Discover and read the best of Twitter Threads about #RelativeStrength

Most recents (15)

Before I sign off I wanted to show you a chart I stumbled upon in today's am/FX by @donnelly_brent (you miss a lot if you do not follow/subscribe)

In this market more than ever, one has to be open minded.

Daily observations below after which go read the rest of his piece 👇

In this market more than ever, one has to be open minded.

Daily observations below after which go read the rest of his piece 👇

@donnelly_brent Under the radar📡:

1. Relative strength: megas, $XHB, $XME

#relativestrength

2. Relative weakness: $XLP, $SMH, $HG_F

#relativeweaknes

1. Relative strength: megas, $XHB, $XME

#relativestrength

2. Relative weakness: $XLP, $SMH, $HG_F

#relativeweaknes

@donnelly_brent Relative strength notes 🟢:

1. $XHB - loved the long-end rates move

2. $XME - new high close for the year

3. megas finally up from oversold levels - $AAPL, $AMZN, $GOOG, $META

1. $XHB - loved the long-end rates move

2. $XME - new high close for the year

3. megas finally up from oversold levels - $AAPL, $AMZN, $GOOG, $META

Let's go back to the previous times gaps ups / downs were bought / faded with relation to inflation (= you are invited to have a look at my memory bias)

The chart and subsequent observations are below, the takeaway is up to you but I got my short expo decreased

The chart and subsequent observations are below, the takeaway is up to you but I got my short expo decreased

Under the radar📡:

1. Relative strength: $XLP, $XLU, $XLV, $XME, fertilzers

#relativestrength

2. Relative weakness: $XLY, $SMH, $KRE

#relativeweaknes

1. Relative strength: $XLP, $XLU, $XLV, $XME, fertilzers

#relativestrength

2. Relative weakness: $XLY, $SMH, $KRE

#relativeweaknes

Relative strength notes 🟢:

1. $XLP, $XLU, $XLV - congrats to the knife catchers

2. $XME - steel bigly up $CLF, $X, $AA, $NUE; big miners $RIO and $BHP doing well too

3. $MOS, $NTR nicely looking charts; when $CF?

1. $XLP, $XLU, $XLV - congrats to the knife catchers

2. $XME - steel bigly up $CLF, $X, $AA, $NUE; big miners $RIO and $BHP doing well too

3. $MOS, $NTR nicely looking charts; when $CF?

1) Guys, where are the good old days when the market used to puke into the close? It is not the 0DTE as there were 0DTEs before

I cannot seem to remember exactly when was the last one but i don't remember seeing one for months. Similar with rallies but I can recall a couple

I cannot seem to remember exactly when was the last one but i don't remember seeing one for months. Similar with rallies but I can recall a couple

2) Full disclosure :

Recongnizing there was a seller today and a lot of stops beneath the lows I got some 393-392 $SPY put spreads for 12c around 2pm

Seemed quite cheap for an index with a catalyst sitting at a 0.4% loss for the day and a heavy trend to the lows.

Recongnizing there was a seller today and a lot of stops beneath the lows I got some 393-392 $SPY put spreads for 12c around 2pm

Seemed quite cheap for an index with a catalyst sitting at a 0.4% loss for the day and a heavy trend to the lows.

3) Max profit of c. 9x was a 0.65% away, I found that tempting.

After the failed attempt to take out the stops at the lows I exited the position at 3 pm for 10c. 2c (without comissions) loss was totally worth it, would take the trade again if I had the chance.

Observations 👇

After the failed attempt to take out the stops at the lows I exited the position at 3 pm for 10c. 2c (without comissions) loss was totally worth it, would take the trade again if I had the chance.

Observations 👇

Proud to announce that lately I have been doing VERY little in terms of buying and selling. Cuz if I had, I would have been thrown by that market left and right.

Hopefully, tomorrow we are finally gonna have some resolution to the choppiness. 🔪

Tickers 👇

Hopefully, tomorrow we are finally gonna have some resolution to the choppiness. 🔪

Tickers 👇

Under the radar📡:

1. Relative strength: $XHB, $KRE, $XLI, $XLB

#relativestrength

2. Relative weakness: $FXI, $SOXX

#relativeweaknes

1. Relative strength: $XHB, $KRE, $XLI, $XLB

#relativestrength

2. Relative weakness: $FXI, $SOXX

#relativeweaknes

Relative strength notes 🟢:

1. $XHB - jaw-dropping performance after $PHM earnings. I don't think c. 9%+ is typical ER for this one.. A bit more euphoria, cancelation of priced cuts and homebuilders will be short again

2. $XLI, XLB - economy bid; transportation good $FDX, $UPS

1. $XHB - jaw-dropping performance after $PHM earnings. I don't think c. 9%+ is typical ER for this one.. A bit more euphoria, cancelation of priced cuts and homebuilders will be short again

2. $XLI, XLB - economy bid; transportation good $FDX, $UPS

If you happen to follow us and read our weekly attempts to make sense out of markets,

you must know we expected some normalization after what happened on Friday.

When uber crap squuezes higher, it is usally a good sign that indices are due for a pause.

Today 👇

you must know we expected some normalization after what happened on Friday.

When uber crap squuezes higher, it is usally a good sign that indices are due for a pause.

Today 👇

Under the radar📡:

1. Relative strength: $PFF, $PGX, $XLP

#relativestrength

2. Relative weakness: $SOXX, $XLV, $UNG & $USO, $XLE

#relativeweaknes

1. Relative strength: $PFF, $PGX, $XLP

#relativestrength

2. Relative weakness: $SOXX, $XLV, $UNG & $USO, $XLE

#relativeweaknes

Relative strength notes 🟢:

1. $PFF, $PGX - those do not wanna give up..once the EOM/BOM inflows are over I think this will change

2. $XLP - only green thing today; chart is stuck, same as $XLU; do not touch territory for me

1. $PFF, $PGX - those do not wanna give up..once the EOM/BOM inflows are over I think this will change

2. $XLP - only green thing today; chart is stuck, same as $XLU; do not touch territory for me

In markets, there is always something worth mentioning.

Even on slow days like today.

👇

Even on slow days like today.

👇

Under the radar📡:

1. Relative strength : $KRE, $XLV, $XLU, $JETS

#relativestrength

2. Relative weakness: $QQQ, $AAPL, $FXI, $CL_F, $NG_F, $ATVI

#relativeweakness

1. Relative strength : $KRE, $XLV, $XLU, $JETS

#relativestrength

2. Relative weakness: $QQQ, $AAPL, $FXI, $CL_F, $NG_F, $ATVI

#relativeweakness

Relative strength notes 🟢:

1. $KRE - finally closing above sma200d.

2. $XLV, $XLU - defensive sectors bid for another day. $XLU stalled at sma200d. Ripe for some mean reversion?

3. $JETS - strong but paused at sma200d too. $BA sees no retracement after 50% up in 2m

1. $KRE - finally closing above sma200d.

2. $XLV, $XLU - defensive sectors bid for another day. $XLU stalled at sma200d. Ripe for some mean reversion?

3. $JETS - strong but paused at sma200d too. $BA sees no retracement after 50% up in 2m

Hope everyone feels loved and grateful the following days.

Before we all get the rest we deserve,

Here is what happened today 👇

Before we all get the rest we deserve,

Here is what happened today 👇

Under the radar📡:

1. Relative strength : $TLT, $TSLA, $IGV, $ARKK, $JETS, $XLU

#relativestrength

2. Relative weakness: $CL_F, $KRE, $IWM

#relativeweakness

1. Relative strength : $TLT, $TSLA, $IGV, $ARKK, $JETS, $XLU

#relativestrength

2. Relative weakness: $CL_F, $KRE, $IWM

#relativeweakness

Relative strength notes 🟢:

1. $TLT - the savage pullback in long-term rates continues

2. $TSLA - finally lifted from the dead. Took $ARKK and the speculative software names $IGV with it

3. $JETS - doing well today

4. $XLU - best defensive sector today. Closed @ sma100d

1. $TLT - the savage pullback in long-term rates continues

2. $TSLA - finally lifted from the dead. Took $ARKK and the speculative software names $IGV with it

3. $JETS - doing well today

4. $XLU - best defensive sector today. Closed @ sma100d

Slow and steady wins the race is not a phrase coined to explain the market but definitely fits well with what has been going on the last couple of days.

In case you have been busy procrastinating and in need of a summary,

this is what happened today👇

In case you have been busy procrastinating and in need of a summary,

this is what happened today👇

Under the radar📡:

1. Relative strength : $XME, $XLE, $XRT, $XLB

#relativestrength

2. Relative weakness: $JETS, $ARKK, $TSLA, $AMZN, $ITA, $DIS

#relativeweakness

1. Relative strength : $XME, $XLE, $XRT, $XLB

#relativestrength

2. Relative weakness: $JETS, $ARKK, $TSLA, $AMZN, $ITA, $DIS

#relativeweakness

Relative strength notes 🟢:

1. $XME, $XLB, $XLE - classic bidding in real economy stocks

2. $XRT - continues with the overnight gaps. $DKS, $AEO, $BBY had monster earnings reactions, whereas $DLTR sucked.

1. $XME, $XLB, $XLE - classic bidding in real economy stocks

2. $XRT - continues with the overnight gaps. $DKS, $AEO, $BBY had monster earnings reactions, whereas $DLTR sucked.

A typical day of a trader:

Soon after the open - gotta short $XLE, gravitational pull finally. Crap, entry is gone, missed this one.

1h later, Saudi news out - quick, gotta get long $CL_F. Entry? Does not matter, load it up.

Flexability is everything.

Today 👇

Soon after the open - gotta short $XLE, gravitational pull finally. Crap, entry is gone, missed this one.

1h later, Saudi news out - quick, gotta get long $CL_F. Entry? Does not matter, load it up.

Flexability is everything.

Today 👇

Under the radar📡:

1. Relative strength : $DIS, $XLP, $XLU, $XME, $NUE

#relativestrength

2. Relative weakness: $XLE, $XOP, $XES, $HG_F, $EL, $COTY, $TSLA, $AMZN, $GOOG, $V, $MA

#relativeweakness

1. Relative strength : $DIS, $XLP, $XLU, $XME, $NUE

#relativestrength

2. Relative weakness: $XLE, $XOP, $XES, $HG_F, $EL, $COTY, $TSLA, $AMZN, $GOOG, $V, $MA

#relativeweakness

Relative strength notes 🟢:

1. $DIS - CEO change making investors hopeful. Selling the whole day though.

2. $XME, $NUE - $XME got a nice bid right after the Saudi news and finished on the highs at sma200d. $NUE with a nice BO.

3. $XLP, $XLU - defensives with inflows again

1. $DIS - CEO change making investors hopeful. Selling the whole day though.

2. $XME, $NUE - $XME got a nice bid right after the Saudi news and finished on the highs at sma200d. $NUE with a nice BO.

3. $XLP, $XLU - defensives with inflows again

@Justsiva123 has been a master of #Options Scalping. His Strategies have been helping thousands of Traders who has been part of the OI Pulse Movement. Learn from him: sedg.in/njl2p783 👇

@premalparekh is a name known for his advanced strategies based on #RelativeStrength. Having trained over 5000 Relative Strength Warriors, he is a stalwart To know more of his works, visit: sedg.in/6abg3l9r 👇

Premal Parekh (@premalparekh) has extensively studied Relative Strength and is one of the names behind the new wave of trading using advanced #RelativeStrength Strategies!

sedg.in/5af9bk6j (1/6)

sedg.in/5af9bk6j (1/6)

Here's a thread on some of his webinars

Use Code RS40 For 40% Off!

🧵... (2/16)

Use Code RS40 For 40% Off!

🧵... (2/16)

1. Fine tune your #stock selection using Relative Strength and be the blazing Tendulkar of #StockMarkets! sedg.in/jnzepg58 (3/6)

🔥OUR BIGGEST EVENT OF THE YEAR IS BACK🔥 sedg.in/e4abfuip

Presenting: SuperSix. A 2-Day Webinar Marathon by 6 Indian #Stockmarket Superstars! ✨🪄

Here's the lineup(🧵).....

Presenting: SuperSix. A 2-Day Webinar Marathon by 6 Indian #Stockmarket Superstars! ✨🪄

Here's the lineup(🧵).....

1. Premal Parekh (@premalparekh), the master of #RelativeStrength is back with a blockbuster!🔥 sedg.in/514c9bxa

Learn how to gain the First Mover Advantage by identifying the strongest stocks across Sectors using CRS, Spread Charts! 📈

Learn how to gain the First Mover Advantage by identifying the strongest stocks across Sectors using CRS, Spread Charts! 📈

2. The mastermind behind OI Pulse- Sivakumar Jayachandran (@Justsiva123) is focusing on an Open & High Strategy for #Futures & #Options! sedg.in/dfb9w543

Generate significant ROI through hands-on experience!

Generate significant ROI through hands-on experience!

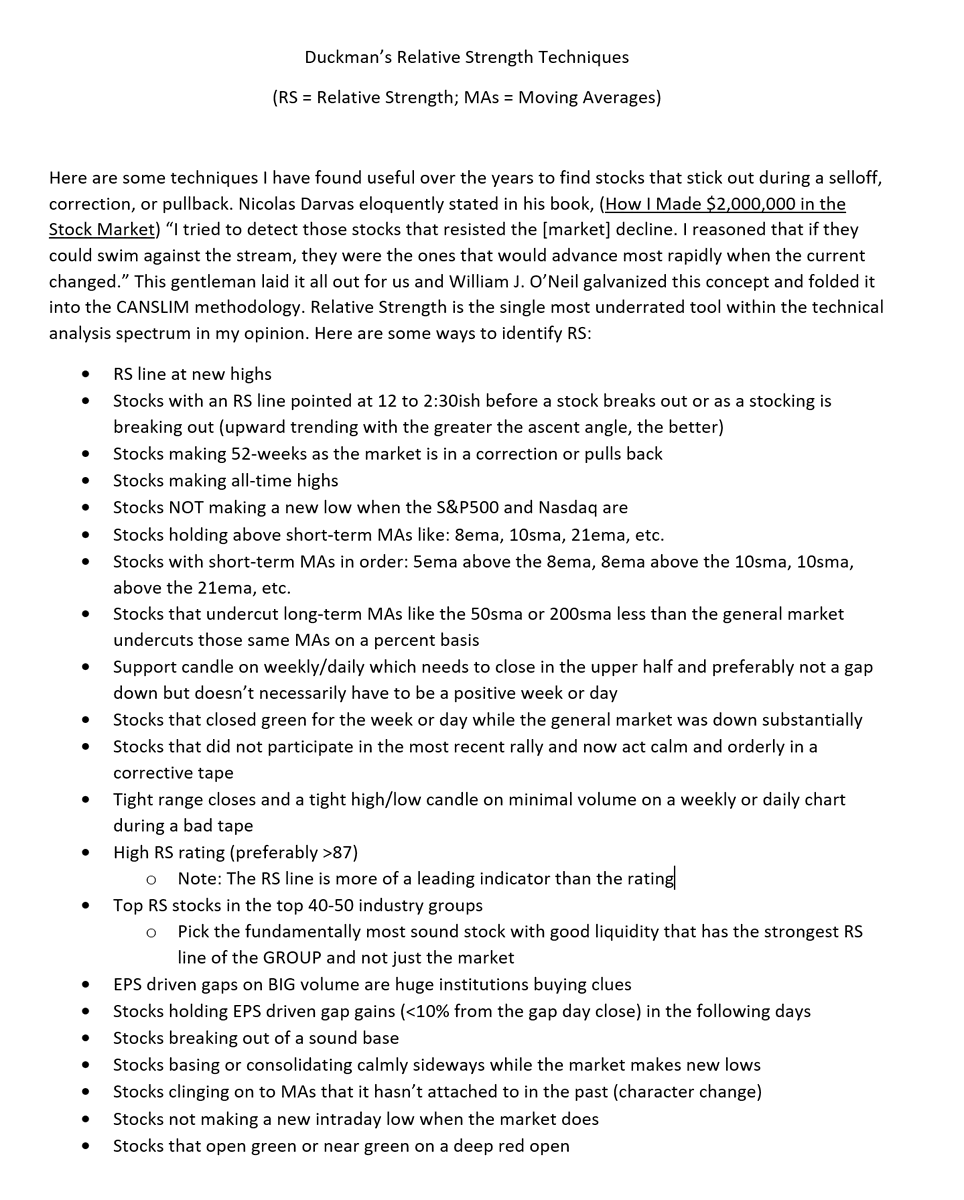

I tweeted my #RelativeStrength techniques out for new followers on 2/24/2020. I decided to update it a bit with new techniques that I have found studying this most recent Bear Market. I hope ya'll enjoy and can apply some of this in your careers/trading.

Cheers. 🦆🇺🇸🐕🍻

Cheers. 🦆🇺🇸🐕🍻

During any harsh corrective periods or bear markets when the market is below the 50sma/200sma, pay attention to the % of stocks above their 50sma and 200sma. Notice how it got to 7% (% above 200sma) at the March lows? That was our queue to find those 7%. .

You did this by starting with the fundamentals and liquidity first to weed out the crap. Here are some select growth stocks that either didn't undercut the 200sma as much as the general market or didn't even touch it in March 2020:

$ZM, $DOCU, $DXCM, $TSLA, $TDOC, $AMD, $QDEL

$ZM, $DOCU, $DXCM, $TSLA, $TDOC, $AMD, $QDEL

#CNXSMALLCAP at a precarious junction. If we break the trendline & horizontal #resistance, then the party will continue, else 🙃. Next week and this month closing will be crucial. #Trendlines #investing #relativestrength #CCI #breakout #pricexpansion #Momentum

#CNXSMALLCAP still alive👀

#CNXMIDCAP too alive😅

The following stocks are contracting and could possibly go up in the coming days.

SKM egg products

Shilpa medicare

Laksh Vilas bank

Kellton tech

Network18 media

Nectar Lifesciences

Career point

Manali petrochem

Morepen

Please define your risk & SL before taking the trades.

SKM egg products

Shilpa medicare

Laksh Vilas bank

Kellton tech

Network18 media

Nectar Lifesciences

Career point

Manali petrochem

Morepen

Please define your risk & SL before taking the trades.

I don't have the time to post the charts for all of them. But, these comprise some pullback and some trendline break trades. #stockideas #Trendlines #investing #relativestrength #CCI #breakout #pricexpansion #Momentum