Discover and read the best of Twitter Threads about #BalajiAmines

Most recents (11)

👉Business blueprint since beginning:

1) Focus on import substitute products.

2) Use local technology to develop & manufacture products.

3) Alter design & processes to make products cost effective.

1) Focus on import substitute products.

2) Use local technology to develop & manufacture products.

3) Alter design & processes to make products cost effective.

👉Largest Indian producer of the following products:

• Methylamines

• Ethylamines

• Di-Methyl Acetamide (DMAC)

• Di-Methyl Amine Hydrochloride (DMA HCL)

• Dimethylformamide (DMF)

• Methylamines

• Ethylamines

• Di-Methyl Acetamide (DMAC)

• Di-Methyl Amine Hydrochloride (DMA HCL)

• Dimethylformamide (DMF)

🚀45 mid & small cap #stocks from 10 different sectors that have shown improvement in fundamentals & can deliver strong growth going forward :

~ Pharma

~ Hospital

~ Metal

~ Alcohol

~ Textile

~ Logistics

~ Energy

~ Auto Ancl

~ Chemical

~ Paper

short 🧵....

~ Pharma

~ Hospital

~ Metal

~ Alcohol

~ Textile

~ Logistics

~ Energy

~ Auto Ancl

~ Chemical

~ Paper

short 🧵....

▶️Pharma:

#IndocoRem

#LaurusLabs

#AlkemLabs

#JBChemPharma

▶️Hospitals:

#HGS

#NHrudalaya

▶️Metals/Mining :

#MaithanAlloys

#SandurMagnese

#Godavaripower

#ShyamMetalics

#TinplateIndia

#UshaMartin

▶️Alcoholic Bev:

#GlobusSpirits

#RadicoKhaitan

Cont...

#IndocoRem

#LaurusLabs

#AlkemLabs

#JBChemPharma

▶️Hospitals:

#HGS

#NHrudalaya

▶️Metals/Mining :

#MaithanAlloys

#SandurMagnese

#Godavaripower

#ShyamMetalics

#TinplateIndia

#UshaMartin

▶️Alcoholic Bev:

#GlobusSpirits

#RadicoKhaitan

Cont...

▶️Textiles:

#RUPA

#KRPMills

#Nitinspinner

#SiyaramSilk

#Indocount

#VTL

#Trident

#HimatsinghkaSeide

#Ambicacotton

▶️Logistics:

#AllCargo

#AegisLogistics

▶️Energy:

#GSPL

#GujaratGas

#MGL

▶️Auto Ancillary:

#SSWL

#Banco

#GNAAxels

Cont....

#RUPA

#KRPMills

#Nitinspinner

#SiyaramSilk

#Indocount

#VTL

#Trident

#HimatsinghkaSeide

#Ambicacotton

▶️Logistics:

#AllCargo

#AegisLogistics

▶️Energy:

#GSPL

#GujaratGas

#MGL

▶️Auto Ancillary:

#SSWL

#Banco

#GNAAxels

Cont....

How Weekly SuperTrend protected us from huge drawdowns

Complex exit rules lead to confusion and i like supertrend because it is very simple.

Examples -

#Deepaknitrite

#JubilantIngrevia

#Sequent

#Alkylamines

#Balajiamines

#Neulandlab

#Nocil

1. #Deepaknitrite

Complex exit rules lead to confusion and i like supertrend because it is very simple.

Examples -

#Deepaknitrite

#JubilantIngrevia

#Sequent

#Alkylamines

#Balajiamines

#Neulandlab

#Nocil

1. #Deepaknitrite

3.#Sequent

To understand the strength of a chemical business, it is very important to understand the chemistry, to understand it one should study the value chains of those businesses.

In this 🧵 we have studied value chains of various businesses

Like & Retweet for better reach 🧪👨🔬

In this 🧵 we have studied value chains of various businesses

Like & Retweet for better reach 🧪👨🔬

#Balajiamines Q3 22 Concall Highlights 🧪🧪

Like & Retweet for better reach !

Operational Highlights

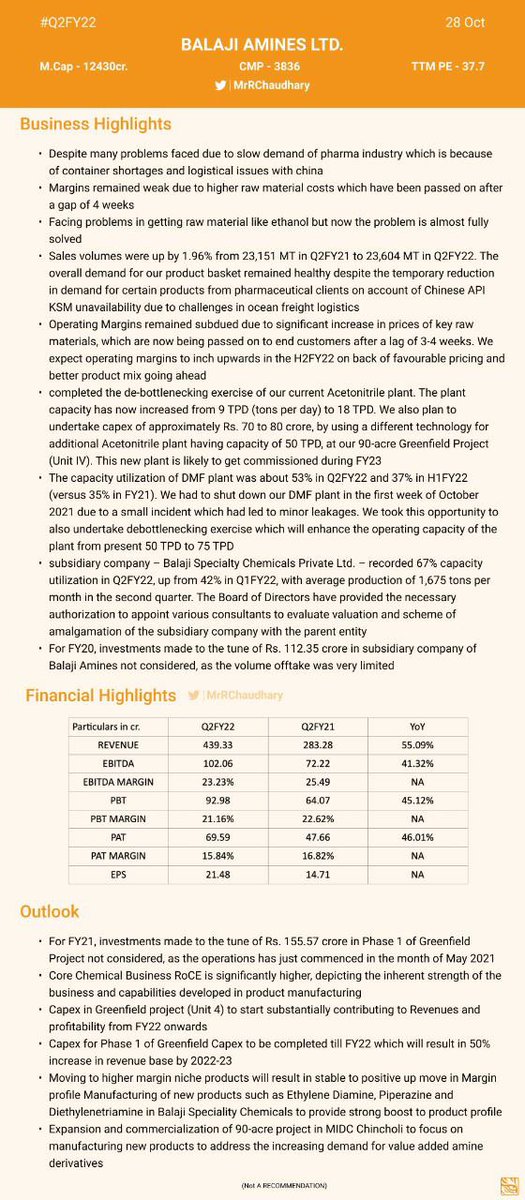

1. Revenues stood at ₹475 Cr in Q3FY22 compared to ₹366 Cr in Q3FY21, growth of 29.4% YoY

2. EBITDA stood at 109.3 Cr translating 23% EBITDA margins

Like & Retweet for better reach !

Operational Highlights

1. Revenues stood at ₹475 Cr in Q3FY22 compared to ₹366 Cr in Q3FY21, growth of 29.4% YoY

2. EBITDA stood at 109.3 Cr translating 23% EBITDA margins

3. Sales volumes were down by 13.77% from 31,993 MT in Q3FY21 to 27,589 MT in Q3FY22. As few of the clients couldn’t procure Key Starting Materials (KSMs) to match the products.

4. Despite sluggish demand for few of the products and shut down of acetonitrile and DMF plants for debottlenecking which were completed in the month of November 2021, the revenues showed a decent growth of 44% which stood at ₹556 Cr in Q3FY22

#LaurusLabs #DeepakNitrite #BalajiAmines - Posting Q2 Concall Snippets 🙏 Deep Dive Before their Upcoming Q3 Results. A 🧵 15 Companies 🙏

(Our Team Has Worked Really Hard.If You feel it's Valuable, RT/Share To Educate Investor Community ♥️)

(Our Team Has Worked Really Hard.If You feel it's Valuable, RT/Share To Educate Investor Community ♥️)

A Detailed Thread on #JubilantIngrevia as Promised

Let's start with the #Technicals to time the Entry

A perfect VCP -3 + Shakeout and crawling near the ATH and awaiting a ATH Breakout

For Investment I use the Weekly Chart with 10EMA

Let's start with the #Technicals to time the Entry

A perfect VCP -3 + Shakeout and crawling near the ATH and awaiting a ATH Breakout

For Investment I use the Weekly Chart with 10EMA

Let's Deep Dive into the Fundamentals of #JubilantIngrevia

Jubilant Ingrevia is an Integrated Speciality Chemicals Comapany

They are into Speciality Chemicals ,nutraceuticals and Life Sciences

Revenue Split and Region wise Revenue in the Below Presentation

Jubilant Ingrevia is an Integrated Speciality Chemicals Comapany

They are into Speciality Chemicals ,nutraceuticals and Life Sciences

Revenue Split and Region wise Revenue in the Below Presentation

Who are its Competitors ?

Closest peers - Laxmi Organic

Two major Products in Common Ethyl Acetate Diketene

Prices of Both have been on Steep Uptrend and Jubilant has not caught up with that

Its a competitor to other Speciality Chemicals like Balaji Amines also in some

Closest peers - Laxmi Organic

Two major Products in Common Ethyl Acetate Diketene

Prices of Both have been on Steep Uptrend and Jubilant has not caught up with that

Its a competitor to other Speciality Chemicals like Balaji Amines also in some

A Thread on #Laurus Labs as Promised

#Technicals - To time the entry and Price

Laurus Labs Currently near Support zones .

620 in my view is a strong support

Showing Buying Volumes since yesterday !

#Technicals - To time the entry and Price

Laurus Labs Currently near Support zones .

620 in my view is a strong support

Showing Buying Volumes since yesterday !

#Fundamentals

Laurus labs is into API , Formulations , Bio Synthesis and CDMO Bussiness

API Bussiness leader #Divis Labs - Only API . No formulations - PE Rating 66

Lowest Cost producer

#Laurus Labs - Into API and formulations . One among the lowest cost producer

Laurus labs is into API , Formulations , Bio Synthesis and CDMO Bussiness

API Bussiness leader #Divis Labs - Only API . No formulations - PE Rating 66

Lowest Cost producer

#Laurus Labs - Into API and formulations . One among the lowest cost producer

🚀10 sectors from which many mid & small cap companies which came up with Excellent Q1 nos

~Pharma

~Hospital

~Metal

~Alcohol

~Textile

~AgriChem

~Energy

~AutoAnc

~Chemical

~Paper

Shortlisting the 48 #stocks from these sectors that could deliver their 🚀best FY results ever

👉🧵

~Pharma

~Hospital

~Metal

~Alcohol

~Textile

~AgriChem

~Energy

~AutoAnc

~Chemical

~Paper

Shortlisting the 48 #stocks from these sectors that could deliver their 🚀best FY results ever

👉🧵

▶️Pharma:

#GuficBio

#LaurusLabs

#AlkemLabs

#JBChemPharma

▶️Hospitals:

#MaxHealth

#KIMS

▶️Metals/Mining :

#MaithanAlloys

#SandurMagnese

#Godavaripower(GPIL)

#ShyamMetalics

#TinplateIndia

#TataSteelBSL

#SunflagIron

▶️Alcoholic Bev:

#GlobusSpirits

#RadicoKhaitan

Cont...

#GuficBio

#LaurusLabs

#AlkemLabs

#JBChemPharma

▶️Hospitals:

#MaxHealth

#KIMS

▶️Metals/Mining :

#MaithanAlloys

#SandurMagnese

#Godavaripower(GPIL)

#ShyamMetalics

#TinplateIndia

#TataSteelBSL

#SunflagIron

▶️Alcoholic Bev:

#GlobusSpirits

#RadicoKhaitan

Cont...

▶️Textiles:

#LUX

#RUPA

#VTL

#Nitinspinner

#SiyaramSilk

#Indocount

#TRIDENT

#KPRMills

#HimatsinghkaSeide

#Ambicacotton

▶️Agrichem:

#Heranba

#Sumitomo

▶️Energy:

#GSPL

#GujaratGas

#MGL

▶️Auto Ancillary:

#SSWL

#Banco

#GNAAxels

Cont...

#LUX

#RUPA

#VTL

#Nitinspinner

#SiyaramSilk

#Indocount

#TRIDENT

#KPRMills

#HimatsinghkaSeide

#Ambicacotton

▶️Agrichem:

#Heranba

#Sumitomo

▶️Energy:

#GSPL

#GujaratGas

#MGL

▶️Auto Ancillary:

#SSWL

#Banco

#GNAAxels

Cont...

🌟Top 3( high growth +strong business) companies of my favorite😍 sectors for long term.

1⃣chemical sector - #deepaknr #balajiamines #tatachemical

2⃣power - #adanitransmissons #tatapower #adanipower

3⃣Fmcg - #ltfoods #hindustanfoods #hatsun

1⃣chemical sector - #deepaknr #balajiamines #tatachemical

2⃣power - #adanitransmissons #tatapower #adanipower

3⃣Fmcg - #ltfoods #hindustanfoods #hatsun

4⃣cement - #jklakshmi #birlacement #prism

5⃣ packaging - #polyplex #jindalpoly #cosmofilms

6⃣textiles - #luxind #srf #welspun

7⃣ fertilizers - #fact #gnfc #rcf

5⃣ packaging - #polyplex #jindalpoly #cosmofilms

6⃣textiles - #luxind #srf #welspun

7⃣ fertilizers - #fact #gnfc #rcf

1⃣ sugar sector -#renukasugar #dalmiabharat #Uttamsugar

2⃣ agrochemical - #piind #upl #paushak

3⃣ beverage sector - #radico #globus #ifbagro

If you love ❤ & like 💞 ,then share more sectors companies.

2⃣ agrochemical - #piind #upl #paushak

3⃣ beverage sector - #radico #globus #ifbagro

If you love ❤ & like 💞 ,then share more sectors companies.

#BalajiAmines blasts it out of the park! Pat grows from 20 cr to 78 cr yoy. and this is after they incurred a loss of 8.5 cr in CFL division. outdid Alkyl as well!

#Balajiamines commissions its ethyl amines project & now becomes the largest manufacturer of its products both in ethyl and methyl amines.

Brilliant performance continues by #Balajiamines, goes one better on its stupendous performance last quarter. PBT goes 3x from 40 crores last year same quarter to 120 crores this year