Discover and read the best of Twitter Threads about #ConnectingTheDots

Most recents (12)

1 - #ConnectingTheDots The Bloomberg economist consensus for January is out

Expectations are for a "hot" month-on-month number, that annualises at ~5-6%

A significant step-up from recent prints

Expectations are for a "hot" month-on-month number, that annualises at ~5-6%

A significant step-up from recent prints

2 - What's the reason?

Simple - many fees, bills and contracts reset in January (example below)

Inflation was very high last year, so this seasonal effect should be very pronounced this year

Simple - many fees, bills and contracts reset in January (example below)

Inflation was very high last year, so this seasonal effect should be very pronounced this year

3 - Meanwhile, underlying inflation trends continue to weaken

1- #ConnectingTheDots The Fed meeting yesterday was hawkish, both the statement and Powell's press conference

The movement of FOMC members' dots - their view on high rates need to go - illustrates this well

The movement of FOMC members' dots - their view on high rates need to go - illustrates this well

2- This was contrary to my expectations, as "leaks" suggested ambiguity that the market would have read dovish

1- #ConnectingTheDots Markets & the economy

Let's start with the economy: There is an abundance of signs now pointing to a "hard landing"

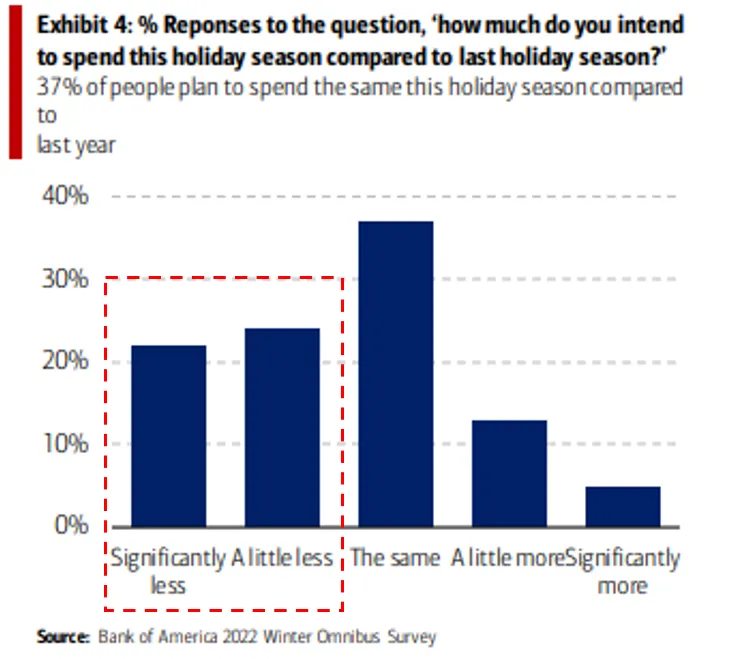

Near term US Retail data tracks very poorly...

Let's start with the economy: There is an abundance of signs now pointing to a "hard landing"

Near term US Retail data tracks very poorly...

2- ...the European consumer is cutting back sharply...

3- ... and China is ravaged by Covid. This wave will blow over soon, but what remains afterwards? A property bubble with 20% vacancy rates

1- #ConnectingTheDots On Friday, the US released employment numbers

Of particular note was strong wage growth for November, +0.6% m-o-m (>7% annualised)

US bond yields should have RALLIED on this highly inflationary signal, instead they FELL

Of particular note was strong wage growth for November, +0.6% m-o-m (>7% annualised)

US bond yields should have RALLIED on this highly inflationary signal, instead they FELL

2- Now, the wage data likely wasn't an error or outlier

As @jasonfurman highlights prior months saw upwards revisions, too

As @jasonfurman highlights prior months saw upwards revisions, too

3- The US Treasury bond market is the most sophisticated asset market

No retail, no memes, mostly big institutions

Such a highly unusual "RISK-OFF" signal is worth paying attention to

So what is going on?

No retail, no memes, mostly big institutions

Such a highly unusual "RISK-OFF" signal is worth paying attention to

So what is going on?

1- #ConnectingTheDots Commodities/Oil & Gas

We are currently in the ~4th inning of an economic slowdown

We are currently in the ~4th inning of an economic slowdown

1- #ConnectingTheDots Checking on the US Consumer

Today we got Initial Jobless Claims, a lead datapoint for the evolution of Unemployment

They went DOWN

Today we got Initial Jobless Claims, a lead datapoint for the evolution of Unemployment

They went DOWN

1- #ConnectingTheDots Checking in on #Housing following recent data

Question 1: What will happen to HOUSE PRICES?

Let's keep things simple - there is a RECORD number of houses under construction...

Question 1: What will happen to HOUSE PRICES?

Let's keep things simple - there is a RECORD number of houses under construction...

1- #ConnectingTheDots Lots of focus on what the Fed will do next, and whether inflation comes down

That is the WRONG debate

Yes, inflation has PEAKED. Yes, it will come DOWN

But why is the 10-Year is UP, despite declining inflation expectations?

That is the WRONG debate

Yes, inflation has PEAKED. Yes, it will come DOWN

But why is the 10-Year is UP, despite declining inflation expectations?

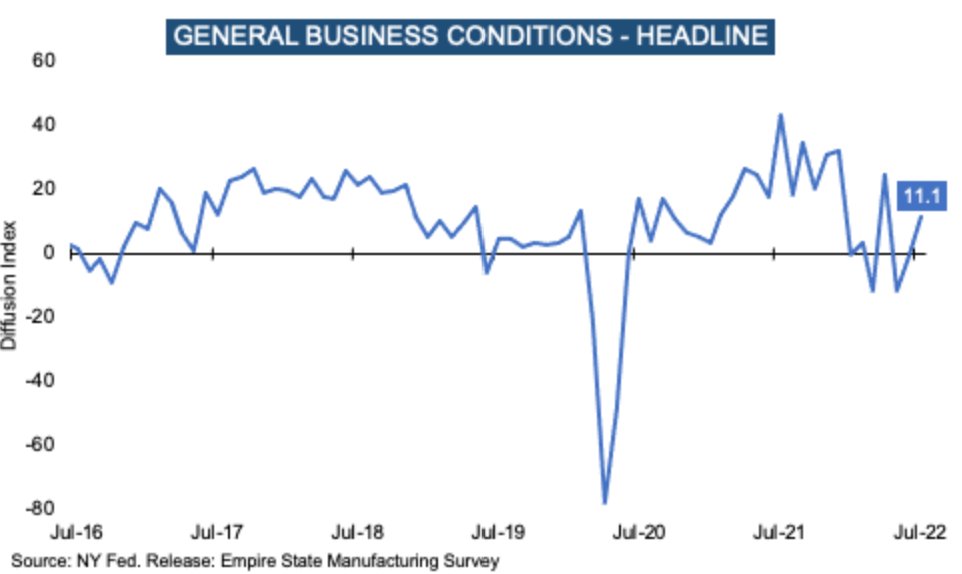

1- #Connectingthedots Today the NY Fed survey came out, which surveys local manufacturing businesses. The headline number, which is based on *current* view, looks benign. So "all is good"?

Tracing for the #RealMoses Standby. BIG Thread. 🔥 🔥 🔥

#ConnectingTheDots

We will read the scriptures literally as we connect the dots.

Moses’ mother was a Levite, Jochebed (Yo'Cheved, Numbers 26:59), which means, "Yahweh’s honour" or “Yahweh is glory” (NOBSE Study Bible Name List&Jones' Dictionary of Old Testament Proper Names).

We will read the scriptures literally as we connect the dots.

Moses’ mother was a Levite, Jochebed (Yo'Cheved, Numbers 26:59), which means, "Yahweh’s honour" or “Yahweh is glory” (NOBSE Study Bible Name List&Jones' Dictionary of Old Testament Proper Names).

2/ Moses' siblings were given in the Hebrew Scriptures as Aharown (Aaron) (Exodus 4:14) and Miryam (Miriam) (Exodus 6:20 and Numbers 26:57-59).

At the age of 40, he fled to Midian where he lived for 40 years (Exodus 2:11-15).

At the age of 40, he fled to Midian where he lived for 40 years (Exodus 2:11-15).

We will be livetweeting @PeggyBaileyDC, @hannahkatch , & Jenny Sullivan on the health's sector role in #housing starting in just a few minutes. Follow along with #ConnectingTheDots

@PeggyBaileyDC @hannahkatch We'll be starting with @PeggyBaileyDC: "We started to coalesce around the fact that zip codes determine health... It means that I didn't have control over the fact that I've lived to 47 years old & that's not fair. We don't recognize that luck enough." #ConnectingTheDots

@PeggyBaileyDC @hannahkatch There's a role in health care advocates in calling for improving people's health. -- @PeggyBaileyDC

#ConnectingTheDots

#ConnectingTheDots

#CorpScoop

@Nestle is the largest food company in the world and produces over 2000 products marketed to every possible demographic.

They are also one of the least ethical global corporations in the world.

1/

@Nestle is the largest food company in the world and produces over 2000 products marketed to every possible demographic.

They are also one of the least ethical global corporations in the world.

1/

Their efforts to market baby formula in third world nations had a devastating impact globally that led to hearings in the Senate & regulations to help curb certain practices.

The Trump admin has overturned many of these regulatory requirements, however.

#CorpScoop

2/

The Trump admin has overturned many of these regulatory requirements, however.

#CorpScoop

2/

For some background on the issue please click the provided links.

#CorpScoop #Nestle

3/

google.com/amp/s/www.theb…

#CorpScoop #Nestle

3/

google.com/amp/s/www.theb…