Discover and read the best of Twitter Threads about #bullishness

Most recents (18)

Analysis: #NASDAQ $BIOL

Case 561 #BIOLASE Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

BIOL 1/3

Case 561 #BIOLASE Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

BIOL 1/3

Daily Chart: Jan. 2021 #trendline support has yielded and is now heading for the #SMA 200 and 0.5716. Farther down the #pivot at 0.4700 then block #support 0.3872- 0.2254 with balance at 0.1651. Price needs to .....

BIOL 2/3

BIOL 2/3

..... close above control at 1.0594 for medium term #bullishness. Above 1.3718 quickly targets 1.65/70.

The #Strategy is printed on the image.

BIOL 3/3

The #Strategy is printed on the image.

BIOL 3/3

Analysis: #NASDAQ $ONTX

Case 550 #Onconova Therapeutics Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

ONTX 1/3

Case 550 #Onconova Therapeutics Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

ONTX 1/3

Daily Chart: Conditions are becoming more #bearish especially with a loss of 0.6622, below the #SMA 200 at 0.6593. Father down #pivot 0.6344 - a close below targets the buying interest zone 0.4422- 0.2900. Notable #resistance begins at .....

ONTX 2/3

ONTX 2/3

..... the broken #trendline, now resistance at 0.9497 with SMA 50 at 1.0930. Long term #bullishness can only be achieved on a close/hold above control at 1.6400.

The #Strategy is printed on the image.

ONTX 3/3

The #Strategy is printed on the image.

ONTX 3/3

Analysis: #NYSE $ASXC

Case 546 #Asensus Surgical Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

ASXC 1/3

Case 546 #Asensus Surgical Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

ASXC 1/3

Daily Chart: The outlook has turned very #bearish with the loss of the SMA 50 and #pivot 2.86 supports. The current target is 2.25 with a close below eying 1.89 then control at 1.56 and #SMA 200 at 1.47. Farther down ......

ASXC 2/3

ASXC 2/3

..... strong #support 1.20- 0.87. Immediate #resistance 3.40/71 then 5.06 but medium term #bullishness can only be achieved above the synthetic at 5.48.

The #Strategy is printed on the image.

ASXC 3/3

The #Strategy is printed on the image.

ASXC 3/3

Analysis: #NYSE $GSAT

Case 543 #Globalstar Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

GSAT 1/3

Case 543 #Globalstar Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

GSAT 1/3

Daily Chart: The #parabolic move seen in Feb. 2021 has made conditions messy - the correction hasn't ended and price is contained below the #SMA 20 and 50. The current target is the #pivot 1.02 with spikes down towards 0.92. Strong .....

GSAT 2/3

GSAT 2/3

..... #support 0.73/51 with the SMA 200 in between. Immediate #resistance is 1.48/56. Medium term #bullishness can only be achieved on a close above 3.53. Use price flexibility upon entering the trade.

The #Strategy is printed on the image.

GSAT 3/3

The #Strategy is printed on the image.

GSAT 3/3

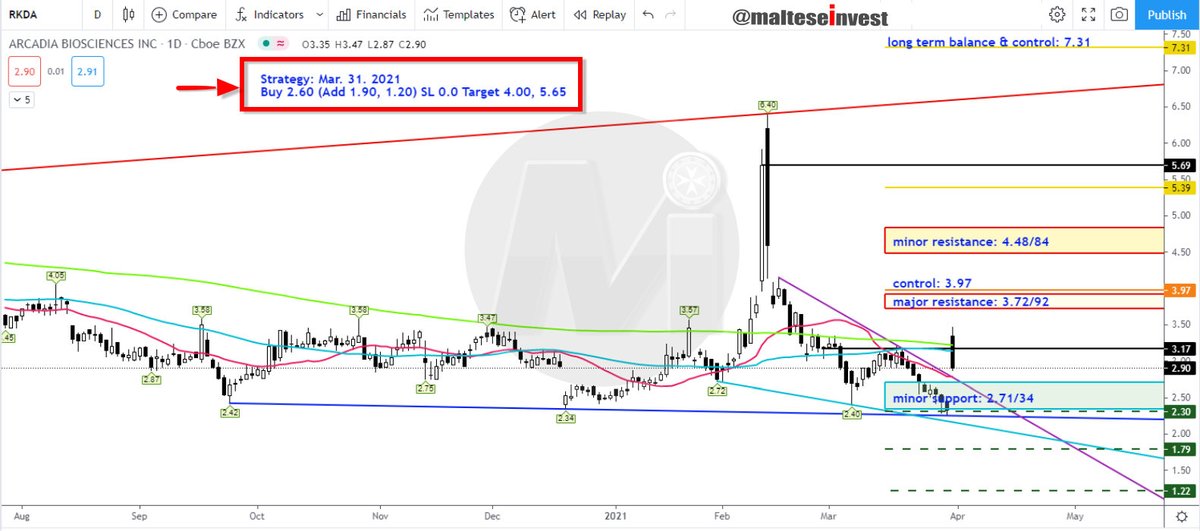

Analysis: #NASDAQ $RKDA

Case 536 #ArcadiaBiosciences, Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

RKDA 1/3

Case 536 #ArcadiaBiosciences, Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

RKDA 1/3

Daily Chart: Gapped up and down again, holding below the #SMA 200 and #pivot (3.22/17 respectively). Above major #resistance 3.72/92 with control at 3.97. Medium term #bullishness on a .....

RKDA 2/3

RKDA 2/3

..... daily close above 7.31. #Support begins at 2.71/34 then the #trendline 2.13, farther down buying interest 1.79/22.

The #Strategy is printed on the image.

RKDA 3/3

The #Strategy is printed on the image.

RKDA 3/3

Analysis: #NASDAQ $NNDM

Case 531 #NanoDimension Ltd.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

NNDM 1/3

Case 531 #NanoDimension Ltd.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

NNDM 1/3

Daily Chart: Expecting another leg lower towards the #trendline and control around 6.87. Decent #support seen at the #SMA 200 and #pivot 5.86. To the upside, mild #resistance at the Feb. 2021 trendline at 9.67, medium term #bullishness .....

NNDM 2/3

NNDM 2/3

..... will be achieved on a close above 12.96 which would then target 17.74.

The #Strategy is printed on the image.

NNDM 3/3

The #Strategy is printed on the image.

NNDM 3/3

Analysis: #NYSE $QS

Case 530 #QuantumScape Corporation

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

QS 1/3

Case 530 #QuantumScape Corporation

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

QS 1/3

Daily Chart: Heavily #bearish targeting 38.52- 35.42 a close below the latter eyes the major #support zone 28.58- 19.72. Price needs to close above a minimum 53.02 to target 64.45- 66.12, farther up .....

QS 2/3

QS 2/3

..... balance at 70.35. Medium term #bullishness can only be achieved above synthetic #resistance currently sloping at 91.55.

The #Strategy is printed on the image.

QS 3/3

The #Strategy is printed on the image.

QS 3/3

Analysis: #NYSE $PLTR

Case 528 #Palantir Technologies Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

PLTR 1/3

Case 528 #Palantir Technologies Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

PLTR 1/3

Daily Chart: Grinding lower, heading towards block #support 21.30- 19.43 below control at 17.68. To remove the immediate #bearish outlook a close above 28.35 is required but stability can only be achieved on a close/hold above .....

PLTR 2/3

PLTR 2/3

..... control at 31.48. This will target 35.28/87 and farther up #trendline support turned #resistance around 37.02. Long term #bullishness above 39.18.

The #Strategy is printed on the image.

PLTR 3/3

The #Strategy is printed on the image.

PLTR 3/3

Analysis: #NYSE $SOS

Case 525 #SOS Limited

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

SOS 1/3

Case 525 #SOS Limited

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

SOS 1/3

Daily Chart: Price has corrected lower but we are doubtful it has ended. Strong #support is seen 3.82- 0.24. A foothold above 11.21 is required to target 15.10 then firm #resistance 18.46- 25.22. Long term .....

SOS 2/3

SOS 2/3

#bullishness will only be achieved on a close above control at 31.34.

The #Strategy is printed on the image.

SOS 3/3

The #Strategy is printed on the image.

SOS 3/3

Analysis: #NASDAQ $GLBS

Case 521 #Globus Maritime Limited

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

GLBS 1/3

Case 521 #Globus Maritime Limited

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

GLBS 1/3

Daily Chart: Price needs to close above a minimum of 8.14 and then take hold of 8.90 to prevent the possibility of registering new lows, possibly down to 4.33. Price would need to close above .....

GLBS 2/3

GLBS 2/3

..... the #SMA 200 currently at 21.85 then above 43.29 for long term #bullishness.

The #Strategy is printed on the image.

GLBS 3/3

The #Strategy is printed on the image.

GLBS 3/3

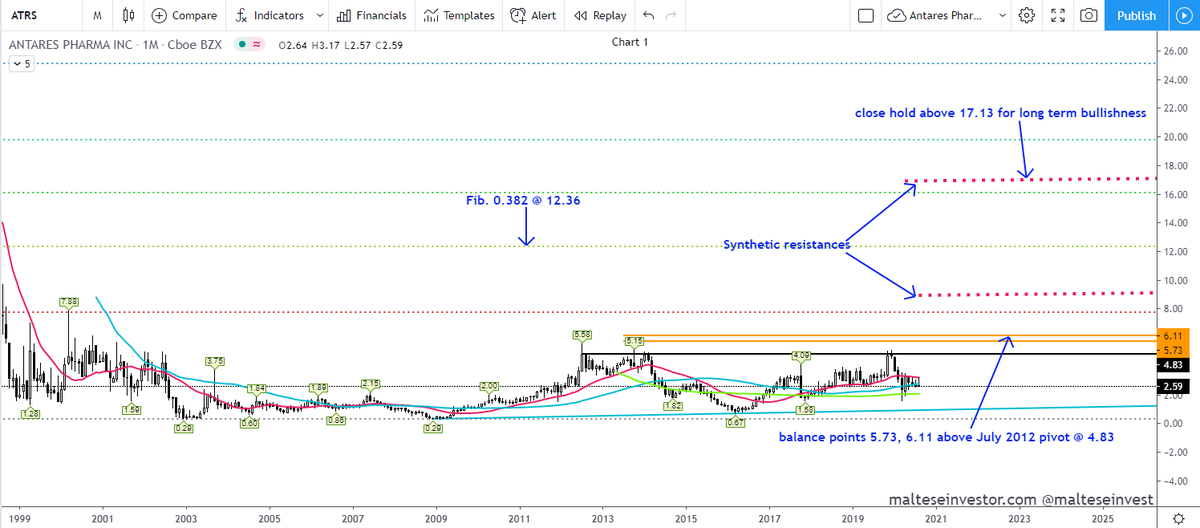

Analysis: #NASDAQ $ATRS

Case 450 #AntaresPharma Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#ATRS 1/4

Case 450 #AntaresPharma Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#ATRS 1/4

Chart 1

Monthly Chart: The 2012 range continues to dictate conditions. To get things going a minimum close/hold above the July 2012 #pivot at 5.58 is required, but this must be followed up with .....

ATRS 2/4

Monthly Chart: The 2012 range continues to dictate conditions. To get things going a minimum close/hold above the July 2012 #pivot at 5.58 is required, but this must be followed up with .....

ATRS 2/4

..... the close above 2 balance points at 5.73 and 6.11. Higher up #Fib. 0.236 at 7.74 then the synthetic #trendline at 8.97 and it is only above here that medium term #bullishness is achieved.

ATRS 3/4

ATRS 3/4

Analysis: #NASDAQ $AYTU

Case 438 #Aytu BioScience Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#AYTU 1/5

Case 438 #Aytu BioScience Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#AYTU 1/5

Chart 1

Daily Chart: The #parabolic move seen in Mar.2020 stalled exactly at the one year trendline #resistance and has since corrected lower to the #Fib. 0.786 at 0.90, the gap has been partially filled - off by 0.45. #Momentum is negative and beginning to .....

AYTU 2/5

Daily Chart: The #parabolic move seen in Mar.2020 stalled exactly at the one year trendline #resistance and has since corrected lower to the #Fib. 0.786 at 0.90, the gap has been partially filled - off by 0.45. #Momentum is negative and beginning to .....

AYTU 2/5

..... fall. The range is 2.17- 0.58, heavier at the top due to short term profit taking. Price needs to close above the Mar. 2020 #trendline with #SMA 50 riding it at 1.41, then hold above 1.72 to target 2.01/05 but #bullishness will only be achieved by the .....

AYTU 3/5

AYTU 3/5

Analysis: #NASDAQ $VXRT

Case 419 #Vaxart Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#VXRT 1/5

Case 419 #Vaxart Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#VXRT 1/5

Chart 1

Weekly Chart: The all time low at 0.25 is confirmed following the strong close above Nov. 2017 trendline. June 2020 witnessed a strong close above a #confluence of #resistance - Jan. 2020 #trendline, SMA 200 and Oct. 2018 .....

VXRT 2/5

Weekly Chart: The all time low at 0.25 is confirmed following the strong close above Nov. 2017 trendline. June 2020 witnessed a strong close above a #confluence of #resistance - Jan. 2020 #trendline, SMA 200 and Oct. 2018 .....

VXRT 2/5

..... pivot respectively at 4.85, 5.01 and 5.25. Note that the last time price traded above the #SMA 200 was in 2011. A close above the Sept. 2016 #pivot is now required for 30.14 and then above the control point 39.82 for long term #bullishness.

VXRT 3/5

VXRT 3/5

Analysis: #NASDAQ $NOVN

Case 401 #Novan Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#NOVN 1/4

Case 401 #Novan Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#NOVN 1/4

Chart 1

Weekly Chart: The #SMA 50 at 1.2256 continues to underpin upside probes but price needs to first close above synthetic #resistance at 1.3524 then the Sept. 2017 trendline at 2.7845 for #bullishness. Price is currently .....

NOVN 2/4

Weekly Chart: The #SMA 50 at 1.2256 continues to underpin upside probes but price needs to first close above synthetic #resistance at 1.3524 then the Sept. 2017 trendline at 2.7845 for #bullishness. Price is currently .....

NOVN 2/4

..... targeting Dec. 2018 #pivot at 0.7000 below that SMA 20 at 0.4732, then Mar. 2020 #trendline at 0.4112. A loss of 0.3888 will be disastrous as it's the last level of #support.

NOVN 3/4

NOVN 3/4

Analysis: #NASDAQ $KNDI

Case 375 #Kandi_Technologies Group Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#KNDI 1/4

Case 375 #Kandi_Technologies Group Inc.

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#KNDI 1/4

Chart 1

Weekly Chart: The Mar. 2020 low found #support at the 2007 #trendline and has bounced and is attempting to close above the SMA 200 4.87. Conditions are messy and a little overstretched with immediate .....

KNDI 2/4

Weekly Chart: The Mar. 2020 low found #support at the 2007 #trendline and has bounced and is attempting to close above the SMA 200 4.87. Conditions are messy and a little overstretched with immediate .....

KNDI 2/4

..... #resistance at 8.02 (2015 trendline). Further up #pivot resistance at 9.53 - a 2 week close above #cluster base at 12.15 is required for long term #bullishness.

KNDI 3/4

KNDI 3/4

Analysis: #NASDAQ $HEAR

Case 336 #Turtle_Beach Corporation

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#HEAR 1/4

Case 336 #Turtle_Beach Corporation

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#HEAR 1/4

Chart 1

Weekly Chart: Price has risen strongly above the control point at 13.56 and is currently attempting to break/close above long term #trendline resistance at 14.97. Mild cluster #resistance is seen at 17.61 - a close above targets 27.56. To .....

HEAR 2/4

Weekly Chart: Price has risen strongly above the control point at 13.56 and is currently attempting to break/close above long term #trendline resistance at 14.97. Mild cluster #resistance is seen at 17.61 - a close above targets 27.56. To .....

HEAR 2/4

..... achieve long term #bullishness price needs to close above 6 year #pivot resistance at 42.24 which will target the cluster base at 58.16 sitting atop #Fib. 0.618.

HEAR 3/4

HEAR 3/4

Analysis: #NYSE $SHOP

Case 334 #Shopify Inc. - Revisited

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#SHOP 1/4

Case 334 #Shopify Inc. - Revisited

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#SHOP 1/4

Chart 1

Weekly Chart: The strong close above #trendline #resistance seen in May 2020 continues to support the current upmove. The first objective is 887.47 and a close above will target 1018/20. To maintain .....

SHOP 2/4

Weekly Chart: The strong close above #trendline #resistance seen in May 2020 continues to support the current upmove. The first objective is 887.47 and a close above will target 1018/20. To maintain .....

SHOP 2/4

..... #bullishness the price needs to hold above 708.97 - a close below targets major #support between 643.19 - 593.89.

SHOP 3/4

SHOP 3/4

Analysis: #NASDAQ $NKLA

Case 333 #Nikola Corporation

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#NKLA 1/4

Case 333 #Nikola Corporation

DISCLAIMER: The analysis is strictly for educational purposes and should not be construed as an invitation to trade.

#NKLA 1/4

Chart 1

Daily Chart: The July blowout reached an all time high of 93.99 and since then half of the gains have been wiped out. To maintain #bullishness the control point at 63.59 needs to hold then close above #pivot #resistance at 73.27 to .....

NKLA 2/4

Daily Chart: The July blowout reached an all time high of 93.99 and since then half of the gains have been wiped out. To maintain #bullishness the control point at 63.59 needs to hold then close above #pivot #resistance at 73.27 to .....

NKLA 2/4

..... target 100.23 - 101.47 in the long term. To the downside an unfilled gap of 40.42-35.98 exists. The immediate support zone (below the broken #trendline) is 42.34 - 28.30 and further down major #support, sandwiched between #SMA 50 and 200 is 21.83 - 15.57.

NKLA 3/4

NKLA 3/4