1) Banking & credit are the lifeblood of capitalism.

2) The most conservative lender is only one severe credit cycle away from failure.

3) Banks fail, Sovereigns default. Hundreds of banks fail every 10+ years.

5) Government (Fiat) money ≠ Sound money.

6) Human civilization flourishes in times and places where sound money is widely adopted.

7) Bitcoin is a monetary system.

9) Credit is older than money & Fintech.

10) The only way banks get in trouble is because of their bad loans.

11) The only good loan is the one that gets paid back.

13) There is no downtime in the Credit business.

14) Market forces and business/credit cycles can’t be defied, only managed.

15) Only benign Credit is sustainable.

17) Wealth is not about money, but about Options.

18) Money is a story. Very few people understand the money and monetary systems they live in.

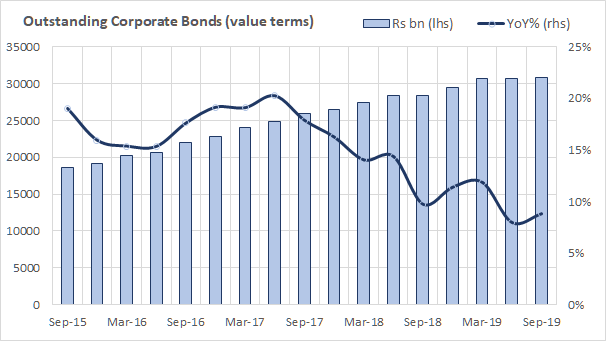

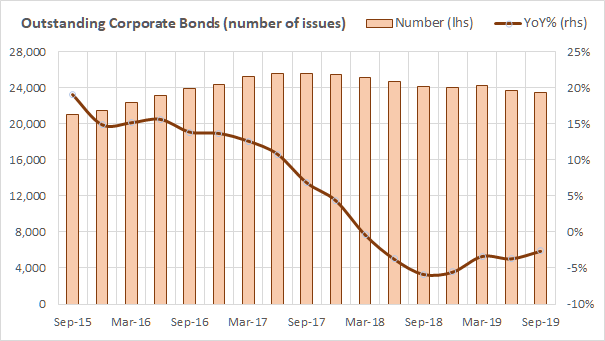

19) Progress is cyclical in finance.

21) Irrational lenders come and go, mostly they go.

Markets are driven by human behavior. Erratic markets lend themselves to irrational decisions.

23) A big business starts small. Technology and Capital are leverage.

24) Credit and debt are the two sides of the same coin and go together.

26) The economy is driven by Productivity and Debt Cycles (Short-term and Long-Term).

28) Money never declines. Money just Moves.

29) The credit cycle is the most powerful force in finance.

<more later>