Discover and read the best of Twitter Threads about #com

Most recents (24)

'Energy stocks are down this year. But the bullish case is very much alive. Count Canadian energy stocks among this year’s biggest disappointments.'

#COM 1/5

theglobeandmail.com/investing/mark…

#COM 1/5

theglobeandmail.com/investing/mark…

TD analyst: Energy market is being driven partly by speculative behaviour, as panic-stricken commodity traders react to deteriorating economic activity and the U.S. banking crisis that emerged in March.

the dip in energy stocks this year, to a range between US$70 and US$80 a barrel, suggests that the commodity is caught in a period of uncertainty, which could be rewarding for investors if demand holds up.

I'm still bouncing off the walls from the espresso beans so even tho no one asked - here's my #COM cast picks...open to discussion except for me, because Jennifer Aniston (same name, same crap love life) and of course @nyetjgoldblum = Jeff Goldblum...

Hopefully no one is offended by these choices - most of you accounts are anon and FTR I googled attractive celebs...haven't met the majority - just how I see you all via Twitter:

@RazorOil = John Cena (wrestling🤷♀️)

@JamesHMackay = Chris Evans

@Albertagarbage = Joaquin Phoenix

@sohaibab9 = Rahul Kohli

@jleqc = John Krasinski

@Josh_Young_1 = Ryan Reynolds

@JamesHMackay = Chris Evans

@Albertagarbage = Joaquin Phoenix

@sohaibab9 = Rahul Kohli

@jleqc = John Krasinski

@Josh_Young_1 = Ryan Reynolds

I seriously started a TV script about the #COM - because let’s face it, they (we) are a fascinating bunch. If energy moons, I can’t imagine - the plot lines already seem endless.

I even had some celebs in mind to play the characters, and of course it would be on Fox, not CBC.

I even had some celebs in mind to play the characters, and of course it would be on Fox, not CBC.

Because CBC would insist on being sympathetic to eco-terrorists.

Kind of Dallas meets Curb Your Enthusiasm meets The Big Bang Theory.

Some of my Tinder stories for a touch of romance (or horror, not sure).

Kind of Dallas meets Curb Your Enthusiasm meets The Big Bang Theory.

Some of my Tinder stories for a touch of romance (or horror, not sure).

Plenty of drama, which increased as the price of oil declined and some folks refused to attend gatherings anymore.

Humour with hot mics and lawsuits about fake gold mines.

International intrigue with OPEC and Chinese influence.

Humour with hot mics and lawsuits about fake gold mines.

International intrigue with OPEC and Chinese influence.

"People should invest money with Josh at Bison because they're out-performing the benchmark and the oil industry is starved of capital." Amazing endorsement @hkuppy, thank you!!! twitter.com/i/web/status/1…

I wasn't expecting to hear that! I like listening to @hkuppy interviews, and @KYRRadio does great interviews. I'd probably have shared this anyway. Made my day!

open.spotify.com/episode/36TFbz…

open.spotify.com/episode/36TFbz…

It gets even better! He discusses @joyenergyinc - he says it is available at a discount to PDP & has a superior acquisition model with great leadership by @AlexVergeJOY. And the power business is sneakily creating substantial value. I own $joy.to no recommendation #oil #com

DJ - Shaken, not stirred - 4Q22 review, and 2023/2024 estimates

Charts/tables edition 1/10 🧵

First up: 4Q22 Quarterly CFPS comparison

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

#COM #OOTT

Charts/tables edition 1/10 🧵

First up: 4Q22 Quarterly CFPS comparison

$CNQ $CVE $IMO $SU $CPG $ERF $HWX $TVE $WCP $FRU $ATH $MEG $ARX $TOU $PEY $PNE $VET $TPZ $AAV $CR

#COM #OOTT

DJ - Shaken, not stirred—4Q22 review

-pullback a buying opportunity 1/x 🧵

Top picks:

$SU integrated

$TOU large cap gas

$ERF mid cap oil

$AAV mid cap gas

$SDE wet gas

$FRU royalty

$ARX.TO $CNQ $CVE $CPG $PEY.TO $PNE $TPZ $TVE $VET.TO $WCP $ATH $CR $HWX $NVA $IMO $MEG

#OOTT #COM

-pullback a buying opportunity 1/x 🧵

Top picks:

$SU integrated

$TOU large cap gas

$ERF mid cap oil

$AAV mid cap gas

$SDE wet gas

$FRU royalty

$ARX.TO $CNQ $CVE $CPG $PEY.TO $PNE $TPZ $TVE $VET.TO $WCP $ATH $CR $HWX $NVA $IMO $MEG

#OOTT #COM

NBF - Revisiting Liquids (Wet gas) Peers

-revisit the relative bias across our liquids peers:

$KEC, $KEL, $NVA, $PIPE, $POU (~250 mboe/

w/ $9-10b market cap

-recent management updates

~75% of CF in group from liquids (9% CFPS per $5 WTIΔ, 4% per $0.25 HH Δ)

1/x 🧵

#OOTT #COM

-revisit the relative bias across our liquids peers:

$KEC, $KEL, $NVA, $PIPE, $POU (~250 mboe/

w/ $9-10b market cap

-recent management updates

~75% of CF in group from liquids (9% CFPS per $5 WTIΔ, 4% per $0.25 HH Δ)

1/x 🧵

#OOTT #COM

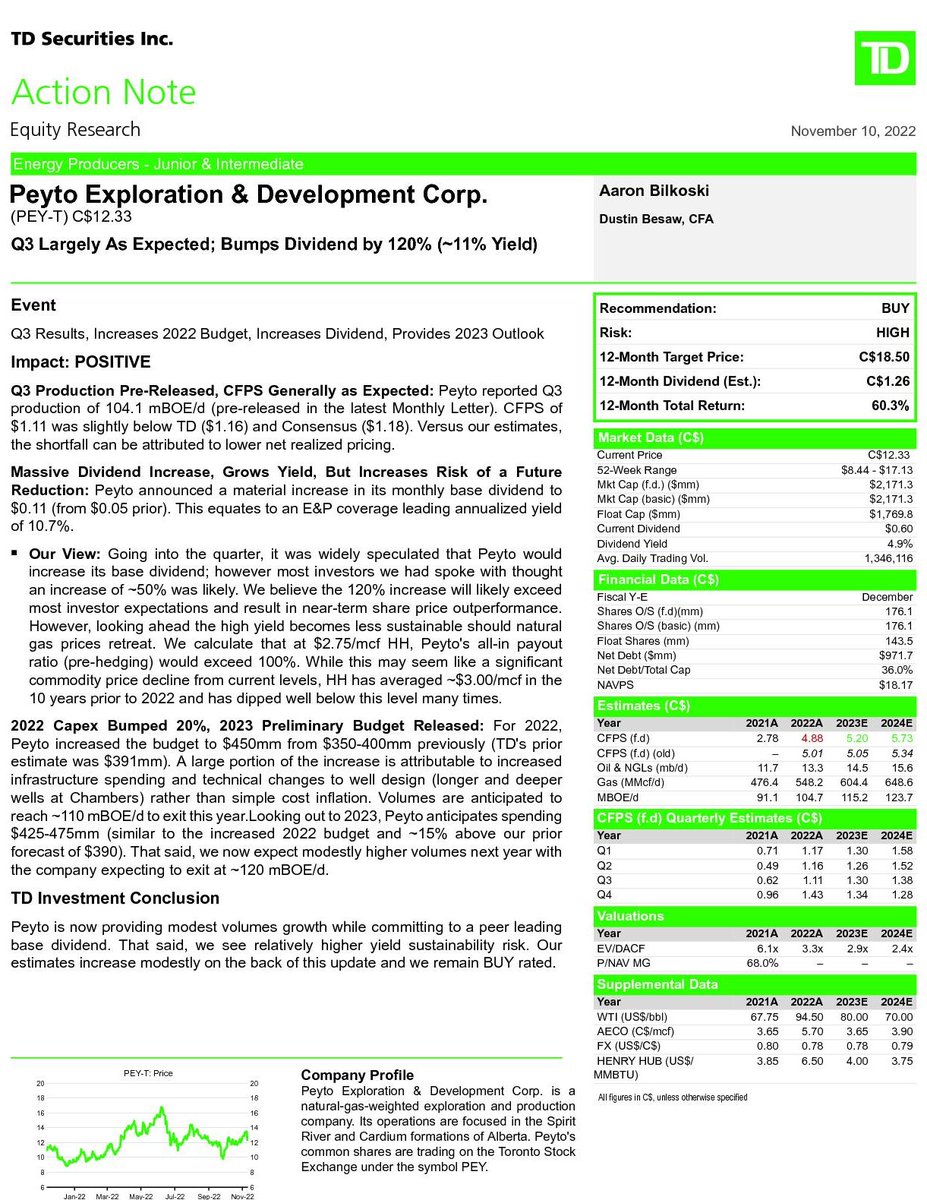

TD - Exploring Full-cycle Costs & Margins of Canadian E&Ps

-Which Companies Have the Lowest Full-cycle Costs?

gas $PEY.TO $AAV, oil $CPG $WCP

-Highest margins?

$PEY (cash cost), $SDE (F&D cost & tax pools), & $CPG (realized price & tax pools) then $ARX.TO

1/x 🧵

#COM #OOTT

-Which Companies Have the Lowest Full-cycle Costs?

gas $PEY.TO $AAV, oil $CPG $WCP

-Highest margins?

$PEY (cash cost), $SDE (F&D cost & tax pools), & $CPG (realized price & tax pools) then $ARX.TO

1/x 🧵

#COM #OOTT

What happened on last night's extra-special edition? Let's find out. ...

00:09:30 @jim_duffus joins and discusses $WCP and $TVE. J riffs with Jim about $OBE and $SDE and other #COM names. Duff broke the rule and threw away the note. Suncor! Deep touches on Whitecap earnings. Duff and J discuss Chemtrade.

#COM @USAEnergyNatGas @oilmutt @RazorOil A thread/question on #natgas and the current contango.

Markets, like natgas, where the commodity is "just in time" consumed usually exhibit backwardation. There is a plausible theory for why con tango must be rare in such markets.

Markets, like natgas, where the commodity is "just in time" consumed usually exhibit backwardation. There is a plausible theory for why con tango must be rare in such markets.

The argument goes like this: owning reserves is like having an option on natgas, where the strike price of the option is the total cost of extraction and the payoff at expiry is the then spot price.

If natgas were in contango, E&Ps would have no incentive to extract . . .

If natgas were in contango, E&Ps would have no incentive to extract . . .

or exercise this option because they could get a higher price in the future. So, there would be no production under contango. It's a similar argument as to why no one exercises and American call prior to maturity. exercises and American call prior to maturity. In this case,

Okay, so WTF happened with $CL today?

Here's a thread with my best guess, although there's probably something huge I'm also overlooking.

1/x

#OOTT #COM h/t

@Josh_Young_1

Here's a thread with my best guess, although there's probably something huge I'm also overlooking.

1/x

#OOTT #COM h/t

@Josh_Young_1

@Josh_Young_1 There was a lot of news coming out today, first with inventories reported by the EIA at 10:30 ET.

Oil showed a build in key inventories like raw crude, diesel, and gasoline at 10:30. The market handled that well-- it was roughly inline with other numbers last night (API).

2/x

Oil showed a build in key inventories like raw crude, diesel, and gasoline at 10:30. The market handled that well-- it was roughly inline with other numbers last night (API).

2/x

@Josh_Young_1 Bulls have been focused on oil unloadings in China and global inventories, while bears have been focused on OECD demand and US balances.

However, it's shoulder season, and there were no terrible surprises and the oil market handled things well for an hour.

#COM #OOTT 3/x

However, it's shoulder season, and there were no terrible surprises and the oil market handled things well for an hour.

#COM #OOTT 3/x

What happened on last night's Space? Let's find out.

00:02:30 Power-napping and awakening to a Blueberry River First Nations agreement, allowing Canadian companies to produce in native lands. @jleqc and @jim_duffus join.

00:08:00 Jim and Jleqc were trading NG recently and discuss the challenges in doing so. After a great morning, the day ended poorly. Jleqc channels @Seawolfcap and @YellowLabLife.

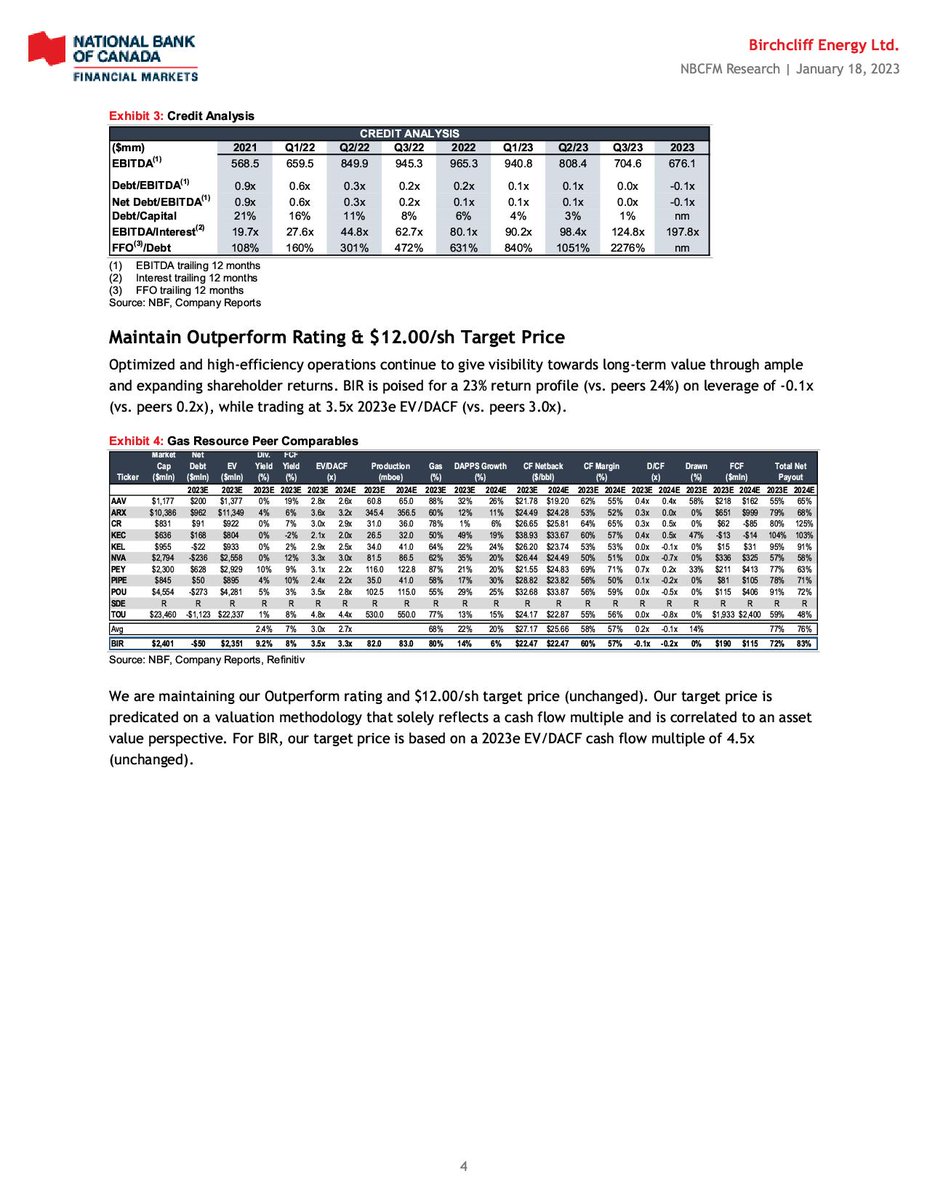

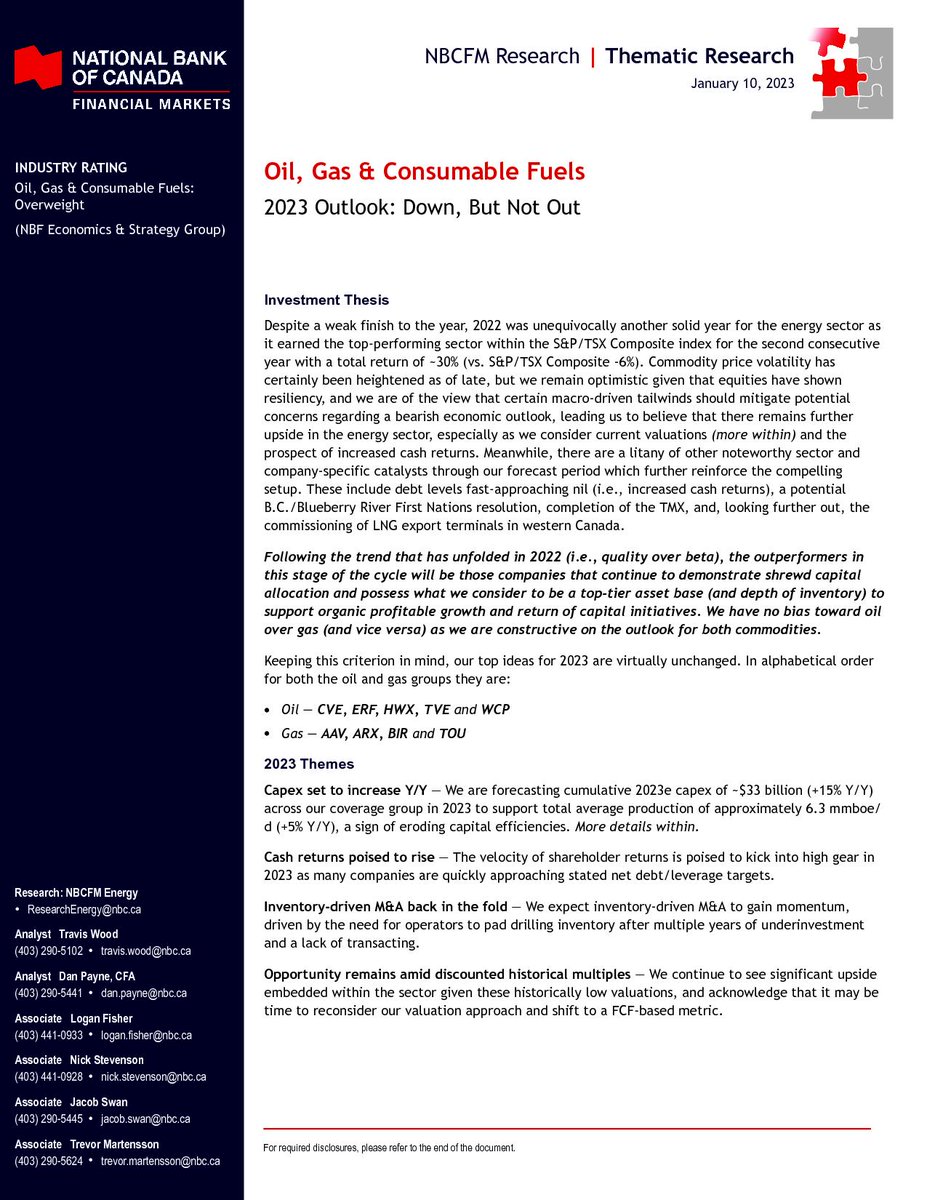

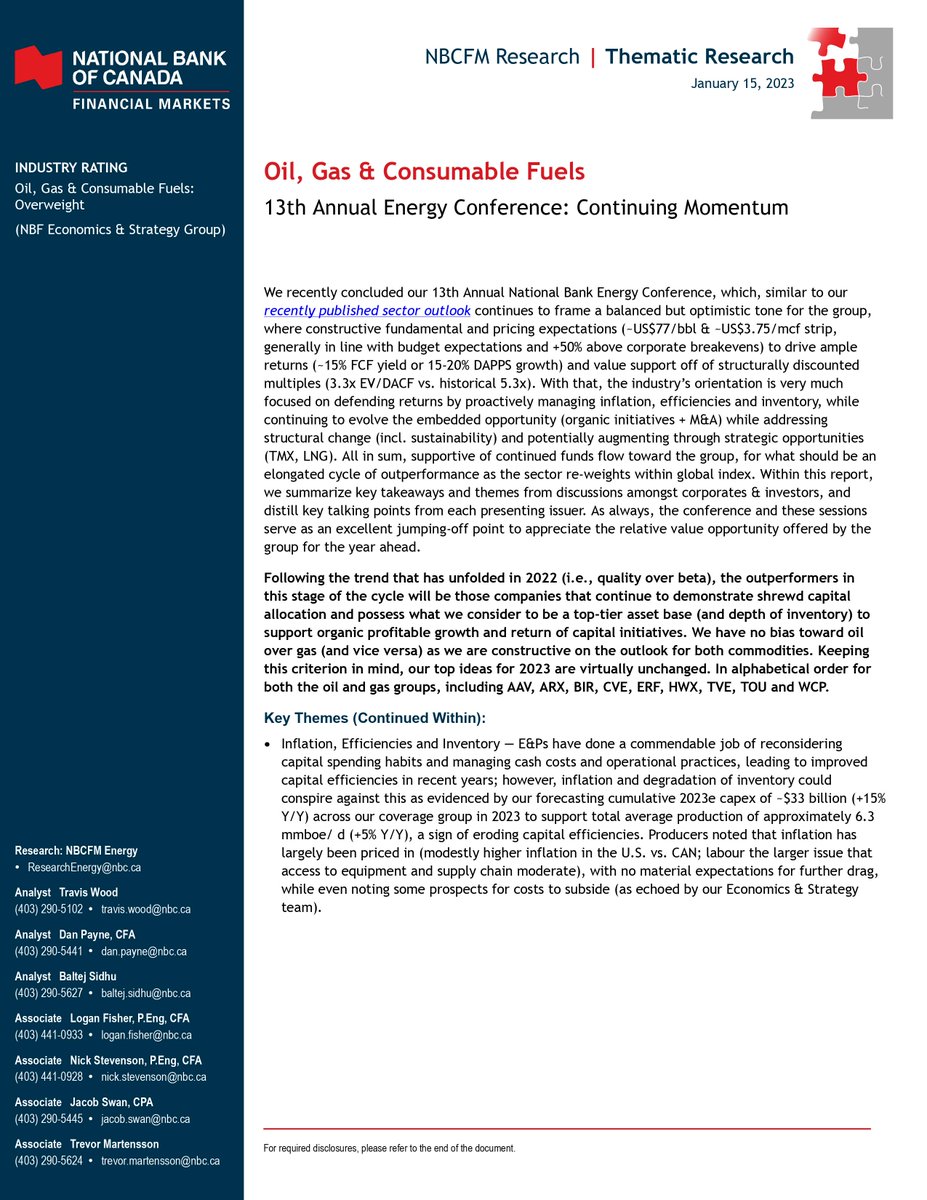

NBF - Oil, Gas & Consumable Fuels - 13th Annual Energy Conference: Continuing Momentum

Summaries on: $AAV $BIR $CPG $HWX $KEC $PSK $SGY $TVE.TO $TPZ $VET.TO $WCP

Key themes:

-Inflation, Efficiencies and Inventory

1/14🧵

#COM #OOTT

Summaries on: $AAV $BIR $CPG $HWX $KEC $PSK $SGY $TVE.TO $TPZ $VET.TO $WCP

Key themes:

-Inflation, Efficiencies and Inventory

1/14🧵

#COM #OOTT

#com

La relation ambiguë de #Twitter et des #journalistes

En 15 ans, #Twitter a radicalement modifié leur travail. Côté positif, l'accès à une multitude de sources et d'infos, côté négatif, une vision déformée de la réalité et le risque de s'enfermer ds une bulle 1/7

La relation ambiguë de #Twitter et des #journalistes

En 15 ans, #Twitter a radicalement modifié leur travail. Côté positif, l'accès à une multitude de sources et d'infos, côté négatif, une vision déformée de la réalité et le risque de s'enfermer ds une bulle 1/7

2/7 L’usage de #Twitter par les #journalistes est «profondément ambivalent», selon @fcinq @Inafr_officiel : il leur facilite le contact direct avec des sources d'information, experts comme politiques.

3/7 Les #médias ont cessé d'être systématiquement les premiers à révéler une info et a considérablement fait évoluer le rôle des #journalistes, désormais davantage lié au fait de contextualiser et vérifier des infos » d'abord sorties sur #Twitter.

@ANice24675304 So what You’re saying is, you would rather see all who have done those evil acts you listed be ‘Unforgiven’? Which I then would have made them not sing (flip on all other evil in the world) & continue Making everyone’s lives hell even worse than what everyone’s gone through?

@ANice24675304 You too would choose & Accept being ‘Unforgiven’ for what you have done in your life?

“When bad does good”?

How/#WHY do you think MANY evil beings chose to do good for humanity?

Just because you Don’t see it or hear about it, does not mean it hasn’t happened.

“When bad does good”?

How/#WHY do you think MANY evil beings chose to do good for humanity?

Just because you Don’t see it or hear about it, does not mean it hasn’t happened.

@ANice24675304 Show me someone innocent in this world …

Where does that question come from?

- A heart of Stone?

- A Heart of Flesh ?

What is A #ROOT ?

If you NEVER forget the #WHY, Care about the #Why Along with the #ROOT, you begin to show mercy for those who-

Where does that question come from?

- A heart of Stone?

- A Heart of Flesh ?

What is A #ROOT ?

If you NEVER forget the #WHY, Care about the #Why Along with the #ROOT, you begin to show mercy for those who-