Discover and read the best of Twitter Threads about #TATACOMM

Most recents (5)

Best way to use #RSI for Trading

What is RSI indicator?

RSI is used on price to identify oversold and overbought market conditions. In relative terms, when RSI line touches the 30 line, price is said to be oversold. When RSI touches the 70 line, price is said to be overbought.

What is RSI indicator?

RSI is used on price to identify oversold and overbought market conditions. In relative terms, when RSI line touches the 30 line, price is said to be oversold. When RSI touches the 70 line, price is said to be overbought.

Problem of using RSI traditionally is that in heavily trending market #RSI can remain oversold and overbought for a considerably long duration. Consider example of #TATACHEM for example. If you keep selling because of RSI Oversold, you can continue to make losses.

So the proper way is to use RSI + Divergence.

What is RSI Divergence? When price is moving in opposite direction of the RSI.

1. Near 70, Price is making Higher Highs & RSI is making Lower Highs; or

2. Near 30, Price is making Lower Lows & RSI is making Higher Lows.

What is RSI Divergence? When price is moving in opposite direction of the RSI.

1. Near 70, Price is making Higher Highs & RSI is making Lower Highs; or

2. Near 30, Price is making Lower Lows & RSI is making Higher Lows.

Price action characteristics prior clean breakouts:

Not more than 20%+ away from 50 Moving Average

2-3 Narrow Range Bars (Net Change < 2%)

Contracted Volumes

Selling Rejection/Shakeout

No recent buying rejections/Down days with high volumes

High relative volume at start

(1/n)

Not more than 20%+ away from 50 Moving Average

2-3 Narrow Range Bars (Net Change < 2%)

Contracted Volumes

Selling Rejection/Shakeout

No recent buying rejections/Down days with high volumes

High relative volume at start

(1/n)

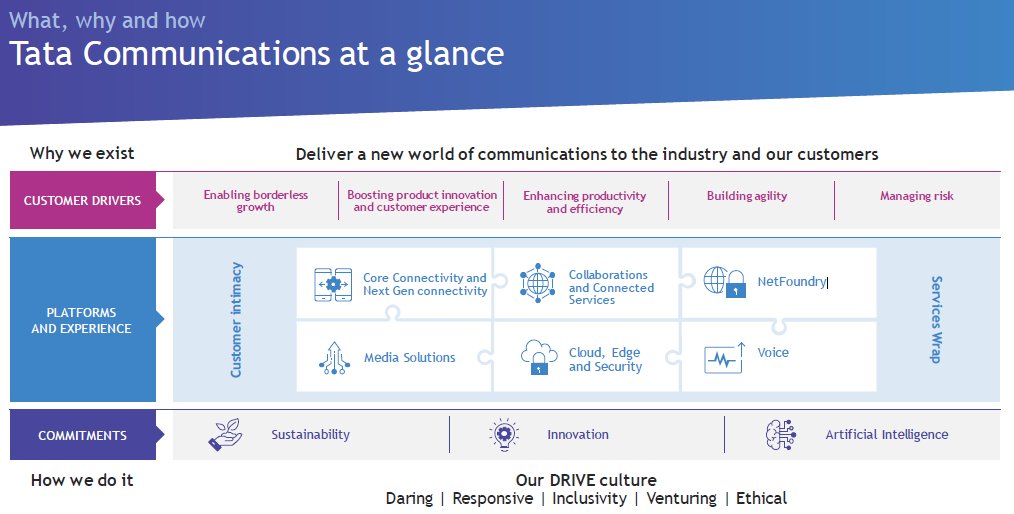

#TataCommunications

It said "Transformation is in our DNA"

So is it really a GEM 💎which can be market leader in New Digitally Transformed World?🧐

Let's deep dive its transformation journey, current biz. portfolio & future prospect.

Here we start this LONG #Thread..

1/🧵

It said "Transformation is in our DNA"

So is it really a GEM 💎which can be market leader in New Digitally Transformed World?🧐

Let's deep dive its transformation journey, current biz. portfolio & future prospect.

Here we start this LONG #Thread..

1/🧵

#TataCommunication

2/🧵

Evolution & Journey so far.

#DoYouKnow: The business was founded as Videsh Sanchar Nigam Limited (VSNL) in 1986. VSNL is credited to have brought the internet into the country.

2/🧵

Evolution & Journey so far.

#DoYouKnow: The business was founded as Videsh Sanchar Nigam Limited (VSNL) in 1986. VSNL is credited to have brought the internet into the country.

#TataCommunication

3/🧵

Current Biz. portfolio can be clubbed in 3 large bucket

1⃣ Data

➖Core Connectivity & Next-Gen Connectivity

➖Collaborations and Connected Services

➖Cloud, Edge and Security

➖Media Services

2⃣Voice Services

3⃣Others

➖NetFoundry

➖Other subsidiaries

3/🧵

Current Biz. portfolio can be clubbed in 3 large bucket

1⃣ Data

➖Core Connectivity & Next-Gen Connectivity

➖Collaborations and Connected Services

➖Cloud, Edge and Security

➖Media Services

2⃣Voice Services

3⃣Others

➖NetFoundry

➖Other subsidiaries

BIG TIME FRAME = Less Noise + Less Shock + Less Volatality

Fortume can be made on Big Time Frame,

small time Frame can Run / May not run your Kitchen

(Just my View)

R:R Risk Reward is mostly in our Favour

and can give Prosperity in Long Term

as @velumania Say

#Thread

Fortume can be made on Big Time Frame,

small time Frame can Run / May not run your Kitchen

(Just my View)

R:R Risk Reward is mostly in our Favour

and can give Prosperity in Long Term

as @velumania Say

#Thread

Ek Lamba Baal kheecho,

usme ek knot bandh lo

pahad ke upar dalo,

kheecho

aaya to Pahad

gaya to Baal

usme ek knot bandh lo

pahad ke upar dalo,

kheecho

aaya to Pahad

gaya to Baal

One line thesis for top momentum stocks:

#ADANIGREEN - Largest govt contracts

#LAURUSLABS - Superb Q results, CDMO, Sector Tailwinds

#ALKYLAMINE - Duopoly, Proxy to Pharma(60%) and agroChem(40%) boom

#GMMPFAUDLR - Market leader, MNC, Pharma Proxy

(1/n)

#ADANIGREEN - Largest govt contracts

#LAURUSLABS - Superb Q results, CDMO, Sector Tailwinds

#ALKYLAMINE - Duopoly, Proxy to Pharma(60%) and agroChem(40%) boom

#GMMPFAUDLR - Market leader, MNC, Pharma Proxy

(1/n)

#GRANULES - Pharma boom, API, Cos Moving from China to India for APIs.

#DCAL - CDMO business

#BSOFT - Big wins from the likes of Microsoft, Oracle, etc

#DIXON - Marquee clients like Samsung, Philips, Xiaomi, Proxy to electronics consumption theme in India

(2/n)

#DCAL - CDMO business

#BSOFT - Big wins from the likes of Microsoft, Oracle, etc

#DIXON - Marquee clients like Samsung, Philips, Xiaomi, Proxy to electronics consumption theme in India

(2/n)

#TATACOMM - New investments from FIIs, WFH, Few players left, INet growth

#DHANUKA - Agrochem boom, Asset light business, collaboration with innovators

#AFFLE - Digital consumption growth

#INTELLECT - Financial platform, new product financial services-ready public cloud

(3/n)

#DHANUKA - Agrochem boom, Asset light business, collaboration with innovators

#AFFLE - Digital consumption growth

#INTELLECT - Financial platform, new product financial services-ready public cloud

(3/n)