Discover and read the best of Twitter Threads about #productmarketfit

Most recents (4)

1/7 Fundamentals van Product-Market Fit 🚀

Ontdek de geheimen om de perfecte product-market fit te bereiken voor je e-commerce bedrijf. Volg deze belangrijke principes! (thread)

Ontdek de geheimen om de perfecte product-market fit te bereiken voor je e-commerce bedrijf. Volg deze belangrijke principes! (thread)

2/7 Klantsegmenten:

Identificeer en begrijp je doelgroepen. Onderzoek hun behoeften, wensen en pijn. Verzamel gegevens en creëer buyer persona's.

Identificeer en begrijp je doelgroepen. Onderzoek hun behoeften, wensen en pijn. Verzamel gegevens en creëer buyer persona's.

3/7 Waardepropositie:

Definieer de unieke waarde die jouw product biedt aan je klanten. Dit onderscheidt je van concurrenten en helpt bij het aantrekken van de juiste klanten.

Definieer de unieke waarde die jouw product biedt aan je klanten. Dit onderscheidt je van concurrenten en helpt bij het aantrekken van de juiste klanten.

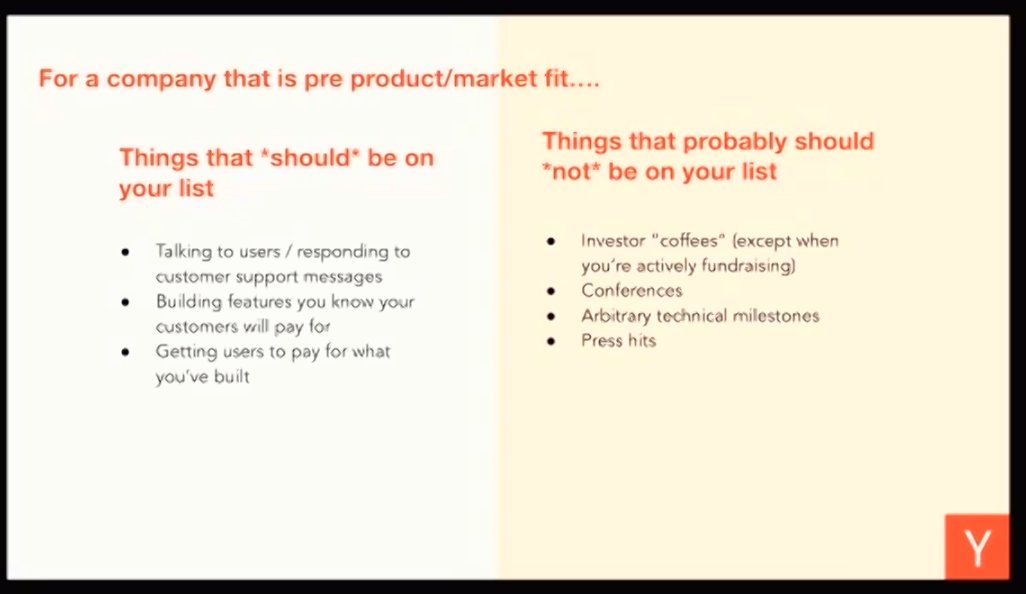

Stop using a fake list. @ycombinator @startupschool #startup #founder Divya Bhat explained how to pick which metrics to focus on #productmarketfit

How much growth is enough? @paulg

🏀There are TWO questions that every @RumbleKongs owner is asking themselves right now.🏀

- How big can this project get?

- How much $ can my Kong be worth in the near future?

Here's a THREAD to help you understand the magnitude. 👇

- How big can this project get?

- How much $ can my Kong be worth in the near future?

Here's a THREAD to help you understand the magnitude. 👇

A Kong/nft must to be part of a TEAM to compete against other teams. There will be a limited amount of teams available in the entire ecosystem. Teams must also be part of a LEAGUE. The game will launch with a total of 6 league divisions.

The higher the league, the more $RKL tokens paid out to the winning teams, and the more passive income that your will Kong make per game. In other words, Kongs will become a passive income-generating machine.

The @PrefaceVentures website is live: prefaceventures.com. Special thanks to @BrettBerson @atouchofair as well as an anonymous designer akin to Banksy for the output. We're doing a few things a bit differently, specifically around founder #communication. A thread:

1 / Founders deserve more #transparency into how VC's operate and what we will do for them as partners. At Preface we call this "The Code", which is essentially our #SLA for #frontierenterprise founders

2 / We are clear how and what we invest in you. How much initially ($250-$750k), how much is reserved for follow-ons (1-3x) and how often (5-7x pa, ~20 investments per fund). This simple info is impossible to find online on 99% of VC’s