The Council of Economic Advisers for the Biden-Harris Administration

How to get URL link on X (Twitter) App

The unemp. rate ticked up to 3.9% in April, the 27th straight month below 4%, tied for the longest period since the late 1960s. The broadest measure of underemployment, U-6—including those working part-time for economic reasons and the marginally attached—ticked up to 7.4%. 2/

The unemp. rate ticked up to 3.9% in April, the 27th straight month below 4%, tied for the longest period since the late 1960s. The broadest measure of underemployment, U-6—including those working part-time for economic reasons and the marginally attached—ticked up to 7.4%. 2/

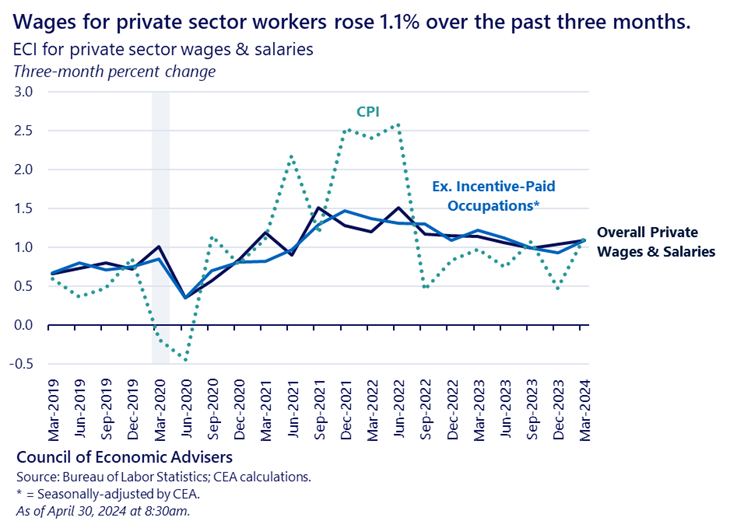

Excluding incentive-paid occupations—in which pay tends to be more volatile—private-sector wage growth was also 1.1%. 2/

Excluding incentive-paid occupations—in which pay tends to be more volatile—private-sector wage growth was also 1.1%. 2/

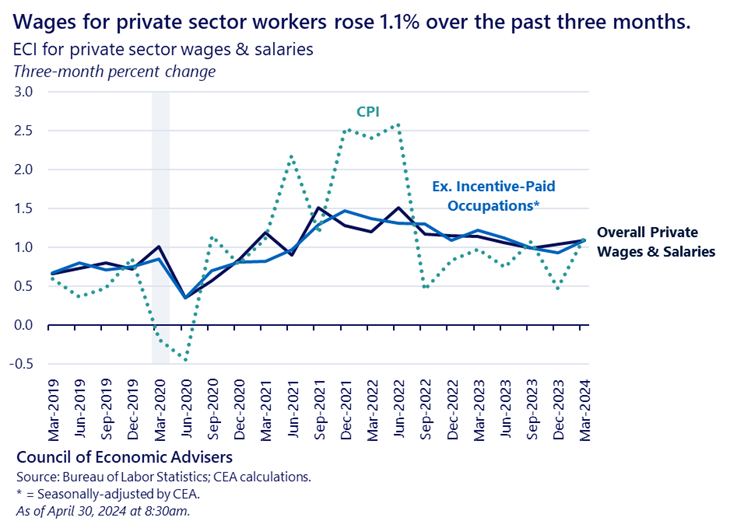

Real private domestic final purchases (PDFP), which removes net exports, inventory investment, and government spending, is estimated to have grown by 3.1% at an annualized rate, a strong pace. In 2023:H2, real PDFP grew by a similar average pace of 3.2%. 2/

Real private domestic final purchases (PDFP), which removes net exports, inventory investment, and government spending, is estimated to have grown by 3.1% at an annualized rate, a strong pace. In 2023:H2, real PDFP grew by a similar average pace of 3.2%. 2/

Year-over-year headline inflation increased 0.3 ppt to 3.5% in March, well below its rate of 5% a year ago. Core inflation was 3.8% over the year, the same as February’s rate and down from 5.6% a year ago. 2/

Year-over-year headline inflation increased 0.3 ppt to 3.5% in March, well below its rate of 5% a year ago. Core inflation was 3.8% over the year, the same as February’s rate and down from 5.6% a year ago. 2/

Year-over-year headline inflation ticked up 0.1 ppt to 3.2% in February, well below its rate of 6% a year ago. Core inflation was 3.8% over the year, a tick below January’s rate and down from 5.5% a year ago. 2/

Year-over-year headline inflation ticked up 0.1 ppt to 3.2% in February, well below its rate of 6% a year ago. Core inflation was 3.8% over the year, a tick below January’s rate and down from 5.5% a year ago. 2/

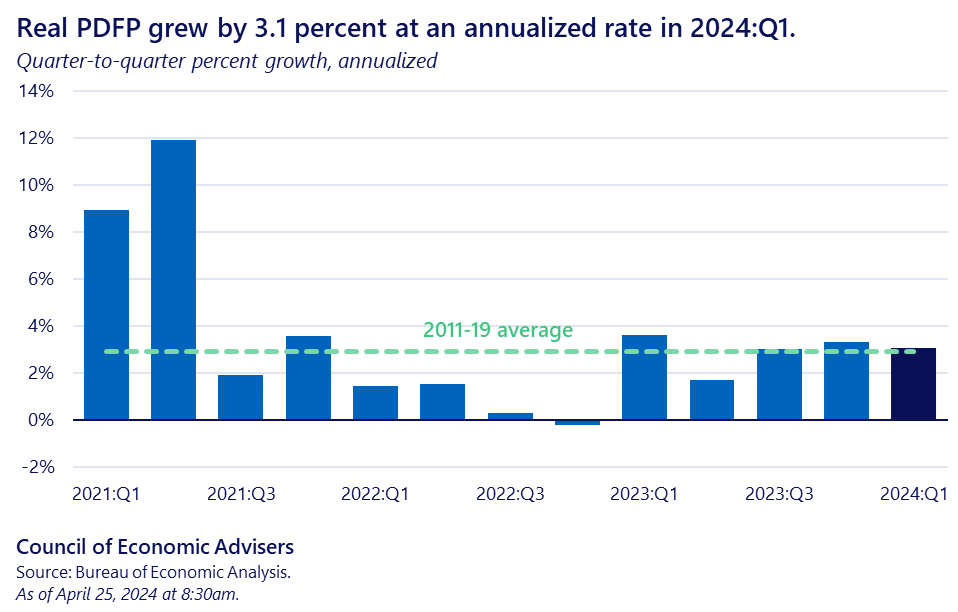

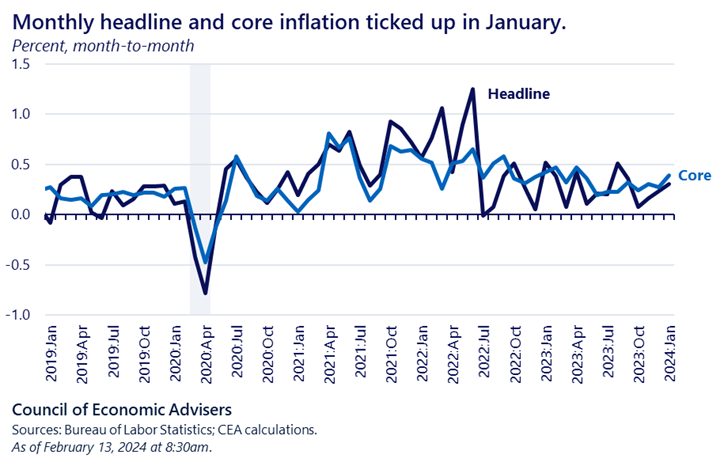

Year-over-year headline inflation continued to ease, falling 0.3 ppt to 3.1% in January, well below its rate of 6.4% a year ago. Core inflation was 3.9% over the year, still at an elevated pace, but down from 5.6% last year. 2/

Year-over-year headline inflation continued to ease, falling 0.3 ppt to 3.1% in January, well below its rate of 6.4% a year ago. Core inflation was 3.9% over the year, still at an elevated pace, but down from 5.6% last year. 2/

Note that employment in truck transportation fell 37,000, primarily driven by the bankruptcy of Yellow. Motion picture & sound recording employment fell 17,000, mostly reflecting effects from the SAG-AFTRA strike. 2/

Note that employment in truck transportation fell 37,000, primarily driven by the bankruptcy of Yellow. Motion picture & sound recording employment fell 17,000, mostly reflecting effects from the SAG-AFTRA strike. 2/

Year-over-year headline inflation was 4.9 percent in April, the slowest increase since April 2021 and the tenth consecutive month of declines, but still an elevated pace. Core inflation was 5.5 percent, a tick down from March’s rate. 2/

Year-over-year headline inflation was 4.9 percent in April, the slowest increase since April 2021 and the tenth consecutive month of declines, but still an elevated pace. Core inflation was 5.5 percent, a tick down from March’s rate. 2/

Energy prices declined by 3.5 percent in March, driven by a 7.1 percent decline in natural gas utility prices and a 4.6 percent decline in gasoline prices. 2/

Energy prices declined by 3.5 percent in March, driven by a 7.1 percent decline in natural gas utility prices and a 4.6 percent decline in gasoline prices. 2/

Note that the January CPI release incorporated updated relative importance weights reflecting more recent purchasing patterns. 2/

Note that the January CPI release incorporated updated relative importance weights reflecting more recent purchasing patterns. 2/

Private domestic final purchases (PDFP), which removes net exports, inventory investment, and government spending, is estimated to have grown by 0.2 percent at an annualized rate. 2/

Private domestic final purchases (PDFP), which removes net exports, inventory investment, and government spending, is estimated to have grown by 0.2 percent at an annualized rate. 2/

Energy prices decreased in December, although the path for energy prices is unclear in the coming months, as world events continue to impact the supply and demand for energy. 2/

Energy prices decreased in December, although the path for energy prices is unclear in the coming months, as world events continue to impact the supply and demand for energy. 2/

Energy prices decreased in November, while food price growth ticked down to 0.5 percent. 2/

Energy prices decreased in November, while food price growth ticked down to 0.5 percent. 2/

Energy prices increased in October, while food price growth declined to 0.6 percent. This is the slowest rate for food price growth since December 2021. 2/

Energy prices increased in October, while food price growth declined to 0.6 percent. This is the slowest rate for food price growth since December 2021. 2/