Discover and read the best of Twitter Threads about #Degens

Most recents (13)

Once the #DeFi summer truly begins, there will be lots of newcomers in lowcap degen space. Altcoin traders and normies will flood in, hoping to make that life/wife changing money. And falling into all sorts of traps. How to not get rekt while trading degens? Thread 👇🧵 (1/10)

Don't listen blindly to *anyone*. Be careful with influencers. Watch the space closely, observe changing trends, adapt to ongoing meta. Make your decisions according to your solid research and gut feeling. Only you are responsible for your investments.

(2/10)👇

(2/10)👇

NEVER throw all your resources into single project. This is a jungle and even the most impressive token can vanish overnight. Scams, hack attacks, contract errors, panic dumps - all this shit happens in #lowcap DeFi on daily basis, so watch out.

(3/10)👇

(3/10)👇

Now you can use $MaticX as collateral to borrow stablecoin $MAI @qidao

And earn 3% SD Boost💰💰

Well, you already know that !

Let's go step-by-step on how to make the most of this opportunity 🧵

1/6

And earn 3% SD Boost💰💰

Well, you already know that !

Let's go step-by-step on how to make the most of this opportunity 🧵

1/6

Our partnership with @QiDaoProtocol allows borrowing a loan upto 74% of the collateral value…

With 0% Borrow APY🤯

It's a money minting opportunity for all the #DeFi #Degens

2/6

With 0% Borrow APY🤯

It's a money minting opportunity for all the #DeFi #Degens

2/6

Step #1:

Stake MATIC with Stader on polygon.staderlabs.com

And mint MaticX while earning MATIC at a ~5.76% APY

Next…

3/6

Stake MATIC with Stader on polygon.staderlabs.com

And mint MaticX while earning MATIC at a ~5.76% APY

Next…

3/6

YOU ASK FOR IT, NOW YOU GET IT

HERE IS A THREAD 🧵 ON SOME OF MY POST ON;

(1) DEFI

(2) CRYPTO JOBS

(3) NFTS

(4) AIRDROPS

(5) TRADING SHITCOINS

AND SO ON...

#Binance10M #BUSD #Airdrop $BTC

HERE IS A THREAD 🧵 ON SOME OF MY POST ON;

(1) DEFI

(2) CRYPTO JOBS

(3) NFTS

(4) AIRDROPS

(5) TRADING SHITCOINS

AND SO ON...

#Binance10M #BUSD #Airdrop $BTC

WHAT IS DECENTRALISED FINANCE

WAYS TO MAKE MONEY 💰 IN DEFI

Ready to start earning from trading even in bad market conditions?

@0xpolysynth has an all-weather solution that #degens will love. More on this innovative project in this thread... 🧵

#Polysynth @0xPolysynth

@0xpolysynth has an all-weather solution that #degens will love. More on this innovative project in this thread... 🧵

#Polysynth @0xPolysynth

This thread will cover but not be excluded to the following scope:

1/ What is #Polysynth?

2/ Structured Products ( FCN )

3/ Why invest in FCNs?

4/ My closing thoughts

1/ What is #Polysynth?

2/ Structured Products ( FCN )

3/ Why invest in FCNs?

4/ My closing thoughts

1️⃣ Polysynth protocol is a Defi Options Vault (DOV) protocol powered by #Ethereum

Can you imagine making 30%+ APY on your stablecoins? You read that right....

Can you imagine making 30%+ APY on your stablecoins? You read that right....

This thread articulates the problem well enough but I'd argue it incorrectly equates

1."#identity data able to be consumed by the chain"

and

2. "identity data must be on the chain".

The answer is less data on-ledger not more. First, an example using #TornadoCash .👇

1."#identity data able to be consumed by the chain"

and

2. "identity data must be on the chain".

The answer is less data on-ledger not more. First, an example using #TornadoCash .👇

Hopefully everyone is aware of what happened to #TornadoCash over the last week and most terrifyingly, the developer being arrested.

The main outcome for us to focus on is a tonne of addresses are now denylisted by a mix of protocols, DEXs and CEXs.

The main outcome for us to focus on is a tonne of addresses are now denylisted by a mix of protocols, DEXs and CEXs.

The balances in those accounts can be assumed to be dead since it's now extremely difficult to extract that value.

Now if these accounts were linked to real-world identities, suddenly, off-chain assets could become fair game too.

Now if these accounts were linked to real-world identities, suddenly, off-chain assets could become fair game too.

If you type vitalik.eth.link in your browser...

It loads Vitalik's Website!

Here's how YOU can also make YOUR .eth ENS name resolve to a web2 site! 👇 🧵

It loads Vitalik's Website!

Here's how YOU can also make YOUR .eth ENS name resolve to a web2 site! 👇 🧵

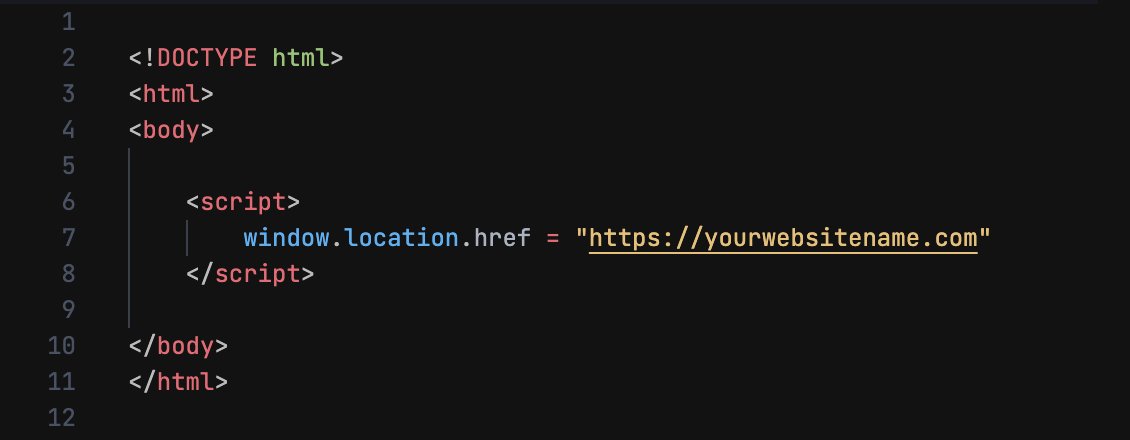

2/ First, you have to create a HTML file and upload it on IPFS

You can create the HTML using an IDE or a basic text editor (save it as a .html file)

Here's a basic HTML file that redirects to an existing website:

You can create the HTML using an IDE or a basic text editor (save it as a .html file)

Here's a basic HTML file that redirects to an existing website:

3/ Head to Pinata.cloud pinata.cloud to upload the file on IPFS

Create an account, then click 'Upload' and select your HTML file

Once it's added, you’ll get an IPFS CID (Content Identifier)

Copy the CID

Create an account, then click 'Upload' and select your HTML file

Once it's added, you’ll get an IPFS CID (Content Identifier)

Copy the CID

1/ Can you smell what #0VIX is cooking on @0xPolygon? Maintaining a sustainable ecosystem is a challenging task. But with Vote Escrow tokens on Polygon, it becomes super easy. But let us explain the advantages of Vote Escrow…

2/ The VE token design aims to give future yield to early adopters while continuously incentivizing engagement. The main goal of veTokenomics is to offer added value to users and make sure capital sticks to the protocol so people don’t jump ship after any early gains.

Game changer. Sienna lend and private #DeFi

Finally! we are getting a DeFi platform complete with lending on a network that is private by default #privacymatters so all of the fun stuff that us #Degens love to play with 👇

Finally! we are getting a DeFi platform complete with lending on a network that is private by default #privacymatters so all of the fun stuff that us #Degens love to play with 👇

But without the invasive public surveilance that we have become desensitized to.

You can share what you wish but not be spied on without consent. This has big implications for you and for protocols. Bad actors are going to have a much harder time manipulating both.

You can share what you wish but not be spied on without consent. This has big implications for you and for protocols. Bad actors are going to have a much harder time manipulating both.

Imagine a #degenbox type of strategy that you come up with, and only those you share with can use it, because it cant be spied? @sienna_network has a great AMM already, and they have already implimented stkd- $SCRT ( @Shade_Protocol's liquid $SCRT derivative) /SCRT LP.

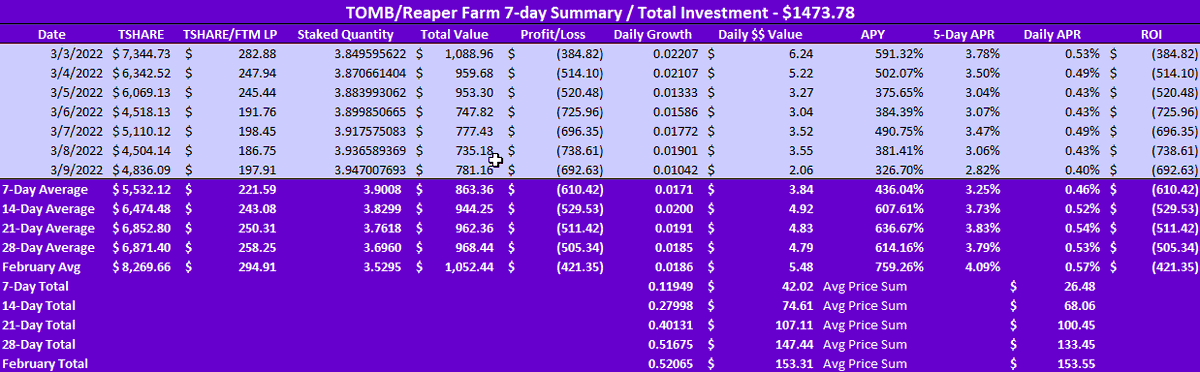

It's Wednesday, so we have a new weekly summary for all of the daily investment posts. This thread includes data from:

@tombfinance / @Reaper_Farm

@HectorDAO_HEC / @nemesis_dao

@osmosiszone / @ThorNodes

@VaporNodes / @AngelNodes

Check it out!

🧵👇

@tombfinance / @Reaper_Farm

@HectorDAO_HEC / @nemesis_dao

@osmosiszone / @ThorNodes

@VaporNodes / @AngelNodes

Check it out!

🧵👇

2/ First let's take a look at @tombfinance, staking $TShare / $FTM LP in #autofarm @Reaper_Farm. @FantomFDN #drama caused some lower price action this month, but Tomb shows some consistent returns. Don't care about price, I care about #Compounding

3/ Next, let's look at @HectorDAO_HEC. APR is slow and steady and this project is pretty boring with very low returns. Price action continues to decline, but looks like a bottom is near. The pivot to a bank and $TOR saved the #rebase project, but we'll see what happens with $HEC

Some of You may be already familiar with @standarddefi but If You are somehow not, check what is coming from this #MultiChain #protocol for #synthetic assets. Standard Protocol is coming with lots of goodies for #Dotsama #Defi degens. Check this thread to know what to expect…

1. Standard Protocol Decentralised exchange with own AMM module launching on @ShidenNetwork with swap functions, LP provision and unique #Standard #dividends pool. Users will have a great Opportunity to generate revenue from DAY1 of #mainnet launch on #Shiden

Users will have unique #opportunities to generate #revenue on Standard DEX, with #STND and #SDN @ShidenNetwork tokens. #Defi #degens from #Dotsama ecosystem can try all those on testnet in from of mainnet Launch

You can join testnet Here:

apps.standard.tech

You can join testnet Here:

apps.standard.tech

1/

In the Age before #Crypto, the world was shrouded by fog. But then there was Fire. And with Fire came disparity. And #ETH with #BSC were born.

The 3rd world had always been a tale of ancient #degens. But the truth appeared before #1inch mascot in the form of a green portal.

In the Age before #Crypto, the world was shrouded by fog. But then there was Fire. And with Fire came disparity. And #ETH with #BSC were born.

The 3rd world had always been a tale of ancient #degens. But the truth appeared before #1inch mascot in the form of a green portal.

2/

🪂 Jump into the @0xPolygon's portal with #1inch and feel the 🦾 full power of one of the most promising scaling solutions on #ETH.

⤵️ Follow this thread or read our new blog post to solve all mysteries hidden inside. 🔮

#Ethereum #Blockchain #DeFi

blog.1inch.io/1inch-network-…

🪂 Jump into the @0xPolygon's portal with #1inch and feel the 🦾 full power of one of the most promising scaling solutions on #ETH.

⤵️ Follow this thread or read our new blog post to solve all mysteries hidden inside. 🔮

#Ethereum #Blockchain #DeFi

blog.1inch.io/1inch-network-…

3/

You asked for it, you got it! 😎

🔥 The #1inch Network expanded to #Polygon! 🔥

✅ The expansion provides 1inch users with access to multiple liquidity sources on Polygon such as @CurveFinance, @SushiSwap, @AaveAave, @MUSTCometh, and @QuickswapDEX.

You asked for it, you got it! 😎

🔥 The #1inch Network expanded to #Polygon! 🔥

✅ The expansion provides 1inch users with access to multiple liquidity sources on Polygon such as @CurveFinance, @SushiSwap, @AaveAave, @MUSTCometh, and @QuickswapDEX.

🚨 Mempool Congestion Alert 🚨

We are seeing sustained high rates of transaction eviction over the past several days.

For more on the impact of transaction eviction, see our Black Thursday post: blog.blocknative.com/blog/mempool-f…

We are seeing sustained high rates of transaction eviction over the past several days.

For more on the impact of transaction eviction, see our Black Thursday post: blog.blocknative.com/blog/mempool-f…

For perspective: Last night we tweeted that one of our large North American nodes had ~160,000 pending transactions in its mempool.

But a default configuration Geth node has 4,096 slots (and shared memory at that).

🤔

But a default configuration Geth node has 4,096 slots (and shared memory at that).

🤔

So… most of the nodes on the network have room for ~2.56% of all pending TX.

In other words, many (most?) of the nodes on the network are wedged. 😲

This is mempool pressure. And the result is decreased predictability in transaction behavior.

In other words, many (most?) of the nodes on the network are wedged. 😲

This is mempool pressure. And the result is decreased predictability in transaction behavior.

1/ 2014 bear was different then now. Back then besides bitcoin maximalists and lucky people who got in early, it was mostly caused by mt gox. Now it is a different animal for $btc #bitcoin

2/ retail didn’t exist then cuz if it did you would have been in it. Now large smart money got in, exited, and dumped all over you.

3/ i fully agree with @Crypto_Macro when he says there is a fundamental and technical catalyst that must lead us forward. Also the recent thread by @AriDavidPaul is worth noting.