Discover and read the best of Twitter Threads about #tcja

Most recents (11)

Paper alert: @heimbergecon +I investigate: Do corporate tax cuts boost economic growth? There is a growing empirical literature. As often, studies come to ambiguous conclusions: corporate tax cuts increase,reduce, or do not signif. affect growth. Thread: boeckler.de/de/faust-detai…

This is a classic partisan fiscal policy debate. One camp claims that tax cuts improve profit margins which will spur investment and thus growth+jobs. The other doubts that higher profits will lead to more investment and claims that the tax revenues could be used more effectively

Former Pres. #Trump promoted the #TCJA, which entailed a large corporate tax cut, insisting on huge growth effects. The #Biden admin. now argues for reversal: funds should better be used for public investment instead. @WhiteHouseCEA

In 2020, #TCJA will generate more $ benefit to foreign investors ($38.3 billion) than to the the least well-off half of Americans (1.9 + 12.4 + 0.5*24.4 billion).

Lots of analysis @Schieder_ @iteptweets, including at the state level.

itep.org/tcja-2020/

Lots of analysis @Schieder_ @iteptweets, including at the state level.

itep.org/tcja-2020/

@Schieder_ @iteptweets In 2020, #TCJA will generate 8.4x more benefit for the richest 20% of American families than for the middle 20% of American families

#priorities

#priorities

@Schieder_ @iteptweets #TCJA's estate tax cut generates benefits only for families in the richest 1%.

The 1%'s estate-tax benefit alone exceeds all benefits to average families at every income level outside the richest 5% of families.

#TCJA benefited the 1% 8.4x their estate-tax benefit.

#priorities

The 1%'s estate-tax benefit alone exceeds all benefits to average families at every income level outside the richest 5% of families.

#TCJA benefited the 1% 8.4x their estate-tax benefit.

#priorities

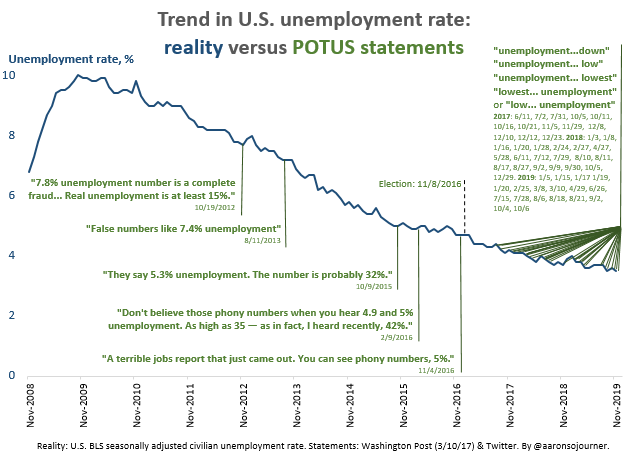

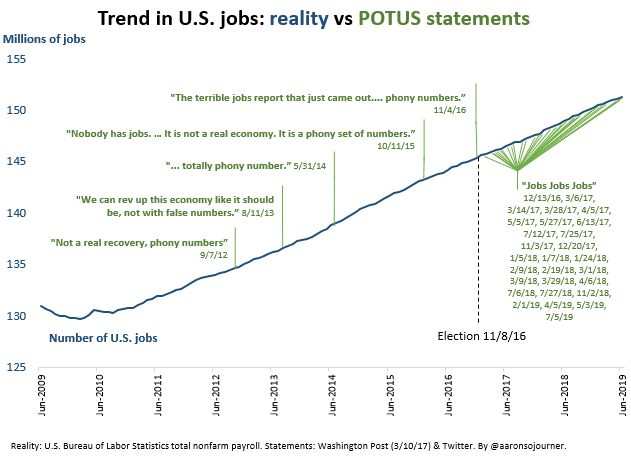

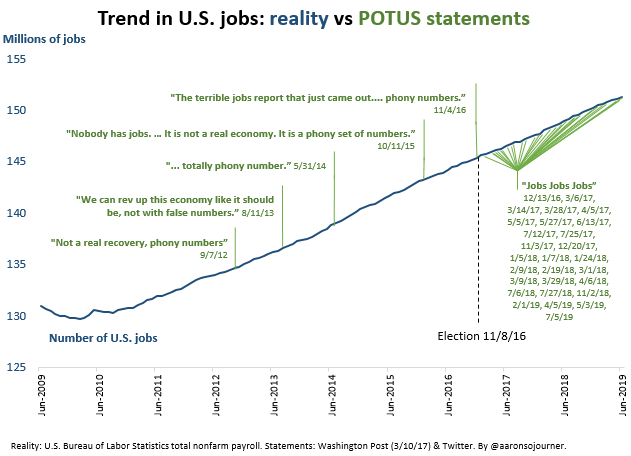

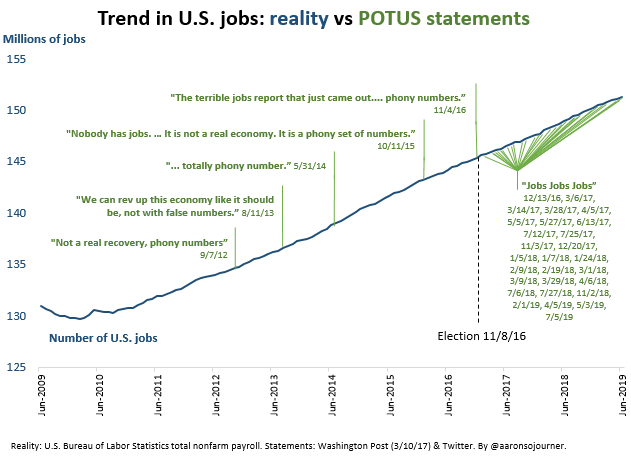

@realDonaldTrump @foxandfriends No. You just changed your talking point (green text). The job-growth trend (blue line), not so much.

Your administration was born on 3rd base & you want to con us into thinking you hit a triple. Americans aren't falling for it. #NoFool

Your administration was born on 3rd base & you want to con us into thinking you hit a triple. Americans aren't falling for it. #NoFool

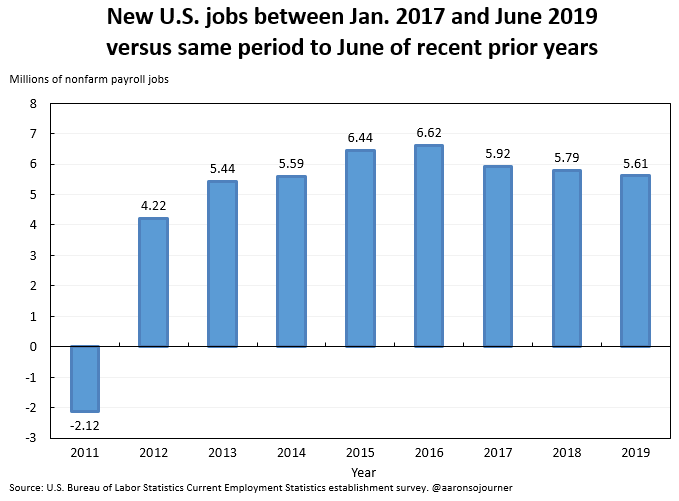

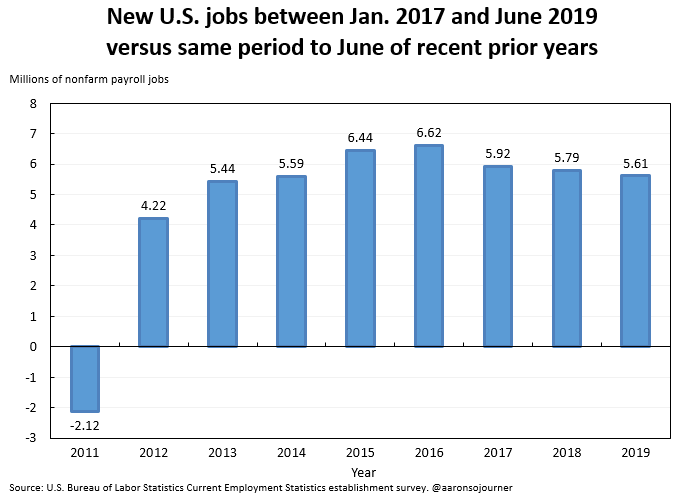

@realDonaldTrump @foxandfriends Job growth has basically just continued on the inherited trend. But slowed a little.

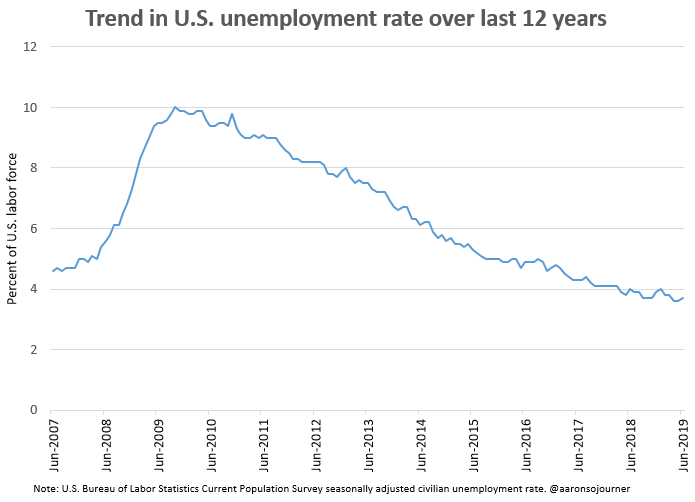

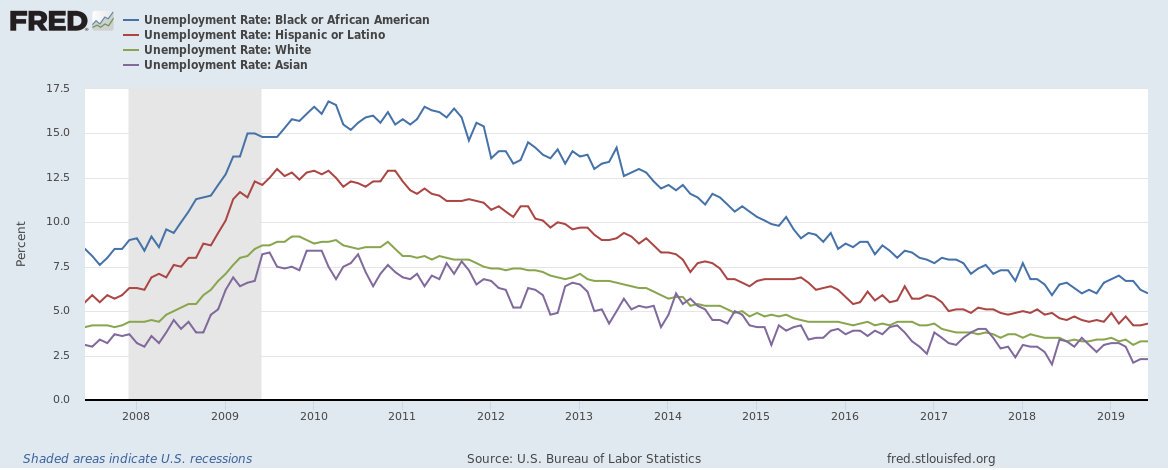

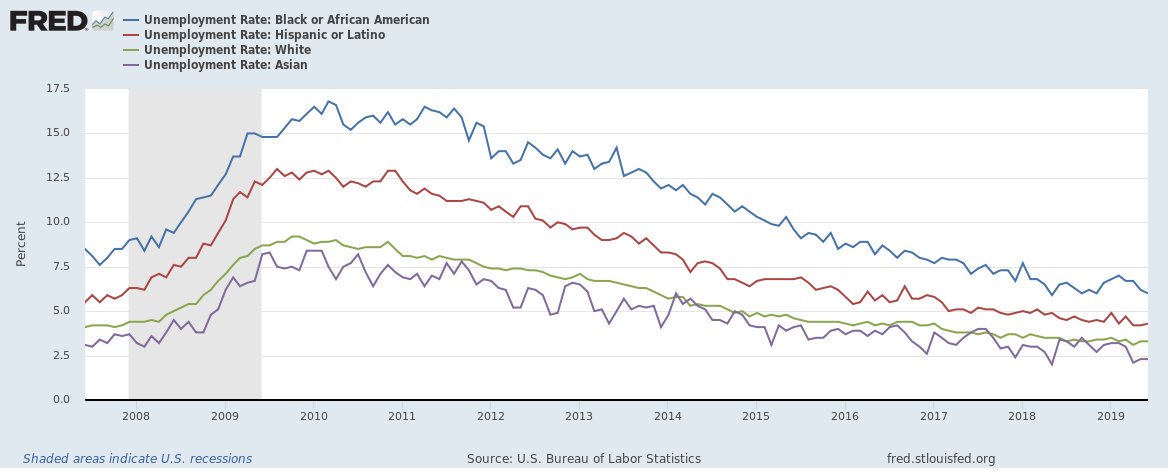

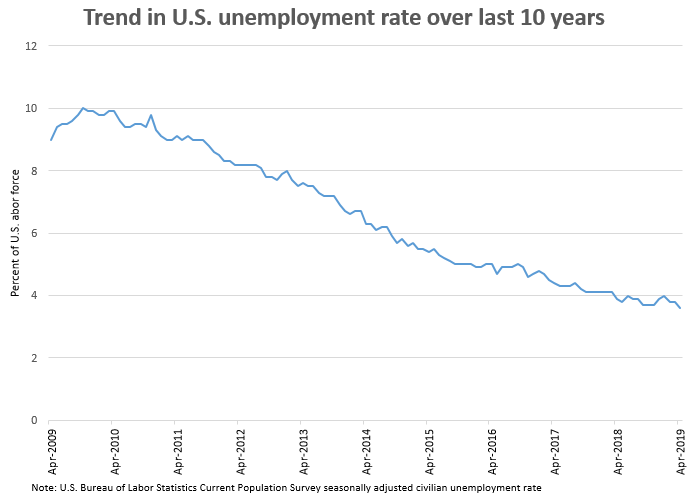

@realDonaldTrump @foxandfriends Same story with the unemployment rate. It's low & that's wonderful.

It's low thanks to progress so steady over so many years. Check out the trend over the last 12 years. Inherited progress has slowed.

It's low thanks to progress so steady over so many years. Check out the trend over the last 12 years. Inherited progress has slowed.

@realDonaldTrump You changed your talking point. The job-growth trend, not so much (graph).

Your administration was born on 3rd base & you work to con people into thinking you hit a triple.

Your administration was born on 3rd base & you work to con people into thinking you hit a triple.

@realDonaldTrump Job growth has basically continues on the same trend you inherited. But slowed a little.

@realDonaldTrump Same story with the unemployment rates. They're low & that's wonderful. They're low thanks to progress so steady over so many years.

@realDonaldTrump Unemployment is low & that's good. Check out trends in unemployment for African-Americans & other groups.

Progress so steady since 2010. No improvement on the trends you inherited.

Progress so steady since 2010. No improvement on the trends you inherited.

@realDonaldTrump Check out the trend in the # of U.S. jobs. Same story. Progress so steady since 2010. No improvement on the trend you inherited.

You changed your talking point. The job-growth trend, not so much.

You changed your talking point. The job-growth trend, not so much.

@realDonaldTrump This chicken can claim it's doing an awesome job driving because it took over the wheel when momentum's going the right direction.

When circumstances require more than squawking & preening, reality will be clear.

When circumstances require more than squawking & preening, reality will be clear.

@GOPChairwoman @realDonaldTrump Same story with the unemployment rate.

The administration was born on third base & you work to con us into thinking it hit a triple.

#NoFool

The administration was born on third base & you work to con us into thinking it hit a triple.

#NoFool

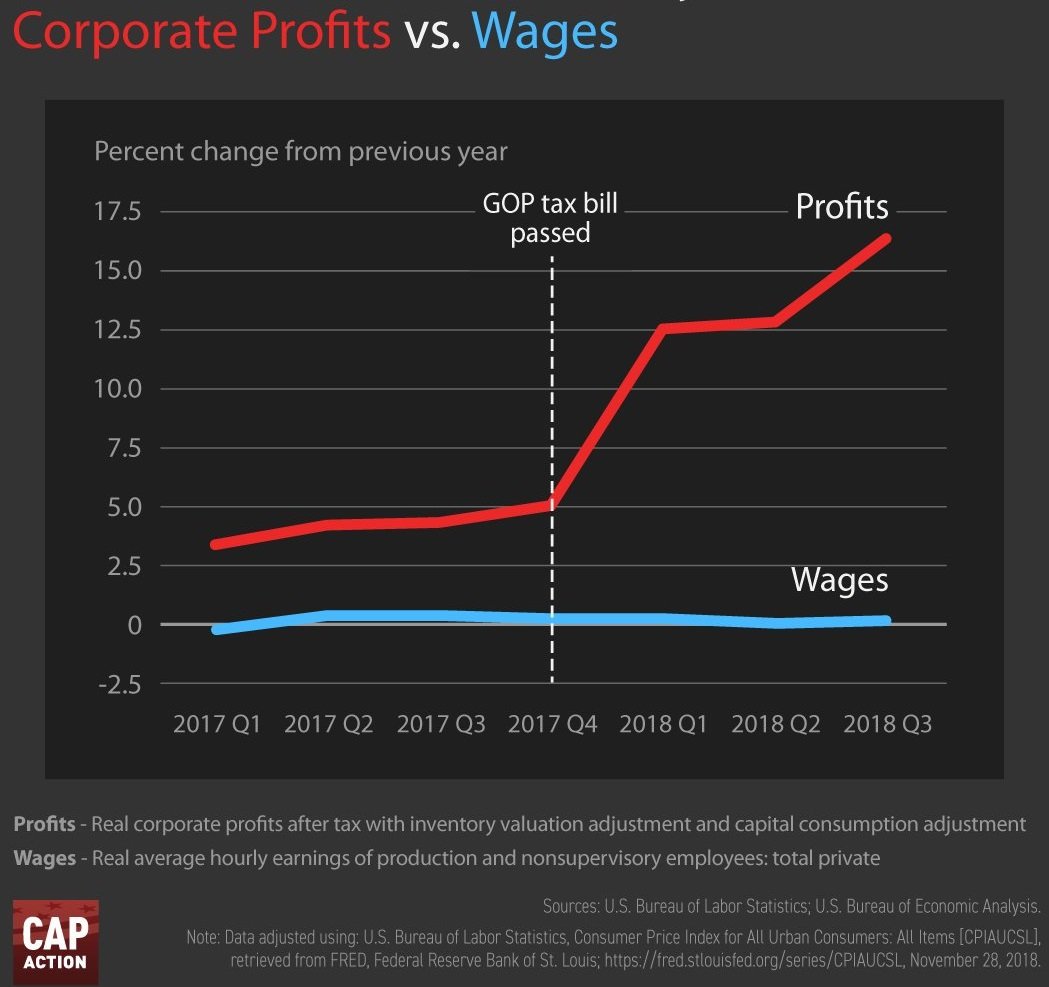

@GOPChairwoman @realDonaldTrump Beyond coasting on inherited trends, how has POTUS used power of his office?

Managed 1 big econ policy change: #TCJA tax law. Gave gift ($$ requiring no behavior change) to company owners. Profits skyrocketed.

Wages? An average hour of work buys 1.3% more now than a year ago.

Managed 1 big econ policy change: #TCJA tax law. Gave gift ($$ requiring no behavior change) to company owners. Profits skyrocketed.

Wages? An average hour of work buys 1.3% more now than a year ago.

All 50 states & DC saw their avg. tax liability fall from 18.0% to 29.1%. D.C. saw the least decrease, and largest decline in avg. tax refund at 6.1%, while North Dakota saw the largest increase at 6.7% on average.

Also, UPDATE/ASSESS W-4s!

#TaxDay #TCJA

Also, UPDATE/ASSESS W-4s!

#TaxDay #TCJA

Tax liability in real dollars is down nearly $1,200 on avg. (as promised), but tax refunds were up avg. $43. That’s BC an average of $1,156 went into paychecks during the year, or about $50 for a biweekly paycheck starting in March of 2018.

So...

peoplespunditdaily.com/policy/2019/04… #TaxDay

So...

peoplespunditdaily.com/policy/2019/04… #TaxDay

So... everyone should make sure they reassess and update W-4s if need be, because w/ all 12 months impact, some could see refunds decline by $200 or more next year as less is taken from their paychecks.

But overall, #TCJA was a big net positive.

peoplespunditdaily.com/policy/2019/04… #TaxDay

But overall, #TCJA was a big net positive.

peoplespunditdaily.com/policy/2019/04… #TaxDay

Happy #JobsDay! 8:30 ET @BLS_gov delivers most important signals abt how economy is changing

Expectations:

+208K jobs. If >0, extends longest streak of monthly job creation on record to 8 years+1 month (graph). Progress so steady over so many years.

Big question: wage growth?

Expectations:

+208K jobs. If >0, extends longest streak of monthly job creation on record to 8 years+1 month (graph). Progress so steady over so many years.

Big question: wage growth?

I worked as CEA senior economist for labor in 2016-‘17. Briefed @WhiteHouse & LaborSec on #JobsReport monthly

carlsonschool.umn.edu/news/aaron-soj…

I was honored to serve American people:

@barackobama

obamawhitehouse.archives.gov/administration…

@realDonaldTrump

web.archive.org/web/2018050822…

carlsonschool.umn.edu/news/aaron-soj…

I was honored to serve American people:

@barackobama

obamawhitehouse.archives.gov/administration…

@realDonaldTrump

web.archive.org/web/2018050822…

Public servants toiled all month surveying abt 200K bizs + individs, crunched data & made #JobsReport stats for us. Thanks @BLS_gov! Read @ryan_d_nunn @dwschanz @MichaelRStrain

brookings.edu/research/in-or…

brookings.edu/research/in-or…

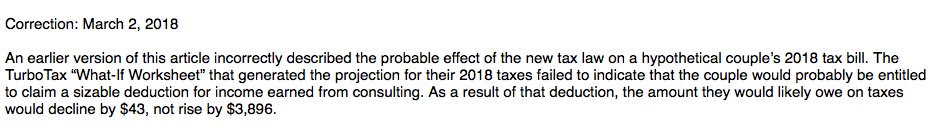

Anyone else notice @nytimes made a monumental mistake in their report about Samuel and Felicity Taxpayer? As it turns out (We blame Turbo Tax!), the happy couple will pay LESS in taxes (like appx. 85% of the country), due to the Tax Cuts and Jobs Act. NOT a $3,896 tax hike. #SMH

2. @nytimes excuse for flawed & failed analysis on impact of tax reform for Samuel and Felicity Taxpayer doesn't even make sense. You can't blame @turbotax “What-If Worksheet” for NY Times not claiming earned income credit. And they're corrected analysis is still wrong...

3. Even in @nytimes corrected "analysis," which now adds earned income credit, they STILL did not give Samuel & Felicity Taxpayer $1500.00 in credits for dependents! So, they are actually paying $1543 less in taxes due to #taxcutsforamerica, or #TCJA. Very sloppy partisan report.

(1) Here's my latest Team Trump #PhotosThread.📸🦁🇺🇸

The previous one ran from Dec 8 to 18:

Info & links to 12 other photos threads since June 2017: godlessnz.wordpress.com/2017/10/27/lin… … …

Enjoy! RT to help #MAGA

The previous one ran from Dec 8 to 18:

Info & links to 12 other photos threads since June 2017: godlessnz.wordpress.com/2017/10/27/lin… … …

Enjoy! RT to help #MAGA

(2) The President started the week with a landmark National Security Strategy speech in Washington, DC. #PeaceThroughStrength #AmericaFirst

(3) Oh noes! He held the glass with both hands again! Probably because he unconsciously worries about spilling some, like I do. We're neat freaks and germaphobes, stop judging us!😎