Discover and read the best of Twitter Threads about #SaaS

Most recents (24)

🧶I have been reflecting on how many product professionals today find it negative to fulfill a customer's request, even in early-stage products. The way I see this issue is illustrated in the graph below. #SaaS #ProductManagement #startup

When a product is new, we usually have a small team, with less capacity to absorb demands. But the challenge we have is to win the first customers, deliver value and get recurring revenue from it - the famous Product Market Fit.

For this, we need to be willing to accept more requests from the few prospects we have. This does not mean that we will accept any request, but it does mean that our filter is less rigorous.

🧶Estive refletindo sobre como muitos dos profissionais de produto hoje acham negativo atender um pedido de um cliente, mesmo em produtos early stage. A maneira que eu enxergo esta questão é ilustrada no gráfico abaixo. #SaaS #ProductManagement #startup

Quando um produto é novo, geralmente temos um time pequeno, com menor capacidade de absorver demandas. Mas o desafio que temos é conquistar os primeiros clientes, entregar valor e conseguir receita recorrente com isso - o famoso Product Market Fit.

Para isso precisamos estar dispostos a aceitar mais os pedidos dos poucos prospects que temos. Isso não quer dizer que aceitaremos qualquer pedido, mas quer dizer sim que nosso filtro é menos rigoroso.

🚨Global management consulting and strategy advisory firm Zinnov and venture capital firm Chiratae Ventures on Tuesday marked down 2026 revenue projections of the Indian software-as-a-service (#Saas) startups from $100 billion to $26 billion in its latest annual report.

The report, titled India #SaaSonomics: Navigating Growth and Efficiency, said that concerns of a recession loom large for the Indian #SaaS industry, but that it has displayed remarkable antifragility to withstand turbulent times.

The report indicated three challenges plaguing the industry -- customer churn, customer demand slowdown and delayed sales cycles, and downward pressure on cash flows caused by macroeconomic headwinds.

🚨There may be a further demand slowdown for Indian IT firms in the quarter ending June, going by the latest results of global software-as-a-service (#SaaS) and digital engineering firms.

Analysts though expect the demand to revive in the second half of 2023-24 as deal pipelines remain strong and there would be additional business from cost-optimisation initiatives that will benefit the Indian IT sector.

Indian IT companies have sell-to and sell-with partnerships with #SaaS firms like #Servicenow, #Salesforce, #Snowflake and #Workday, while the performance of digital engineering firms like Globant, EPAM and Endava can be considered a proxy for high-end digital services demand.

As a SaaS UX designer, understanding the power of design tokens can greatly enhance your design workflow, consistency, and scalability. Design tokens are a central repository of reusable design elements that encapsulate colors, typography, spacing, and other design attributes.

Here's an explanation of the power of design tokens:

Consistency and efficiency: Design tokens establish a single source of truth for design elements. By using design tokens, you ensure consistency across your SaaS product's design system.

Consistency and efficiency: Design tokens establish a single source of truth for design elements. By using design tokens, you ensure consistency across your SaaS product's design system.

Any changes made to design tokens automatically update all instances throughout the interface, saving time and effort in maintaining consistency.

Scalability: Design tokens allow for scalability as your SaaS product grows and evolves.

Scalability: Design tokens allow for scalability as your SaaS product grows and evolves.

Companies in MA, explore lower rates & combat rising costs for business services (Telecom/Waste/Merchant Services), with Brian Plain at Schooley Mitchell:

Schooley Mitchell: Brian Plain & Joe Gifford:

225 Cedar Hill St

Suite 200 D117 Marlborough, MA 01752

508-266-5814

#Business

Schooley Mitchell: Brian Plain & Joe Gifford:

225 Cedar Hill St

Suite 200 D117 Marlborough, MA 01752

508-266-5814

#Business

"Learn more about #waystoreduceoverhead costs and improve your #bottomline local and online at Schooley Mitchell at:

Schooley Mitchell: Brian Plain & Joe Gifford:

225 Cedar Hill St

Suite 200 D117 Marlborough, MA 01752

508-266-5814 schooleymitchell.com/jgifford/

google.com/maps/place/Sch…"

Schooley Mitchell: Brian Plain & Joe Gifford:

225 Cedar Hill St

Suite 200 D117 Marlborough, MA 01752

508-266-5814 schooleymitchell.com/jgifford/

google.com/maps/place/Sch…"

We’ve built the world’s first AI-driven, personalized investment coach. Now we’re launching a direct #ChatGPT plugin that will help us bring this powerful tool to millions!

Our mission is to democratize access to hedge-fund caliber models for all self-directed investors. 🧵👇

Our mission is to democratize access to hedge-fund caliber models for all self-directed investors. 🧵👇

In addition to asking for a portfolio analysis by our Recommendation Engine, you can ask questions about what our models think is going to happen, including a security’s expected return or the performance of a segment of the market, like the #SP500 or $AAPL.

For us, it’s an obvious fit for @worldpred to leverage #GenerativeAI to improve the experience of our users. @portfoliopilot is already helping investors improve their portfolios.

👨👩👧👦3k+ users

🏦Connecting brokerages, 401k, real estate, crypto, PE, etc.

💰$2.1B assets on platform

👨👩👧👦3k+ users

🏦Connecting brokerages, 401k, real estate, crypto, PE, etc.

💰$2.1B assets on platform

Met another VC in India today who was concerned about whether I would be moving my early-stage #SaaS to the US (since all our customers are there).

@SeanB @LakshmanThatai @mrgirish @svembu @prasanna_says @skirani @sureshsambandam @avlesh @cbkrish

@SeanB @LakshmanThatai @mrgirish @svembu @prasanna_says @skirani @sureshsambandam @avlesh @cbkrish

I find selling #SaaS from India to SMB US companies way easier when I’m based in India. I am a US citizen with a predominantly India-based team.

VCs in India ask me about whether I am moving far more than US VCs. I find this odd since they should understand the productivity benefits better than most, given most of their LPs will probably be in the US.

Hey, SaaS founders and finance pros, have you heard of Remaining Performance Obligations (RPO)?

It's a required disclosure for public SaaS companies and provides forward-looking revenue visibility.

Quick thread. #saas #RPO

It's a required disclosure for public SaaS companies and provides forward-looking revenue visibility.

Quick thread. #saas #RPO

RPO is the value of contracted revenue that SaaS companies expect to recognize in the future from existing contracts with customers.

It's an important measure of a company's revenue visibility and backlog.

It's an important measure of a company's revenue visibility and backlog.

Your cash balance is the result of the decisions you make every day in your business.

If you're in a cash-burn mode, you must have a path to profitability. Understand the levers to pull with my 5 Pillar SaaS Metrics Framework.

Quick summary. #saas

If you're in a cash-burn mode, you must have a path to profitability. Understand the levers to pull with my 5 Pillar SaaS Metrics Framework.

Quick summary. #saas

I use my framework as a roadmap to financial transparency and better decision-making in SaaS.

Move from left to right. Right metrics for the right stage of your business. #metrics

Move from left to right. Right metrics for the right stage of your business. #metrics

SaaS Metrics are more powerful when used together. In isolation, they offer less context.

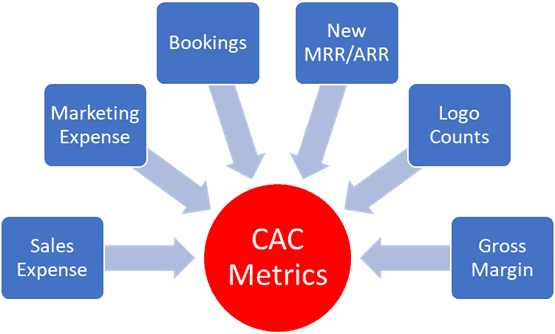

Assess your CAC Profile to grasp the full picture of GTM efficiency.

🧵 Here’s a quick summary to help you analyze your CAC profile and grow. 📈 #saas

Assess your CAC Profile to grasp the full picture of GTM efficiency.

🧵 Here’s a quick summary to help you analyze your CAC profile and grow. 📈 #saas

You will need the following inputs for CAC profile calculations:

1️⃣Sales expenses - wages, taxes, benefits, travel, commissions, CRM, training, etc.

2️⃣Marketing - marketing, paid ads, conferences, brand, swag, ESP, etc.

3️⃣Bookings - dollars and logo counts

1️⃣Sales expenses - wages, taxes, benefits, travel, commissions, CRM, training, etc.

2️⃣Marketing - marketing, paid ads, conferences, brand, swag, ESP, etc.

3️⃣Bookings - dollars and logo counts

4️⃣MRR/ARR - includes new, expansion, and maybe contraction

5️⃣Logo count - the number of new customers/users each month

6️⃣Gross Margin - recurring gross margin and maybe variable gross margin

5️⃣Logo count - the number of new customers/users each month

6️⃣Gross Margin - recurring gross margin and maybe variable gross margin

2023 is about time to value!

Watch this short demo on how you can create and publish your first #SaaS metrics dashboard in 2 minutes.

Follow the thread to see this live dashboard in your browser and how to create your dashboard account.

Watch this short demo on how you can create and publish your first #SaaS metrics dashboard in 2 minutes.

Follow the thread to see this live dashboard in your browser and how to create your dashboard account.

See the live dashboard here. It's very easy to share with your team, Board, and investors without adding them as users. app.backofficetools.com/metricsdashboa…

To create an account and your first dashboard, register for this short video tutorial here. thesaasacademy.com/offers/FGT86tv…

Le mail d'annonce des pépites de la semaine vient de partir à près de 700 personnes inscrites sur Below50.

Au programme, 5 pépites de très bon level !

Je dis 5, mais en réalité c'est plutôt 4....

🧵👇

Au programme, 5 pépites de très bon level !

Je dis 5, mais en réalité c'est plutôt 4....

🧵👇

Chaque lundi, nous publions la sélection des sites ayant fini de passer notre filtre (manuel).

En moyenne 5 à 10 sites / semaine (et ça devrait grimper au fil des optimisations de process).

Cette semaine, il y en avait donc 5 à publier pour les profils Investisseurs.

En moyenne 5 à 10 sites / semaine (et ça devrait grimper au fil des optimisations de process).

Cette semaine, il y en avait donc 5 à publier pour les profils Investisseurs.

Don't let anyone fool you!

A SaaS App can be quite simple.

Here are a few rules that help you make the right decisions 🚀🧵

A SaaS App can be quite simple.

Here are a few rules that help you make the right decisions 🚀🧵

💡 Mindset (1/2)

The SaaS space is a mature, highly commoditized one where you can cherry-pick a lot of what is needed from a pool of mature services and ready-to-use modules and use well-established, common best practices.

The SaaS space is a mature, highly commoditized one where you can cherry-pick a lot of what is needed from a pool of mature services and ready-to-use modules and use well-established, common best practices.

💡 Mindset (2/2)

Just don't lock yourself into short-lived technologies or dependencies.

And let your team only build stuff that sets you apart from the competition and/or builds up real value in your startup.

Buy everything else (the commodities)

Just don't lock yourself into short-lived technologies or dependencies.

And let your team only build stuff that sets you apart from the competition and/or builds up real value in your startup.

Buy everything else (the commodities)

📈🛠️ Creating a SaaS backbone ?

Here's a checklist of measurable steps to follow 👇

Here's a checklist of measurable steps to follow 👇

✅ Define your target audience & value proposition

🎯 Knowing your target audience and value proposition is key to building a successful business. Define them clearly to guide your product development and marketing efforts.

🎯 Knowing your target audience and value proposition is key to building a successful business. Define them clearly to guide your product development and marketing efforts.

✅ Develop a minimum viable product (MVP)

✅ Test, iterate & gather feedback

🚀 Develop the core features that solve your users' problems and get it in front of them.

👥 Gather feedback and iterate to create a better product.

✅ Test, iterate & gather feedback

🚀 Develop the core features that solve your users' problems and get it in front of them.

👥 Gather feedback and iterate to create a better product.

Oilytics Weekly Chart of the Day recap: Week 6

How important are clear and distinct revenue streams in SaaS? Well, your valuation depends on it.

The proper SaaS P&L setup helps your team, your Board, and your investors.

Quick guide. #saas

The proper SaaS P&L setup helps your team, your Board, and your investors.

Quick guide. #saas

SaaS Revenue Streams

It's no longer just subscription revenue for SaaS companies. That was SaaS pricing 1.0.

I've worked with SaaS companies that had 5 distinct revenue streams.

Have you clearly defined your revenue categories?

It's no longer just subscription revenue for SaaS companies. That was SaaS pricing 1.0.

I've worked with SaaS companies that had 5 distinct revenue streams.

Have you clearly defined your revenue categories?

Subscription Revenue

🚀Generated from invoicing subscription contracts that range from monthly to multi-year. Your product and resold products. This is contracted MRR or ARR.

☠️Careful with resold products. I may roll up to subscriptions but I code to a different GL account

🚀Generated from invoicing subscription contracts that range from monthly to multi-year. Your product and resold products. This is contracted MRR or ARR.

☠️Careful with resold products. I may roll up to subscriptions but I code to a different GL account

Time for Advanced SaaS COGS. COGS vs OpEx is so important to get right.

But what if we have multiple revenue streams? Our COGS section must align with this.

Quick guide. #saas

But what if we have multiple revenue streams? Our COGS section must align with this.

Quick guide. #saas

SaaS COGS vs. OpEx is a common discussion in my courses and with my clients.

What should I include in SaaS cost of goods sold (COGS)?

Quick guide below and why this is important. #saas

What should I include in SaaS cost of goods sold (COGS)?

Quick guide below and why this is important. #saas

What departments are included in SaaS COGS?

For pure-play SaaS, your COGS structure should include:

1⃣Technical Support

2⃣Professional Services

3⃣Customer Success

4⃣Dev Ops

Of course, CS is up for debate depending on their role.

Dev Ops = Cost of Ops in my examples

For pure-play SaaS, your COGS structure should include:

1⃣Technical Support

2⃣Professional Services

3⃣Customer Success

4⃣Dev Ops

Of course, CS is up for debate depending on their role.

Dev Ops = Cost of Ops in my examples

📌Technical Support

They manage inbound customer contact regarding product bugs and how-to's.

💡Typical Expenses: Wages, payroll taxes, benefits, travel, training, internal software subscriptions

💡Margin: Included in recurring gross margin

They manage inbound customer contact regarding product bugs and how-to's.

💡Typical Expenses: Wages, payroll taxes, benefits, travel, training, internal software subscriptions

💡Margin: Included in recurring gross margin

1/ How do you sell SaaS products to enterprise customers?

The hard way or the harder way :). There is no easy way.

There are two major approaches to enterprise that work today.

The hard way or the harder way :). There is no easy way.

There are two major approaches to enterprise that work today.

2/ First is the traditional enterprise sales model, today it might also be enhanced with Account Based Marketing support. This is the harder way. Folks have written tons of books about this.

3/ Second is land and expand, which works for horizontal, bottoms-up products, that can be adopted team by team within the org. The latter is more interesting especially for smaller startups who seek to play judo with a $100M competitor for an enterprise customer.

#India's #startup ecosystem raised $455 million across 24 deals last week (Jan.16-21,'23) with #fintech #unicorn PhonePe turning decacorn at $12 billion valuation.

#StartupIndia #DigitalIndia #VentureCapital #funding #Entrepreneurship #innovation #Motivation #prosunjoyi #Thread

#StartupIndia #DigitalIndia #VentureCapital #funding #Entrepreneurship #innovation #Motivation #prosunjoyi #Thread

Rumblings on "Private-to-Private" M&A deals

From an M&A practitioner perspective, I can't help but to think there will be a newfound appreciation for the level of complexity involved in consummating these specific types of transactions in today's environment

Let me explain...🧵

From an M&A practitioner perspective, I can't help but to think there will be a newfound appreciation for the level of complexity involved in consummating these specific types of transactions in today's environment

Let me explain...🧵

Talks of a wave of "VC-backed consolidation" over the next 12-18 months have been pervasive in various Valley circles recently, and manifesting in the form of:

🤝 Buyers using '21 valuations opportunistically as "M&A currency"

🤝 "Roll-ups of last resort" for subscale players

🤝 Buyers using '21 valuations opportunistically as "M&A currency"

🤝 "Roll-ups of last resort" for subscale players

The term "hostile takeover" begets images of "raiders" dawning two-toned collared shirt & suspender combos, screaming into phones in a cigar-smoke-clouded mahogany rooms filled with dot matrix printer tear-sheets...

But, $EMR showed that companies too can also "go hostile"🧵

But, $EMR showed that companies too can also "go hostile"🧵

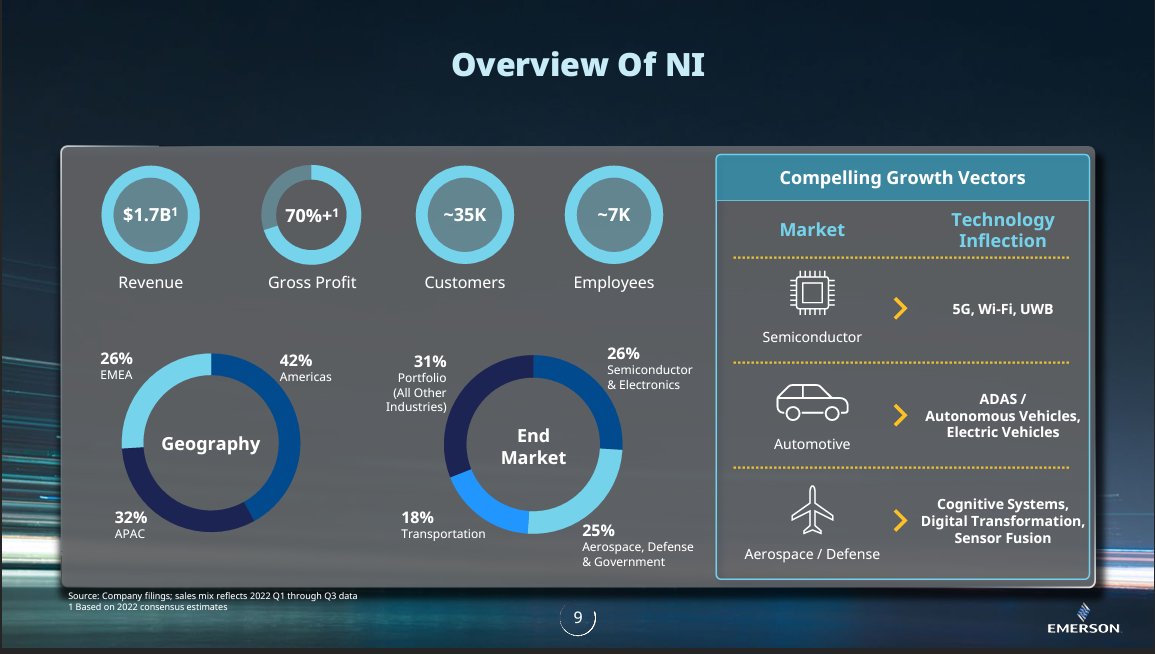

So yesterday, $EMR announced *a proposal* to acquire $NATI for $53.00 a share (~$7.6bn and 32% premium to last close)

$NATI is a $1.7bn electronic T&M business with 70% GMS, 35K customers across diverse end markets

Deal would advance $EMR's global automation focus & strategy

$NATI is a $1.7bn electronic T&M business with 70% GMS, 35K customers across diverse end markets

Deal would advance $EMR's global automation focus & strategy

Why go "hostile"?

Well, in short, if as a buyer you're getting stonewalled by management & their Board, you can put the target "in play" by going directly to shareholders

$EMR made many attempts to engage with $NATI in private dating to 5/22 with no constructive engagement

Well, in short, if as a buyer you're getting stonewalled by management & their Board, you can put the target "in play" by going directly to shareholders

$EMR made many attempts to engage with $NATI in private dating to 5/22 with no constructive engagement