Discover and read the best of Twitter Threads about #BMN

Most recents (24)

1/

What a great RNS from @BushveldMin_Ltd #BMN

londonstockexchange.com/news-article/B…

Completely pinching some analysis (@BMNperspective)

....

What a great RNS from @BushveldMin_Ltd #BMN

londonstockexchange.com/news-article/B…

Completely pinching some analysis (@BMNperspective)

....

2/

At Brits 3.5MWp (peak) solar may generate 1826*3.5 MWh per year = 6,400 MWh

However 1MW of this is potentially going into the battery so that it can be used later so the amount going straight into the plant would be 2.5 * 1826 = 4,565 MWh

At Brits 3.5MWp (peak) solar may generate 1826*3.5 MWh per year = 6,400 MWh

However 1MW of this is potentially going into the battery so that it can be used later so the amount going straight into the plant would be 2.5 * 1826 = 4,565 MWh

3/

The Battery would produce 4MWh per day = 1,460 per year if charged once per day. Twice this if the system were grid tied and the battery was charged from cheap electricity from the grid overnight.

The cost of electricity is currently R2.6 per kWh (Or R2,600 per MWh, ..

The Battery would produce 4MWh per day = 1,460 per year if charged once per day. Twice this if the system were grid tied and the battery was charged from cheap electricity from the grid overnight.

The cost of electricity is currently R2.6 per kWh (Or R2,600 per MWh, ..

Two weeks from entry into @BushveldMin_Ltd, and the SP (and vanadium market!) is really heating up.

Russia accounts for almost 20% of global V production. With sanctions potentially about to bite, panic buying is evidently already occurring.

The #BMN investment case ⬇️

1/25

Russia accounts for almost 20% of global V production. With sanctions potentially about to bite, panic buying is evidently already occurring.

The #BMN investment case ⬇️

1/25

@BushveldMin_Ltd controls one of the largest and highest grade vanadium resource bases globally, at 549 million tonnes.

It controls:

- 3 major, high-grade deposits, one of which is a working open-pit mine;

- 2 processing plants;

- an electrolyte plant (in construction).

2/25

It controls:

- 3 major, high-grade deposits, one of which is a working open-pit mine;

- 2 processing plants;

- an electrolyte plant (in construction).

2/25

#BMN's operations are located on the Bushveld Complex in the North of South Africa.

Prior to 2017, the Co was a pre-revenue mineral explorer. Its flagship asset was the Mokopane vanadium deposit.

A 2016 prefeasibility study suggested a 30-year mine-life, producing...

3/25

Prior to 2017, the Co was a pre-revenue mineral explorer. Its flagship asset was the Mokopane vanadium deposit.

A 2016 prefeasibility study suggested a 30-year mine-life, producing...

3/25

1/ #LAYER2ROUNDUP: In Jan, both protocols had a slew of big announcements:

🌋 #BitcoinBond update

🥕 #Taproot on @Liquid_BTC

🏛 New #LiquidFederation members

🇦🇷 @ln_strike launches in Argentina

⚡️ Anniversary of the #LightningNetwork whitepaper

Let's review and more👇🧐

🌋 #BitcoinBond update

🥕 #Taproot on @Liquid_BTC

🏛 New #LiquidFederation members

🇦🇷 @ln_strike launches in Argentina

⚡️ Anniversary of the #LightningNetwork whitepaper

Let's review and more👇🧐

2/ Network capacity for both the @Liquid_BTC and #LightningNetwork continued to expand, LQ (3,528) / LN (3,399), reaching new highs for a combined capacity of 6,927 #Bitcoin.

Year-over-year, network capacity has grown LQ 25% / LN 290%, respectively. 🌊⚡️

Year-over-year, network capacity has grown LQ 25% / LN 290%, respectively. 🌊⚡️

3/ On the eve of the #LightningNetwork whitepaper's sixth anniversary, @jackmallers announced the Lightning-powered app @ln_strike was to begin rolling out in Argentina, one of many Latin American nations battling inflation and economic uncertainty.

btctimes.com/news/bitcoin-l…

btctimes.com/news/bitcoin-l…

1/ #LAYER2ROUNDUP: Last month, Lightning implementations #clightning and #LND rolled out major updates, and @Liquid_BTC took centerstage at @AdoptingBTC for the #BitcoinBond announcement.

Combined #L2 capacity also reached a new high of 6,661 BTC (~$377M).

Combined #L2 capacity also reached a new high of 6,661 BTC (~$377M).

2/ We begin at the @TABConf in Atlanta with a #LightningNetwork panel - @alexbosworth, @gkrizek, @niftynei, and @TheBlueMatt - who discussed off-chain scaling, privacy on Lightning, and liquidity ads.

3/ #Liquidityads are a spec proposal that allows Lightning nodes to source inbound capital via the gossip protocol.

1 month on, and FeV (Europe) has increased by 27%.

#BMN is down several % month-on-month.

Broker EBITDA forecast for 2022 is $80m, based on an average FeV price of $40/kg.

The global V market is incredibly inelastic. There are very few deposits that are nearing... 1/11

#BMN is down several % month-on-month.

Broker EBITDA forecast for 2022 is $80m, based on an average FeV price of $40/kg.

The global V market is incredibly inelastic. There are very few deposits that are nearing... 1/11

...construction ready. It's doubtful that any new production will be able to come online within the next two years - apart from the primary producers, #BMN and $LGO, expanding their operations.

@BushveldMin_Ltd owns two of only four primary production operations worldwide. 2/11

@BushveldMin_Ltd owns two of only four primary production operations worldwide. 2/11

It is incredibly leveraged to the V price, which itself is illiquid and prone to exceptional moves.

With the global economic recovery driving steel output to all-time highs, demand for V (which is primarily used to strengthen steel) is steadily increasing.

3/11

With the global economic recovery driving steel output to all-time highs, demand for V (which is primarily used to strengthen steel) is steadily increasing.

3/11

1/5

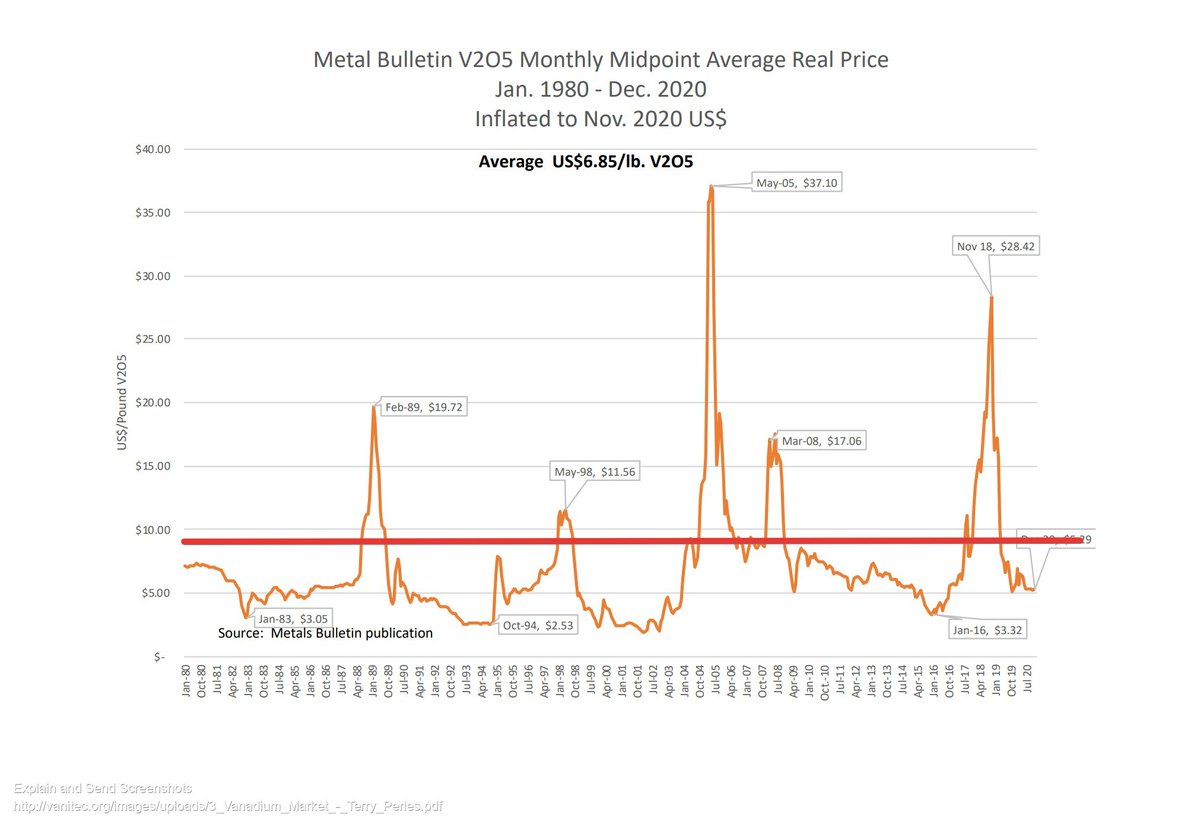

In this enclosed blog I attempted to demonstrate the significance of the V205 $8 per lb point.

Given what has just been reported in China, I believe we will shortly see $9 pr lb V205.

#BMN

In this enclosed blog I attempted to demonstrate the significance of the V205 $8 per lb point.

Given what has just been reported in China, I believe we will shortly see $9 pr lb V205.

#BMN

2/

Here now is the same historical V205 price chart marked up at $9 per lb.

Upon hitting $9 per lb the only time since 1980 that the V205 price has not gone on to spike to at least $11.50 per lb was in 2006/07 but it was coming off a downtrend.

Here now is the same historical V205 price chart marked up at $9 per lb.

Upon hitting $9 per lb the only time since 1980 that the V205 price has not gone on to spike to at least $11.50 per lb was in 2006/07 but it was coming off a downtrend.

3/

on all other occasions, the price continued higher because such pricing demonstrates a tight market is in play.

On a simple comparison to FeV that equates to a $50 per kg market.

Yes, we need more information on Europe/US prices.

thebushveldperspective.com/vanadium-prices

on all other occasions, the price continued higher because such pricing demonstrates a tight market is in play.

On a simple comparison to FeV that equates to a $50 per kg market.

Yes, we need more information on Europe/US prices.

thebushveldperspective.com/vanadium-prices

1/7

The latest vanadium price report is now available.

V205 120,500 CNY/t now the norm. See my previous explanations for what this likely means for the price in dollars.

I make China V205 running at $8.70 per lb.

#BMN #vanadium

The latest vanadium price report is now available.

V205 120,500 CNY/t now the norm. See my previous explanations for what this likely means for the price in dollars.

I make China V205 running at $8.70 per lb.

#BMN #vanadium

2/

That's now well above my $8 per lb rising trend break out point.

More importantly,

"People in the market has high enthusiasm for inquiries, and big factory is expected to adjust June V2O5 flake next week, and their wait-and-see sentiment increases."

That's now well above my $8 per lb rising trend break out point.

More importantly,

"People in the market has high enthusiasm for inquiries, and big factory is expected to adjust June V2O5 flake next week, and their wait-and-see sentiment increases."

1/5

Bushveld Energy 2021 position if listed separately,

A. $8m profit on #IES investment.

B. 25.25% ownership in Enerox who's 2020 contract wins were c. 65% of what IES achieved and will hold $30m for expansion to production twice the size of IES.

#BMN

Bushveld Energy 2021 position if listed separately,

A. $8m profit on #IES investment.

B. 25.25% ownership in Enerox who's 2020 contract wins were c. 65% of what IES achieved and will hold $30m for expansion to production twice the size of IES.

#BMN

2/

C. 55% ownership of a 200MWh electrolyte plant under construction with the IDC of S.A.

D. Mini-grid project under construction at Vametco in partnership with the IDC with potential to open up localised VRFB production and industrial opportunity.

C. 55% ownership of a 200MWh electrolyte plant under construction with the IDC of S.A.

D. Mini-grid project under construction at Vametco in partnership with the IDC with potential to open up localised VRFB production and industrial opportunity.

3/

E. Actively tendering for Eskom BESS projects totalling c. 1,440MWh with the battery tender element valued by the World Bank at $468m.

F. First active vanadium rental product in play with a UK client.

E. Actively tendering for Eskom BESS projects totalling c. 1,440MWh with the battery tender element valued by the World Bank at $468m.

F. First active vanadium rental product in play with a UK client.

1/12

This energetic and informative interview with #BMN Mikhail Nikomarov gives great insight into what VRFBs can potentially offer the S.A. market

From 3m 23s,

VRFBs are "cheaper if you need multiple hours of storage on a daily basis"

#vanadium

moneyweb.co.za/moneyweb-radio…

This energetic and informative interview with #BMN Mikhail Nikomarov gives great insight into what VRFBs can potentially offer the S.A. market

From 3m 23s,

VRFBs are "cheaper if you need multiple hours of storage on a daily basis"

#vanadium

moneyweb.co.za/moneyweb-radio…

2/

By "shifting energy from when it is sunny to when it's not, like in the evenings."

Also, to "support the transmission system and the distribution network."

There he touches upon S.A.s biggest hindrances "load shedding" but also "overloaded networks."

By "shifting energy from when it is sunny to when it's not, like in the evenings."

Also, to "support the transmission system and the distribution network."

There he touches upon S.A.s biggest hindrances "load shedding" but also "overloaded networks."

3/

Added to this is the vanadium rental product which significantly reduces the upfront capital costs.

Given that Eskom is effectively broke but in need of efficiencies, it is a perfect solution for their ongoing troubles.

Added to this is the vanadium rental product which significantly reduces the upfront capital costs.

Given that Eskom is effectively broke but in need of efficiencies, it is a perfect solution for their ongoing troubles.

1/11

Further to my earlier set of tweets regarding the IDC's involvement with #BMN.

The 2020 interims stated that BMN,

"obtained a debt financing term-sheet from a French Development Bank, to be underwritten by a South African institution."

Further to my earlier set of tweets regarding the IDC's involvement with #BMN.

The 2020 interims stated that BMN,

"obtained a debt financing term-sheet from a French Development Bank, to be underwritten by a South African institution."

2/

The IDC is a national development finance institution.

So give that the IDC state involvement in the mini-grid and the actual debt element appears to have come from a French Development Bank, then perhaps their role is as the underwriter.

The IDC is a national development finance institution.

So give that the IDC state involvement in the mini-grid and the actual debt element appears to have come from a French Development Bank, then perhaps their role is as the underwriter.

3/

If so then that demonstrates significant confidence in the product, the BE team, the future market and the relationship.

With everything I've discussed today in mind the following statement from the Q1 2020 update is all the more intriguing,

If so then that demonstrates significant confidence in the product, the BE team, the future market and the relationship.

With everything I've discussed today in mind the following statement from the Q1 2020 update is all the more intriguing,

1/18

Enclosed below is a copy of the IDC 2020 accounts. The IDC is the S.A. Government's investment vehicle, investing c. $780m in 2020.

Their New Industries unit has taken a 45% stake in the #BMN electrolyte plant currently being built in South Africa.

idc.co.za/wp-content/upl…

Enclosed below is a copy of the IDC 2020 accounts. The IDC is the S.A. Government's investment vehicle, investing c. $780m in 2020.

Their New Industries unit has taken a 45% stake in the #BMN electrolyte plant currently being built in South Africa.

idc.co.za/wp-content/upl…

2/

Page 44 deals with the business activities of the New Industries unit.

What is interesting is on addition to the electrolyte plant they are clearly also the funder for the Vametco mini-grid which is currently awaiting license sign off from the regulator.

Page 44 deals with the business activities of the New Industries unit.

What is interesting is on addition to the electrolyte plant they are clearly also the funder for the Vametco mini-grid which is currently awaiting license sign off from the regulator.

3/

So not only are they backing electrolyte but also the project that BMN describe in their 11th Nov 2020 RNS as,

"one of the first solar generation project with long-duration storage to be financed, off-balance-sheet in Africa."

BMN go on to say,

So not only are they backing electrolyte but also the project that BMN describe in their 11th Nov 2020 RNS as,

"one of the first solar generation project with long-duration storage to be financed, off-balance-sheet in Africa."

BMN go on to say,

1/8

Interesting deal announced between Brisbane based @VeccoTom and Shanghai Electric for the supply of an electrolyte plant in Australia.

Yet another sign of momentum that is gathering in the VRFB inudusty.

#BMN #Vanadium

veccogroup.com.au/vecco-group-to…

Interesting deal announced between Brisbane based @VeccoTom and Shanghai Electric for the supply of an electrolyte plant in Australia.

Yet another sign of momentum that is gathering in the VRFB inudusty.

#BMN #Vanadium

veccogroup.com.au/vecco-group-to…

2/

Shanghai Electric recently announced plans for a 100MW/400MWh VRFB project in Yancheng in east China's Jiangsu province.

One of several high profile projects and which alone should demand c. 1,600 mtV of vanadium,

argusmedia.com/en/news/219673…

Shanghai Electric recently announced plans for a 100MW/400MWh VRFB project in Yancheng in east China's Jiangsu province.

One of several high profile projects and which alone should demand c. 1,600 mtV of vanadium,

argusmedia.com/en/news/219673…

3/

which is close to 1.5% of total world vanadium supply in 2020.

Just one project.

A subject I discussed in a recent blog (see here).

bbnbigbitenow.com/post/do-newly-…

which is close to 1.5% of total world vanadium supply in 2020.

Just one project.

A subject I discussed in a recent blog (see here).

bbnbigbitenow.com/post/do-newly-…

1/2

The latest Chinese vanadium market update and shows bullishness.

It's the middle of the month and so steel mill bidding is at best sporadic and market weakness should be expected.

However, key V205 prices simply aren't giving any ground and it's hard to...

#BMN

The latest Chinese vanadium market update and shows bullishness.

It's the middle of the month and so steel mill bidding is at best sporadic and market weakness should be expected.

However, key V205 prices simply aren't giving any ground and it's hard to...

#BMN

2/

find supplies from large factories.

Rather interestingly ammonium metavanadate prices are also creeping higher, whilst everyone else is deadlocked but reluctant to accept lower prices.

Larger factory prices such as Pangang will be interesting to see later in the month.

find supplies from large factories.

Rather interestingly ammonium metavanadate prices are also creeping higher, whilst everyone else is deadlocked but reluctant to accept lower prices.

Larger factory prices such as Pangang will be interesting to see later in the month.

3/4

Latest vanadium price report and the wording on raw materials (V205).

"some (V205) manufacturers think the price will rise, so the offer is firm.

"V2O5 flake price is in cash 111,000 CNY/Ton."

#BMN

Latest vanadium price report and the wording on raw materials (V205).

"some (V205) manufacturers think the price will rise, so the offer is firm.

"V2O5 flake price is in cash 111,000 CNY/Ton."

#BMN

1/13

What I liked most about the @BushveldMin_Ltd update today, was that it was focused on an isolated but important project for #BMN. Thus allowing it to breathe a tad more and not get lost in the lengthy and often detailed updates, that are the norm.

londonstockexchange.com/news-article/B…

What I liked most about the @BushveldMin_Ltd update today, was that it was focused on an isolated but important project for #BMN. Thus allowing it to breathe a tad more and not get lost in the lengthy and often detailed updates, that are the norm.

londonstockexchange.com/news-article/B…

2/13

I would like to see the company continue with this pattern moving forward.

As to the update, very solid but it will now be all about how long NERSA need to sign off on the license application. Being 1MW, its certainly falls within their powers to act quickly but what that..

I would like to see the company continue with this pattern moving forward.

As to the update, very solid but it will now be all about how long NERSA need to sign off on the license application. Being 1MW, its certainly falls within their powers to act quickly but what that..

3/13

...means exactly, will act as a template for future BMN projects at their facilities and indeed across S.A.

Great to see Enerox staking a claim in this particular area of the business too. They were always going to be the focus due to the increased ownership and control...

...means exactly, will act as a template for future BMN projects at their facilities and indeed across S.A.

Great to see Enerox staking a claim in this particular area of the business too. They were always going to be the focus due to the increased ownership and control...

1/9

I will mainly park the #BMN interims for just a moment because for me, a loss was coming.

The story is about the future and what it will cost shareholders.

I am still working through the very detailed finance agreement but would highlight several stand out points.

I will mainly park the #BMN interims for just a moment because for me, a loss was coming.

The story is about the future and what it will cost shareholders.

I am still working through the very detailed finance agreement but would highlight several stand out points.

2/9

My take.

$65m in new finance.

To pay

$6.15m Duferco

$22.2m Nedbank

= $28.35m

Dilution at this stage

Duferco $6.5m (£5m) @ c. 10p (worst case) = 50m shares.

Cash on hand.

$24m

Planned Investments through this finance

Vanchem phase 1 = $14m

Vametco phase 3 = $26m

My take.

$65m in new finance.

To pay

$6.15m Duferco

$22.2m Nedbank

= $28.35m

Dilution at this stage

Duferco $6.5m (£5m) @ c. 10p (worst case) = 50m shares.

Cash on hand.

$24m

Planned Investments through this finance

Vanchem phase 1 = $14m

Vametco phase 3 = $26m

1/9

From the #IES interims today ;

"Core sales markets identified; US West Coast, UK, Australia and South Africa"

Reading through the report, I can find only 1 direct ref. to why South Africa is now core but most interesting it is S.A. and not Africa in general.

#BMN

From the #IES interims today ;

"Core sales markets identified; US West Coast, UK, Australia and South Africa"

Reading through the report, I can find only 1 direct ref. to why South Africa is now core but most interesting it is S.A. and not Africa in general.

#BMN

2/9

Given that in Sept IES signed an electrolyte rental agreement with BMN, it is important to keep tabs on their progress.

So its good to see that contracts running from closed through to "a strong chance of close in the immediate term" (upside), now number c. 57MWh.

Given that in Sept IES signed an electrolyte rental agreement with BMN, it is important to keep tabs on their progress.

So its good to see that contracts running from closed through to "a strong chance of close in the immediate term" (upside), now number c. 57MWh.

3/9

That's good progress given the fact that the electrolyte rental agreement is only just being introduced and so has yet to really affect those numbers.

All that aside, my reading is that a clear move is being made to take advantage of the BMN cost advantages and

That's good progress given the fact that the electrolyte rental agreement is only just being introduced and so has yet to really affect those numbers.

All that aside, my reading is that a clear move is being made to take advantage of the BMN cost advantages and

1/11

Some further notes on the upcoming Eskom BESS Project.

Annual Report 2019 page 27;

"focused on the African market" hence why the Eskom project, easily the biggest in the world to date, first in Africa to be grid connected and right on #BMN doorstep, is firmly in BMN sights.

Some further notes on the upcoming Eskom BESS Project.

Annual Report 2019 page 27;

"focused on the African market" hence why the Eskom project, easily the biggest in the world to date, first in Africa to be grid connected and right on #BMN doorstep, is firmly in BMN sights.

2/11

And;

"the country’s characteristic demand profile, which lasts for six hours a day and peaks twice a day, makes the

economics especially favourable for long-duration, nearly limitless recycling technologies such as VRFBs."

Add lower cost, locally produced, rented vanadium,

And;

"the country’s characteristic demand profile, which lasts for six hours a day and peaks twice a day, makes the

economics especially favourable for long-duration, nearly limitless recycling technologies such as VRFBs."

Add lower cost, locally produced, rented vanadium,

1/8

A potential spanner in the works for #BMN for the Eskom BESS Project tender, which has now been extended to 21st October.

In the bidders clarification doc from 10th Sept, one answer states ;

"The criterion requires each member of a JV to meet 25%"

A potential spanner in the works for #BMN for the Eskom BESS Project tender, which has now been extended to 21st October.

In the bidders clarification doc from 10th Sept, one answer states ;

"The criterion requires each member of a JV to meet 25%"

2/8

"of the Average Annual Turnover of R3.5bn and failure to meet the requirement will result in disqualification of the Bidder i.e. the JV."

Ave. Rand/dollar exchange 2019 was 14.45, which equates to a turnover fig. of c. $60m.

In terms of BMN that's no problem but for

"of the Average Annual Turnover of R3.5bn and failure to meet the requirement will result in disqualification of the Bidder i.e. the JV."

Ave. Rand/dollar exchange 2019 was 14.45, which equates to a turnover fig. of c. $60m.

In terms of BMN that's no problem but for

3/8

Enerox and Invinity it is, if its intended that they are to be part of a JV with BMN.

I am absolutely sure BMN will be part of a JV tendering for this first Eskom package but how they introduce VRFB technology, whilst achieving the above criteria will be interesting.

Enerox and Invinity it is, if its intended that they are to be part of a JV with BMN.

I am absolutely sure BMN will be part of a JV tendering for this first Eskom package but how they introduce VRFB technology, whilst achieving the above criteria will be interesting.

1/13

Been focused on other things for a few days but a few thoughts on shares I hold, given the perceived turmoil.

Main focuses for me for a while now, has been shares exposed to Covid, battery metals (incl. energy storage) and gold.

#HZM #BCN #ACP #GDR #AVCT #SRB #BMN

Been focused on other things for a few days but a few thoughts on shares I hold, given the perceived turmoil.

Main focuses for me for a while now, has been shares exposed to Covid, battery metals (incl. energy storage) and gold.

#HZM #BCN #ACP #GDR #AVCT #SRB #BMN

2/13

The events of the last few days if anything strengthen that stance.

In terms of Covid (and I tread carefully because both my stocks have other things in their locker), its a waiting game on both.

I think 1 strong update from #GDR and it moves much higher from here.

The events of the last few days if anything strengthen that stance.

In terms of Covid (and I tread carefully because both my stocks have other things in their locker), its a waiting game on both.

I think 1 strong update from #GDR and it moves much higher from here.

3/13

In terms of #AVCT, an update, one way or the other is pending, whereby the exact progress of BAMS/LFT tests, should be made clearer.

I see no reason for concern and the lockdown measures announced today in the UK, only go to strengthen that argument. Nothing has changed.

In terms of #AVCT, an update, one way or the other is pending, whereby the exact progress of BAMS/LFT tests, should be made clearer.

I see no reason for concern and the lockdown measures announced today in the UK, only go to strengthen that argument. Nothing has changed.

1/4

"the next bid window for independent power production take-off agreements will be done by January 2021"

"energy self-generation projects above 1MW will be fast-tracked, to take the pressure off Eskom."

When I hear an S.A. politician say "fast tracked,"

#BMN

"the next bid window for independent power production take-off agreements will be done by January 2021"

"energy self-generation projects above 1MW will be fast-tracked, to take the pressure off Eskom."

When I hear an S.A. politician say "fast tracked,"

#BMN

2/4

I tend to shudder but ok, lets run with it.

"The plan will be overseen by a presidential working committee chaired by President Cyril Ramaphosa."

So its buck stops here sort of stuff. Positive.

"will meet monthly to make sure it is not reduced to another talk shop."

I tend to shudder but ok, lets run with it.

"The plan will be overseen by a presidential working committee chaired by President Cyril Ramaphosa."

So its buck stops here sort of stuff. Positive.

"will meet monthly to make sure it is not reduced to another talk shop."

3/4

If S.A. can finally allow projects over 1MW to proceed along the same lines currently set for <1MW, then with a demonstration project at Vametco, BMN/BE, are for me, really in business.

Add to that BMN own ambitions to take their all their plants off line,

If S.A. can finally allow projects over 1MW to proceed along the same lines currently set for <1MW, then with a demonstration project at Vametco, BMN/BE, are for me, really in business.

Add to that BMN own ambitions to take their all their plants off line,

1/3

#BMN H1 update dated 2nd Sept ;

An intriguing quote.

"3. Sales of 879 mtV includes sales to customers of 598 mtV and intercompany sales of 281 mtV."

BMN Vametco sold 313mtV more in Q2 than it produced.

#BMN H1 update dated 2nd Sept ;

An intriguing quote.

"3. Sales of 879 mtV includes sales to customers of 598 mtV and intercompany sales of 281 mtV."

BMN Vametco sold 313mtV more in Q2 than it produced.

2/3

So it looks like a decision was taken to sell inventory to another BMN company. First assumption is Vanchem for valued added processing but its not a given.

Its too early for the electrolyte plant to require vanadium surely too early for BE to require it.

So it looks like a decision was taken to sell inventory to another BMN company. First assumption is Vanchem for valued added processing but its not a given.

Its too early for the electrolyte plant to require vanadium surely too early for BE to require it.

3/3

It is nevertheless an interesting change in the BMN ranks because at the very least it points towards synergies between BMNs 2 plants, which again adds value that will show itself in the months to come.

It is nevertheless an interesting change in the BMN ranks because at the very least it points towards synergies between BMNs 2 plants, which again adds value that will show itself in the months to come.

1/7

Whilst I am turning more and more bullish on the #BMN energy front, its important to remember that right now, 99% of income is still derived from vanadium sales into the steel sector, which is suffering somewhat right now.

Whilst I am turning more and more bullish on the #BMN energy front, its important to remember that right now, 99% of income is still derived from vanadium sales into the steel sector, which is suffering somewhat right now.

2/7

At the current H1 sales price of $24.40 per kg, I have BMN roughly breaking even in H1, prior to capital investments programmes

Once we take into account those investments, be it they are scaled back this year, I believe BMN will make a loss, which may shock one or two.

At the current H1 sales price of $24.40 per kg, I have BMN roughly breaking even in H1, prior to capital investments programmes

Once we take into account those investments, be it they are scaled back this year, I believe BMN will make a loss, which may shock one or two.

3/7

But it'll depend on where the cost of additional 559mtV in sales sit.

However, right now BMN is all about riding out the downturn in vanadium prices, whilst gearing up where feasible, with its fully integrated energy storage value chain model, ready for bigger years to come.

But it'll depend on where the cost of additional 559mtV in sales sit.

However, right now BMN is all about riding out the downturn in vanadium prices, whilst gearing up where feasible, with its fully integrated energy storage value chain model, ready for bigger years to come.

1/24

Eskom Battery Storage Project (BESS) Tender.

Not very many people know this, but for the last 4 years #BMN has been implementing a long term strategy to position itself for the very tender that is currently in play at Eskom in S.A.

Eskom Battery Storage Project (BESS) Tender.

Not very many people know this, but for the last 4 years #BMN has been implementing a long term strategy to position itself for the very tender that is currently in play at Eskom in S.A.

2/24

That project is for a combined 1,440MWh of battery storage, split into 4 packages, with the first 80MW (320MWh) package tender out and due to close its bid window on 30th Sept.

For a company with VRFB ambitions, this project, right on the door step of BMN operating mines,

That project is for a combined 1,440MWh of battery storage, split into 4 packages, with the first 80MW (320MWh) package tender out and due to close its bid window on 30th Sept.

For a company with VRFB ambitions, this project, right on the door step of BMN operating mines,

3/24

is almost too good to be true.

However, from history we know that BMN have partnered with the S.A. government's investment arm, the IDC, with the 2 parties sharing ownership of the electrolyte plant, that is also currently being built in S.A and a VRFB tested at Eskom.

is almost too good to be true.

However, from history we know that BMN have partnered with the S.A. government's investment arm, the IDC, with the 2 parties sharing ownership of the electrolyte plant, that is also currently being built in S.A and a VRFB tested at Eskom.

1/4

Well said @MylesMcNulty. I am also adding following the recent pieces of news.

Important to remember that #BMN now has first refusal on vanadium supply to arguably the biggest 2 VRFB suppliers in the world.

Well said @MylesMcNulty. I am also adding following the recent pieces of news.

Important to remember that #BMN now has first refusal on vanadium supply to arguably the biggest 2 VRFB suppliers in the world.

2/4

However, whilst with Invinity that deal continues so long as BMN hold 5% of Invinity stock, there is no current limit on first refusal timescales with Enerox.

The more successful the two companies are, the more vanadium is re-directed away from mining into energy storage.

However, whilst with Invinity that deal continues so long as BMN hold 5% of Invinity stock, there is no current limit on first refusal timescales with Enerox.

The more successful the two companies are, the more vanadium is re-directed away from mining into energy storage.

3/4

What that does is begin to transform BMN into a company for all seasons because energy storage isn't cyclical like mining. It is climate driven and so investment in it is through necessity and not trend.

When BMN demonstrate themselves able to deliver recurring revenues,

What that does is begin to transform BMN into a company for all seasons because energy storage isn't cyclical like mining. It is climate driven and so investment in it is through necessity and not trend.

When BMN demonstrate themselves able to deliver recurring revenues,