Discover and read the best of Twitter Threads about #LCOE

Most recents (10)

$DQ Poly market panic?!?! A quick mini🧵

Polysilicon (and all of #solar as a mfg industry) is a bullwhip-cycle commodity industry.

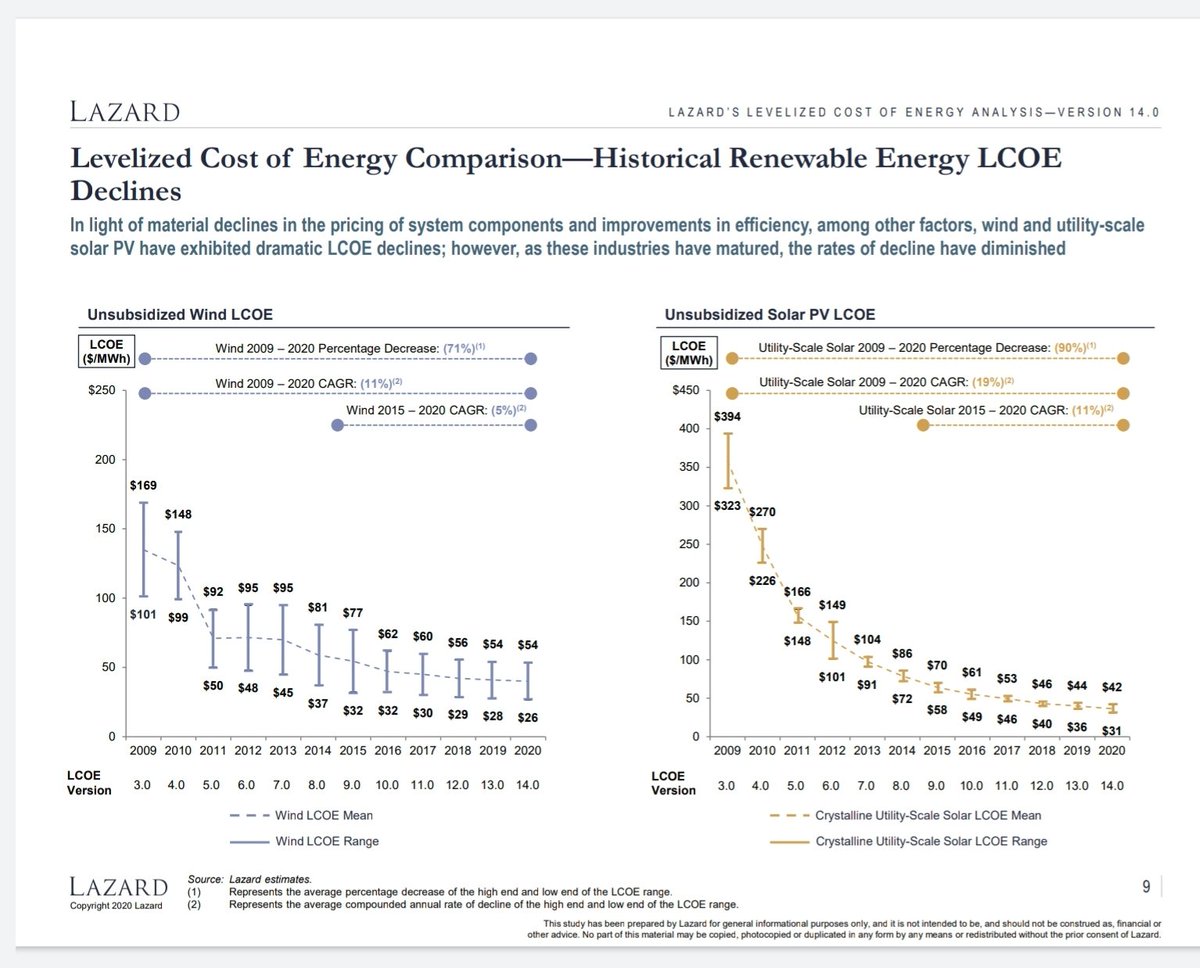

Right now, poly is down, making modules even cheaper - which is wild, because solar is already the cheapest utility-scale option.

Polysilicon (and all of #solar as a mfg industry) is a bullwhip-cycle commodity industry.

Right now, poly is down, making modules even cheaper - which is wild, because solar is already the cheapest utility-scale option.

2/n $DQ

This massive #LCOE superiority is going to further propel demand for panels.

At which time poly goes up again.

While poly dips towards Daqo's cost level ($7.55 total cash cost last Q), other mfgs are under water.

This massive #LCOE superiority is going to further propel demand for panels.

At which time poly goes up again.

While poly dips towards Daqo's cost level ($7.55 total cash cost last Q), other mfgs are under water.

3/n

$DQ will always be last man standing - the last factory operating - because they are cost kings.

Meanwhile, they moved early when market bubbled, reinvesting cash in new capacity.

Now that market is back to normal, the competition will not be able scale similarly.

$DQ will always be last man standing - the last factory operating - because they are cost kings.

Meanwhile, they moved early when market bubbled, reinvesting cash in new capacity.

Now that market is back to normal, the competition will not be able scale similarly.

$CSIQ

Nerd time. 🧵

2023 EPS projection.☀️

Spoiler alert:

Modest projection gives $6.50-$7.00 EPS.

Nerd time. 🧵

2023 EPS projection.☀️

Spoiler alert:

Modest projection gives $6.50-$7.00 EPS.

$CSIQ 2/n

1Q23 EPS was $1.19 on $1.7bn revenue at 18.7% gross margin.

I've seen projection of $2.5bn revenue at 20.5% gross margin.

It would be reasonable to expect that most additional gross margin translates to net profit.

Net profit margin in 1Q was 4.94%.

1Q23 EPS was $1.19 on $1.7bn revenue at 18.7% gross margin.

I've seen projection of $2.5bn revenue at 20.5% gross margin.

It would be reasonable to expect that most additional gross margin translates to net profit.

Net profit margin in 1Q was 4.94%.

$CSIQ 3/n

Let's be cautious and say that 2Q net profit margin goes to 6% (rather than 6.64%).

In 1Q, CSIQ owned 80% of CSI Solar.

Now the share is likely at 62% (and now they have around $1 bn extra in cash).

Let's be cautious and say that 2Q net profit margin goes to 6% (rather than 6.64%).

In 1Q, CSIQ owned 80% of CSI Solar.

Now the share is likely at 62% (and now they have around $1 bn extra in cash).

Canadian Solar IPO🧵

So Canadian Solar $CSIQ is going to raise RMB 6 billion ($850 million) by selling 15% of CSI Solar.

investors.canadiansolar.com/news-releases/…

So Canadian Solar $CSIQ is going to raise RMB 6 billion ($850 million) by selling 15% of CSI Solar.

investors.canadiansolar.com/news-releases/…

2/6

First off, market cap / valuation:

CSI Solar is probably about 80% of $CSIQ total business (other 20% is Recurrent Energy).

So Chinese market values Canadian Solar as approx $7bn company.

But what will the money be used for?

First off, market cap / valuation:

CSI Solar is probably about 80% of $CSIQ total business (other 20% is Recurrent Energy).

So Chinese market values Canadian Solar as approx $7bn company.

But what will the money be used for?

3/6

$CSIQ has already announced plan to build polysilicon plant.

By my modest calculations, 80,000MT of polysilicon capacity - at cost price of $10/kg - can save Canadian Solar anywhere from $400m to over $1bn per year.

Should be massive for the bottom line.

$CSIQ has already announced plan to build polysilicon plant.

By my modest calculations, 80,000MT of polysilicon capacity - at cost price of $10/kg - can save Canadian Solar anywhere from $400m to over $1bn per year.

Should be massive for the bottom line.

With the goal to catalyze more rapid and coordinated action across the full technology value chain, @ENERGY's #NuclearLiftoff establishes a common fact-base for the private sector for critical clean energy technologies. #BuildNuclearNow 1/x liftoff.energy.gov/wp-content/upl…

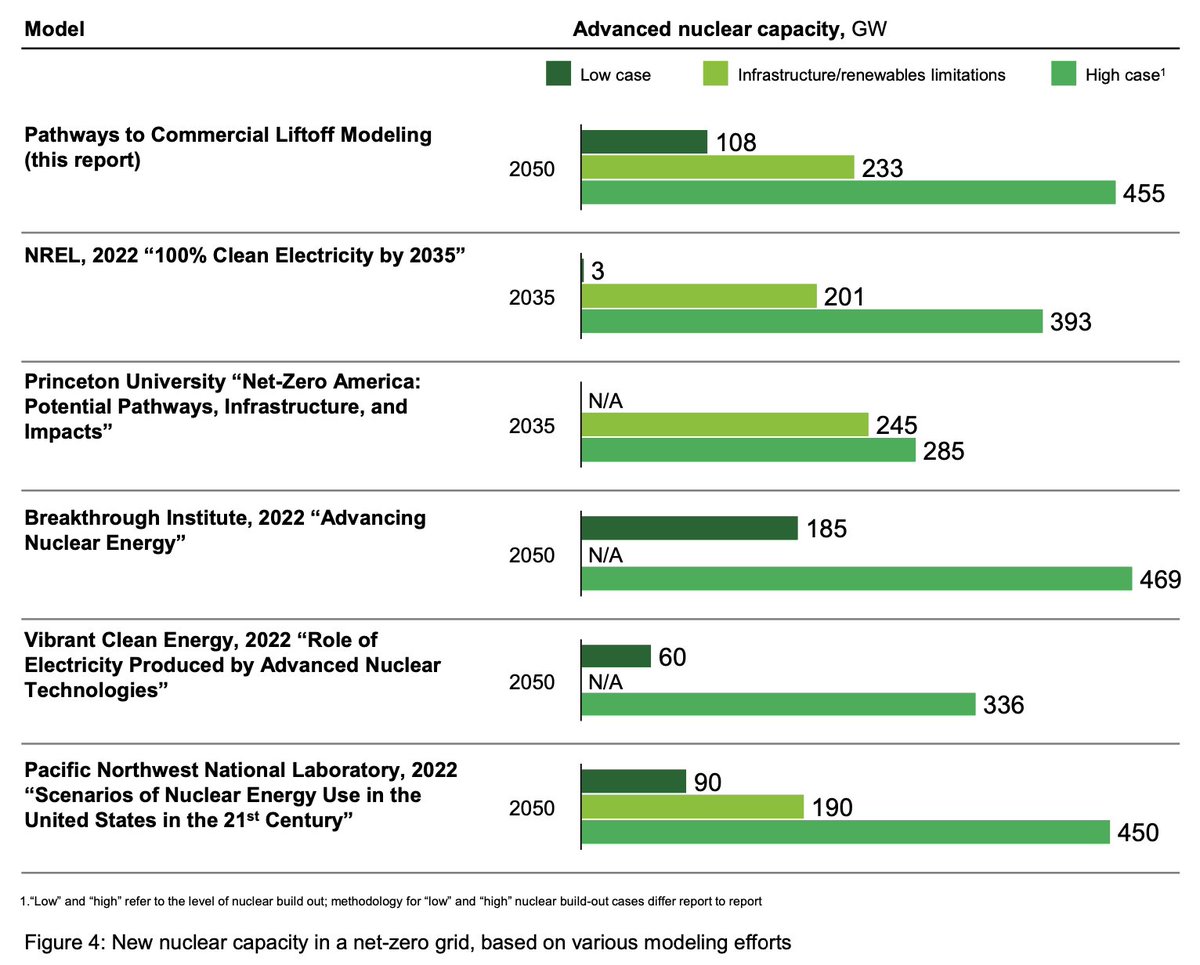

Regardless of level of #renewables deployment, to achieve net-zero in the U.S. by 2050 requires ~550–770 GW of additional clean, firm capacity. Modeling results indicate demand for 200+ GW of new nuclear capacity. #AdvancedNuclear 2/x

Multiple system-level decarbonization modeling exercises over the last 2 years have concluded that, especially with estimates for #renewables buildout that account for limitations from #transmission expansion and #LandUse, significant new #nuclear power would be required by 2050.

🛰️AquaSwitch Report📡

Everyone wants to know what the CHEAPEST way of producing electricity is.

We took on this mammoth task by aggregating reputable #LCOE reports and making a simple average 🤓

Our KEY findings 🧵 👇

Everyone wants to know what the CHEAPEST way of producing electricity is.

We took on this mammoth task by aggregating reputable #LCOE reports and making a simple average 🤓

Our KEY findings 🧵 👇

1/ What is this LCOE? 🤔

It's a calculation of the dollar cost per unit of #energy ($/MWh) that a power station can achieve over its life span.

Except some institutions generalised it to cover a particular technology. @Lazard @WorldBank @IRENA @EIAgov @beisgovuk

It's a calculation of the dollar cost per unit of #energy ($/MWh) that a power station can achieve over its life span.

Except some institutions generalised it to cover a particular technology. @Lazard @WorldBank @IRENA @EIAgov @beisgovuk

Good chart to study: cost per MWh of #energy. Grey and orange balls are wind and solar; dark grey is gas; black is coal. Economic advantage of #renewables in most countries is stunning.

Source:

linkedin.com/posts/michael-…

snippet:

"figure 1.7 [shows] how large the benefit is by looking at the weighted average country #LCOE for #solar #PV and #windpower deployed in 2021 compared to what we thought the marginal generation cost would be for fossil fuels in 2022.

linkedin.com/posts/michael-…

snippet:

"figure 1.7 [shows] how large the benefit is by looking at the weighted average country #LCOE for #solar #PV and #windpower deployed in 2021 compared to what we thought the marginal generation cost would be for fossil fuels in 2022.

Put simply, renewables received their biggest yearly improvement in competitiveness in history in 2022.... the bulk of the boost coming from the eye-wateringly high fossil fuel prices we're dealing with in 2022.

“interconnection queues” and obtaining the necessary #ImpactStudies and #permits from #each grid operator has risen from around 2.1 years for projects built in 2000-2010 to around 3.7 years for those built in 2011-2021.

#decentralizedgrid issues are key.

wired.com/story/everyone…

#decentralizedgrid issues are key.

wired.com/story/everyone…

"researchers found that only 23% of the projects seeking grid connection between 2000 and 2016 have actually been built."

“The grid operators have limited staff to conduct these studies,”

“Maybe they haven't ramped up their workforce quickly enough.”

#Gridlock

#SkillShortages

“The grid operators have limited staff to conduct these studies,”

“Maybe they haven't ramped up their workforce quickly enough.”

#Gridlock

#SkillShortages

The inability of #renewables to deliver #LargeScale solutions may NOT be due to #financing constraints. #Regulatory ones matter too.

As prices fall, the gap btw #LevelisedCostOfEnergy for #Rooftop and #SolarUtility shows, scale matters.

Alot.

#LCoE

#Investment

#DrawDownLabs

As prices fall, the gap btw #LevelisedCostOfEnergy for #Rooftop and #SolarUtility shows, scale matters.

Alot.

#LCoE

#Investment

#DrawDownLabs

Dopo #gridparity e market parity,

ecco a voi la #hydrogen parity!

e cioè il prezzo che rende conveniente la produzione di idrogeno (verde) da elettricità prodotta da fonti #rinnovabili

Il commento di @MassimoNicolazzi

1/7

rivistaenergia.it/2021/02/dopo-g…

ecco a voi la #hydrogen parity!

e cioè il prezzo che rende conveniente la produzione di idrogeno (verde) da elettricità prodotta da fonti #rinnovabili

Il commento di @MassimoNicolazzi

1/7

rivistaenergia.it/2021/02/dopo-g…

Premesso che il costo di produzione dell’#idrogenoverde è sempre più alto di quello dell’#elettricità rinnovabile da cui è generato,

a quali condizioni l’#idrogeno potrà servire come #stoccaggio dell’elettricità prodotta da fonti #rinnovabili?

2/7

rivistaenergia.it/2021/02/dopo-g…

a quali condizioni l’#idrogeno potrà servire come #stoccaggio dell’elettricità prodotta da fonti #rinnovabili?

2/7

rivistaenergia.it/2021/02/dopo-g…

Innanzitutto, bisogna tener conto delle inevitabili #perdite di #efficienza presenti in ogni trasformazione:

per il power-to-power, da elettricità a idrogeno e di nuovo da idrogeno a elettricità

Parti producendo 100 e ne rimetti in rete 40-60

3/7

rivistaenergia.it/2021/02/dopo-g…

per il power-to-power, da elettricità a idrogeno e di nuovo da idrogeno a elettricità

Parti producendo 100 e ne rimetti in rete 40-60

3/7

rivistaenergia.it/2021/02/dopo-g…

Comme promis dans un précédent thread, je vais vous proposer quelques éléments de réflexions sur les #réseaux #électriques !

Focus 🇪🇺

Focus 🇬🇧

Focus 🇫🇷

Focus 🇩🇪

Let's thread !

Focus 🇪🇺

Focus 🇬🇧

Focus 🇫🇷

Focus 🇩🇪

Let's thread !

🇪🇺 - Union Européenne

Pour celles et ceux qui ont peut être raté l'information, il y a une consultation publique en cours concernant la "#taxonomie", dite verte, européenne.

Quelques éléments de réflexion concernant la prod ⚡️et le #nucléaire dans ce thread !

🔽🔽🔽🔽🔽🔽🔽🔽

Pour celles et ceux qui ont peut être raté l'information, il y a une consultation publique en cours concernant la "#taxonomie", dite verte, européenne.

Quelques éléments de réflexion concernant la prod ⚡️et le #nucléaire dans ce thread !

🔽🔽🔽🔽🔽🔽🔽🔽

Commençons par donner le lien qui vous permettra de donner votre avis ou de lire celui de ceux qui y ont déposé le leur :

ec.europa.eu/info/law/bette…

ec.europa.eu/info/law/bette…

Depuis 2015, les institutions européennes ont la volonté d’encourager les investissements durables et de réorienter les flux financiers afin de les « rendre compatibles avec un profil d’évolution vers un dvlpt à faible émission de #GES et résilient aux changements climatiques »