One nerd’s perspective on the financial planning world… CFP, #LifelongLearner, Entrepreneur-In-Denial, Advisor #FinTech, & publisher of the Nerd’s Eye View blog

How to get URL link on X (Twitter) App

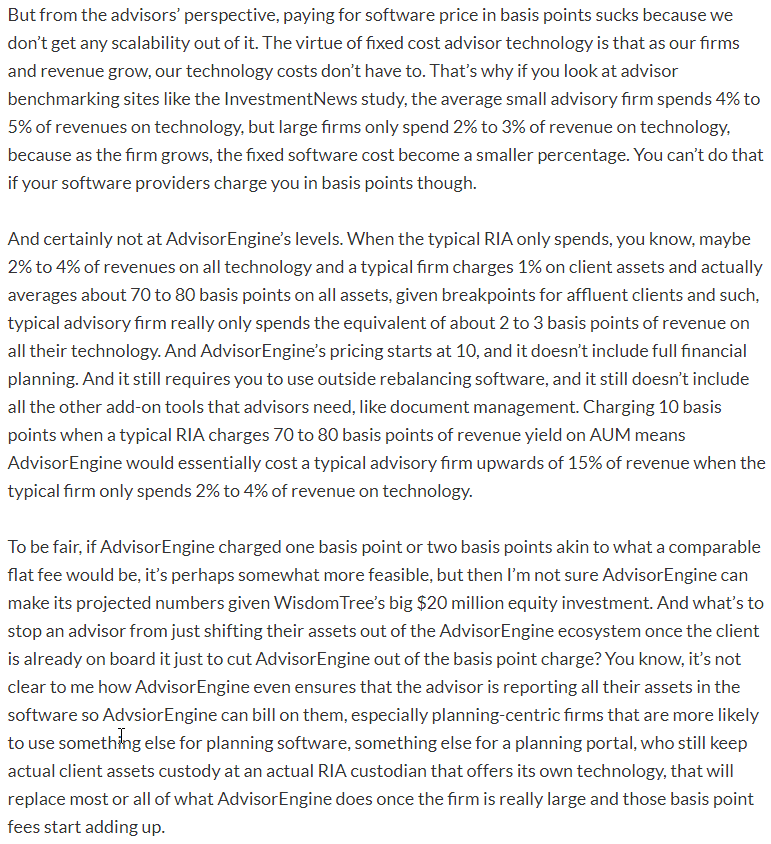

https://twitter.com/ryanWneal/status/1403467256517074945The Robust Wealth acquisition by Principal in 2018 was one of multiple asset managers acquisitions of "robo-advisor-for-advisors" platforms, along w/ WisdomTree buying AdvisorEngine, after Invesco acquiring JemStep, after Blackrock acquired FutureAdvisor. kitces.com/blog/model-mar…

The rumor when United Capital was on the block to be sold was that Duran hoped to position UC as a #FinTech company (and sell for FinTech multiples). Instead, they 'just' got a great valuation as a mega-RIA business.

The rumor when United Capital was on the block to be sold was that Duran hoped to position UC as a #FinTech company (and sell for FinTech multiples). Instead, they 'just' got a great valuation as a mega-RIA business.

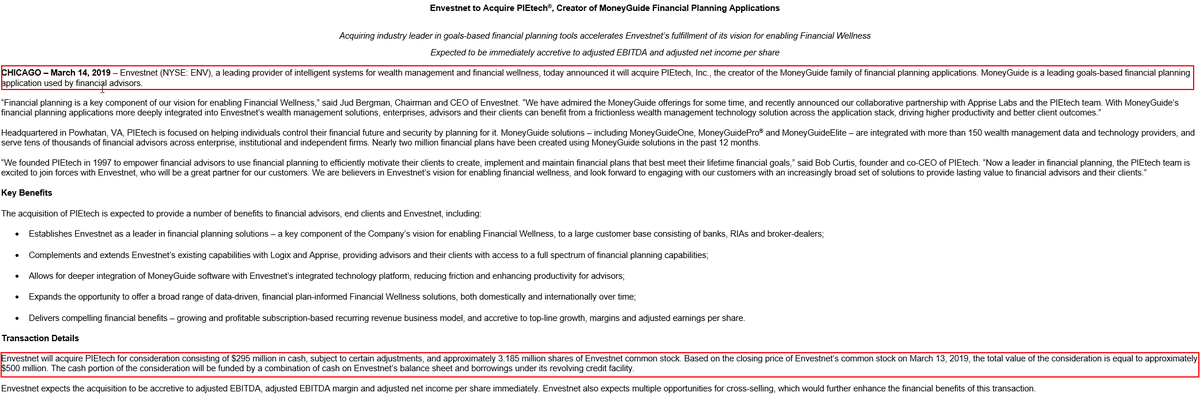

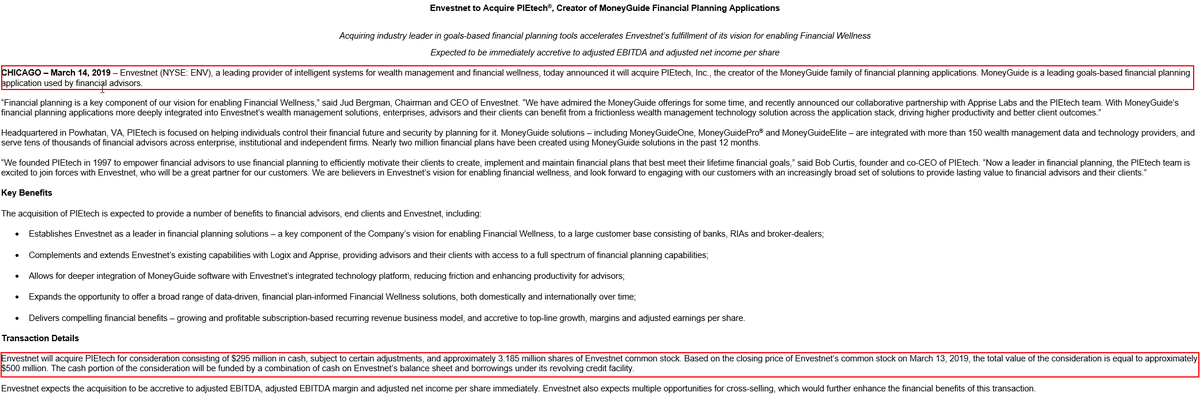

From the strategic perspective, the @MoneyGuidePro deal makes a ton of sense for @ENVIntel. MGP has a massive client base, including a huge overlap with Envestnet's own broker-dealer enterprises. It lets Envestnet expand market share and wallet share where it already is.

From the strategic perspective, the @MoneyGuidePro deal makes a ton of sense for @ENVIntel. MGP has a massive client base, including a huge overlap with Envestnet's own broker-dealer enterprises. It lets Envestnet expand market share and wallet share where it already is.