How to get URL link on X (Twitter) App

The correlation to the moon has been well studied, here's a 2005 study looking at price impact on stock markets.

The correlation to the moon has been well studied, here's a 2005 study looking at price impact on stock markets.

https://twitter.com/woonomic/status/1596183033069342720

Cost basis comparison suggests the bottom has formed. The peak discount that short term purchases got over long term purchases has crested.

Cost basis comparison suggests the bottom has formed. The peak discount that short term purchases got over long term purchases has crested.

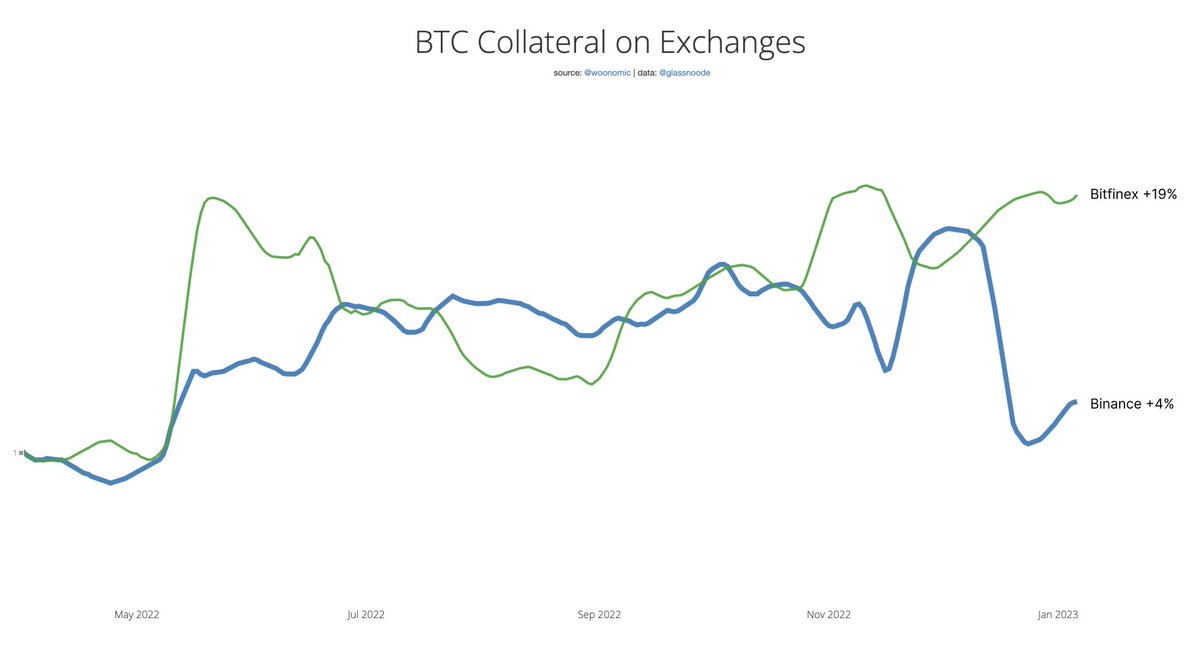

Bitfinex is the sleeper here.

Bitfinex is the sleeper here.

First some orientation.

First some orientation.

Every shitcoin shiller or toxic maximalist

Every shitcoin shiller or toxic maximalist

MVRV was created by @dpuellARK and @MustStopMurad. It tracks the ratio between Bitcoin's marketcap vs the capital invested into the network.

MVRV was created by @dpuellARK and @MustStopMurad. It tracks the ratio between Bitcoin's marketcap vs the capital invested into the network.https://twitter.com/BernieSpofforth/status/1593158578071736320How did we get here? It was the breakdown of The Fairness Doctrine. It stated important issues needed to presented in a contrasting way to the public. Both sides of important issues needed to be told.

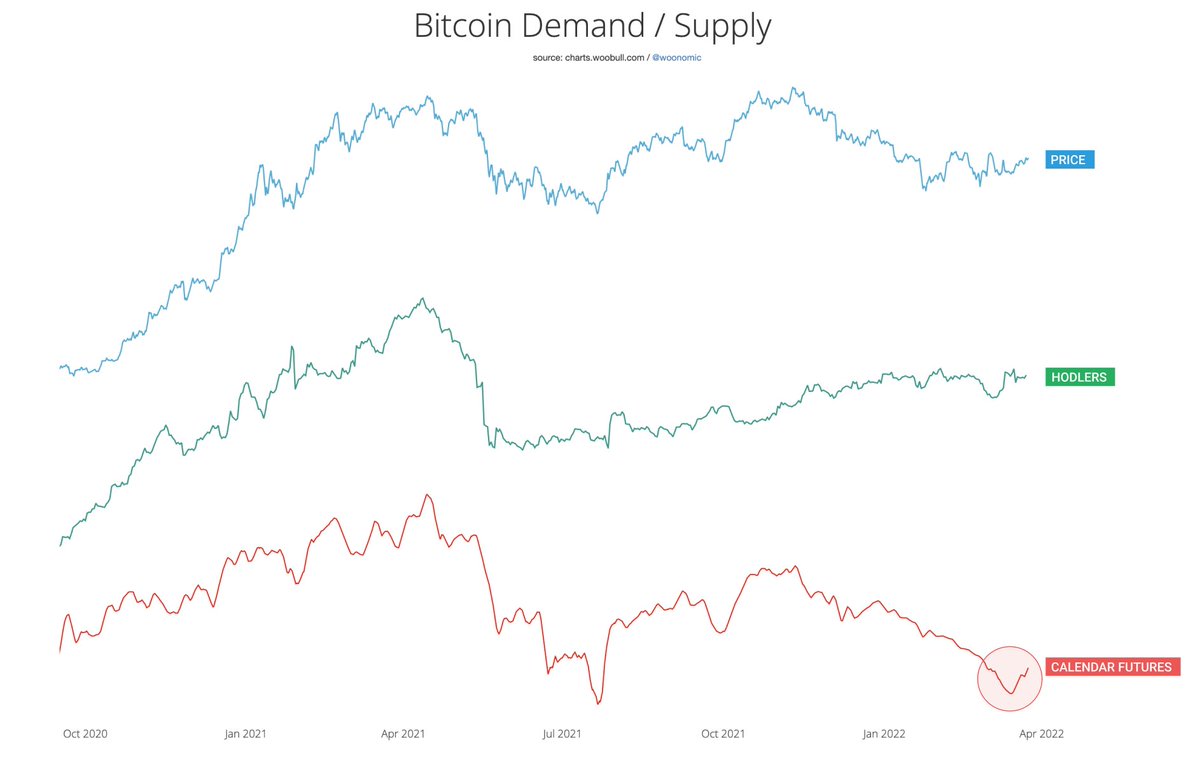

Bottoms are formed by...

Bottoms are formed by...

https://twitter.com/woonomic/status/1509452928683507712?s=20&t=gkY8Ll60ofNeOfVDxKt-jw

https://twitter.com/nic__carter/status/1506378858936864776

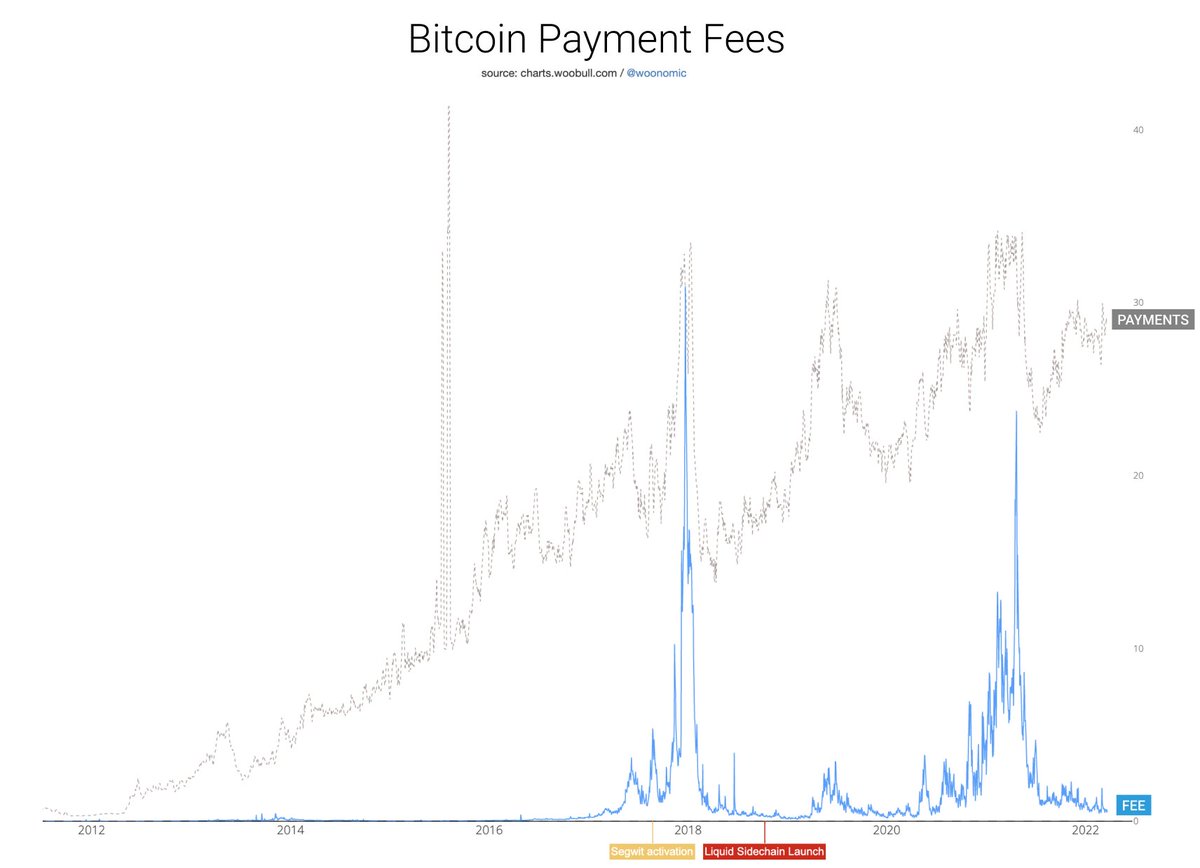

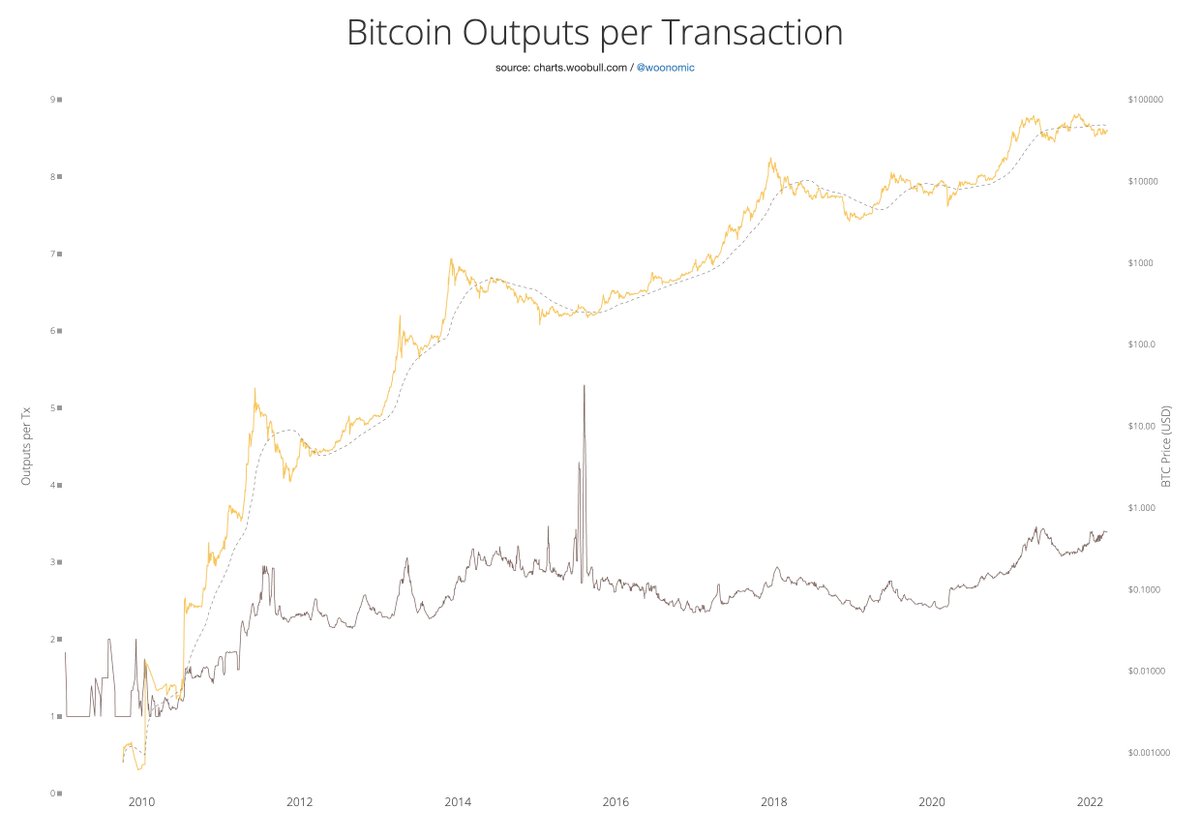

A single BTC transaction today contains 3.39 batched payments on average. This number continues to become more efficient as exchanges become more efficient in batching their withdrawals together.

A single BTC transaction today contains 3.39 batched payments on average. This number continues to become more efficient as exchanges become more efficient in batching their withdrawals together.

Added: @exodus_io (ticker: EXOD)

Added: @exodus_io (ticker: EXOD)

122 subscribed

122 subscribed