Discover and read the best of Twitter Threads about #Curvewar

Most recents (8)

1/ General landscape of #NFTFi

#NFT is gaining popularity and is simple for users to understand. I believe #NFTFi will be a major trend, similar to #DeFi summer.

A deep-dive thread about #NFTFi👇🧵

#NFT is gaining popularity and is simple for users to understand. I believe #NFTFi will be a major trend, similar to #DeFi summer.

A deep-dive thread about #NFTFi👇🧵

🧵(1/33)

Did you know @ConvexFinance $cvxCRV has been depegged for 3 months?

Read this thread and you will know it.

Likes/ Retweet/ Comment, please🫡

@CurveFinance @iearnfinance @ConvexFinance @StakeDAOHQ

#Curve #Curvewar #defi

Did you know @ConvexFinance $cvxCRV has been depegged for 3 months?

Read this thread and you will know it.

Likes/ Retweet/ Comment, please🫡

@CurveFinance @iearnfinance @ConvexFinance @StakeDAOHQ

#Curve #Curvewar #defi

(2/33)

$cvxCRV has been depegged for three months.

Why did that happen, and what will occur in the future?

In this thread, I will mainly cover four topics

1️⃣ Curve Eco brief

2️⃣ Depeg Event

3️⃣ Market Equilibrium

4️⃣ Mike's Memo

$cvxCRV has been depegged for three months.

Why did that happen, and what will occur in the future?

In this thread, I will mainly cover four topics

1️⃣ Curve Eco brief

2️⃣ Depeg Event

3️⃣ Market Equilibrium

4️⃣ Mike's Memo

(3/33)

1️⃣ Curve Eco brief

Before discussing depeg, we need to understand the following:

🌬The emission of $CRV

🪙Curve Tokenomics - $CRV and $veCRV

Curve is a very complex protocol, I don't think I can fully cover it in a thread, I will only do the brief in this thread

1️⃣ Curve Eco brief

Before discussing depeg, we need to understand the following:

🌬The emission of $CRV

🪙Curve Tokenomics - $CRV and $veCRV

Curve is a very complex protocol, I don't think I can fully cover it in a thread, I will only do the brief in this thread

Last month, @fraxfinance launched their liquid staking service and related token $frxETH

A thread 🧵to talk about $frxETH, and why I think it goona be the biggest challenger for Lido and $stETH 👇

Keep reading!

A thread 🧵to talk about $frxETH, and why I think it goona be the biggest challenger for Lido and $stETH 👇

Keep reading!

(1)

Let me introduced the mechanism of $frxETH first.

Users can deposit their ETH into the validator ran by frax finance and mint $frxETH.

Different with Lido’s stETH rebase mechanism, $frxETH is constant and holding $frxETH cannot generate yield

Let me introduced the mechanism of $frxETH first.

Users can deposit their ETH into the validator ran by frax finance and mint $frxETH.

Different with Lido’s stETH rebase mechanism, $frxETH is constant and holding $frxETH cannot generate yield

(2)

Two choice for users to earning rewards

First. Staking $frxETH to mint sfrxETH. sfrxETH is ERC-4626 vault and accumulates staking yield of Frax ETH validators.

The rates of frxETH:sfrxETH is changeable, holders will earn reward when redeem frxETH back.

Curreny APY is 4.72%

Two choice for users to earning rewards

First. Staking $frxETH to mint sfrxETH. sfrxETH is ERC-4626 vault and accumulates staking yield of Frax ETH validators.

The rates of frxETH:sfrxETH is changeable, holders will earn reward when redeem frxETH back.

Curreny APY is 4.72%

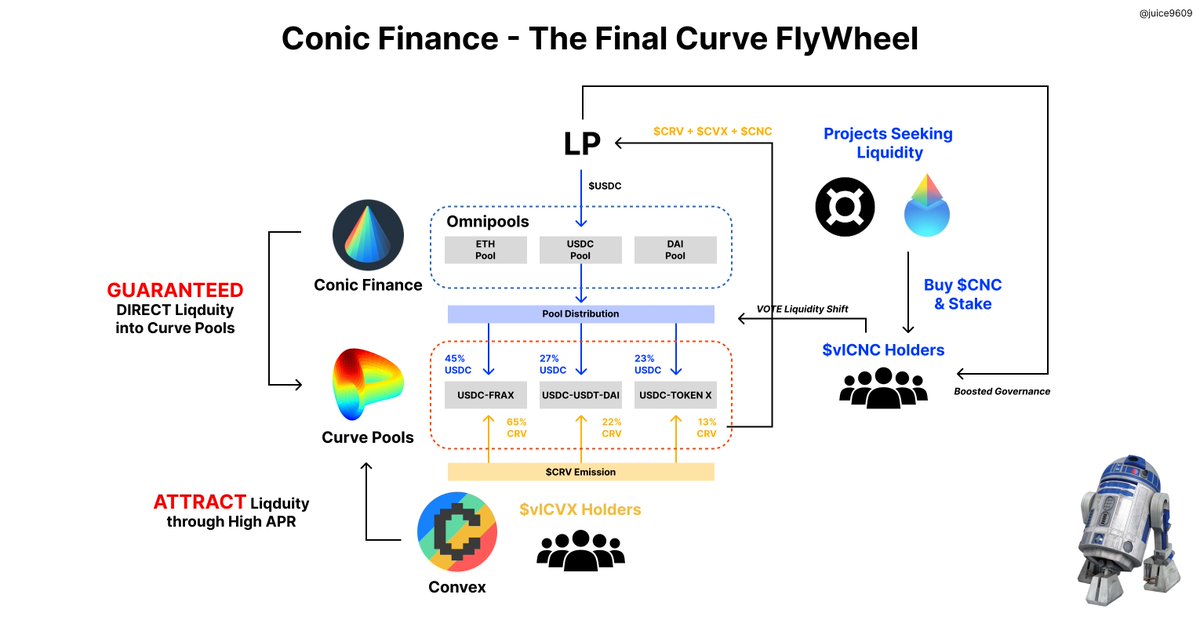

1/ Understanding the underlying value of $CNC of @ConicFinance 🍦 to accurately evaluate the value it brings to the $CRV-$CVX-$CNC flywheel 🛞

A 🧵 on everything you need to know on why $vlCNC is the next big thing (Hint: Cheap Liquidity 😉)

A 🧵 on everything you need to know on why $vlCNC is the next big thing (Hint: Cheap Liquidity 😉)

3/ @ConvexFinance was the first flywheel, allowing protocols to bribe for higher emission of $CRV on specific pools in @CurveFinance

This allowed @FraxFinance to acquire $vlCVX and direct higher $CRV emissions on $FRAX pools compared to other pools ($FRAX > $3POOL)

This allowed @FraxFinance to acquire $vlCVX and direct higher $CRV emissions on $FRAX pools compared to other pools ($FRAX > $3POOL)

🧵[SOULBOUND TOKENS : LE FUTUR DE LA BLOCKCHAIN ETHEREUM ?]

Selon @VitalikButerin, les SBTs pourraient totalement révolutionner notre identité sur le web dans les prochaines années

5min pour comprendre ce que sont les SBTs et l’impact qu’ils auront sur nos vies à l'avenir 👇

Selon @VitalikButerin, les SBTs pourraient totalement révolutionner notre identité sur le web dans les prochaines années

5min pour comprendre ce que sont les SBTs et l’impact qu’ils auront sur nos vies à l'avenir 👇

1. Qu’est-ce qu’un SBT ?

2. Quels problèmes résolvent-ils ?

3. Les cas d’utilisations

4. Les points encore à travailler selon Vitalik

2. Quels problèmes résolvent-ils ?

3. Les cas d’utilisations

4. Les points encore à travailler selon Vitalik

👉 SBT signifie “soul bound token” (en traduction littérale “token lié à l’âme”)

Pour faire simple, un SBT est un #NFT avec les caractéristiques suivantes :

➡️non-transférable

➡️non “mintable” : les SBTs sont créés (et peuvent être burn) uniquement par la structure qui les émet

Pour faire simple, un SBT est un #NFT avec les caractéristiques suivantes :

➡️non-transférable

➡️non “mintable” : les SBTs sont créés (et peuvent être burn) uniquement par la structure qui les émet

今天聊一个 (名字) 很酷的项目 #hiddenhand。

感觉翻译不好,留着英文大家自己品味吧!😅

写在前面:本文谈及的协议及相关背景可能大家不太熟悉,为了保持内容的聚焦,将不在本文做过多介绍,还请各位见谅🙏

感觉翻译不好,留着英文大家自己品味吧!😅

写在前面:本文谈及的协议及相关背景可能大家不太熟悉,为了保持内容的聚焦,将不在本文做过多介绍,还请各位见谅🙏

❓首先 #hiddenhand 是什么?

🔴#hiddenhand 是无需许可的贿赂市场。

#curvewar 相信大家都比较熟悉了

其中有个重要角色 @VotiumProtocol

@VotiumProtocol 让 #curvewar 的贿赂变得更简单

🔴#hiddenhand 是无需许可的贿赂市场。

#curvewar 相信大家都比较熟悉了

其中有个重要角色 @VotiumProtocol

@VotiumProtocol 让 #curvewar 的贿赂变得更简单

1/18 换个方向聊聊沉寂已久的 #DeFi 板块。在 @CipholioCN 和 @devoteEndlessly 共同举办的活动上分享了下目前对 #CurveWar 的认识和看法,其实关于生态的讨论已经有很多现有资料,借这个机会拾人牙慧再来谈谈自己浅显的认知,希望可以帮大家从头再梳理下这场战争的来龙去脉。

2/18 在正式进入 Cruve 生态之前不得不提一嘴目前稳定币的发展和生态。我们大致经历了从法币抵押➡️超额抵押➡️算法稳定的三个发展阶段,他们都各有各的优势与问题,而流动性战争的核心则围绕解决算法稳定币的价值锚定和提供代币使用场景展开。

3/18 第一个问题:如何锚定(算法)稳定币的价值?在众多的 AMM 之间大家最终选择了 @CurveFinance 。其提供的 Stableswap 算法使得其在盘口提供的深度要比 Uniswap V1 算法更优,这一天然优势使得其可以满足稳定币大额低滑点交易的需求,因此逐渐建立起稳定币兑换的生态。

1/ Curve Finance est sans aucun doute un pionnier de la DeFi.

Aujourd'hui, #Curve traite plus de 6 milliards de dollars en volume mensuel et a atteint la TVL la plus élevée des projets #DeFI : plus de 19 milliards de dollars. 💵

Vous l'avez compris ce 🧵sera sur @CurveFinance:

Aujourd'hui, #Curve traite plus de 6 milliards de dollars en volume mensuel et a atteint la TVL la plus élevée des projets #DeFI : plus de 19 milliards de dollars. 💵

Vous l'avez compris ce 🧵sera sur @CurveFinance:

2/ Qu'est ce que Curve ?

Curve est un #DEX spécialement conçu pour échanger des stables coins ou des actifs rattachés à la même valeur ex : $wBTC / $renBTC.

Le protocole est conçu pour ne pas avoir de slippage et y parvient en combinant des invariants de somme et de produit.

Curve est un #DEX spécialement conçu pour échanger des stables coins ou des actifs rattachés à la même valeur ex : $wBTC / $renBTC.

Le protocole est conçu pour ne pas avoir de slippage et y parvient en combinant des invariants de somme et de produit.

3/ Curve Update

Dernièrement, Michaele Egorov a publié un white paper sur les AMMs avec un système de peg dynamique.

Cela a permis de créer dans #curve des pools pour tout type d'actifs, qu'ils soient stables ou pas.

curve.fi/files/crypto-p…

Dernièrement, Michaele Egorov a publié un white paper sur les AMMs avec un système de peg dynamique.

Cela a permis de créer dans #curve des pools pour tout type d'actifs, qu'ils soient stables ou pas.

curve.fi/files/crypto-p…