Discover and read the best of Twitter Threads about #Definedge

Most recents (13)

Thread: True Strength Index (TSI) Indicator

A combination of momentum (leading) and smoothing (lagging) qualities.

(1/20)

#Indicator #trading #investing #definedge

A combination of momentum (leading) and smoothing (lagging) qualities.

(1/20)

#Indicator #trading #investing #definedge

A momentum indicator developed by William Blau, the True Strength Index (TSI) measures a stock's strength.

In general, momentum indicators are aggressive, while smooth indicators are lagging. Both have their advantages & disadvantages.

In general, momentum indicators are aggressive, while smooth indicators are lagging. Both have their advantages & disadvantages.

However, aggressive indicators are leading but they often result in frequent shifts. Smoothed indicators are lagging, but they are relatively stable.

TSI is a helpful indicator for strength analysis that combines momentum & the smoothing factor.

Let me explain.

TSI is a helpful indicator for strength analysis that combines momentum & the smoothing factor.

Let me explain.

Alligator indicator is created by Bill Williams. He was a popular trader and author.

Before we discuss the indicator, let us understand an important concept.

Before we discuss the indicator, let us understand an important concept.

Thread: Trade Plan - My thoughts and experience.

You must have heard “Plan your trade and trade your plan”.

#tradeplan #trading #investing #definedge

You must have heard “Plan your trade and trade your plan”.

#tradeplan #trading #investing #definedge

Many experienced traders, authors and analysts keep saying trade as per your plan.

You must write your plan of taking trades and focus on the execution. But you will not see many people really doing that - even many experienced traders.

Possible reasons:

You must write your plan of taking trades and focus on the execution. But you will not see many people really doing that - even many experienced traders.

Possible reasons:

1. Lack of awareness – What’s Trading plan?

2. Do not know how to do that or need guidance.

3. We keep learning new things, making it difficult to stick to a plan.

4. Like to rely on other’s studies and recommendations, no need of plan.

5. Trading is art, not science.

2. Do not know how to do that or need guidance.

3. We keep learning new things, making it difficult to stick to a plan.

4. Like to rely on other’s studies and recommendations, no need of plan.

5. Trading is art, not science.

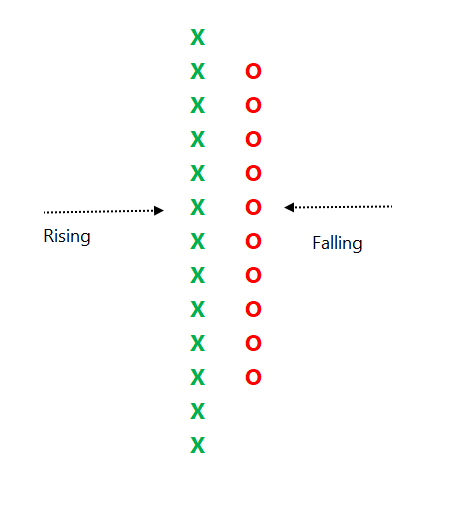

Thread: P&F Super Pattern

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

An effective price pattern defined using properties of P&F charts.

#Superpattern #Pointandfigure #Definedge

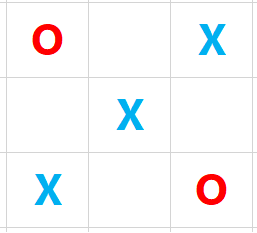

Point & Figure is an oldest charting method where price is plotted vertically, and the chart moves only when price moves. It is a different way of looking at the price, the objective box-value and reversal value offers advantage of identifying objective price patterns.

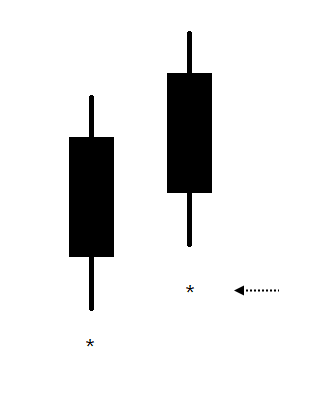

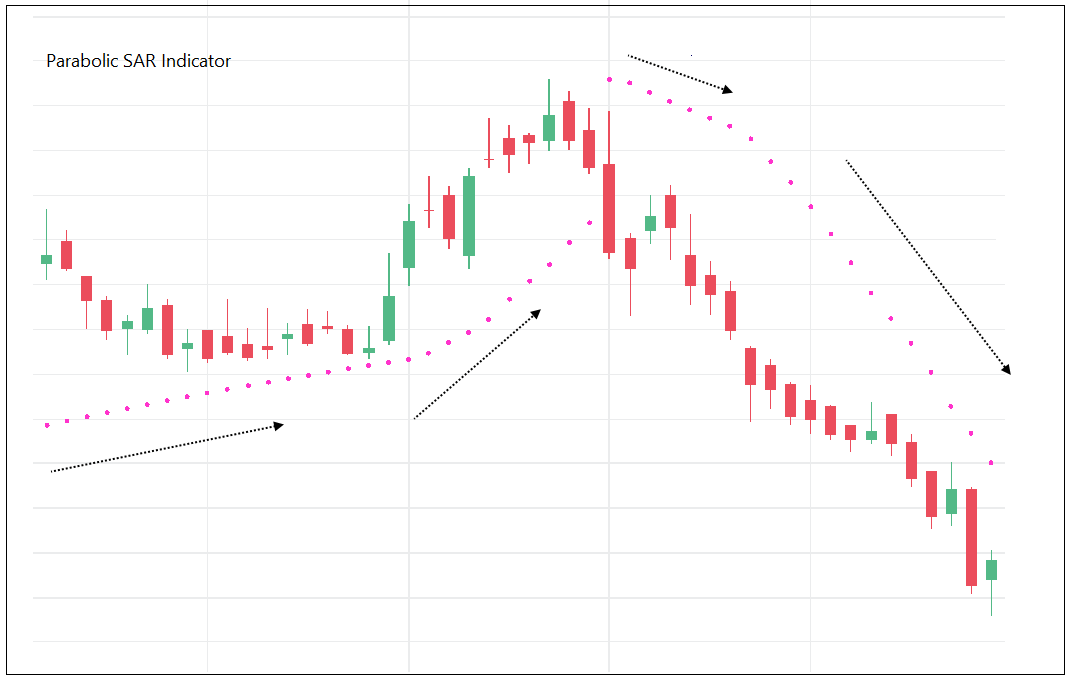

Thread: Parabolic SAR Indicator

Parabolic SAR (PSAR) indicator was developed by J. Welles Wilder.

#PSAR #Indicators #Definedge

Parabolic SAR (PSAR) indicator was developed by J. Welles Wilder.

#PSAR #Indicators #Definedge

The calculation of this indicator is a bit complex, but the concept is extremely useful. I will try to simplify it and explain the logic. I will briefly explain the concept, calculation and reading.

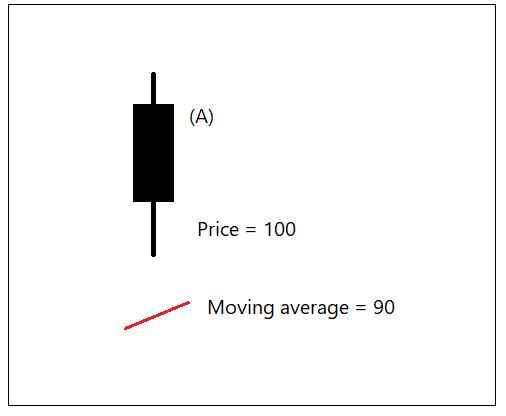

Let us think about creating an indicator that shows the trend.

Let us think about creating an indicator that shows the trend.

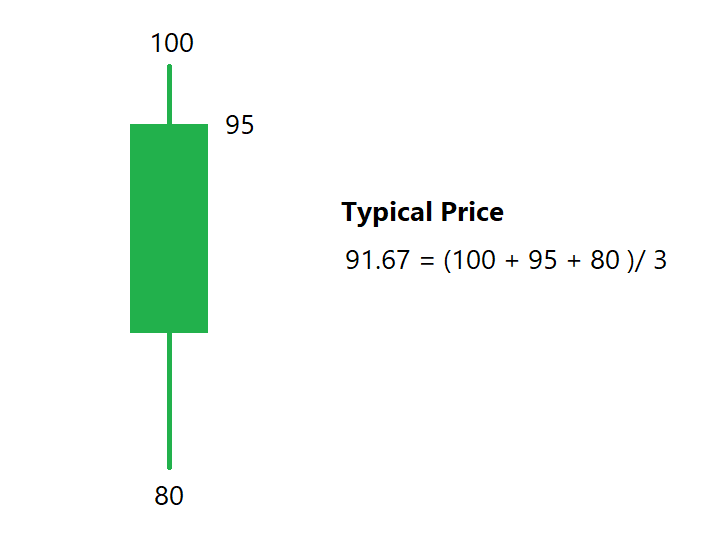

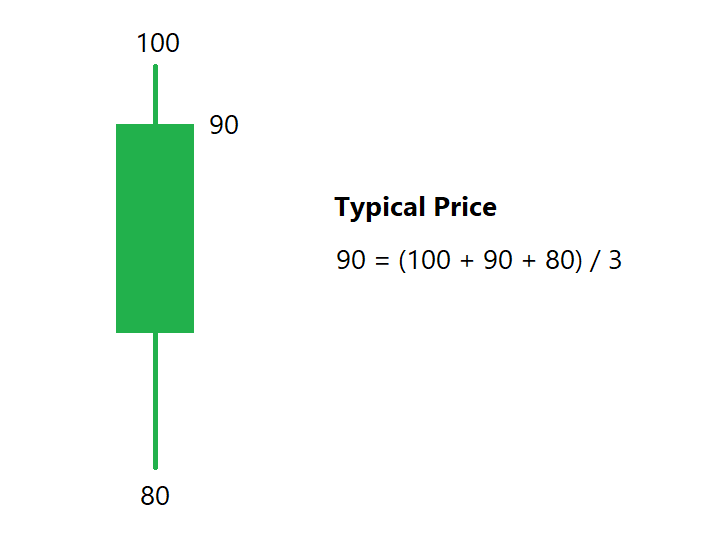

Chester W. Keltner (1909-1998) was a Chicago grain trader. He worked with successful traders who back-tested trading systems. He talked about Ten-Day Moving average trading rule in his book 'How to Make Money in Commodities' in 1960.

He did not claim that he invented the strategy so origin of this idea is uncertain. But people started referring it as Keltner channel after the book.

There are two versions of Keltner channel. First is explained by Keltner in his book, and the other one is a modified version.

There are two versions of Keltner channel. First is explained by Keltner in his book, and the other one is a modified version.

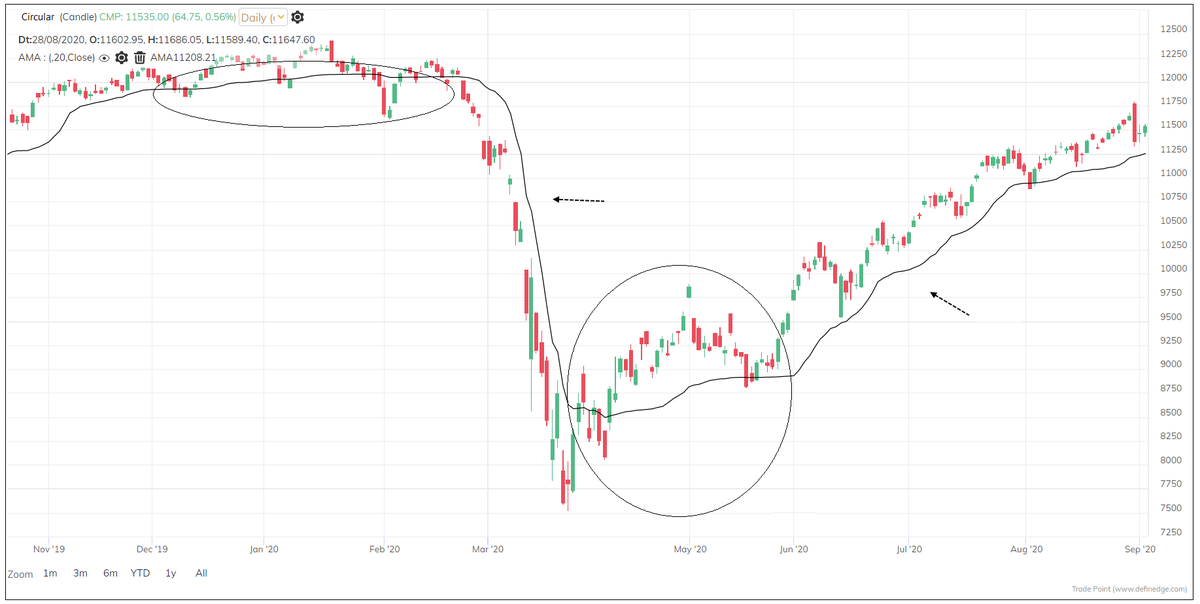

Thread: Adaptive Moving Average (AMA)

AMA is an indicator devised by Perry Kaufman explained in his book Trading System and Methods. It is also known as Kaufman’s Adaptive Moving Average (KAMA).

#AMA #Adaptivemovingaverage #indicators #definedge

AMA is an indicator devised by Perry Kaufman explained in his book Trading System and Methods. It is also known as Kaufman’s Adaptive Moving Average (KAMA).

#AMA #Adaptivemovingaverage #indicators #definedge

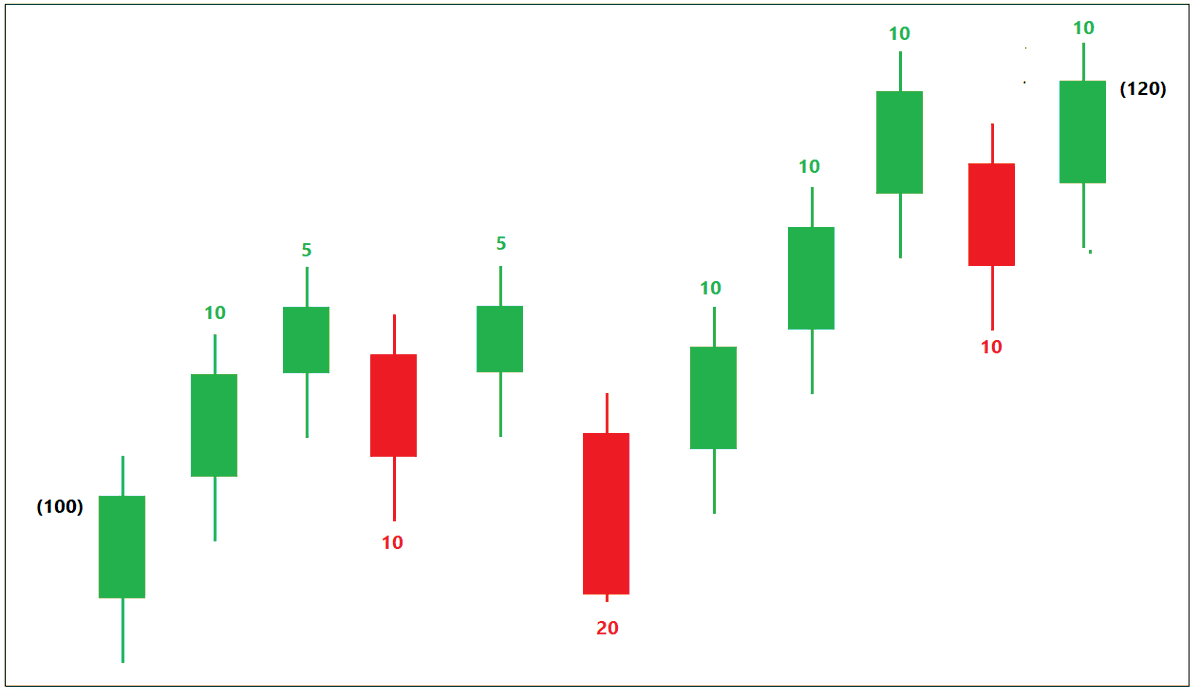

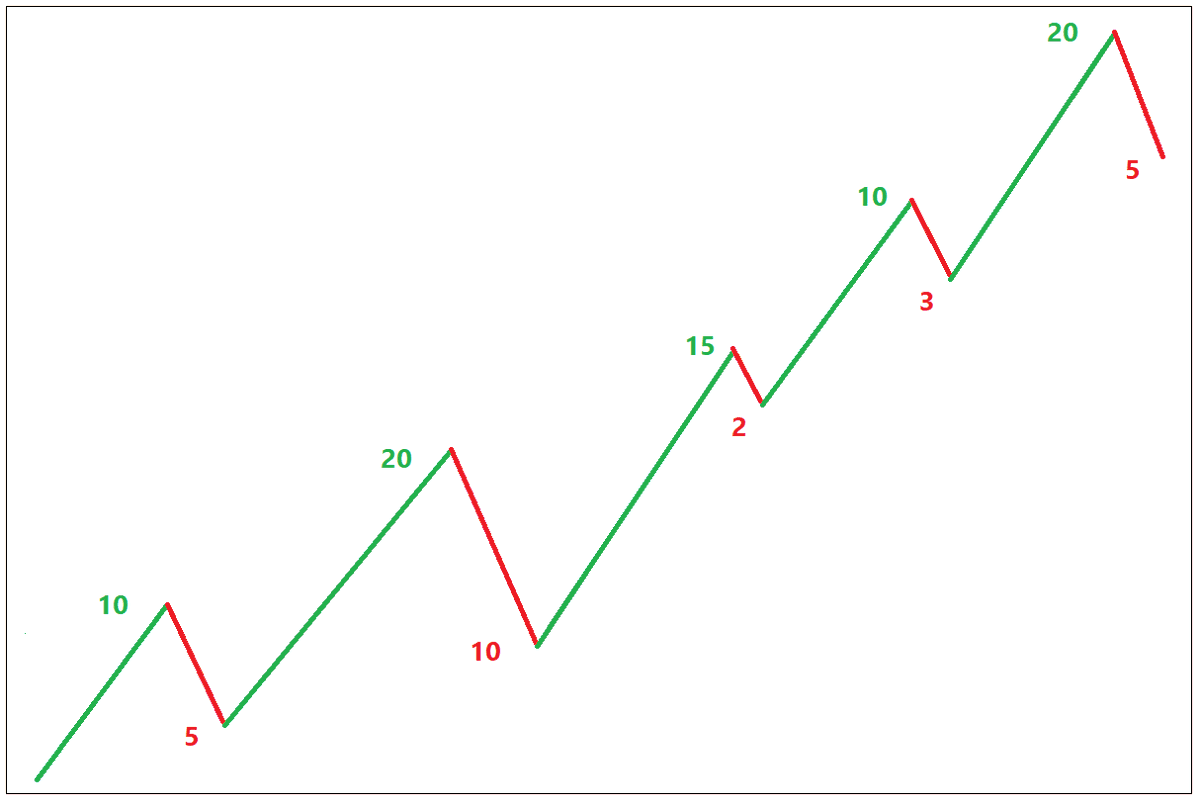

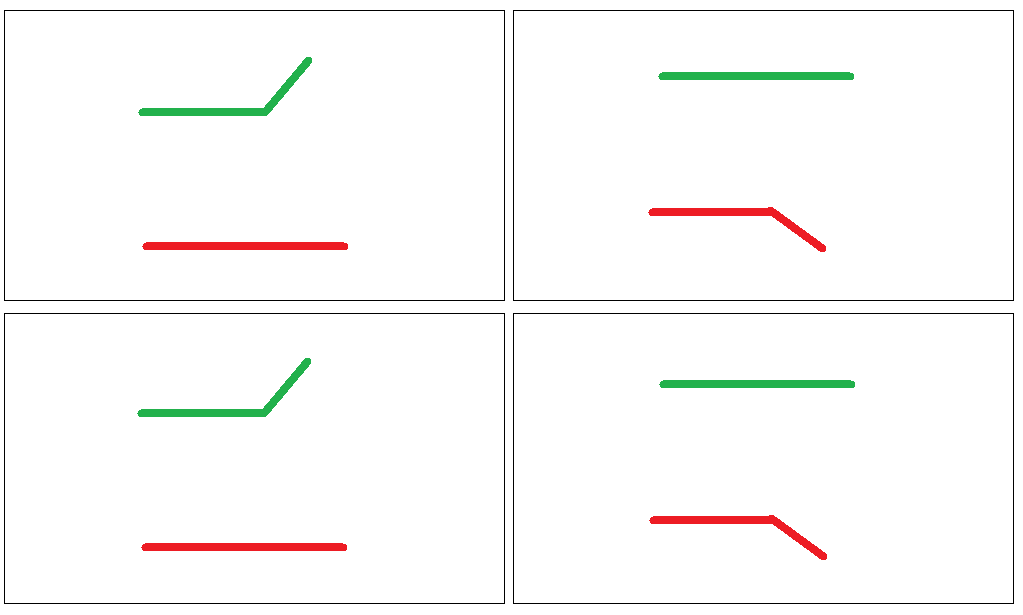

Rate of change (ROC) is a study that measures how much price moved up or down from previous bar. The daily rate of change captures the trend. When we make it absolute, captures volatility.

Meaning,

Price went up or down by 10 points = trend

Price moved by 10 points = volatility

Meaning,

Price went up or down by 10 points = trend

Price moved by 10 points = volatility

Thread: Bollinger Bands

Bollinger Bands® is a wonderful invention of John Bollinger.

#Bollingerbands #Indicators #Definedge

Bollinger Bands® is a wonderful invention of John Bollinger.

#Bollingerbands #Indicators #Definedge

Thread: Donchian Channels

Donchian channels were invented by Richard Donchian. He is known as a father of trend following trading. He was founder of world’s first managed fund in 1949.

#donchianchannels #indicators #definedge

Donchian channels were invented by Richard Donchian. He is known as a father of trend following trading. He was founder of world’s first managed fund in 1949.

#donchianchannels #indicators #definedge

Donchian was born in 1905, he got interested in trading after learning abt story of Jesse Livermore. Donchian started relatively at young age but wasn’t successful initially in the market. He lost significant money in 1929 crash. Bt managed to come back & started practicing again

He was a self-taught chartist and technician. He created strategies using charts and indicators and also studied company’s underlying fundamental characteristics. He also wrote technical newsletters for over two decades for well-known firms.

Thread: MFI Indicator

Created by Gene Quong and Avrum Soudack, MFI stands for Money Flow Index.

#MFI #Indicators #Definedge

Created by Gene Quong and Avrum Soudack, MFI stands for Money Flow Index.

#MFI #Indicators #Definedge

Nicolas Darvas (1920 – 1977) was a professional dancer and he travelled around the world. He founded a Dance company in 1950s. Someone offered him shares against his Dance programme and that is how he came across stock market and the business of trading.

He reportedly turned thousand dollars into millions in the late 1950s.

He wrote a popular book during 1960 “How I made $2000000 in Stock Market” in which he explained his Box theory. It is a must read.

He used a combination fundamental and technical approach for investing.

He wrote a popular book during 1960 “How I made $2000000 in Stock Market” in which he explained his Box theory. It is a must read.

He used a combination fundamental and technical approach for investing.

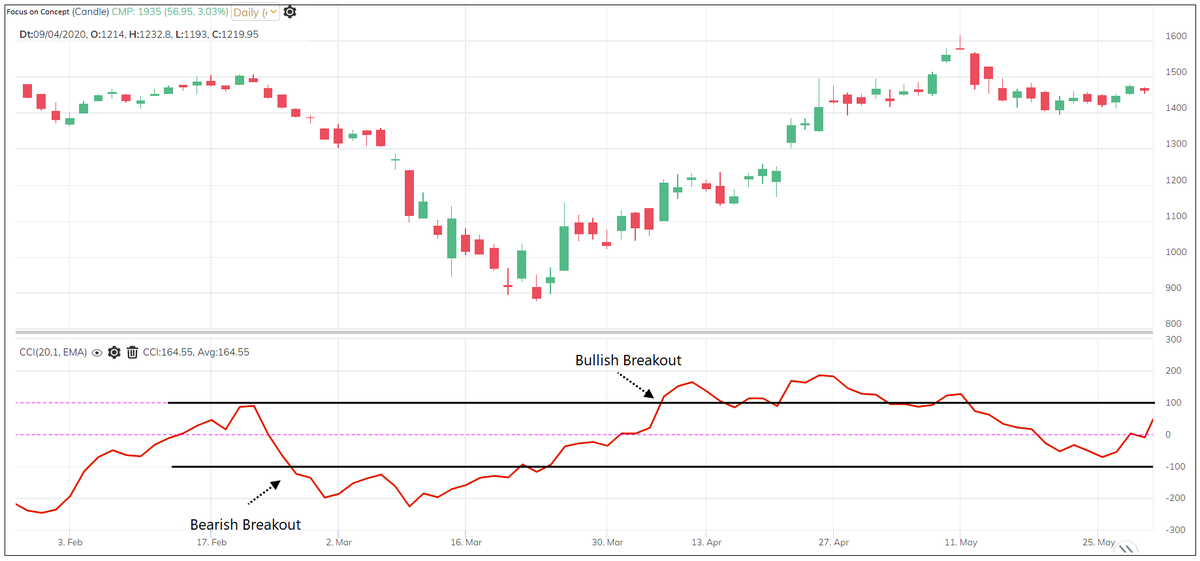

Thread: CCI Indicator

Invented by Donald Lambert, CCI stands for Commodity Channel Index.

There are three parts of CCI Indicator: You can remember it as TMC.

#CCI #Indicators #Definedge

Invented by Donald Lambert, CCI stands for Commodity Channel Index.

There are three parts of CCI Indicator: You can remember it as TMC.

#CCI #Indicators #Definedge