Discover and read the best of Twitter Threads about #TechnoFunda

Most recents (24)

#WisdomTales: Insights from Legends

In this series, we cover interesting stories and insights of legendary investors which will give invaluable lessons in the journey of investing

In this thread, Kenneth Andrade explained how using #TechnoFunda does not work on huge PF size !!

In this series, we cover interesting stories and insights of legendary investors which will give invaluable lessons in the journey of investing

In this thread, Kenneth Andrade explained how using #TechnoFunda does not work on huge PF size !!

According to him both the studies contradicts each other, example, A technical chart will tell you to sell it 20% below your purchase price and as a Fundamental analyst you will double your position at 50% below your purchase price so those things are conflicting

In his career he held “MRF” from 2003 to 2015 it was 110 times up, held “Page industries” from 2007 to 2015 it gave an 80x or 90x, & Kaveri seeds which gave 70x

After this there’s just one question he asks is why would you want to sell a business where fundamentals are improving

After this there’s just one question he asks is why would you want to sell a business where fundamentals are improving

I just realised something. If you’re a profitable trader and investor, the trading can help your investing. -

- you dont take as much risk in your investments. Your risk appetite is whetted by the trading -

- you develop better nerve to hold your investments

- you dont take as much risk in your investments. Your risk appetite is whetted by the trading -

- you develop better nerve to hold your investments

Longer. Because you’re not so anxious to be profitable quickly in your investments. -

- you’re not as anxious when your high probability investment bets have drawdowns, because you’re having money to average down through your trading profits. -

- TA knowledge

- you’re not as anxious when your high probability investment bets have drawdowns, because you’re having money to average down through your trading profits. -

- TA knowledge

Helps you to time your entries and (if needed) exits from your investments.

Why #PSB (Punjab Sind Bank) is Buzzing ?

Hit 20% Upper Circuit Today with Huge Volume ...

🌟Detailed #TechnoFunda Analysis🌟

(Must read🧵for Investors & Traders!)

@chartmojo @KommawarSwapnil Views Invited 🙏

Hit 20% Upper Circuit Today with Huge Volume ...

🌟Detailed #TechnoFunda Analysis🌟

(Must read🧵for Investors & Traders!)

@chartmojo @KommawarSwapnil Views Invited 🙏

1⃣

Punjab & Sind Bank is an Indian public sector bank headquartered in New Delhi.

Since last few days, the counter has been buzzing and today it hit 20% upper circuit with huge volumes.

#PSB #PunjabSindBank #TechnoFunda

Punjab & Sind Bank is an Indian public sector bank headquartered in New Delhi.

Since last few days, the counter has been buzzing and today it hit 20% upper circuit with huge volumes.

#PSB #PunjabSindBank #TechnoFunda

2⃣

On Saturday, 3rd November 2022 Bank declared its Q2 Results.

Turnaround seen.

@nid_rockz @caniravkaria Views Invited. 🙏

#PSB #PunjabSindBank #TechnoFunda

On Saturday, 3rd November 2022 Bank declared its Q2 Results.

Turnaround seen.

@nid_rockz @caniravkaria Views Invited. 🙏

#PSB #PunjabSindBank #TechnoFunda

10 common money mistakes that will cost you your financial freedom....

Don't miss the 7th one...

A thread....Let's go

#investing #mistakes #technofunda #YouCanCompound

Don't miss the 7th one...

A thread....Let's go

#investing #mistakes #technofunda #YouCanCompound

1. Procrastinating to INVEST

Compounding is the 8th wonder of the world...and the exponential factor in it's equation is TIME

The more time you give yourself to compound your investment, the better it is

Even if you are in 20s or 30s...START NOW...Don't wait

Compounding is the 8th wonder of the world...and the exponential factor in it's equation is TIME

The more time you give yourself to compound your investment, the better it is

Even if you are in 20s or 30s...START NOW...Don't wait

2. Lure of LEVERAGE

As soon as we start earning decent salary or income...there is lure from all around...

The EMI trap...for that Amazon sale, that iPhone, bigger home, bigger car...foreign holidays...

AVOID DEBT....Build your nest egg....that starts compounding...

As soon as we start earning decent salary or income...there is lure from all around...

The EMI trap...for that Amazon sale, that iPhone, bigger home, bigger car...foreign holidays...

AVOID DEBT....Build your nest egg....that starts compounding...

#EngineersIndia - Safe bet for good gains in medium term.

CMP – 73.20 (7/11/22)

Strong Momentum in PSUs, Highly Undervalued, Breakout on Cards

🌟#TechnicalAnalysis inputs by @rohanshah619 🌟

(Must read🧵for Investors & Traders!)

@KommawarSwapnil Views Invited

#TechnoFunda

CMP – 73.20 (7/11/22)

Strong Momentum in PSUs, Highly Undervalued, Breakout on Cards

🌟#TechnicalAnalysis inputs by @rohanshah619 🌟

(Must read🧵for Investors & Traders!)

@KommawarSwapnil Views Invited

#TechnoFunda

1⃣

#EngineersIndia (EIL) is a public sector undertaking which is a leading global engineering consultancy & EPC company.

Company provides engineering consultancy & EPC services principally focused on the oil & gas & petrochemical industries.

#StockMarket #Trading #Investing

#EngineersIndia (EIL) is a public sector undertaking which is a leading global engineering consultancy & EPC company.

Company provides engineering consultancy & EPC services principally focused on the oil & gas & petrochemical industries.

#StockMarket #Trading #Investing

2⃣

#EIL has diversified into infrastructure, water and waste management, solar & nuclear power & fertilizers sectors.

Company has also initiated business development activities in sectors like Bio Fuels, SMART Cities, LNG Terminals, Ports & Harbours, Defence.

#StockMarket

#EIL has diversified into infrastructure, water and waste management, solar & nuclear power & fertilizers sectors.

Company has also initiated business development activities in sectors like Bio Fuels, SMART Cities, LNG Terminals, Ports & Harbours, Defence.

#StockMarket

10 Quotes that helped me navigate the bull markets

9th one from Charlie Munger is super powerful...

Kindly re-tweet to help more investors🧵

Here we go...

#technofunda #investing

9th one from Charlie Munger is super powerful...

Kindly re-tweet to help more investors🧵

Here we go...

#technofunda #investing

(1)

“Rule no. 1 - Fish where the fishes are...

Rule no. 2- Don’t forget rule no. 1"

- Charlie Munger

“Rule no. 1 - Fish where the fishes are...

Rule no. 2- Don’t forget rule no. 1"

- Charlie Munger

(2)

“The difference between really successful people and successful people is that really successful people say NO to almost everything"

- Warren Buffett

Learn to say NO to enticing ideas in a bull market...be focused...

“The difference between really successful people and successful people is that really successful people say NO to almost everything"

- Warren Buffett

Learn to say NO to enticing ideas in a bull market...be focused...

Some of the F2F Interviews done by @Abhishekkar_ and @elearnmarkets @vivbajaj have helped us to sharpen our skill in #trading and #investing.

These 10 F2F videos could make you one step closer to be a better trader !

5th one is our favourite !

A thread 🧵

These 10 F2F videos could make you one step closer to be a better trader !

5th one is our favourite !

A thread 🧵

@Abhishekkar_ has shared about his trading journey in his video. How he started trading with his savings from pocket money and right now he is one of the best trader who has helped us and many others in their trading journey.

@Mitesh_Engr Sir have make big money in Futures and Options. His trading style is simple short when supports breaks and long when resistance breaks.

Simple strategy to execute provided one is disciplined.

Simple strategy to execute provided one is disciplined.

#TimeTechno - A Small Cap Possible Turn-Around Story ...

CMP – 99.80 (22/04/2022)

(Must read 🧵Thread for traders searching for 🚀🚀🚀 )

Technical Inputs by @YTA_School

@rohanshah & @caniravkaria Views Invited.

CMP – 99.80 (22/04/2022)

(Must read 🧵Thread for traders searching for 🚀🚀🚀 )

Technical Inputs by @YTA_School

@rohanshah & @caniravkaria Views Invited.

1⃣

Time Technoplast Ltd (#TimeTechmo) is a multinational conglomerate and a leading manufacturer of polymer-based products with varied applications.

#TechnoFunda #StockMarket #Trading #Investing

Time Technoplast Ltd (#TimeTechmo) is a multinational conglomerate and a leading manufacturer of polymer-based products with varied applications.

#TechnoFunda #StockMarket #Trading #Investing

2⃣

Company's portfolio consists of segments like, Industrial Packaging Solutions, Lifestyle Products, Automotive Components, Healthcare Products, Infrastructure Construction related products, Material Handling Solutions & Composite Cylinders.

#TimeTechno #Investing

Company's portfolio consists of segments like, Industrial Packaging Solutions, Lifestyle Products, Automotive Components, Healthcare Products, Infrastructure Construction related products, Material Handling Solutions & Composite Cylinders.

#TimeTechno #Investing

#RajapalayamMills - Small-cap stock for 50% gains in short term & 2X in medium term.

CMP – 1219.10 (13/1/22)

Sectoral Tailwinds, Highly Undervalued, Capex, Breakout on Cards ...

(Must read🧵Thread for Investors !)

@caniravkaria Views Invited

#TechnoFunda

CMP – 1219.10 (13/1/22)

Sectoral Tailwinds, Highly Undervalued, Capex, Breakout on Cards ...

(Must read🧵Thread for Investors !)

@caniravkaria Views Invited

#TechnoFunda

1⃣

#RajapalayamMills Limited is flagship mill of the Ramco Group’s Textile Division.

#TechnoFunda #ShareMarket #StockMarket #Investing #Trading

@Anshi_________ Views Invited.

#RajapalayamMills Limited is flagship mill of the Ramco Group’s Textile Division.

#TechnoFunda #ShareMarket #StockMarket #Investing #Trading

@Anshi_________ Views Invited.

2⃣

Ramco Group Textile Division, produces a wide range of yarns from Cotton, Lenzing Modal & Tencel fibres to meet requirements of top class customers across the world.

Ramco Group Textile Division has 18 units across the country.

#TechnoFunda #StockMarket #Investing #Trading

Ramco Group Textile Division, produces a wide range of yarns from Cotton, Lenzing Modal & Tencel fibres to meet requirements of top class customers across the world.

Ramco Group Textile Division has 18 units across the country.

#TechnoFunda #StockMarket #Investing #Trading

After #Kitex Now comes #VishalFabrics ...

A Small-cap stock that can become 2X in medium term.

CMP – 107.40 (11/1/2022)

Sectoral Tailwinds, Promoters Buying, Breakout ...

(Must read 🧵Thread for Investors !)

@saditya10p Views Invited 🙏

#TechnoFunda #ShareMarket

A Small-cap stock that can become 2X in medium term.

CMP – 107.40 (11/1/2022)

Sectoral Tailwinds, Promoters Buying, Breakout ...

(Must read 🧵Thread for Investors !)

@saditya10p Views Invited 🙏

#TechnoFunda #ShareMarket

1⃣

A flagship company of the Chiripal Group, #VishalFabrics Limited is a leading denim manufacturer.

Company has been promoted by Shri Brijmohan Chiripal who has nearly three decades of experience in the fabric and yarn business and marketing of knitted apparels.

#TechnoFunda

A flagship company of the Chiripal Group, #VishalFabrics Limited is a leading denim manufacturer.

Company has been promoted by Shri Brijmohan Chiripal who has nearly three decades of experience in the fabric and yarn business and marketing of knitted apparels.

#TechnoFunda

2⃣

Chiripal Group, is a leading manufacturer and exporter of Textile and BOPP Film products in India with a group turnover of more than Rs. 6,000+ crore.

Other Listed companies of the group - #NandanDenim Ltd. and CIL Nova Petrochemicals Ltd.

#TechnoFunda #Investing #Trading

Chiripal Group, is a leading manufacturer and exporter of Textile and BOPP Film products in India with a group turnover of more than Rs. 6,000+ crore.

Other Listed companies of the group - #NandanDenim Ltd. and CIL Nova Petrochemicals Ltd.

#TechnoFunda #Investing #Trading

Thread 🧵on Best Textile Sector Stocks in India ...

Why Invest in Textile ❓

Charts of Best Stocks for Trading / Investing (Based on Set Criteria)

Charts & TA Courtesy : @YTA_School

(Must Read for Traders & Investors)

@Anshi_________ @AmitabhJha3 (Views Invited) 🙏🙏🙏

Why Invest in Textile ❓

Charts of Best Stocks for Trading / Investing (Based on Set Criteria)

Charts & TA Courtesy : @YTA_School

(Must Read for Traders & Investors)

@Anshi_________ @AmitabhJha3 (Views Invited) 🙏🙏🙏

Covid-19 has altered global textile & apparel (T&A) supply chain with several brands preferring more than one sourcing destination.

Further, US-China trade war & imposition of additional duties on Chinese T&A imports have forced US-based importers to search for alternatives.

Further, US-China trade war & imposition of additional duties on Chinese T&A imports have forced US-based importers to search for alternatives.

In December, US signed a law that bans imports from China's Xinjiang region over concerns about forced labour. As Xinjiang constitutes ~ 20 per cent of global cotton market, supply re-adjustment on account of this ban has led to more demand for Indian cotton and cotton yarn.

#Kitex - A Small-cap stock that can give 2X Returns in medium term.

CMP – 220.05 (5/1/2022)

Sectoral Headwinds, Capex, Promoters Buying, Breakout, Relatively Stronger than Benchmark

(Must read🧵Thread for Investors !)

Thanks to @YTA_School for special Inputs

@caniravkaria

CMP – 220.05 (5/1/2022)

Sectoral Headwinds, Capex, Promoters Buying, Breakout, Relatively Stronger than Benchmark

(Must read🧵Thread for Investors !)

Thanks to @YTA_School for special Inputs

@caniravkaria

1⃣

Kitex Garments Limited, is reportedly the world's second largest infant clothing manufacturer.

Company’s vision is to become the No.1 infant apparel manufacturer in the world.

#TechnoFunda #Investing #Trading

Kitex Garments Limited, is reportedly the world's second largest infant clothing manufacturer.

Company’s vision is to become the No.1 infant apparel manufacturer in the world.

#TechnoFunda #Investing #Trading

2⃣

#Kitex has set growth target mission for 2025 to achieve a projected turnover of Rs. 2000+ crores by 2024-25.

While aiming the ambitious target the company is planning to invest Rs. 910 crores in six years.

Source - Company AR

@caniravkaria @nakulvibhor Views Invited 🙏

#Kitex has set growth target mission for 2025 to achieve a projected turnover of Rs. 2000+ crores by 2024-25.

While aiming the ambitious target the company is planning to invest Rs. 910 crores in six years.

Source - Company AR

@caniravkaria @nakulvibhor Views Invited 🙏

#ValiantOrganics - A Fundamentally Sound Stock which can give 2X Returns in medium to long term.

CMP – 995.40 (22/12/2021)

🌟Special Inputs from @rohanshah619🌟

(Must read 🧵Thread for Investors !)

#TechnoFunda + #HarmonicTrading

Views Invited 🙏🙏🙏

CMP – 995.40 (22/12/2021)

🌟Special Inputs from @rohanshah619🌟

(Must read 🧵Thread for Investors !)

#TechnoFunda + #HarmonicTrading

Views Invited 🙏🙏🙏

1⃣

#ValiantOrganics is engaged in manufacturing and marketing of specialty chemicals.

Company manufactures chemicals for a variety of industries such as speciality and agro chemicals, cosmetics, pharmaceuticals.

#TechnoFunda #StockMarket #Investing #Trading

#ValiantOrganics is engaged in manufacturing and marketing of specialty chemicals.

Company manufactures chemicals for a variety of industries such as speciality and agro chemicals, cosmetics, pharmaceuticals.

#TechnoFunda #StockMarket #Investing #Trading

2⃣

Company’s Chairman Chandrakant Gogri is the founder of Aarti Industries and has a good amount of experience in this segment.

#ValiantOrganics #TechnoFunda #StockMarket #Investing #Trading

Company’s Chairman Chandrakant Gogri is the founder of Aarti Industries and has a good amount of experience in this segment.

#ValiantOrganics #TechnoFunda #StockMarket #Investing #Trading

Thread-Stage Analysis. Thanks to @MashraniVivek for Introducing this in hackathon session

Source - Secrets for Profiting in Bull and Bear Markets, by Stan Weinstein

#technofunda

Source - Secrets for Profiting in Bull and Bear Markets, by Stan Weinstein

#technofunda

Key ingredient for Stage Analysis

-Weekly Chart –System for Long Term trade

-31 EMA - Price action vs 31 week EMA

- Volume -Transition from Stage 1 to Stage 2 supported by big volume

-Market Indexes –Sector/market must in stage 2

-Relative Strength-Outperforming the NIFTY50

-Weekly Chart –System for Long Term trade

-31 EMA - Price action vs 31 week EMA

- Volume -Transition from Stage 1 to Stage 2 supported by big volume

-Market Indexes –Sector/market must in stage 2

-Relative Strength-Outperforming the NIFTY50

Stage 1: Basing Stage

Long base on the chart

-Create a list of stocks in this stage & identify pivot point

-Check sector tailwind to validate the breakout into Stage 2 supported by sector

-Look for increased volume as approaches the breakout level

-Stage 1 go from weeks to years

Long base on the chart

-Create a list of stocks in this stage & identify pivot point

-Check sector tailwind to validate the breakout into Stage 2 supported by sector

-Look for increased volume as approaches the breakout level

-Stage 1 go from weeks to years

Thread 🧵explaining #MarketCycle

(Accumulation - Advancing - Distribution & Decline Phase)

Basics of #TechnicalAnalysis

(Must read for #TA learners)

🙏Like & RT to spread learning with all 🙏

@rohanshah619 / @PAlearner / @Puretechnicals9

#TechnicalAnalysis #StockMarket

(Accumulation - Advancing - Distribution & Decline Phase)

Basics of #TechnicalAnalysis

(Must read for #TA learners)

🙏Like & RT to spread learning with all 🙏

@rohanshah619 / @PAlearner / @Puretechnicals9

#TechnicalAnalysis #StockMarket

1⃣

✅Market Cycle refers to period between two latest highs or lows in case of any security (stock, bonds, commodity, currency, etc).

✅It refers to the phases in which price of any security moves.

#MarketCycle #StagesofMarket #TechnoFunda #StockMarket

✅Market Cycle refers to period between two latest highs or lows in case of any security (stock, bonds, commodity, currency, etc).

✅It refers to the phases in which price of any security moves.

#MarketCycle #StagesofMarket #TechnoFunda #StockMarket

2⃣

Understanding stages of market & how price moves during these stages helps a trader to identify new trading opportunities & lower their trading risk.

Market cycles goes through 4 stages -

⦁Accumulation

⦁Advancing

⦁Distribution

⦁Declining

#MarketCycle

Understanding stages of market & how price moves during these stages helps a trader to identify new trading opportunities & lower their trading risk.

Market cycles goes through 4 stages -

⦁Accumulation

⦁Advancing

⦁Distribution

⦁Declining

#MarketCycle

#KKCL - A Mid-Cap Stock which can give 2X Returns in medium to long term.

CMP – 1283.15 (9/12/2021)

(Must read🧵Thread for those looking for Long Term Wealth Creation)

@rohanshah619 @caniravkaria Views Invited 🙏🙏🙏

CMP – 1283.15 (9/12/2021)

(Must read🧵Thread for those looking for Long Term Wealth Creation)

@rohanshah619 @caniravkaria Views Invited 🙏🙏🙏

1⃣

Kewal Kiran Clothing Limited (#KKCL) is one of India’s largest branded apparel manufacturers, engaged in the designing, manufacturing and marketing of branded jeans and a wide range of western wear.

#TechnoFunda #StockMarket #Investing #Trading

Kewal Kiran Clothing Limited (#KKCL) is one of India’s largest branded apparel manufacturers, engaged in the designing, manufacturing and marketing of branded jeans and a wide range of western wear.

#TechnoFunda #StockMarket #Investing #Trading

2⃣

With in-house fashion brands Killer, Integriti, LawmanPg3, Easies, K-Lounge and Addictions, company has created a niche segment for apparel and accessory lovers across India.

#KKCL #TechnoFunda #StockMarket #Investing #Trading

With in-house fashion brands Killer, Integriti, LawmanPg3, Easies, K-Lounge and Addictions, company has created a niche segment for apparel and accessory lovers across India.

#KKCL #TechnoFunda #StockMarket #Investing #Trading

Sona Comstar

Sona BLW Precision Forgings Ltd

Let us understand the business first and also connect the dots why market is valuing it so richly almost at par with few OEMs.

Have done a detailed presentation on the same. Ready to discuss, exchange data and learnings.

#sonacoms

Sona BLW Precision Forgings Ltd

Let us understand the business first and also connect the dots why market is valuing it so richly almost at par with few OEMs.

Have done a detailed presentation on the same. Ready to discuss, exchange data and learnings.

#sonacoms

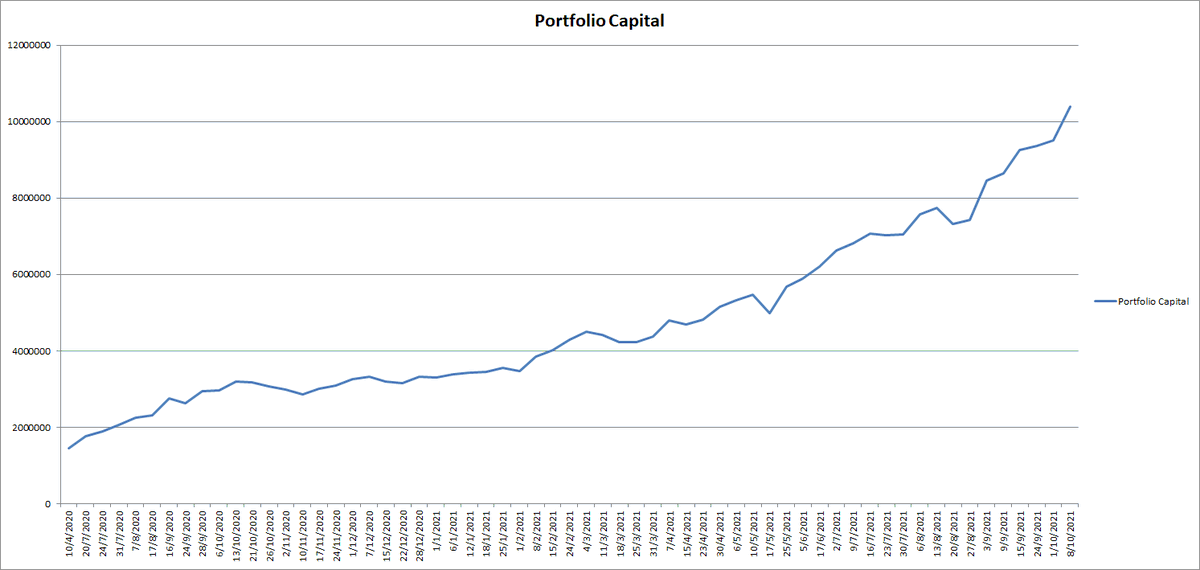

🛣️My Journey from 5000₹ to 1Cr₹

Stock market journey that started with just 5000, now with 7.2X return on PF from Apr20 With Capital in Apr20 was 14.5L &

With 617%(7.2X) return in 17months PF increased to 1.04Cr₹(equity trade only)

Here is my journey in brief,

Stock market journey that started with just 5000, now with 7.2X return on PF from Apr20 With Capital in Apr20 was 14.5L &

With 617%(7.2X) return in 17months PF increased to 1.04Cr₹(equity trade only)

Here is my journey in brief,

In 2011, when I joined my 1st Job, A banker came to our hostel to open Bank Acc. of all new Joinee along with that he also opened our Demat acc. in HDFC sec by taking many signs

Few of my colleague (from metro cities) started dabbling in share market, So I also thought to (3/n)

Few of my colleague (from metro cities) started dabbling in share market, So I also thought to (3/n)

Start as I was always curious about share market from college days but does not know anything other than sensex headline in TOI paper.

I bought Indiabulls Power share worth Rs 5000 only as was working in same and in 2 months I earned 500₹.

Then from one of my friend 4/n

I bought Indiabulls Power share worth Rs 5000 only as was working in same and in 2 months I earned 500₹.

Then from one of my friend 4/n

🎯

How understand world of investing and capital through the lens of Cycles..

Time for a thread on an amazing book "CAPITAL RETURNS"..

Capital is the engine of all cycles if you think about it..

And we need framework around it.. which is

(1/n)

🧵🧵🧵

amzn.to/38ZlhE1

How understand world of investing and capital through the lens of Cycles..

Time for a thread on an amazing book "CAPITAL RETURNS"..

Capital is the engine of all cycles if you think about it..

And we need framework around it.. which is

(1/n)

🧵🧵🧵

amzn.to/38ZlhE1

Theme of this book how capital cycles can help predict periods of booms and bursts for an industry.

If you can understand these 4 stages

You can understand how changes in amount of capital employed / supply within any industry are likely to impact future returns..

How?

(2/n)

If you can understand these 4 stages

You can understand how changes in amount of capital employed / supply within any industry are likely to impact future returns..

How?

(2/n)

Ultimately, it's all about demand and supply...world, countries, economies, companies, products

Stage-1: New investors in any sector/industry gets attracted by prospects of high returns

Think about startups around us...they see problems..they see opportunities..

Next is

(3/n)

Stage-1: New investors in any sector/industry gets attracted by prospects of high returns

Think about startups around us...they see problems..they see opportunities..

Next is

(3/n)

1/n

We will understand why Logarithmic charts should be used for Technical Analysis over Arithmetic charts

Traders looking to capture short-term price movement may prefer Arithmetic(linear) scale charts.

#TechnoFunda

#StockMarket

#metals

#StockMarketindia

#stocks

We will understand why Logarithmic charts should be used for Technical Analysis over Arithmetic charts

Traders looking to capture short-term price movement may prefer Arithmetic(linear) scale charts.

#TechnoFunda

#StockMarket

#metals

#StockMarketindia

#stocks

2/n

The problem with linear scale is when zoomed out to view long-term price history it can make the chart look parabolic or scary to retail investors. Commonly, when a security's price range over the period being studied is greater than 20%, a log scale chart should be used.

The problem with linear scale is when zoomed out to view long-term price history it can make the chart look parabolic or scary to retail investors. Commonly, when a security's price range over the period being studied is greater than 20%, a log scale chart should be used.

3/n

Long-term charts consisting of X years should also be plotted on the log scale. This becomes even more important when charting growth stocks. Log scale help investors visualize a nice consistent uptrend while softening chart volatility which in turn helps take out emotion.

Long-term charts consisting of X years should also be plotted on the log scale. This becomes even more important when charting growth stocks. Log scale help investors visualize a nice consistent uptrend while softening chart volatility which in turn helps take out emotion.

#DhampurSugar - Short Term Swing Trading Opportunity !

CMP – 287.85 (11/8/2021)

(Must read Thread Thread for #TA learners)

@rohanshah619 @caniravkaria 👉#TechnoFunda Views Invited.

CMP – 287.85 (11/8/2021)

(Must read Thread Thread for #TA learners)

@rohanshah619 @caniravkaria 👉#TechnoFunda Views Invited.

1⃣

#DhampurSugar is first & largest producer of refined sulphurless sugar in country.

Company's sugarcane co-generation capacity is one of the largest in the country & it has perhaps highest ethanol manufacturing capacity relative to it’s cane crushing capacity in country.

#DhampurSugar is first & largest producer of refined sulphurless sugar in country.

Company's sugarcane co-generation capacity is one of the largest in the country & it has perhaps highest ethanol manufacturing capacity relative to it’s cane crushing capacity in country.

2⃣

#DhampurSugar Capacity 👉

Crush 45,500 metric tonnes of cane per day

Refine 1,700 metric tonnes of sugar per day

Generate 209 MWH of renewable power

Export upto 125 MWH of renewable power to the grid

Produce 300,000 liters of alcohol/fuel ethanol per day

#StockMarket

#DhampurSugar Capacity 👉

Crush 45,500 metric tonnes of cane per day

Refine 1,700 metric tonnes of sugar per day

Generate 209 MWH of renewable power

Export upto 125 MWH of renewable power to the grid

Produce 300,000 liters of alcohol/fuel ethanol per day

#StockMarket

Case Study 11 : #Dabur - A Stock that doubles every 4 years!

CMP – 590.45 (2/7/2021)

(Must read Thread 🧵for #TA & #FA learners)

Fundamentals Sound & Technically Strong Upmove Candidate!

#TechnoFundaInvesting

@rohanshah619 @Vivek_Investor 🙏(Views Invited) 🙏

CMP – 590.45 (2/7/2021)

(Must read Thread 🧵for #TA & #FA learners)

Fundamentals Sound & Technically Strong Upmove Candidate!

#TechnoFundaInvesting

@rohanshah619 @Vivek_Investor 🙏(Views Invited) 🙏

1⃣

Dabur India Limited is a leading Indian consumer goods company with interests in Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods.

#Dabur #TechnoFunda #Trading #Investing #StockMarket

Dabur India Limited is a leading Indian consumer goods company with interests in Hair Care, Oral Care, Health Care, Skin Care, Home Care and Foods.

#Dabur #TechnoFunda #Trading #Investing #StockMarket

2⃣

Dabur derives around 60% of its revenue from the consumer care business, 11% from the food business and remaining from the international business unit.

#Dabur #TechnoFunda #Trading #Investing #StockMarket

Dabur derives around 60% of its revenue from the consumer care business, 11% from the food business and remaining from the international business unit.

#Dabur #TechnoFunda #Trading #Investing #StockMarket

Case Study 10 : #HDFCLife - Medium Term Investing Pick !

CMP – 725.55 (27/6/2021)

(Must read Thread 🧵for #TA & #FA learners)

Fundamentals Sound & Technically Strong Upmove 🚀Candidate!

#TechnoFundaInvesting

@caniravkaria @dmuthuk @Puretechnicals9 @rohanshah619

🙏(Views) 🙏

CMP – 725.55 (27/6/2021)

(Must read Thread 🧵for #TA & #FA learners)

Fundamentals Sound & Technically Strong Upmove 🚀Candidate!

#TechnoFundaInvesting

@caniravkaria @dmuthuk @Puretechnicals9 @rohanshah619

🙏(Views) 🙏

1⃣ HDFC Life Insurance Company is a long-term life insurance provider offering individual and group insurance services.

#HDFCLife #TechnoFunda #Trading #Investing #StockMarket

#HDFCLife #TechnoFunda #Trading #Investing #StockMarket

2⃣

Company's products meet various customer needs such as Protection, Pension, Savings & Investment and Health, along with Children's and Women's Plan.

#HDFCLife #TechnoFunda #Trading #Investing #StockMarket

Company's products meet various customer needs such as Protection, Pension, Savings & Investment and Health, along with Children's and Women's Plan.

#HDFCLife #TechnoFunda #Trading #Investing #StockMarket