Discover and read the best of Twitter Threads about #volland

Most recents (24)

Good Morning! Another slow market day yesterday, but there should be some vol expansion over the next couple of days, as shown in the premarket. Several liquidity modelers showing we are overdue for a pullback, and any vol expansion will be bearish thanks to positive vanna.

Recently in my discord, I have been previewing earnings reports, both from #volland and @optionrats, and there is a loud, consistent theme... lower profit expectations, lower event vol. Across all sectors, all major companies particularly non-growth companies have lower earnings.

It isn't by a little bit either. $XOM, $BA, $MSFT, $CMG, $META... all of them are seeing reduces profits. Yet markets are floating up, increasing multiples to very high levels. Part of that is dealer hedging, but ultimately this will result in deflation.

Good Morning! A wild 0DTE day with swift and decisive activity yesterday, but again a modest loss. The past few weeks have been reminiscent of all of 2022. Rising rates taking down equities. Yesterday I meandered on Twitter a little more and noticed some prayers to vanna.

@jam_croissant popularized the "window of weakness", a period of 2 weeks after opex where vanna and charm have less of an effect. The subsequent weeks then have a bullish bias because of vanna and charm flows on option hedges for the month. Normally this is accurate, however...

The current environment is different. First, there is less hedging than there was even last month. Second, aggregate charm is currently positive. The 4000 strike was most popular for hedging in March and it is ITM, which makes its charm a bearish force unless we rally past it.

Good Morning! When you look at yesterday's candlestick, and at times price action, you would think it was a fairly calm reversal day after hot retail sales data, but the 0DTE and intraday action was a lot more interesting.

It painted the picture of an institutional battle, with gradual bullish trends countered by sharp slides in price. The bull was very savvy in the 0DTE space, buying loads of 4130 calls and selling ITM put spreads while selling 4150 calls. Then as we reached "Dealer o'clock" (2pm)

The bull rushed the 4130 price point to get the negative charm and negative gamma, recruiting the mercenary option MMs to their side. A few futile sell moments occurred but the bull was victorious, finishing at the sold call 0DTE level of 4150.

I have received a bunch of questions about how I knew 3 weeks ago to be bullish for February from #volland. Ever since the CPI report in January, the options landscape for dealers has been the same as the big bull run... that is, puts bought and calls sold by customers.

That presents as sold puts and bought calls by dealers. That created $91B in open net positive delta in $SPX, seen in the #volland picture. Why is this bullish? In short, this typical GEX formation creates a lot of negative charm to push markets up...

Good Morning! Yesterday's GDP number was decent, starting markets higher that were driven thereafter by 0DTE flows. Today, the "Fed preferred inflation gauge" is demanding only a $32 straddle price, $1 more than GDP and in line with typical daily prices.

In other words, the market doesn't seem to care. This simultaneously makes the market unhedged and more dangerous, but also that this event is not a concern to traders,y and event vol has been well priced recently. I do see a lot of concern in financial and social media...

But to get the real concern, the straddle price is the more accurate gauge. If you feel the event is more significant, you may have an edge, but more likely you have a bias. Event vol rarely misprices the event.

#volland is showing the same bullish formation...

#volland is showing the same bullish formation...

Good Morning! A large drop and rebound yesterday as $MSFT had a gloomy forecast, but why the rebound? Yesterday was driven by 0DTE flows almost exclusively after the initial drop, as noted in the public discord room.

A lot of clamoring over GDP this morning...

A lot of clamoring over GDP this morning...

But the options market doesn't seem to care, pricing a 1-day straddle at $31, which would be the same if there was no catalyst. These events recently have been met with decent market movement prediction and data forecasts within range, but this one is a little curious.

Last month we saw a sharp downturn in retail sales, contraction in manufacturing and services production, and a construction and housing downturn. I'm curious about how economists believe GDP will grow at a 2.6% annualized real rate, and GDPNOW expects 3.5%. Where is the growth?

Good Morning! There were three "catalysts" last night into today that the equity market in particular was not concerned about. By that I mean the 1DTE straddle at the end of the day yesterday was priced at $33, which has been the typical price recently.

The first was the BoJ decision that all the macro analysts have been looking at since last month they raised the 10y rate 25bps. As it turned out, there was no change. Other markets including metals, bonds, and the Yen were prepared for a large move, but oddly equities weren't.

Again, oddly, the Yen rallied from its lows, bonds and metals bounced, and while equities had an initial positive reaction, they are muted now. In other words, the equity volatility outlook was correct.

The second was volex,

The second was volex,

Good Morning! Last week we saw some relentless buying thanks to an in-line CPI print last Tuesday. We are now bumping up against the 4000 $SPX mark. Now the market must make a decision. 4000 is negative gamma, so we will likely see a break one way or another, not a wall. #volland

And it will be determined by IV. 4100 is solidly positive vanna, negative charm going into opex, which portends a rise as long as IV is declining. But we just experienced a vol crunch with 4300 keeping price muted. VIX expansion has occurred when it dropped below 20 recently,

So the question is, have we entered a new vol regime? Is VIX now lower or will we expand again? With the BoJ decision tomorrow morning, a very underrated catalyst with no event vol, I think there is a good chance IV will expand. The BoJ has yield curve control on the block.

Good Morning! The Drunk Santa Rally continues, as equities stumbled yesterday. 4000 $SPX remains a decent resistance according to #volland until January, but the strong vanna at 4100 can help it get overtaken, and if it does, it would be a nice breakout.

Now that the Santa rally timeframe is over, the call for a drunk Santa rally seemed to be correct. There were times of uptick, but we ended up going nowhere in the end. January will be dictated by CPI on 13Jan, but the big March hedges to the downside are strong.

January favors slight upside, particularly if we cross 4000 before opex. March positive vanna can cause a decent drag if IV boosts up, and once January expires, it will have a very strong effect that can cause some more market volatility.

Good Morning! I was going to do today's morning tweet on $TSLA, as it has shed roughly 74% from its ATH over the past year. When will it stop? Kevin already did some analysis but wanted to shed a little more light.

First, that $100 positive vanna would be attractive to price, not repelling. They are also short puts for dealers, so there has been constant hedging on $TSLA all the way down. #volland changes on $TSLA every day, it is a very active stock. But I'll sum up here quickly.

This move in $TSLA is clearly not dealer hedging related. It reeks of margin calls, amd as @Forbes reported a while ago, $TSLA margin loans are collateralized at a 5-1 ratio. forbes.com/sites/johnhyat…

Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps Vol.land. Vanna is the biggest $SPX driver. Notice how the 4000 magnet magnet remains with repellents at 3900/4100. If 3900 gives out, 3800 could become a magnet!

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna magnet @ $400. Repel @ $390. Lots of magnets/accelerants below $390 if it gives out. 5-day delta correlations heavily favor downside & volatility.

Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

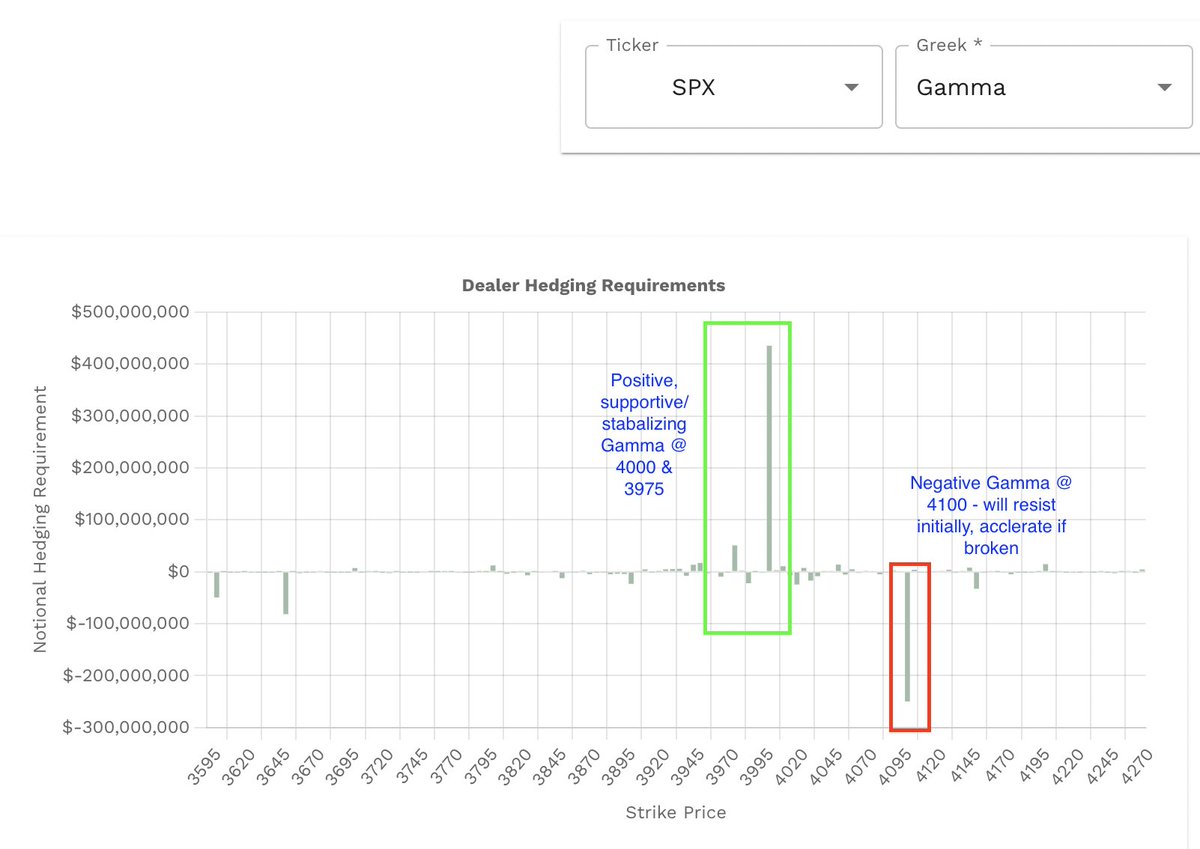

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps #volland. The Vanna magnet at $SPX 4000 remains along with the repellents at 4100. Supportive Gamma at 4000 as well. If 4100 were to break from an event, massive acceleration would occur to the upside. See screen shots.

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna magnet @ $400. Repel @ $390. Neg vanna/gamma @ $404/405 could assist move higher IF broken. The 3-day delta structure indicates higher likelihood of downside.

Here is my morning run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps #volland. The magnet at $SPX 4000 has grown by approx $20bil. Repellent at 3850 remain, accelerate if broken. See attached. Positive gamma shows ceiling at 4000 as well.

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Vanna magnet @ $400. Repel @ $390. Neg gamma @ $395/$397 could assist move to $400 if broken. The 3-day delta forecast shows we could go either way (expected).

Here is a run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps #volland. The magnet at 4000 renaubs. Accelerant's to the downside if broken, but will initially be supportive (see attached). Not much change from yesterday.

Now let's do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Structure still indicates pinning, however if we break below 390, accelerants could be significant, but unlikely. The 400 Vanna magnet remains.

Today I want to do a run down of the current market outlook using Dark Pools, Dealer Positioning and market wide Options Flow to inform our #optionstrading and #futurestrading today. Data can change but it will help formulate a plan.

Lets start with $SPX Gamma and Vanna courtesy of @WizOfOps #volland. We see a small, diminishing magnet at 4000. Accellerants to the downside if broken, but will initially be supportive (see attached).

Now lets do the same for $SPY but add in some additional data points from @Tradytics data driven insights. Structure indicates pinning, however if we break below 392, accelerants could be significant.

Good Morning! An interesting day yesterday as a vanna spike at 3950 was pulled down from a very strong dollar. It was like a game of tug of war that the dollar sort of won. Macro bros still have a lot to say today with jobs data and rumored Chinese pivot regarding Covid.

Talking about a Chinese pivot first because it is easy. If that happens, I would expect a very strong bullish surge. It doesn't solve all of our problems here, but will produce a surge in demand. That surge will also hurt inflation, however. So it would be short term bullish..

But tougher long term economic impact as commodities increase in cost, energy prices increase, and worldwide demand increases. That can make inflation worse.

As for jobs, I was shocked to see in #volland that it was dramtically underhedged. The straddle price for today is $55,

As for jobs, I was shocked to see in #volland that it was dramtically underhedged. The straddle price for today is $55,

📢 @Tradytics & Wizard of Ops announce a bundle discount!

Use code TRADYVOL35 on both platforms (#Volland & Tradytics premium) for $35 off the combined subscription.

Volland: vol.land

Tradytics: tradytics.com

Use code TRADYVOL35 on both platforms (#Volland & Tradytics premium) for $35 off the combined subscription.

Volland: vol.land

Tradytics: tradytics.com

This partnership made sense. We are two data-backed platforms that bring edge to investors. #volland is a novel, accurate approach to dealer hedging, @tradytics has a whole menu of indicators.

In other news, #volland will be releasing a summary page doing all the gamma, vanna, and charm dealer notional calculations for you! This will be next week.

Good Morning! Today is FOMC day, where it seems everyone knows what is going to happen, yet are caught off guard by it anyway. how are dealers and customers positioned? Lets consult #volland.

The overall DAG in $SPY and $SPX is mixed, and have very little push except...

The overall DAG in $SPY and $SPX is mixed, and have very little push except...

$SPY gets dicey below 376. On the upside in the short term we would see strength in $SPX past 3950. That seems to be the acceleration point, but also a major balance point for vanna. 3950 is the big number, and unless FOMC surprises would be my target for the week. #volland

The customer positioning is typical, with calls (primarily at 3950) and puts (between 3750-3850) bought, but ATM puts are sold in $SPX. The put #volland chart is shown below for the week. This is interesting, as it is a bet that premiums are too high for the movement we will see.

Good Morning! Yesterday we got to 3800, and really didn't move from there. There was some back and forth, bit it appeared that 3800 was sort of a pin. There really wasn't anything to pin it there until the 0DTE option dealer positioning shook out.

Anyone following me for a while knows I have a script for following 0DTE flows similar to #volland. I mentioned in my free discord that 3800 was a clear magnet on the 0DTE, even though I was afraid of Chinese contagion. 0DTE has been the subject of debate on its true impact.

I believe it has profound consequences, as that option class has the highest vanna, charm, and gamma levels of any class based on its timing. With 40% of $SPX options traded daily as 0DTE, I believe it is a mix of hedge fund speculation (particularly on the '25' strikes)

Good Morning! Yesterday CPI came in a bit hot, especially core services. The market had an initial selloff, but the large put position at 3650 started to unwind and created a rally. Also, the main driver of core inflation was shelter, and there is data showing rent stabilizing.

So a jump was not completely out of bounds, even though the magnitude was awesome. @myTradeHawk nailed it at the bottom on yesterday's show. That's the second time he nailed a reversal. But the reason why I didn't take the other side of his trade was that 3650 magnet.

Meanwhile for today the hardest part is basically over, which is how will markets react to the BoE halting their bailout of pension funds? My base case was that they wouldn't bail them out just to have them collapse, that would destroy their credibility. The tough BoE talk...

Good Morning! I'd like to say that I was right on the rally yesterday... I called a short term rally for the week... but in this case the market was macro driven by the temporary bailout of pensions by the BoE. Dealer hedging helped, but sentiment was the big driver.

Yesterday showed that CBs want to bend, not break economies to reduce inflation. When something breaks, they will come to fix it. If the BoE did not step in, we would have not seen a rally. Dealer positioning will help market moves, but we are in the throes of macro...

And as I have said numerous times, the macro picture is negative. Throw in the negative gamma profile of individual equities, but positive vanna and charm profile, all moves will be more volatile than typical. Plan for that.

This tweet was my most viral tweet, and I talked about deviation from that relationship being scenarios where MMs become "uncomfortable". Why do they become uncomfortable?

In short, this means that their assumptions surrounding skew have been wrong. 1/13

In short, this means that their assumptions surrounding skew have been wrong. 1/13

A commonly used term for the "vixing" relationship on Twitter and among quants is "spot-vol covariance". This relationship isn't novel, it isn't something no one knew before I tweeted it. As such, this is the assumption that creates skew. See that formula on the regression? 2/13

Every 1% move in $SPX is associated with a move in the $VIX. That association is reflected in the skew curve. Start with 0% move, then move up 1%, and the covariance of the hour determines the IV at that strike. Work all the way to a 0 bid, voila, you have assumed skew. 3/13

The whole options market is now different. Puts and calls in $SPX are sold by customers. While we are in a strongly positive vanna zone (meaning we are in the net sold calls zone), any slight IV positive movement will cause selling. (IV up, delta up). How strong is it? #volland

Good Morning! Yesterday I made a comment that was called out by a reader, and I want to clarify... $VVIX has been this low in most of 2018 and prior, that's true. However, back then $VIX was at 10, and had a hard time even getting to 16... seems like forever ago, right?

So the scope of the difference between spot vol and wing vol is a lot more compelling now than it was, even though the static $VVIX was at these levels. It seems like the short-term inverse correlation has been with $VVIX and $SPX, not $VIX. When dealing with large neg. vanna...

it doesnt take much movement in VIX to create that inverse movement in $SPX. $SPX deltas are extremely sensitive to IV right now, so long vol is the right move to make. When randomly hunting through #volland, there seems to be a disconnect between equities and the indices.