@KLGates |AdjunctProfessor @NYUStern / @NYUlaw |No legal/financial advice |#Bitcoin |#SmartContracts |#Miami |#Phish

2 subscribed

2 subscribed

2 subscribed

2 subscribed

How to get URL link on X (Twitter) App

2 subscribed

2 subscribed

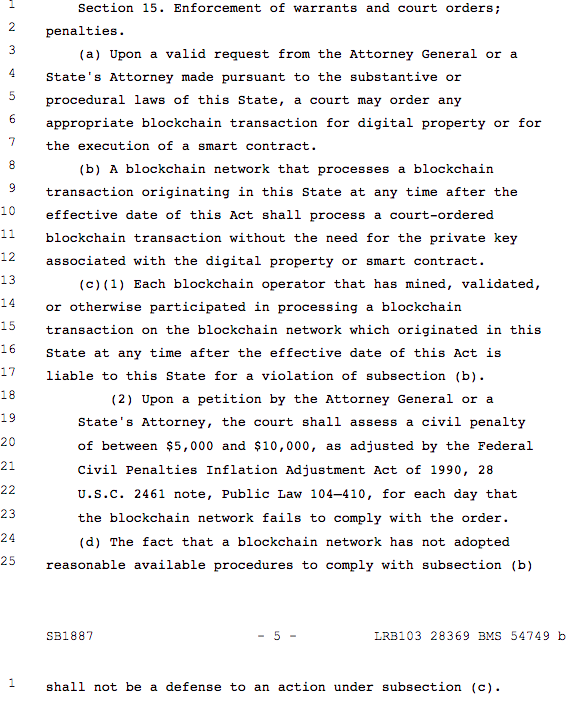

First, establish an government wide-policy. What do we want? Are we pro -innovation? Do want to protecting consumers? Do we want to strike a balance in the middle?Do we want to facilitate experimentation? How much control will the govt take over these experiments? /2

First, establish an government wide-policy. What do we want? Are we pro -innovation? Do want to protecting consumers? Do we want to strike a balance in the middle?Do we want to facilitate experimentation? How much control will the govt take over these experiments? /2

31 CFR 515.201, (i.e. Cuban Assets Control Regulations) prohibits transactions by foreign countries and their nationals including "...transfers, withdrawals, or exportations of, any property," /2

31 CFR 515.201, (i.e. Cuban Assets Control Regulations) prohibits transactions by foreign countries and their nationals including "...transfers, withdrawals, or exportations of, any property," /2

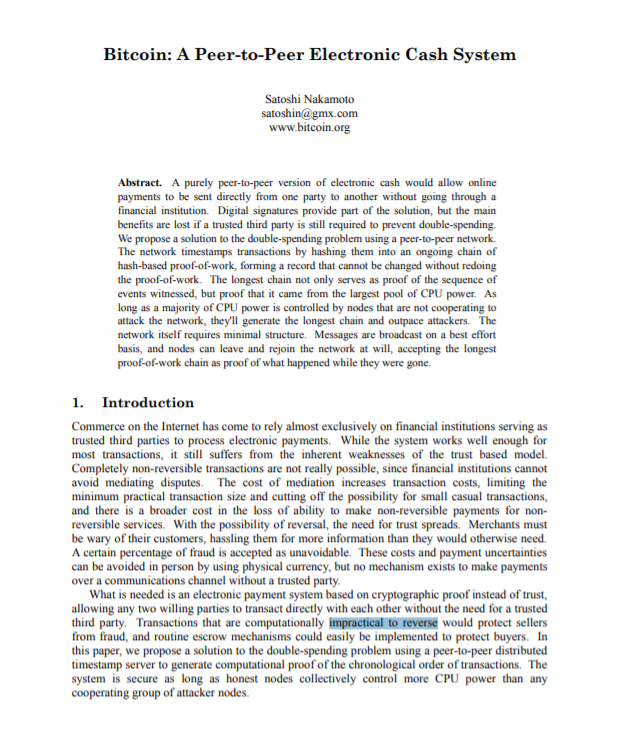

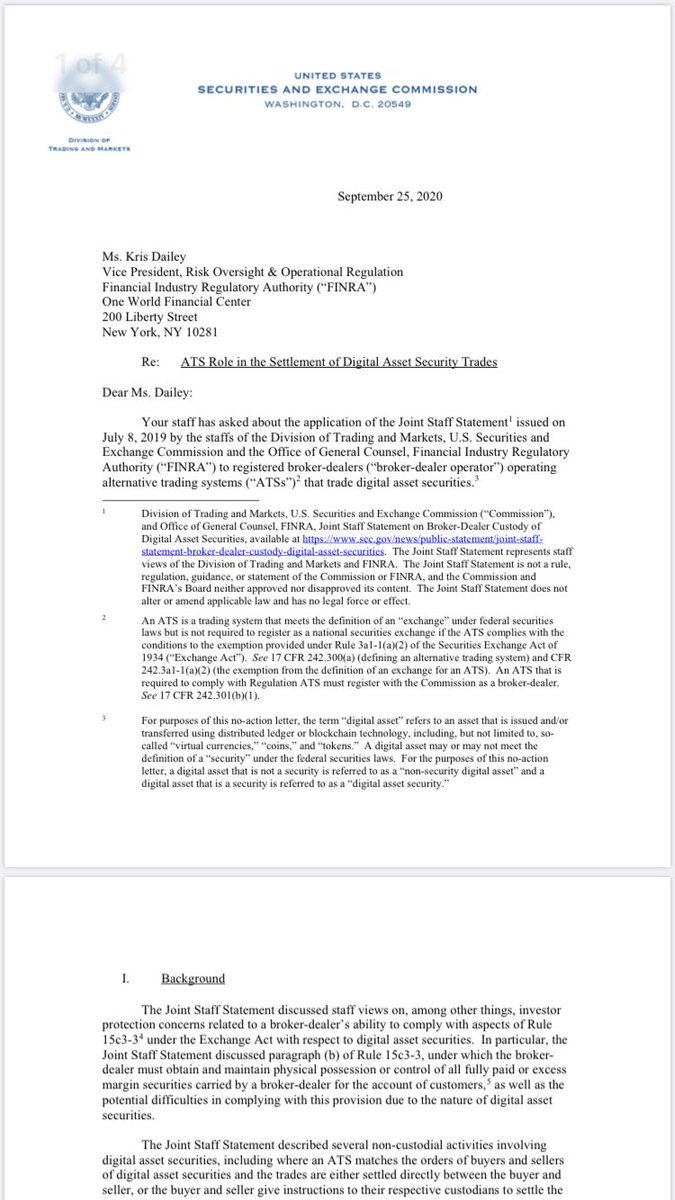

/1 since the Joint Staff Statement (July 8, 2019) which addressed BD custody & handling of trades of digital asset securities (sec.gov/news/public-st…) which emphasized consumer protection, it has not been clear how transactions on ATS should be conducted:

/1 since the Joint Staff Statement (July 8, 2019) which addressed BD custody & handling of trades of digital asset securities (sec.gov/news/public-st…) which emphasized consumer protection, it has not been clear how transactions on ATS should be conducted:

https://twitter.com/masonic_tweets/status/1309166410573197312Short answer- everyone. #Developers #investors & #lawyers all need to understand #blockchain & #smartcontract governance to understand what it means to build on top of others' tech. Can you patent new art built on a blockchain? Will your software work if the underlying chain /2

Here, the divorcing spouse had some #bitcoin tied up in #MtGox and some held on private wallets. One spouse did not disclose the holdings until after the divorce, and the other spouse immediately sought an award of 1/2 and attorney's fees. Court agreed, noting that divorcing /2

Here, the divorcing spouse had some #bitcoin tied up in #MtGox and some held on private wallets. One spouse did not disclose the holdings until after the divorce, and the other spouse immediately sought an award of 1/2 and attorney's fees. Court agreed, noting that divorcing /2

Court ruled that there was no agreement to give Plaintiff #Bitcoingold; there was no "contractual obligation to support or provide services for any particular cryptocurrency." Merger clause barred parol evidence & there was no contractual duty. That's breach of contract /2

Court ruled that there was no agreement to give Plaintiff #Bitcoingold; there was no "contractual obligation to support or provide services for any particular cryptocurrency." Merger clause barred parol evidence & there was no contractual duty. That's breach of contract /2

New proposal limits trading on exchange to listed items, not to provide unlisted trading privileges, which would allow transactions in securities whose home is on another exchange.

New proposal limits trading on exchange to listed items, not to provide unlisted trading privileges, which would allow transactions in securities whose home is on another exchange.

"Covered security" (needed to trigger federal court jursidiction over the matter)= Traded nationally & listed on a regulated national stock exchange. If doesn't involve covered securities, no SLUSA, no federal court jurisidction on that basis. /2

"Covered security" (needed to trigger federal court jursidiction over the matter)= Traded nationally & listed on a regulated national stock exchange. If doesn't involve covered securities, no SLUSA, no federal court jurisidction on that basis. /2