Discover and read the best of Twitter Threads about #SHANKARA

Most recents (9)

Let us.. look at how #traditional people, of times when #Shankaracharya lived, treated him though him being one of the realised beings of his times & respected, when it comes to #scripts&how he responded

One incident is of the cremation of his #beloved #mother.

Thread follows

1/n

One incident is of the cremation of his #beloved #mother.

Thread follows

1/n

1. Company Overview

Shankara Building Products is a leading organised retailer of home improvement and building products with presence across retail network of 91 stores in 10 states and 1 union territory under the brand name Shankara Buildpro. The Company also has own processing

Shankara Building Products is a leading organised retailer of home improvement and building products with presence across retail network of 91 stores in 10 states and 1 union territory under the brand name Shankara Buildpro. The Company also has own processing

Neil, the IPOBase strategy you shared in your newsletter - which was shared by your friend - was popularized in India by my research which was published in March 2021. It is actually O'Neil's work, but had never been popularized here because no one ever did a #deepdive on it. (1)

But #IPOBase in not only about buying the high of the listing week. It is infact an extremely poor interpretation of the work.

A strategy is not only limited to a setup, what makes it effective is when you manage it according to its nature & potential. (2)

A strategy is not only limited to a setup, what makes it effective is when you manage it according to its nature & potential. (2)

The entire fintwit community took the setup from my research - which was done on all IPOs listed since 2017 and parts of it was published on twitter - but didn't paid attention to the trade management rules which resulted into underperformance for them. (3)

The samadhi of AryAmba is the holiest spot in kAladi.. it marks the place where Sankara performed the rites of his mother helped only by two families - one which lifted her head and another the feet on to the pyre.. centuries later sri sri sacchidaananda

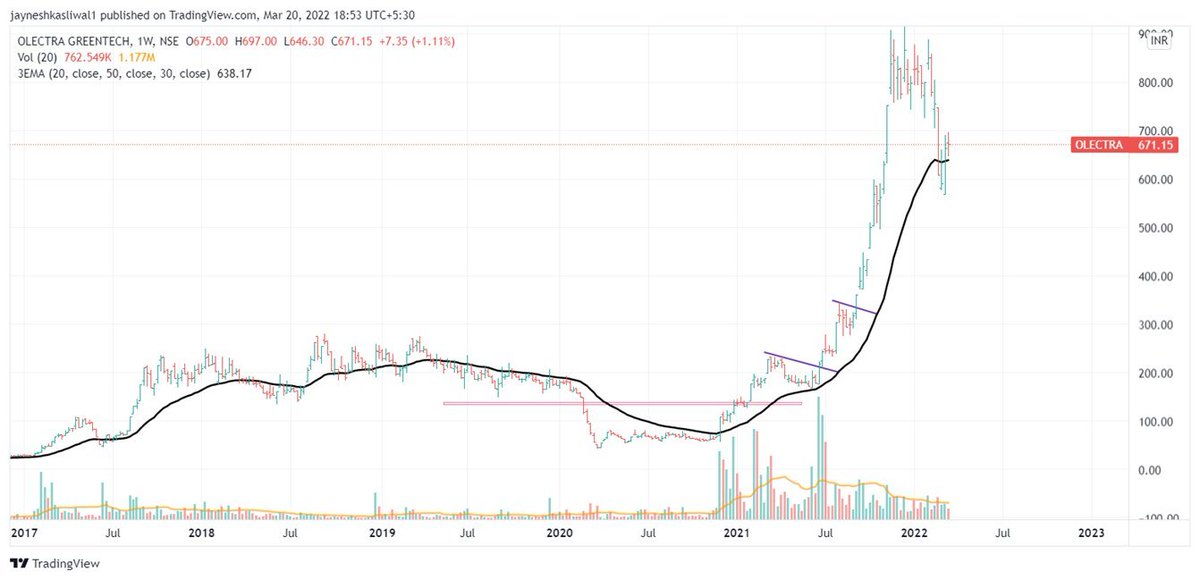

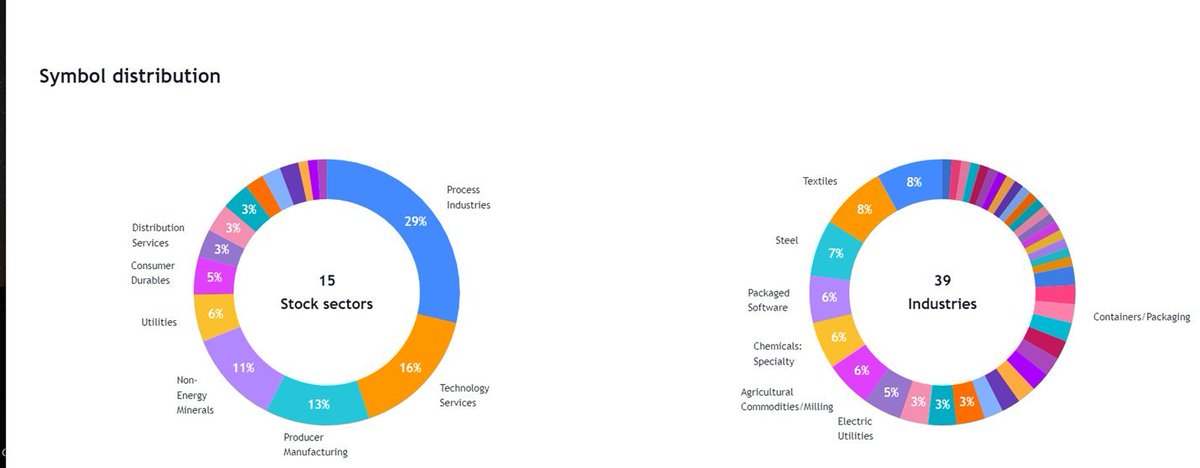

Detailed Study of Stocks that became 5X in past 2 Years

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want a PDF

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want a PDF

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

docs.google.com/document/d/1J-…

( As on 30th March 2022)

[1/n]

These Belonged to various sectors and Groups

Excel Link for List of Stocks

docs.google.com/document/d/1J-…

( As on 30th March 2022)

[1/n]

Detailed Study of Stocks that became 5X in past 2 Years

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

docs.google.com/document/d/1J-…

1/n

These Belonged to various sectors and Groups

Excel Link for List of Stocks

docs.google.com/document/d/1J-…

1/n

How to filter breakout stocks that have higher chances of giving upper circuits or big moves??

A thread❣️

A thread❣️

#CaseStudies #IPOBase #Shankara

As mentioned, here is my next study on #IPOBases on Shankara Building Products. The public offer for Shankara opened on 22nd March, 2017 & closed on 24th March, 2017. It saw good response in public offer, got subscribed 41.88 times and got (1/n)

As mentioned, here is my next study on #IPOBases on Shankara Building Products. The public offer for Shankara opened on 22nd March, 2017 & closed on 24th March, 2017. It saw good response in public offer, got subscribed 41.88 times and got (1/n)

#Intimation #Concall

10Jun20

#DHANUKA: rmls.co/n9r0x5

#TEAMLEASE: rmls.co/wqj4vz

#HEROMOTOCO: rmls.co/W0ZVNo

#XELPMOC: rmls.co/RVLEXL

#KBRL: rmls.co/g9xY5r

11Jun20

#SRTRANSFIN: rmls.co/qkl2r3

#MGL: rmls.co/5zQ5qR

10Jun20

#DHANUKA: rmls.co/n9r0x5

#TEAMLEASE: rmls.co/wqj4vz

#HEROMOTOCO: rmls.co/W0ZVNo

#XELPMOC: rmls.co/RVLEXL

#KBRL: rmls.co/g9xY5r

11Jun20

#SRTRANSFIN: rmls.co/qkl2r3

#MGL: rmls.co/5zQ5qR

#Intimation #Concall

11Jun20(contd)

#GREENPOWER: rmls.co/qk7PkR

#SHANKARA: rmls.co/2w9LXJ

#GENUSPOWER: rmls.co/VVNE4M

#REDINGTON: rmls.co/pjRRgm

12Jun20

#HINDALCO: rmls.co/4y61lk

#IIFLWAM: rmls.co/pjkGqr

11Jun20(contd)

#GREENPOWER: rmls.co/qk7PkR

#SHANKARA: rmls.co/2w9LXJ

#GENUSPOWER: rmls.co/VVNE4M

#REDINGTON: rmls.co/pjRRgm

12Jun20

#HINDALCO: rmls.co/4y61lk

#IIFLWAM: rmls.co/pjkGqr

#Intimation #Concall

12Jun20(contd)

#KNRCON: rmls.co/PVM3ol

#DWARKESH: rmls.co/j9nXPl

#SHRIRAMCIT: rmls.co/9EpYVJ

13Jun20

#GRASIM: rmls.co/8DXnjm

15Jun20

#CASTROLIND: rmls.co/ODQjkE

#ICIL: rmls.co/n9gDoD

12Jun20(contd)

#KNRCON: rmls.co/PVM3ol

#DWARKESH: rmls.co/j9nXPl

#SHRIRAMCIT: rmls.co/9EpYVJ

13Jun20

#GRASIM: rmls.co/8DXnjm

15Jun20

#CASTROLIND: rmls.co/ODQjkE

#ICIL: rmls.co/n9gDoD