Discover and read the best of Twitter Threads about #positionsizing

Most recents (7)

A #PMS must show performance. No escaping it. But,the crucial questions for an investor to choose a PMS must be more nuanced. What fee do I pay in bad times? Do i pay more fees in good times? Is the product going to do anything special for me if i wish to be more ambitious? 1/7

A #PMS which mechanically invests money into its model portfolio just like a mutual fund usually does can only offer you a mediocre experience.

Investing is commoditized and mechanized. Some dealer is blindly filling up stocks like a petrol pump attendant fills your car tank.2/7

Investing is commoditized and mechanized. Some dealer is blindly filling up stocks like a petrol pump attendant fills your car tank.2/7

Your whole purpose of choosing a #PMS over a mutual fund scheme is to make your money work smarter & to get a more personalised process. Afterall, a more ambitious investor needs a superior investment approach to meet his specific needs. You can't have a "carbon copy" PF. 3/7

Time to take stock. It is 29 months since @ithoughtpms rolled out @SolitairePMS. We began modestly. We kept it simple.

Fixed fees.

No distributors.

No promotions.

No influencers.

No model portfolios.

Bespoke portfolios.

We wanted to build a feature rich, investor centric PMS. 1/n

Fixed fees.

No distributors.

No promotions.

No influencers.

No model portfolios.

Bespoke portfolios.

We wanted to build a feature rich, investor centric PMS. 1/n

We invested gradually. Even as we finished deploying in Feb 2019, covid struck. Clearly, our portfolio was not exactly positioned for a pandemic. In fact, we had the wrong positioning.We were overweight pandemic victims. But, we stuck to our approach & built on opportunities. 2/n

The strategy gradually began to work. Interestingly, it worked superbly for investors who believed in the philosophy & scaled up using the opportunity. Multibaggers that investors wished to own simply landed in portfolios. Stocks found their rightful portfolio positions. 3/n

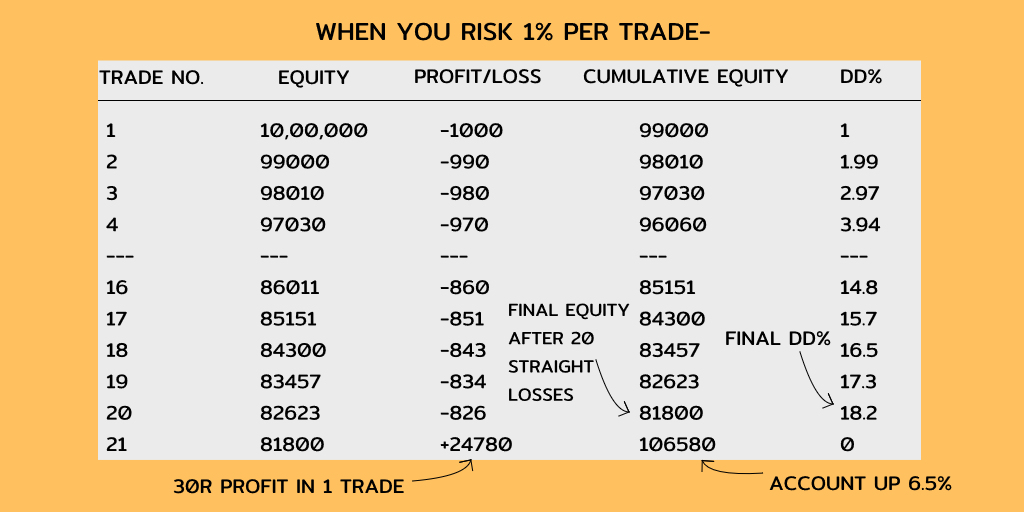

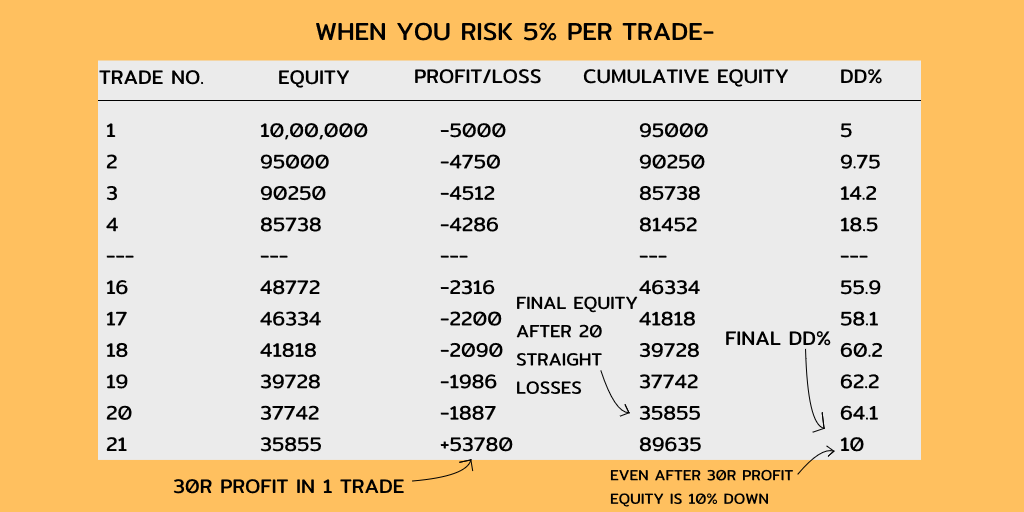

How position sizing can affect your trading performance-

Assuming that you are trading a Trend-following system with Big RR and low win-rate.

For example, assume that you risk one percent per trade on a 100,000 account

and you have 20 straight losses.

Assuming that you are trading a Trend-following system with Big RR and low win-rate.

For example, assume that you risk one percent per trade on a 100,000 account

and you have 20 straight losses.

1/14

* Some practical tips on #PersonalFinance & #Investment *

Met someone who lost heavily in markets( sizeable amt) which makes me write this thread .

DISCLAIMER : There are exceptions always.However the chances of us being in that exception is rare !🤷 Hence the thread.

* Some practical tips on #PersonalFinance & #Investment *

Met someone who lost heavily in markets( sizeable amt) which makes me write this thread .

DISCLAIMER : There are exceptions always.However the chances of us being in that exception is rare !🤷 Hence the thread.

2/14

Pls DON'T ENTER markets without ensuring you have

- An Emergency Fund in place

- A good comprehensive Life & Health insurance policy for all .

- Term Insurance ( especially if taken a house on loan)

More details given in the old tweet.

Pls DON'T ENTER markets without ensuring you have

- An Emergency Fund in place

- A good comprehensive Life & Health insurance policy for all .

- Term Insurance ( especially if taken a house on loan)

More details given in the old tweet.

3/14

* INVEST SURPLUS ONLY *

Consider investing in markets as money locked in ( like in a PPF account) for a few years atleast & THEN decide how much money you CAN AFFORD TO LOCK IN.

Else we may have to sell ( even a good)stock at lower price BECAUSE we need money urgently .

* INVEST SURPLUS ONLY *

Consider investing in markets as money locked in ( like in a PPF account) for a few years atleast & THEN decide how much money you CAN AFFORD TO LOCK IN.

Else we may have to sell ( even a good)stock at lower price BECAUSE we need money urgently .

#PositionSizing

🟢 It is an Intrinsic Principle of Money Management

🟢 It is a Key driver of a Trader's Emotions & Psychology

🟢 Yet least understood part of Trading & Investing Process

🛑 Objective

🟢 It ensures Consistent Profitability in Long Term, once practiced

(1/n)

🟢 It is an Intrinsic Principle of Money Management

🟢 It is a Key driver of a Trader's Emotions & Psychology

🟢 Yet least understood part of Trading & Investing Process

🛑 Objective

🟢 It ensures Consistent Profitability in Long Term, once practiced

(1/n)

🟢 Minimizes chances of Big Draw-downs in case of Gap-Ups & Gap-Downs

🟢 Ensures entire Account is not blown in a Single Trading Session, when one is leveraged too & Trade goes in Opposite Direction

🟢 Ensures Survival for Longer Duration in Markets

(2/n)

🟢 Ensures entire Account is not blown in a Single Trading Session, when one is leveraged too & Trade goes in Opposite Direction

🟢 Ensures Survival for Longer Duration in Markets

(2/n)

🟢 Ensures Psychological Comfort according to an Individual's Risk Profile, if followed sincerely

🛑 What is it?

🟢 It tells how much should I risk in a Trade or how big any Particular Trade should ideally be

🟢 It's a Bridge between Money Management & Risk Management

(3/n)

🛑 What is it?

🟢 It tells how much should I risk in a Trade or how big any Particular Trade should ideally be

🟢 It's a Bridge between Money Management & Risk Management

(3/n)

My CCI based investment strategy - How does it work? A thread.

Objective: Identify stocks that are entering a phase of momentum on the upside and ride the stock until momentum weakens.1/n

Objective: Identify stocks that are entering a phase of momentum on the upside and ride the stock until momentum weakens.1/n

About CCI: CCI is a momentum-based oscillator and a value above 100 indicates the price is well above the historic average and a value below -100 indicates the price is well below the historic average. 2/n

Strategy: This strategy will enter a stock when CCI on the weekly timeframe is greater than 100 & is overbought & exit when CCI on the weekly timeframe is below -100 & is oversold. Does that sound straightforward? Yes, simple and straightforward strategies can make money 3/n

The next two weeks will be about holding fort to attempt getting past the trading errors of this week.

Bad trades, bad decisions.

#trading #markets

Bad trades, bad decisions.

#trading #markets

The thing with bad decisions in trading or any other endeavor is that it begets other bad decisions.

The first thing is to get back to the basics and put things straight.

/2

The first thing is to get back to the basics and put things straight.

/2

The simple things go out of whack with these bad decisions.

#process

#positionsizing

#riskmanagement

/3

#process

#positionsizing

#riskmanagement

/3