Discover and read the best of Twitter Threads about #MillennialMoney

Most recents (11)

ChatGPT semakin popular, dah try?

Saya dgr podcast Morgan Stanley tntg trends 2023. Antara trend: Gen Z akan buat multiple income streams. Why? antara sebab: chatGPT

Saya tanya chatGPT utk dpt jawapan mengapa ini berlaku.

ChatGPT jawab dlm masa 10 saat sahaja‼️

Saya dgr podcast Morgan Stanley tntg trends 2023. Antara trend: Gen Z akan buat multiple income streams. Why? antara sebab: chatGPT

Saya tanya chatGPT utk dpt jawapan mengapa ini berlaku.

ChatGPT jawab dlm masa 10 saat sahaja‼️

"Why settle for one source of income when you can have many? #GenZ is embracing multiple earnings streams for job security, financial stability, the freedom to pursue their passions. The gig economy & technology make it easier than ever! #MillennialMoney #EarningsStreams"

Soalan saya ChatGPT untuk suggest a tweet on multiple income di atas👆

Kemudian saya tanya:

"what are 3 reasons why Gen z going for multiple earnings stream?"

Answers👇

Kemudian saya tanya:

"what are 3 reasons why Gen z going for multiple earnings stream?"

Answers👇

At 37, Paula is more than $60,000 in debt, and that's not including a mortgage for a plot of land.

- $11,200 in student loans

- $17,400 left on a $25,000 personal loan

- $16,500 on her credit card

- $16,500 on a line of credit

#MillennialMoney

thestar.com/business/perso…

- $11,200 in student loans

- $17,400 left on a $25,000 personal loan

- $16,500 on her credit card

- $16,500 on a line of credit

#MillennialMoney

thestar.com/business/perso…

How did it get so bad? Paula says she doesn't think she's a big spender. Her last big purchase was $76,000 plot of land in the country, which she was planning to build a house on.

Making $92,000 in tech, we take a look at her monthly finances. thestar.com/business/perso…

Making $92,000 in tech, we take a look at her monthly finances. thestar.com/business/perso…

Now, she's faced with a strange predicament. Because of the pandemic, her plans of living in the country with a house built on the land are out of reach with her insane debt. Currently, she's renting a spot nearby her land, but still paying her mortgage. thestar.com/business/perso…

This Toronto teen saw his parents struggling financially during pandemic. Relying on dad's single income (under $40,000) Karan Agrawal put university on hold to help his family.

Now, he makes $83,000. Can he buy his parents a home? #MillennialMoney thestar.com/business/perso…

Now, he makes $83,000. Can he buy his parents a home? #MillennialMoney thestar.com/business/perso…

The family rents a spot in Scarborough for $1,200/month. Since leaving school, the 19-year-old is paying almost half the rent. How did he find a job without a degree? Interning at a major bank and picking up a freelance gig in finance.

thestar.com/business/perso…

thestar.com/business/perso…

Now, aggressively saving money and spending as little as possible, Agrawal is saving for his next major goal: buying a place for his parents.

“It’s always been their dream to have a place of their own in Canada,” he said.

thestar.com/business/perso…

“It’s always been their dream to have a place of their own in Canada,” he said.

thestar.com/business/perso…

This new Canadian makes $35,000 as a hospital cleaner. He wants an emergency fund in case rent goes up. How can he start? #MillennialMoney

thestar.com/business/perso…

thestar.com/business/perso…

Luis, 39, makes $35,000 a year as a hospital cleaner. He moved from the Philippines five years ago and is renting a spot in Regent Park. He wants to build an emergency fund in case rents increase, but how can he start?

When Luis moved to Canada, he discovered the cost of living was higher here. It’s why he’s extremely frugal and lives “humbly,” trying to save money by eating all meals at home or preparing food for work. “I only buy things on sale,” Luis said.

thestar.com/business/perso…

thestar.com/business/perso…

This millennial artist and part-time farm hand makes around $12,000 a year.

He's living debt-free in a tiny home in Alberta that he built. How can he sustain this lifestyle for the long-term?

#MillennialMoney by @EVYSTADIUM

thestar.com/business/perso…

He's living debt-free in a tiny home in Alberta that he built. How can he sustain this lifestyle for the long-term?

#MillennialMoney by @EVYSTADIUM

thestar.com/business/perso…

The 34-year-old is an artist and part-time farm hand living in a tiny home on an Alberta farm. He doesn't pay rent or a mortgage and does odd jobs on the farm to keep his property. He is thinking of one day buying his own land. Can he do it?

thestar.com/business/perso…

thestar.com/business/perso…

To build the tiny home, Bartz saved $25,000 toward the build and did all the work himself when he was still on a salaried job. “I also sold anything I didn’t need to raise money,” Bartz added.

thestar.com/business/perso…

thestar.com/business/perso…

$5,000 in credit card debt. $5,000 invested in crypto. This 23-year-old line cook lives at home and makes $19/hour. Since coming back to the restaurant, he's been overworked due to shortages as others pursue new careers. Should he stay? #MillennialMoney

thestar.com/business/perso…

thestar.com/business/perso…

Let's look at his monthly expenses. He takes in around $2,500 a month and pays $0 for housing (thanks mom and dad!)

His largest costs? $700 on transportation, including high insurance because of a past accident.

thestar.com/business/perso…

His largest costs? $700 on transportation, including high insurance because of a past accident.

thestar.com/business/perso…

On a typical work day, he’ll work anywhere from eight to 12 hours. At work, staff are entitled to 50% off their meals, so Cedric buys them often. They cost anywhere between $8 to $12. At home, his parents provide meals.

thestar.com/business/perso…

thestar.com/business/perso…

Sophie, 39, makes $78,000 working multiple jobs, which means 12 hours a day with a 2.5 hour commute time. She's spent her entire working life paying off her mom's debts. It’s almost done. How can she focus on her own savings now? #MillennialMoney thestar.com/business/perso…

Here are Sophie's monthly expenses. She shares a mortgage with her mother that's almost paid off. She's thinking of moving closer to work to cut the 2.5 hour commute time, or moving farther and buying a place. thestar.com/business/perso…

For #MillennialMoney, we ask participants to share a week of expenses to get an idea of what they spend their money on.

Here's week one:

thestar.com/business/perso…

Here's week one:

thestar.com/business/perso…

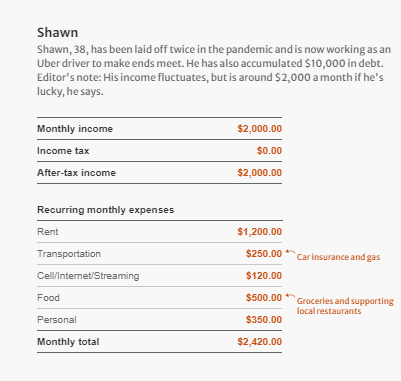

Shawn, 38, has been laid off twice as a bar manager in the pandemic. Once in the first wave, now the second. He's now working as an Uber driver to make ends meet. He has also accumulated $10,000 in debt. #MillennialMoney thestar.com/business/perso…

Renting in downtown Toronto, Shawn says he's barely able to make ends meet, taking in $2,000 in a good work month. Here are his monthly expenses: thestar.com/business/perso…

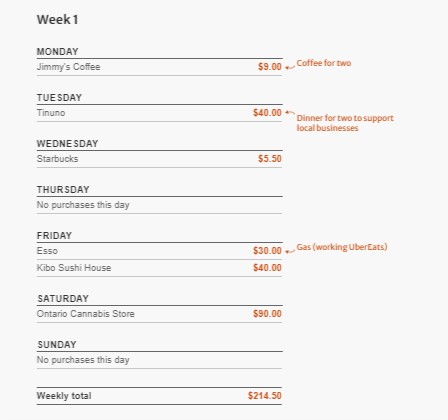

In the #MillennialMoney challenge, we ask participants to share a week into their spending habits. This is week 1 for Shawn: thestar.com/business/perso…

Working the frontlines, Chloe, a nurse practioner making $120,000 a year has come to a realization: She wants to find a way to move to Europe and start her life over. How can she start the move? #MillennialMoney thestar.com/business/perso…

Here are Chloe's monthly finances. She's a homeowner, and is working to pay off her mortgage. An idea she has is to move earlier to Europe, start a business, while renting out her Toronto property. thestar.com/business/perso…

A lot of her expenses recently have to do with seeing friends (in her bubble) on the patio or with another outdoor activity. Here's snapshot of what she spends in a week:

thestar.com/business/perso…

thestar.com/business/perso…

Sammy, 31, has been laid-off due to COVID-19. Right now, she's just hoping to stay financially afloat while taking care of her mental health through outdoor activities. Is there anyway, with $2,000/month, she can be saving right now? #MillennialMoney thestar.com/business/perso…

These are Sammy's monthly finances. Receiving $2,000 a month through CERB, it seems that her costs are still adding up. Currently, she's living between her downtown condo and her parent's home (where she can save on food and transportation costs.)

thestar.com/business/perso…

thestar.com/business/perso…

In #MillennialMoney, we ask our participant to record all their spendings in a week for financial coach @JasonHeathCFP to analyze. This was Sammy's first week. She's been taking up golfing, kayaking to stay mentally healthy during this time. thestar.com/business/perso…

"Millennials get a lot of criticism for their avocado toast and mochaccinos. But splurging a bit doesn't make you irresponsible."

In this special edition of #MillennialMoney, @JasonHeathCFP has tips for millennials and those still on CERB. thestar.com/business/perso…

In this special edition of #MillennialMoney, @JasonHeathCFP has tips for millennials and those still on CERB. thestar.com/business/perso…

Youth unemployment rose to nearly 30 per cent over the past few months and has only just started to recover, he writes. But for younger people who are still on CERB, it's important to prepare.

A list of tips to consider before the benefit ends. thestar.com/business/perso…

A list of tips to consider before the benefit ends. thestar.com/business/perso…

Tip 1: There is a new Canada Recovery Benefit that will also be available as of September 27 for those who are not eligible for EI — mainly those who are self-employed or work in the gig economy. thestar.com/business/perso…