Discover and read the best of Twitter Threads about #protectconsumers

Most recents (4)

The #COVID19 crisis put millions of Americans in financial peril, hitting households of color particularly hard and moratoriums on utility shutoffs instituted in many states to #ProtectConsumers have already expired. 1/6 nclc.org/media-center/c…

Millions of utility customers face the threat of shutoff due to the inability to pay their #energy bills and unpaid #utilitybills are accruing across the country. #COVID19 #LIHEAP #HomeworkGap #Lifeline #ProtectHomeowners 2/6 nclc.org/media-center/c…

New analysis from @NCLC4consumers finds that without additional aid and flexible repayment programs, millions of families and #smallbiz will face or are already facing a mountain of debt that they can’t pay, placing them at high risk of disconnection. 3/6 nclc.org/media-center/c…

THREAD: Debt collectors used to “fear” @CFPB under @RichCordray but now praise the “clarity” from @CFPBDirector Kraninger, who is easing up on enforcement and proposing an industry-friendly regulation. Hat tip @TokyoWoods 1/7

wsj.com/articles/debt-…

wsj.com/articles/debt-…

And this pro-industry rule is coming amid a perfect storm of skyrocketing U.S. household debt — $13.67 trillion — and rising defaults. Under the new rule, debt collectors would be freer to harass more people and invade their privacy while Kraninger fails to #ProtectConsumers. 2/7

Debt-buying companies purchased record levels of debt in 2018 — and collected even more. They buy debt for pennies on the dollar and then harass consumers for repayment. While consumers suffer, debt buyers like @Encore_Capital and @PRAGroupInc make a killing. 3/7

Payday loans can trap low and middle income borrowers in endless cycles of debt. Today with @NewJerseyOAG, we are leading a group of 25 states in opposing the

Trump admin's effort to eliminate consumer protections from risky and predatory loans: bit.ly/2YqZYUy

Trump admin's effort to eliminate consumer protections from risky and predatory loans: bit.ly/2YqZYUy

@NewJerseyOAG According to @pewtrusts, 58% of payday borrowers have trouble meeting their monthly expenses.

They often reborrow to help repay the original loan and can spiral into endless cycles of debt.

They often reborrow to help repay the original loan and can spiral into endless cycles of debt.

The maximum interest rate lenders may charge in #DC is 24%, but some unscrupulous lenders exploit loopholes to offer predatory loans across the country.

This is why the last thing the @CFPB should be doing is rolling back rules designed to #protectconsumers.

This is why the last thing the @CFPB should be doing is rolling back rules designed to #protectconsumers.

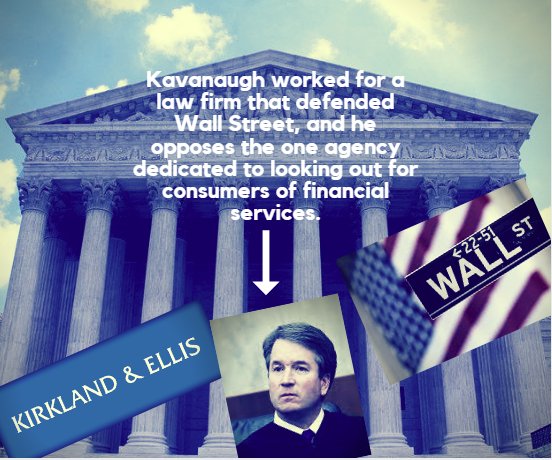

Even some Republican judges felt he went too far when he found the structure of @CFPB unconstitutional in the PHH Corp. case. He's a judicial activist in favor of corporations. (2)

Kavanaugh’s ruling would have let the president remove independent regulators at will, allowing big corporations with friends in high places to influence what ought to be non-political decisions to #ProtectConsumers (3)