Managing partner @dragonfly_xyz. Formerly Metastable, @Airbnb, @earndotcom. Effective Altruist. Writer. Former poker pro. One always finds one's burden again.

9 subscribed

9 subscribed

9 subscribed

9 subscribed

How to get URL link on X (Twitter) App

9 subscribed

9 subscribed

1. The risk-free rate has skyrocketed, so on-chain yields are now below off-chain yields. Compound is paying ~3% on USDC, while the Fed Funds rate is ~5.5%. This naturally pulls capital off-chain.

1. The risk-free rate has skyrocketed, so on-chain yields are now below off-chain yields. Compound is paying ~3% on USDC, while the Fed Funds rate is ~5.5%. This naturally pulls capital off-chain.

1/ In the wake of FTX, traders have been wary of counterparty risk from exchanges. CeFi has entered a new low-trust phase.

1/ In the wake of FTX, traders have been wary of counterparty risk from exchanges. CeFi has entered a new low-trust phase.

https://twitter.com/hosseeb/status/16194632035405987852/ My instinct has always been "well, exchanges like NYSE use time priority, so shouldn't blockchains *eventually* do the same?"

/2 Money has a simple API. It was designed over a thousand years ago.

/2 Money has a simple API. It was designed over a thousand years ago.

2/ @AptosLabs's optimistic concurrency, Move VM, account model, and consensus mechanism will let Aptos achieve massive on-chain throughput while retaining decentralization. From day 1, Aptos should support high-throughput use cases across games, social media, NFTs, and DeFi.

2/ @AptosLabs's optimistic concurrency, Move VM, account model, and consensus mechanism will let Aptos achieve massive on-chain throughput while retaining decentralization. From day 1, Aptos should support high-throughput use cases across games, social media, NFTs, and DeFi.

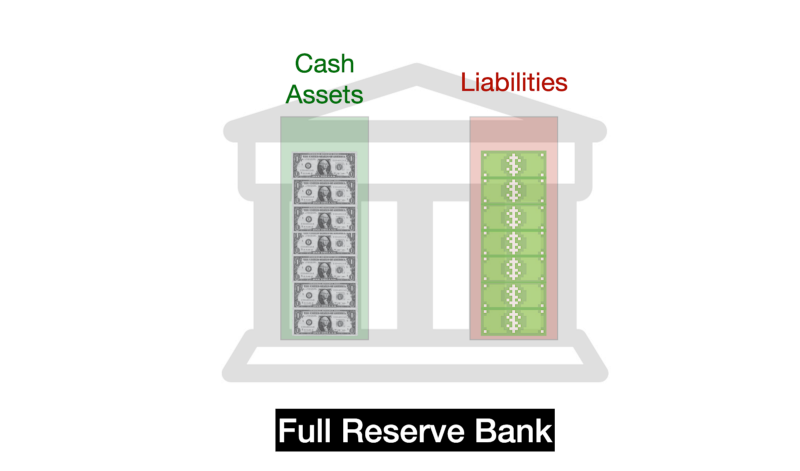

... it begs the question: why would a DeFi bank *care* whether it complies with a US banking regulations?

... it begs the question: why would a DeFi bank *care* whether it complies with a US banking regulations?