Thread in response to @jordanbpeterson's inquiry about @profplum99's recently published disparagement of #Bitcoin and Bitcoiners.

https://twitter.com/jordanbpeterson/status/1395376501940445186

CLAIM: “Namely, that our inevitable flaws, including our lack of perfect foresight, require guardrails to reduce the risk of unintended consequences, like, for example, speculation in “low-risk” mortgages that drove a global financial crisis.”

Contrary to the popular misconception, the 2008 great financial crisis was driven by the eurodollar system (cc: @JeffSnider_AIP), a consequence of central banking.

The “boom and bust” business cycle is a symptom of central bank market manipulation and would be much less severe on a sound money (ie. #Bitcoin) standard. Please read:

mises.org/library/austri…

mises.org/library/austri…

CLAIM: “…a real world game of Monopoly where the objective becomes to take wealth from others rather than work both individually and collectively to raise living standards for all.”

#Bitcoin is anti-monopolistic: as a base money that cannot be monopolized (and weaponized) by central banks, it is a radical enabler of free markets and an existential threat to the economic tyranny imposed by central banks.

#Bitcoin inhibits rent-seeking, reorients incentives toward long-term cooperation (since value can no longer be stolen through inflation), and serves as the ideal substrate for the positive-sum game of macroeconomics: premised on comparative advantage and the division of labor.

#Bitcoin is antithetical to the zero-sum, rent-seeking board game of monopoly. Mike's intellectual dishonesty shines bright here.

CLAIM: “What’s worse is that its proponents are more than willing to conceal the facts to promote its success. For this reason alone we should be skeptical.”

Concealing facts is the opposite of open-source technology and community ethos. #Bitcoin is an absolutely transparent money. Compare this to the closed-source tech/ethos of the US dollar, which is an SQL database maintained by the US central bank (The Fed) where no one knows:

How many US dollars are in existence? How many dollars will be produced in the future? When? Why? Who Receives dollars first? Who gets to decide? By what decision criteria? Who profits from US dollar production?

CLAIM: “Money exists for one purpose: to cancel debt.”

Money is the most marketable good. Debt can be used as money, as central banks do today, but money is not exclusively a tool to cancel debt. Transactions can be settled in money (known as final settlement) or credit (which creates a corresponding debt, a promise for future money)

Money is also useful for both storing and accounting for market value. Money is the universal medium of exchange.

Mike also believes that gold is not money, an ahistorical and, frankly, ignorant position. Gold is a bearer asset, like Bitcoin, that is 100% equity and 0% liability (debt) for its possessor.

The US dollar always carries the counterparty risk of inflation and deauthorization, even when hidden under your mattress. The US dollar, and all fiat currencies, suffer from these same ineradicable liabilities.

Mike's entire worldview on money based on this non-canonical book (which I don’t recommend): amazon.com/Debt-First-5-0…

For a more accurate portrayal of the emergence of money on the free market, read Austrian economics, especially Mises or Menger: mises.org/library/origin…

CLAIM: “In contrast, Bitcoin is a speculative asset that, like all assets, requires systems of law and force to protect it.”

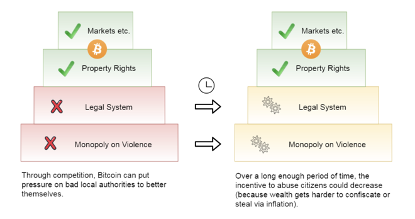

Mike doesn't understand #Bitcoin because it is irreconcilable with a statist worldview:

Mike doesn't understand #Bitcoin because it is irreconcilable with a statist worldview:

#Bitcoin is a property right independent of all monopolies on violence and money, please read: medium.com/@hasufly/bitco…

CLAIM: “Over the course of the 20th century, the relative standard of living of those who lived under the protective umbrella of Pax Americana exploded relative to those living under the competing Soviet or Chinese systems.”

Central banking is a communist system: in the 1848 Manifesto to the Communist Party, measure #5 reads: “Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly.” Please read: mises.org/wire/why-marx-…

Capitalism is an economic system characterized by private ownership of capital goods, by investments that are determined by private decision, and by prices, production, and the distribution of goods that are determined solely by competition in a free market.

Central banking is anticapitalistic institution, as fiat currency inflation is a violation of private property rights, and money is not a freely competitive marketplace. Please read: mises.org/library/ethics…

CLAIM: “Bitcoin mining — the process of record keeping for the “immutable” chain of record on which the Bitcoin network depends — is dominated by entities in countries with the stated objective to harm the interests of the United States.

Miners do not “dominate” #Bitcoin, they enforce rules set by nodes. As history shows, there are likely to be significant geopolitical implications for those nation-states failing to adapt to this emergent sound money standard quickly.

In the words of @saifedean: "History shows it is not possible to insulate yourself from the consequences of others holding money that is harder than yours.”

CLAIM: <quoting Peter Thiel> “It threatens fiat money, but it especially threatens the US dollar.”

Yes, #Bitcoin is existentially threatening to all inferior monetary technologies, including gold and all the central bank fiat currency pyramid schemes built atop gold. Please read: breedlove22.medium.com/masters-and-sl…

CLAIM: “This week’s attack on a U.S. energy pipeline — carried out by a terrorist group operating out of Russia and requesting ransomware payment in Bitcoin — suggests Munger is not unfair in his characterization of Bitcoin as useful to extortionists.”

A hammer can be used to build a house or bash a skull. Money too is a tool, and like any other tool, can be used for either good or bad purposes depending on the intent of its wielder.

Fiat currency is a tool designed for one purpose: to enrich central bank shareholders at the expense of its users.

Fiat currency inflation and non-consensual taxation are indistinguishable from extortion—defined as “obtaining money through force or threats.”

Fiat currency inflation and non-consensual taxation are indistinguishable from extortion—defined as “obtaining money through force or threats.”

#Bitcoin is extortion-resistant money, which has important consequences for nation-state revenue models, which Mike doesn’t understand:

https://twitter.com/Breedlove22/status/1380704045195800577

CLAIM: “Bitcoin usage for purchases of goods and services has stagnated.”

Seriously, Mike doesn't understand economics...

Seriously, Mike doesn't understand economics...

When an asset is undergoing monetization, the incentives are to accumulate as much of it as possible, not spend. #Bitcoin is following the same monetization path as gold, please read by @real_vijay: vijayboyapati.medium.com/the-bullish-ca…

CLAIM: “The language of Bitcoin — “Not gonna make it” or “Have fun staying poor”—are intentionally designed to exploit this amygdala response and drive participation in a scheme that relies entirely on driving additional participation to generate gains for current participants.”

Memetics are emergent, no one is “intentionally designing” #Bitcoin meme that take hold, it's all experimental and highly Darwinian: some gain popularity, most fail, it’s a free market for ideas.

“Memes” that are “intentionally designed” include the US dollar insignias "In God we trust" or "Backed by the full faith and credit of the USG,” which strive to impart trustworthiness on the US dollar despite the self-annihilating nature of its fiat construction.

CLAIM: “Over a year ago, some talented technologists proposed a mechanism by which a state actor could disable the Bitcoin network at remarkably low cost.”

Mike at his best! Total intellectual dishonesty (perhaps that’s why he left it for the end, since most fiat brains typically don’t read that far)...

@aantonop says he doesn't believe this attack would succeed in stopping #Bitcoin. @Jimmysong also wrote a piece debunking this attack vector prior to Mike publishing this piece. They had an exchange about it 2 months ago too, which Mike fails to mention:

https://twitter.com/jimmysong/status/1376388467882663937

Please read by @jimmysong: jimmysong.medium.com/debunking-the-…

The attack is extremely expensive to sustain, and in the event it didn't succeed, would provide the ultimate proof of #Bitcoin's design optimization survivability, and highlight its use case. “If you take a shot at the king, you better not miss…”

Any Bitcoiner worth their salt will tell you this is the most serious “known unknown” for #Bitcoin. Clearly, a money that can’t be inflated and is difficult to tax is an existential threat to the nation-state model (w/ revenues solely from inflation and non-consensual taxation.)

The bet on #Bitcoin is that the tradeoffs it makes for survivability will be adequate against any nation-state countermeasure, and that the dynamics determining monetization on the free market will play out the same way they have for the the past 5,000 years.

Finally, to witness the toppling of Mike’s “towering intellect,” watch the great @nic__carter mop the floor with @profplumb99 in this debate (the only one Mike didn’t link to, of course):

podcasts.apple.com/us/podcast/gra…

podcasts.apple.com/us/podcast/gra…

• • •

Missing some Tweet in this thread? You can try to

force a refresh