Technical Analyst/Blogger/Educator. Blogging on Technical Analysis for 17 yrs. Vested interests in stocks -SEBI RA. Whatsapp 7977801488 for queries & updates

8 subscribed

8 subscribed

8 subscribed

8 subscribed

How to get URL link on X (Twitter) App

8 subscribed

8 subscribed

1) The Constituents tell you the Story

1) The Constituents tell you the Story

According to him both the studies contradicts each other, example, A technical chart will tell you to sell it 20% below your purchase price and as a Fundamental analyst you will double your position at 50% below your purchase price so those things are conflicting

According to him both the studies contradicts each other, example, A technical chart will tell you to sell it 20% below your purchase price and as a Fundamental analyst you will double your position at 50% below your purchase price so those things are conflicting

2) Recession -

2) Recession -

Data Source - MoneyControl 2) The Total AUM of the Multi-Cap Funds is 1.53 lakh crores. 25% allocation to #Smallcap =38300 crores. Current Allocation= 11240 Crores. Potential Buying or Difference to be Aligned = 27062 crores.

Data Source - MoneyControl 2) The Total AUM of the Multi-Cap Funds is 1.53 lakh crores. 25% allocation to #Smallcap =38300 crores. Current Allocation= 11240 Crores. Potential Buying or Difference to be Aligned = 27062 crores.

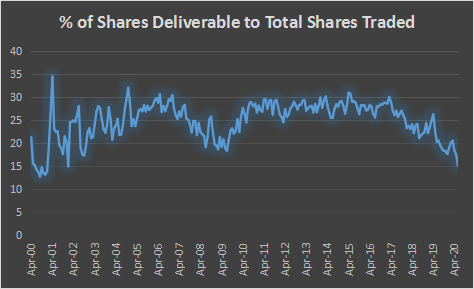

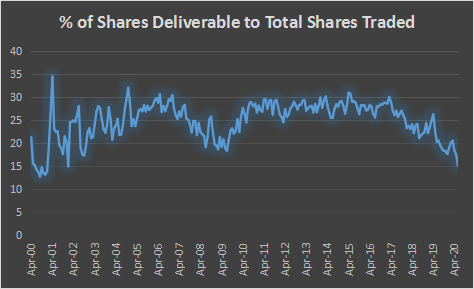

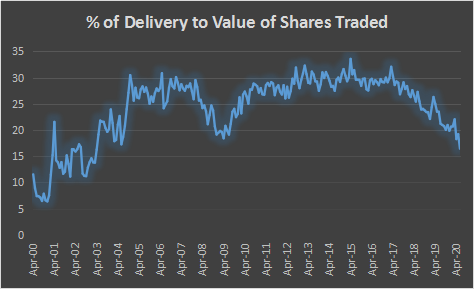

Value of Shares Traded ( Cr ) at the Highest Ever. A peak in this generally an Inflection Point for the long term. For example January 08 value got hit in June 09. What is it now ?

Value of Shares Traded ( Cr ) at the Highest Ever. A peak in this generally an Inflection Point for the long term. For example January 08 value got hit in June 09. What is it now ?