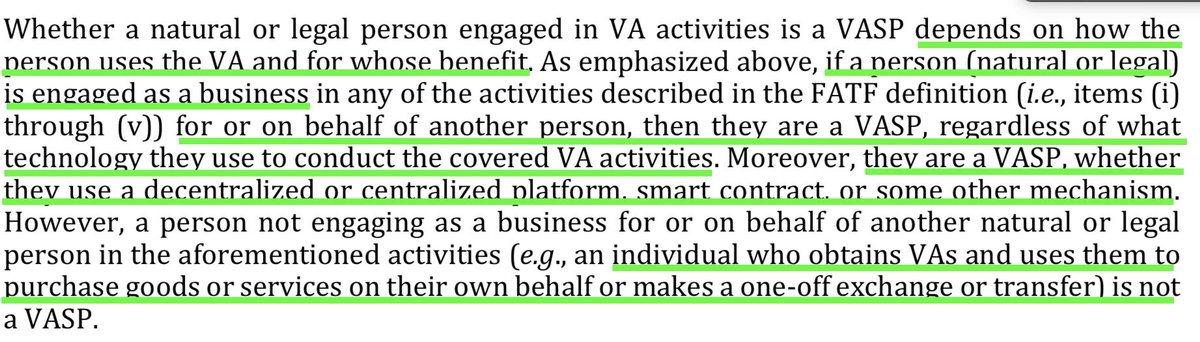

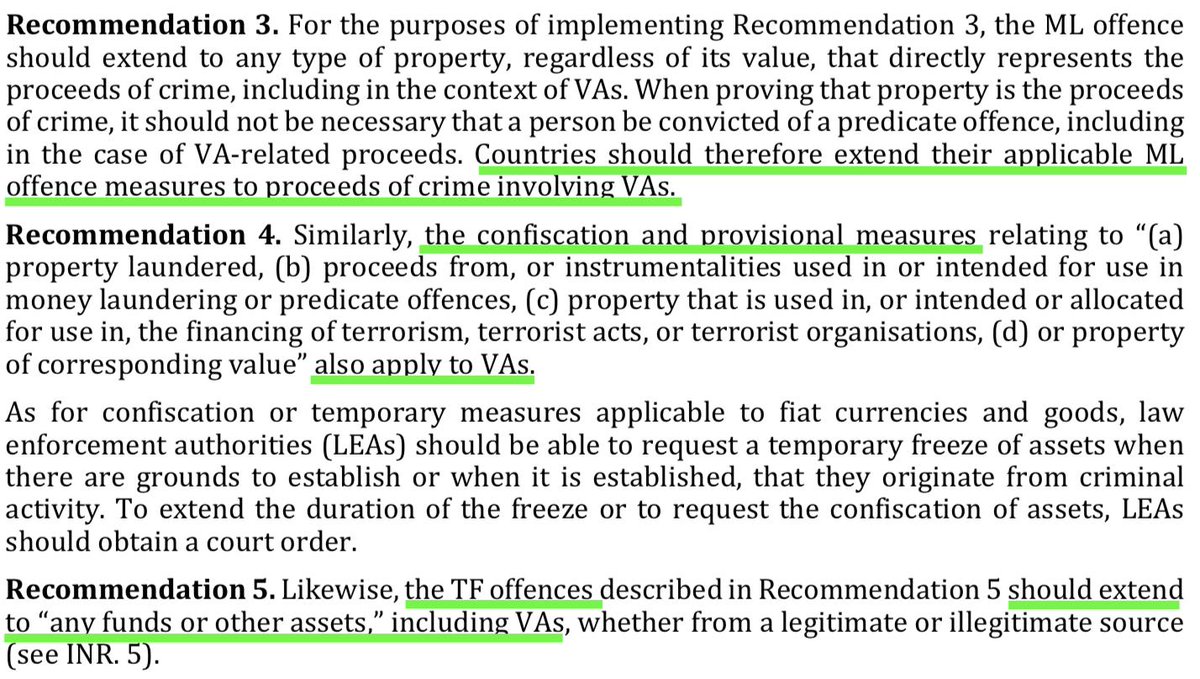

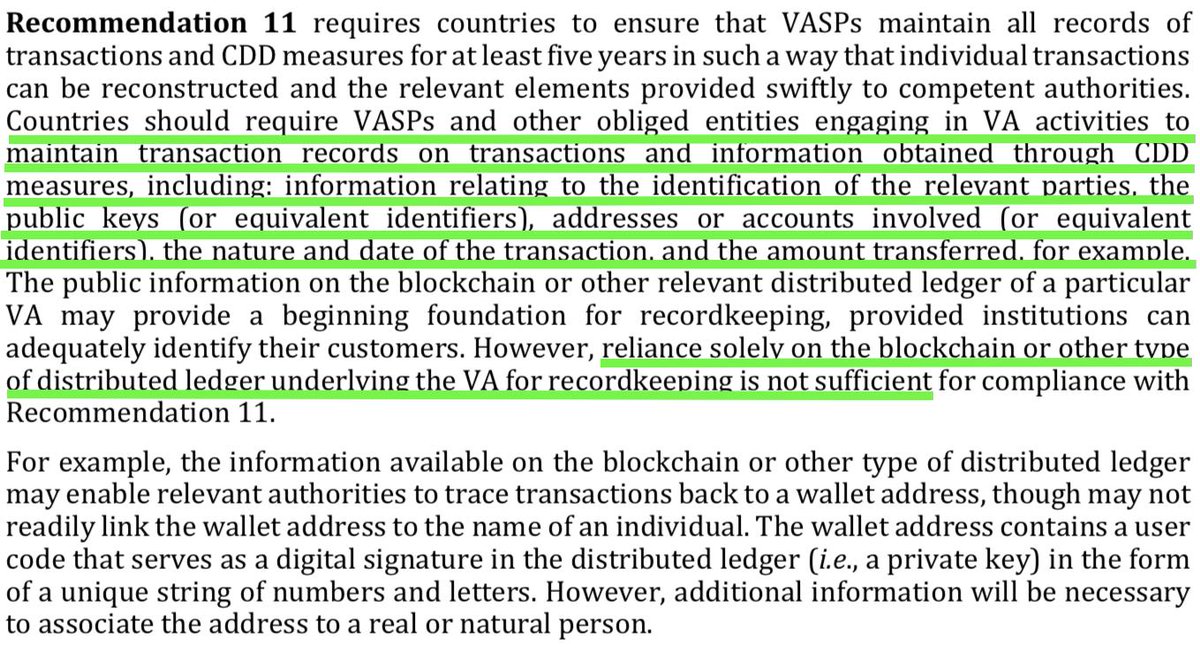

For the most part, Guidance focuses on including Virtual Assets(VAs) and VA businesses(VASPs) into established scope of AML/CFT regulation standards(recommendations)

Note: CDD - customer due diligence

Full doc:bit.ly/2IDGN4G

Those will probably take much longer and offshore crypto havens will persist for years-yet the future market structure implications of the Guidance are significant

This means innovators focusing on catering to "unbanked" or privacy-focused pockets of society will face a pushback. Users get stopped by hurdles..

@ercwl sees it differently, though:bit.ly/2X0SUwz