Discover and read the best of Twitter Threads about #DoKwon

Most recents (4)

🧵1/69 I was reminiscing about old times today and decided to throw together a quick dashboard on the rise and fall of the classic LUNA/UST algorithmic stablecoin pair. Built via @flipsidecrypto as always!

#LUNA #LUNC #DoKwon

flipsidecrypto.xyz/brian-terra/te…

#LUNA #LUNC #DoKwon

flipsidecrypto.xyz/brian-terra/te…

@threadreaderapp unroll

1/🧵 My $Luna Journey & Why I am Upset/Disappointed

Many are mad at/disappointed in #DoKwon #Terra_Luna #LFG , #influencers etc. I am NOT. I am upset w/Myself bc I know better. This isn't my first rodeo.

Many are mad at/disappointed in #DoKwon #Terra_Luna #LFG , #influencers etc. I am NOT. I am upset w/Myself bc I know better. This isn't my first rodeo.

2/ Some may feel a couple of my comments to be a little harsh but I hope you see the balance in my assessment should you read the entire thing. I will address 5 Red Flags I ignored & Humbly give some suggestions for the future based on what I've learned from others & myself

3/

1) How this could've even realistically worked w/the US Gov

2)Echo-chamber in the community

3) Over-leveraging strategies/Number go up

4) Do's actions/comments

5) The community's reactions to Do's behavior/comments & the unwavering idol worship

1) How this could've even realistically worked w/the US Gov

2)Echo-chamber in the community

3) Over-leveraging strategies/Number go up

4) Do's actions/comments

5) The community's reactions to Do's behavior/comments & the unwavering idol worship

JUST IN: #DoKwon submits a revival plan for #Terra including resetting the network ownership to 1B tokens. Maybe it's not game over for #Luna just yet? 👇🧵

@stablekwon proposes to establish a new chain, resetting the supply to 1B tokens. The priority is to preserve the Terra ecosystem community, which is the primary source of value for Terra.

The new chain is to be community run, i.e. the distribution of the new token is to be airdropped to community participants, and none allocated to #TerraformLabs. Check the proposed distribution here.

Why $ust's peg has everything to do with @CurveFinance's #3pool

A thread on $ust's collapse with @dicksonlai_ @GabrielGFoo @themlpx 🧵

@TheSpartanGroup @nansen_ai

#luna

A thread on $ust's collapse with @dicksonlai_ @GabrielGFoo @themlpx 🧵

@TheSpartanGroup @nansen_ai

#luna

1/ The story begins - believe it or not - with $DAI, and how it maintains its peg.

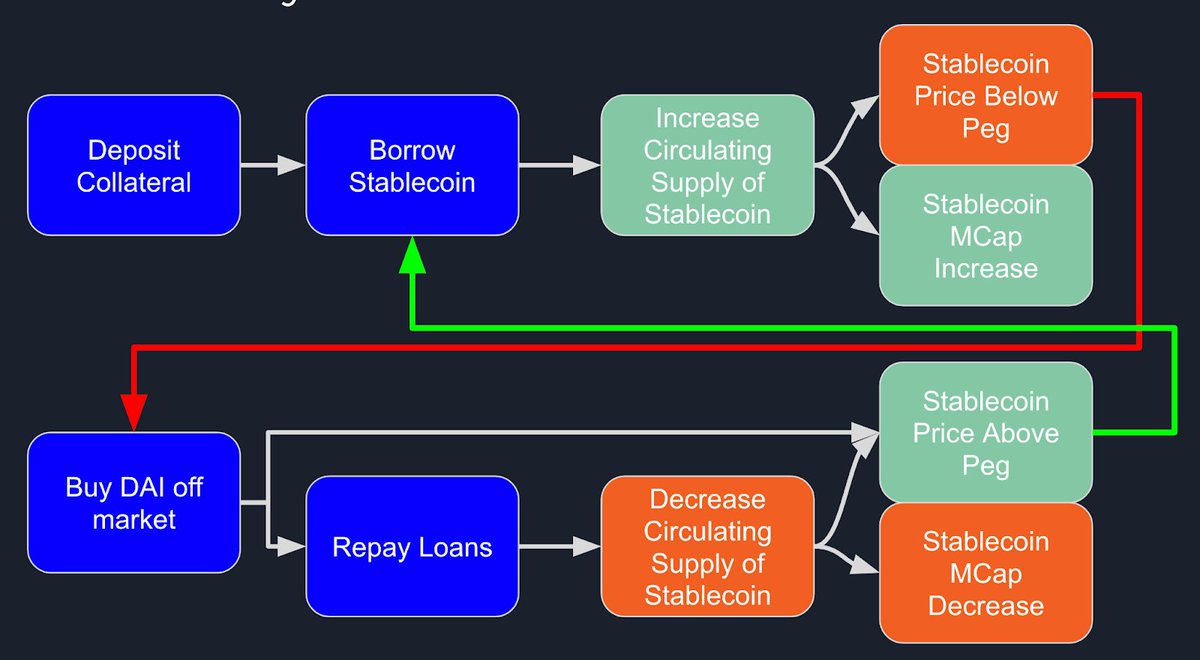

As a stablecoin backed by collateralized debt positions, the outstanding loans within DAI’s economy play an important role with regard to DAI’s ability to maintain its peg.

As a stablecoin backed by collateralized debt positions, the outstanding loans within DAI’s economy play an important role with regard to DAI’s ability to maintain its peg.

2/ When DAI is above peg, borrowers will be incentivized to take more loans with their collateral and sell DAI off on the market.

As a result, this increases DAI’s circulating supply, bringing DAI back to peg.

Vice versa.

Diagram by @dicksonlai_:

As a result, this increases DAI’s circulating supply, bringing DAI back to peg.

Vice versa.

Diagram by @dicksonlai_: