I invest in developing economies and study how sanctions policies are reshaping the world. CEO of @boursebazaar.

3 subscribed

3 subscribed

3 subscribed

3 subscribed

How to get URL link on X (Twitter) App

3 subscribed

3 subscribed

2. Boosting exports is how firms in sanctioned economies try to respond to flat domestic demand, currency volatility, and rising input costs.

2. Boosting exports is how firms in sanctioned economies try to respond to flat domestic demand, currency volatility, and rising input costs.

2. Coinciding with the new executive order, @wallyadeyemo has an op-ed in the @FinancialTimes explaining what Treasury aims to achieve.

2. Coinciding with the new executive order, @wallyadeyemo has an op-ed in the @FinancialTimes explaining what Treasury aims to achieve.

2. Last year, Vietnam exported $791m of cashews to the EU and $885m to the US.

2. Last year, Vietnam exported $791m of cashews to the EU and $885m to the US.

2. This report by @karllesteryap and @EltafN from September points to tighter regulation of the FX market by the Taliban, but there is little detail on potential role of trade.

2. This report by @karllesteryap and @EltafN from September points to tighter regulation of the FX market by the Taliban, but there is little detail on potential role of trade.

2. This is an excerpt from Brett Stephen's op-ed on the Iran "influence network" controversy. It could be about Iran International.

2. This is an excerpt from Brett Stephen's op-ed on the Iran "influence network" controversy. It could be about Iran International.

2. If you've recently taken an Uber in London, you've probably been in an MG5. They're everywhere.

2. If you've recently taken an Uber in London, you've probably been in an MG5. They're everywhere.

2. Originally a performance brand affiliated with Volvo, Polestar is effectively a Chinese automaker.

2. Originally a performance brand affiliated with Volvo, Polestar is effectively a Chinese automaker.

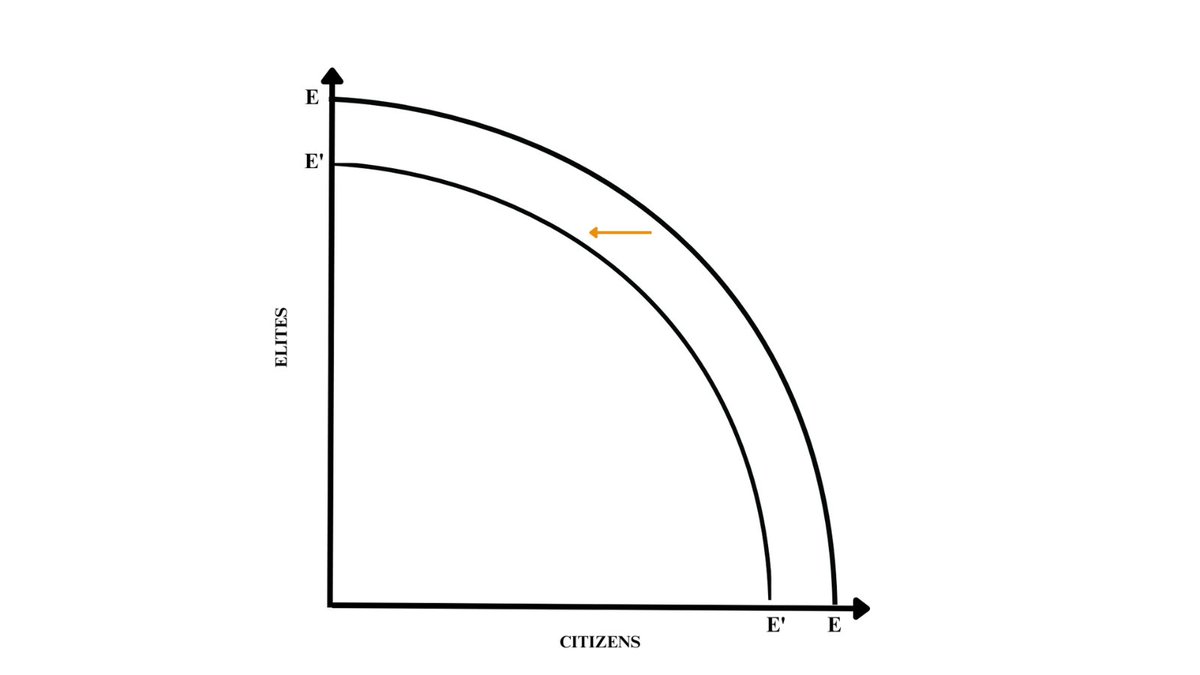

2. This chart is from a forthcoming report by @zepkalb looking at the effect of sanctions across Iran's social classes. The findings are striking. A sanctions program that was ostensibly about putting pressure on elites dramatically reduced consumption across all social classes.

2. This chart is from a forthcoming report by @zepkalb looking at the effect of sanctions across Iran's social classes. The findings are striking. A sanctions program that was ostensibly about putting pressure on elites dramatically reduced consumption across all social classes.

2. I’ll start with a story.

2. I’ll start with a story.

2. The strategic importance of food exports enables Lula to push China to be more aggressive in moving away from the dollar.

2. The strategic importance of food exports enables Lula to push China to be more aggressive in moving away from the dollar.

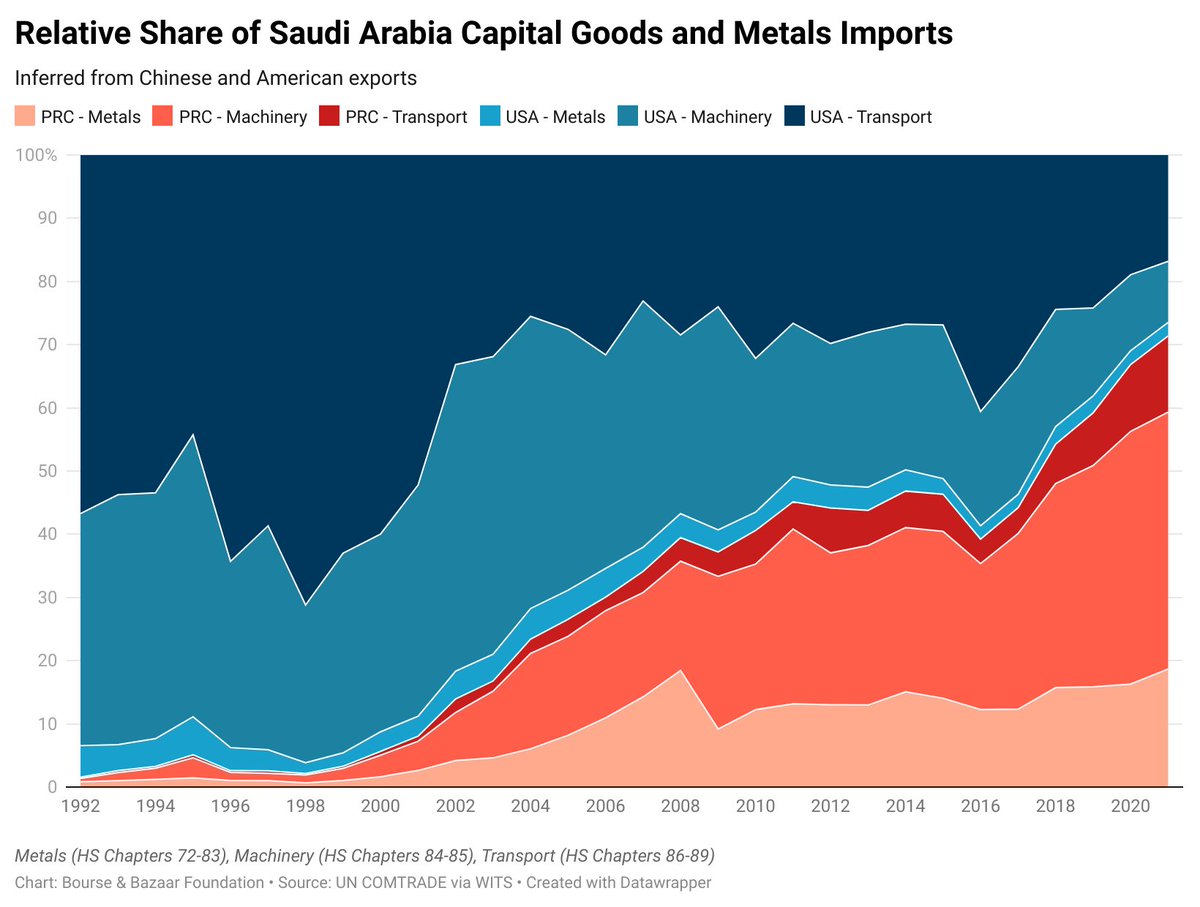

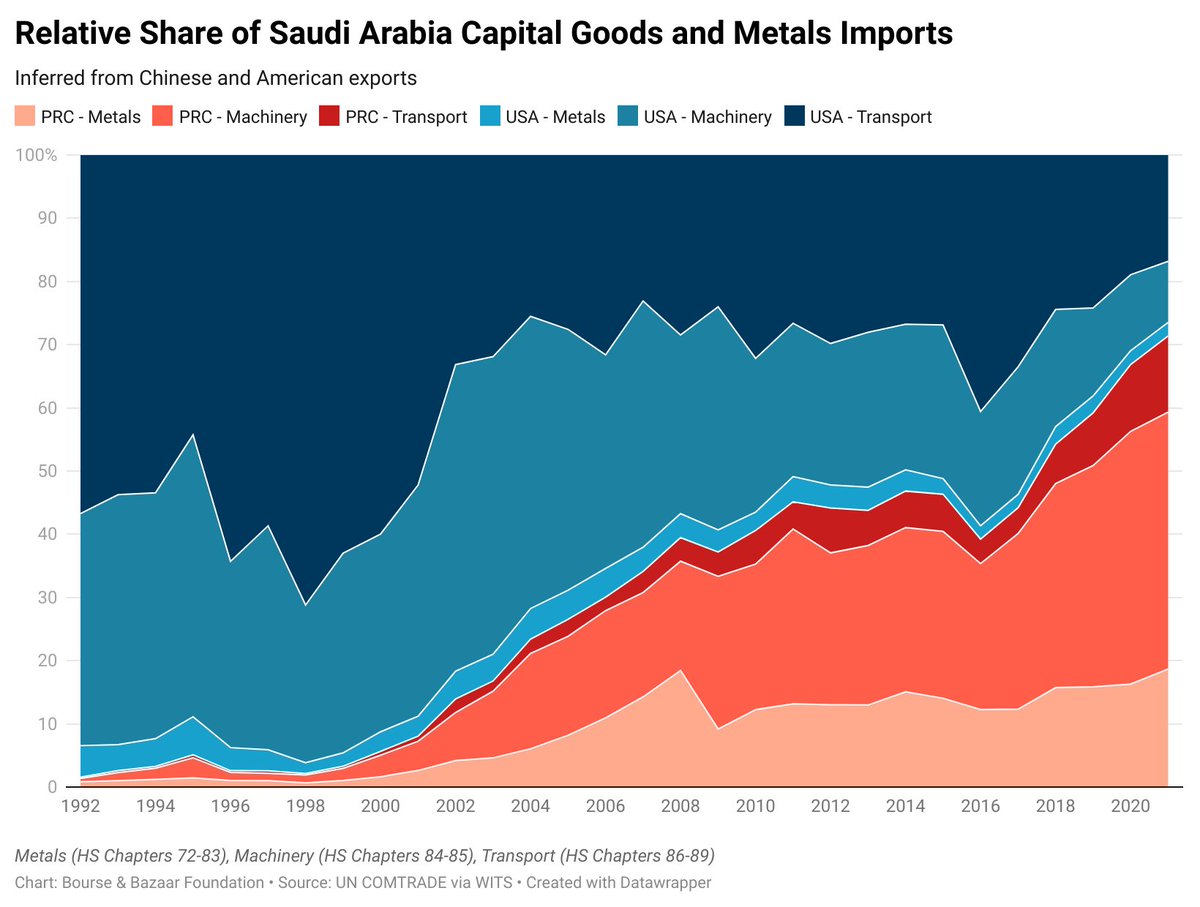

2. The flip side of this is that China imports significant quantities of Saudi oil. The US no longer does.

2. The flip side of this is that China imports significant quantities of Saudi oil. The US no longer does.

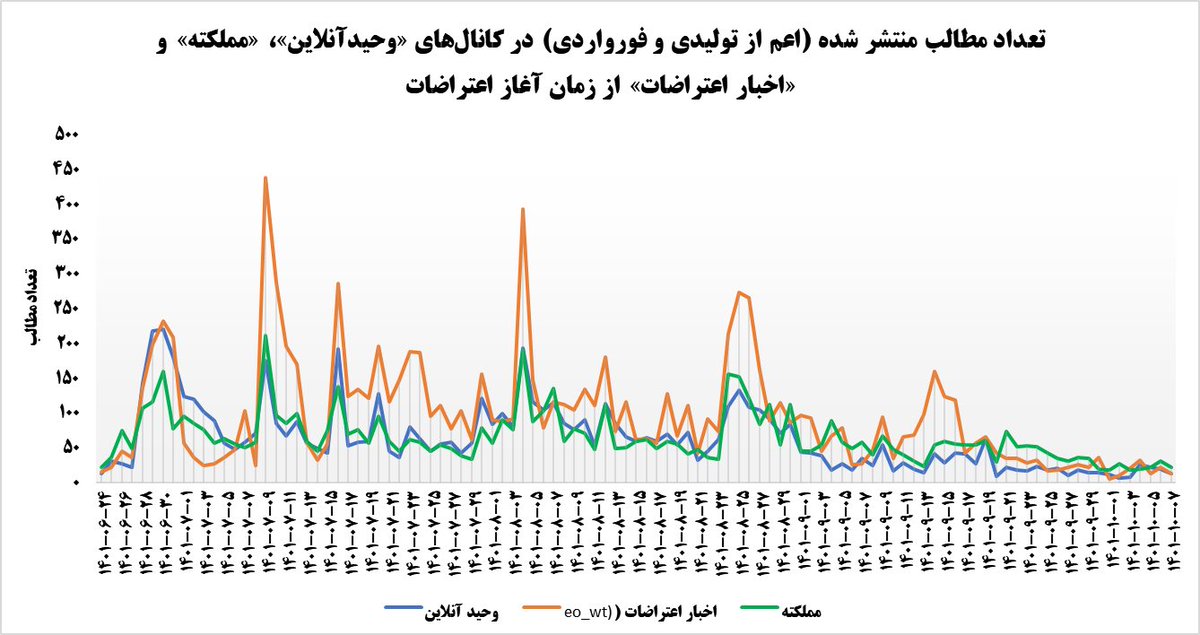

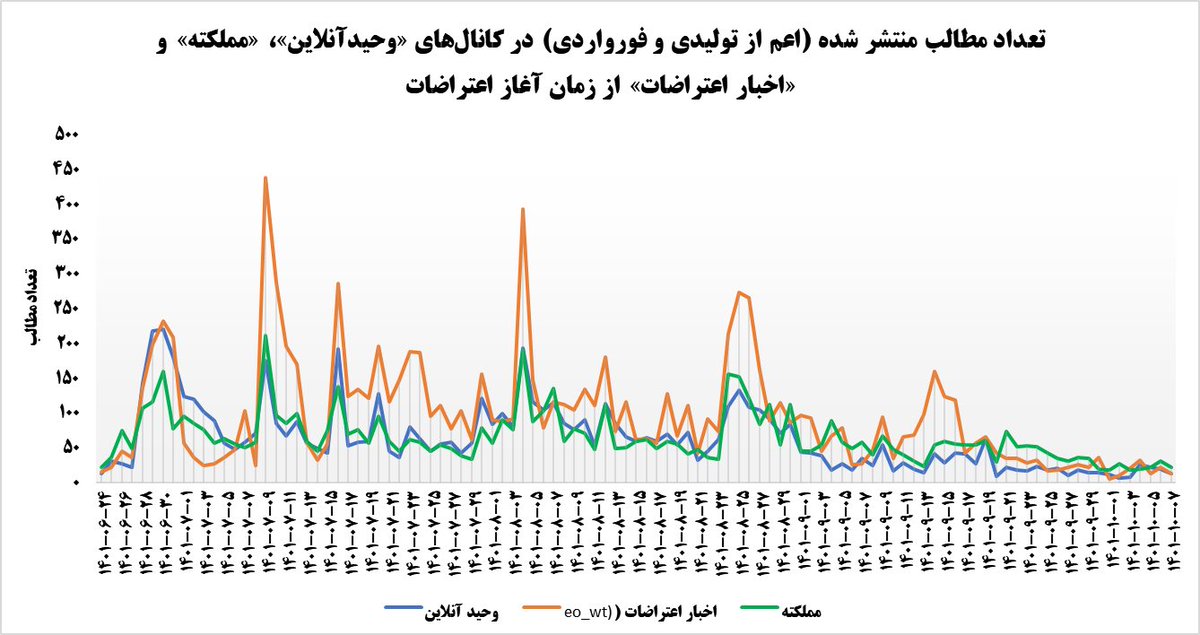

2. The protests triggered by the death of Mahsa Amini felt different from the outset. They were led by women and political in their aims. They generated solidarity across class and regional lines. It seemed like the protests could snowball, despite the state’s violent response.

2. The protests triggered by the death of Mahsa Amini felt different from the outset. They were led by women and political in their aims. They generated solidarity across class and regional lines. It seemed like the protests could snowball, despite the state’s violent response.

2. To think about sanctions we need to think about the impacts of economic shocks on the power of elites and citizens.

2. To think about sanctions we need to think about the impacts of economic shocks on the power of elites and citizens.

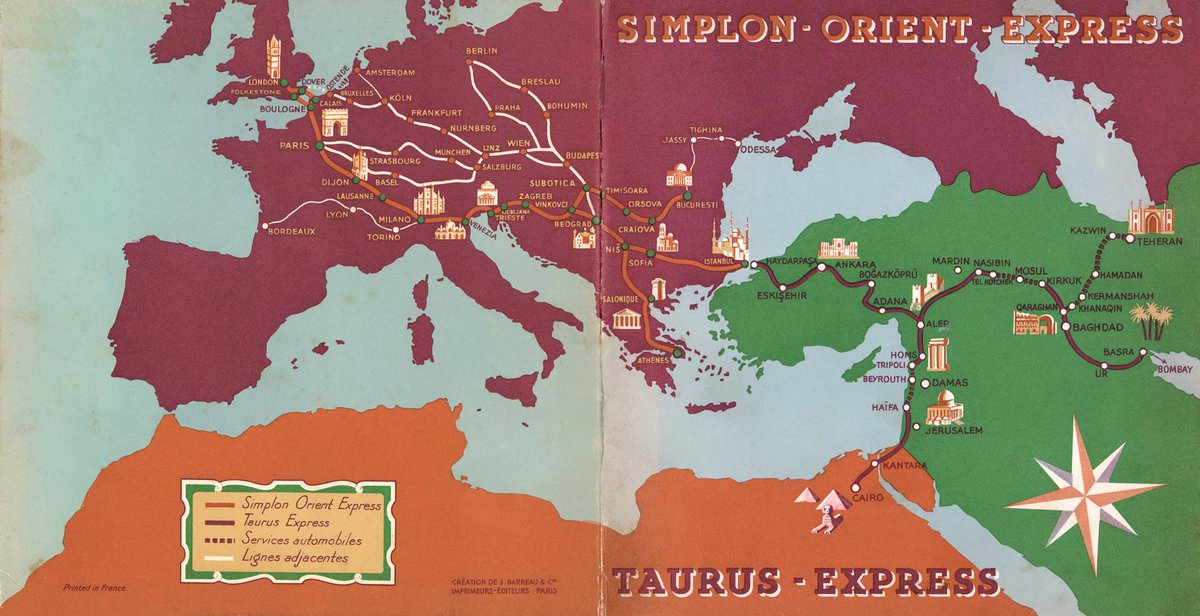

2. CIWL customers could board the Simplon Orient Express in London and arrive in Cairo after 7 days or in Baghdad after 8 days following a transfer to the Taurus Express in Istanbul.

2. CIWL customers could board the Simplon Orient Express in London and arrive in Cairo after 7 days or in Baghdad after 8 days following a transfer to the Taurus Express in Istanbul.

2. The whole point of secondary sanctions is that banks comply even when there is no nexus to the US dollar. It is conceivable to have a world in which the "petrodollar" wanes in importance but in which the vast majority of banks remain chokepoints that the US can weaponise.

2. The whole point of secondary sanctions is that banks comply even when there is no nexus to the US dollar. It is conceivable to have a world in which the "petrodollar" wanes in importance but in which the vast majority of banks remain chokepoints that the US can weaponise.

2. Protests are not the only way for people to make demands of the state, but they are a really important mode of political action. We have generally taken for granted the idea that Iranians enjoy capacities for large protests given their recurrence in recent years.

2. Protests are not the only way for people to make demands of the state, but they are a really important mode of political action. We have generally taken for granted the idea that Iranians enjoy capacities for large protests given their recurrence in recent years.