Discover and read the best of Twitter Threads about #Syngene

Most recents (19)

#MarketAtClose | #Midcaps continue to outperform, Nifty Midcap Index posts record close

#Sensex, #Nifty & #NiftyBank close with minor gains in a range-bound session

Sensex rises 119 points to 62,547 & Nifty 46 points to 18,534

Midcap Index gains 154 points to 33,967 & Nifty Bank… twitter.com/i/web/status/1…

#Sensex, #Nifty & #NiftyBank close with minor gains in a range-bound session

Sensex rises 119 points to 62,547 & Nifty 46 points to 18,534

Midcap Index gains 154 points to 33,967 & Nifty Bank… twitter.com/i/web/status/1…

#MarketAtClose | #Metal stocks rise on improved global prices, #Hindalco up over 3%

#ApolloHospitals gains another 3% on Friday, up 8% for the week

#HeroMoto continues its positive run, less than 2% away from 52-wk high

#Auto stocks rise after strong sales in May, M&M, #Maruti,… twitter.com/i/web/status/1…

#ApolloHospitals gains another 3% on Friday, up 8% for the week

#HeroMoto continues its positive run, less than 2% away from 52-wk high

#Auto stocks rise after strong sales in May, M&M, #Maruti,… twitter.com/i/web/status/1…

#MarketAtClose | #Pharma stocks see some buying, Dr Reddy’s, Sun, Laurus up over 1% each

New-age cos like #Zomato & #Nykaa see healthy gains on Friday, up 4-8%

4 #Nifty stocks (#BajajAuto, #Britannia, #TaMo, #ApolloHosp) hit 52-week highs today

M&M Fin gains more than 1% to hit… twitter.com/i/web/status/1…

New-age cos like #Zomato & #Nykaa see healthy gains on Friday, up 4-8%

4 #Nifty stocks (#BajajAuto, #Britannia, #TaMo, #ApolloHosp) hit 52-week highs today

M&M Fin gains more than 1% to hit… twitter.com/i/web/status/1…

Detailed Analysis on the business of #Syngene International - India’s largest listed #CRO

CMP - ₹590

Like and retweet for maximum reach!!

CMP - ₹590

Like and retweet for maximum reach!!

1. Company Overview

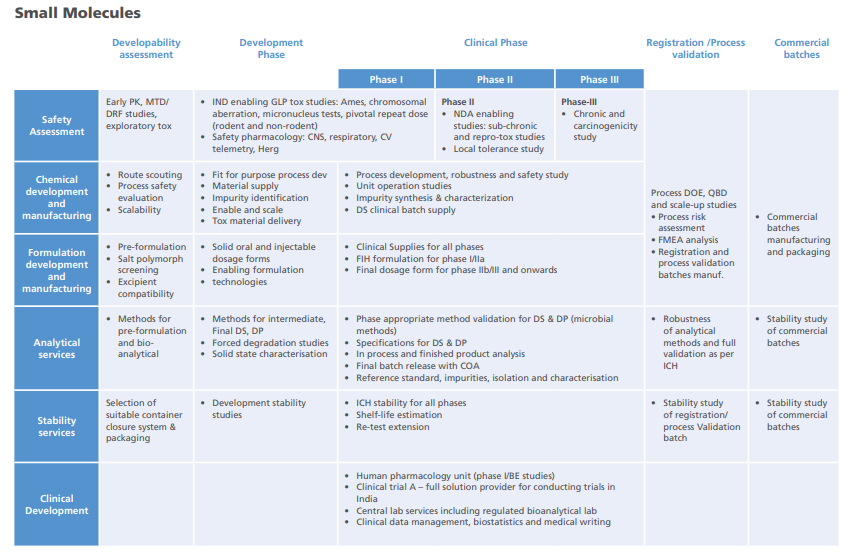

-Syngene provides end-to-end discovery, development and manufacturing services to innovative pharma companies involved in the development of patented drugs.

-Syngene was established in 1993 as a subsidiary of Biocon with the objective of providing contract

-Syngene provides end-to-end discovery, development and manufacturing services to innovative pharma companies involved in the development of patented drugs.

-Syngene was established in 1993 as a subsidiary of Biocon with the objective of providing contract

If you are planning to invest in #Pharmasector or #chemicalsector, Watch the following videos for detailed understanding !

Like & retweet for maximum reach !

1 #Divislabs

Like & retweet for maximum reach !

1 #Divislabs

Update on #SyngeneInternational 💊🧬

Like and retweet for max reach !

#Syngene announced a 10 year agreement with Zoetis to manufacture the biological entity for Librela(bedinvetmab). It is the first monoclonal antibody for the treatment of osteoarthritis in dogs

Like and retweet for max reach !

#Syngene announced a 10 year agreement with Zoetis to manufacture the biological entity for Librela(bedinvetmab). It is the first monoclonal antibody for the treatment of osteoarthritis in dogs

1. About the drug

Currently, the product is only approved for sale in Europe but management has indicated that US approval is expected by the end of 2022. Zoetis launched the product in the second quarter of 2021 in Europe.

Currently, the product is only approved for sale in Europe but management has indicated that US approval is expected by the end of 2022. Zoetis launched the product in the second quarter of 2021 in Europe.

Sales for the product were $15 million in both Q3 and Q4 of 2021 and $20 million in Q1 of 2022. Zoetis management has said that the product will be a blockbuster by the end of 2022 bringing in $100 million from the EU alone. (Blockbuster product in animal health is products with

#Syngene FY 2022 Annual Report Takeaways 💊💊

Like & Retweet for better reach !

1. They were able to add 100+ new clients during the year while increasing repeat business from existing clients

Like & Retweet for better reach !

1. They were able to add 100+ new clients during the year while increasing repeat business from existing clients

2. SynVent - their integrated drug discovery platform made good progress during the year. It is proving to be a particularly attractive model for emerging biotech companies which choose not to establish their own infrastructure.

3. Capex for the year was ₹621 Cr. 70% of it was spent on Discovery Services and Dedicated Centers, 10% was spent on Development Services and another 10% was spent on Manufacturing Services. The remaining investments were in

#Syngene International Concall Q3 FY22 highlights 💊🧪

@unseenvalue

Like & Retweet for better Reach !

1.Operations were mostly unaffected by COVID. They have observed lengthening of supply chains, so they are stocking up on raw materials for Q4.

@unseenvalue

Like & Retweet for better Reach !

1.Operations were mostly unaffected by COVID. They have observed lengthening of supply chains, so they are stocking up on raw materials for Q4.

2. Revenue growth was 10% YoY. EBITDA growth was 12% indicating operating leverage. Key growth drivers for revenue during the quarter were discovery services and dedicated centres. Development and manufacturing services delivered more sustained performances.

3.EBITDA margin was 31.7% compared to 30.1% last year - increase of 160bps. EBITDA margins were affected by 2 opposing forces. Increase in RM and power costs put pressure on margins by 180bps, it was offset by 340bps margin improvement due to better cost performance in other

“Last Diwali to this Diwali: Summary of Momentum Investments/ Trades taken (#MostlyMomentum)!!”:

Introduction of my journey so far:

I started my #StockMarket journey Jul- 2016:

•During 2016-17, as a typical new investor, started with TV Tips, and IPOs,

Introduction of my journey so far:

I started my #StockMarket journey Jul- 2016:

•During 2016-17, as a typical new investor, started with TV Tips, and IPOs,

this (IPOs) helped in a way, best #DMART has still been the best of IPOs I applied for, got allotment, and kept for couple of months and captured fastest 282% of my #StockMarket journey.

• During 2017-18, decided not to go after TV Tips,

• During 2017-18, decided not to go after TV Tips,

and started doing something on my own including a little Option “BUYING” 12, lost some funds in Option Buying, but gained a lot of experience regarding not to so something you don’t know. Alongside this, also started exploring cash market strategies of buying what is going up and

A Thread on #Laurus Labs as Promised

#Technicals - To time the entry and Price

Laurus Labs Currently near Support zones .

620 in my view is a strong support

Showing Buying Volumes since yesterday !

#Technicals - To time the entry and Price

Laurus Labs Currently near Support zones .

620 in my view is a strong support

Showing Buying Volumes since yesterday !

#Fundamentals

Laurus labs is into API , Formulations , Bio Synthesis and CDMO Bussiness

API Bussiness leader #Divis Labs - Only API . No formulations - PE Rating 66

Lowest Cost producer

#Laurus Labs - Into API and formulations . One among the lowest cost producer

Laurus labs is into API , Formulations , Bio Synthesis and CDMO Bussiness

API Bussiness leader #Divis Labs - Only API . No formulations - PE Rating 66

Lowest Cost producer

#Laurus Labs - Into API and formulations . One among the lowest cost producer

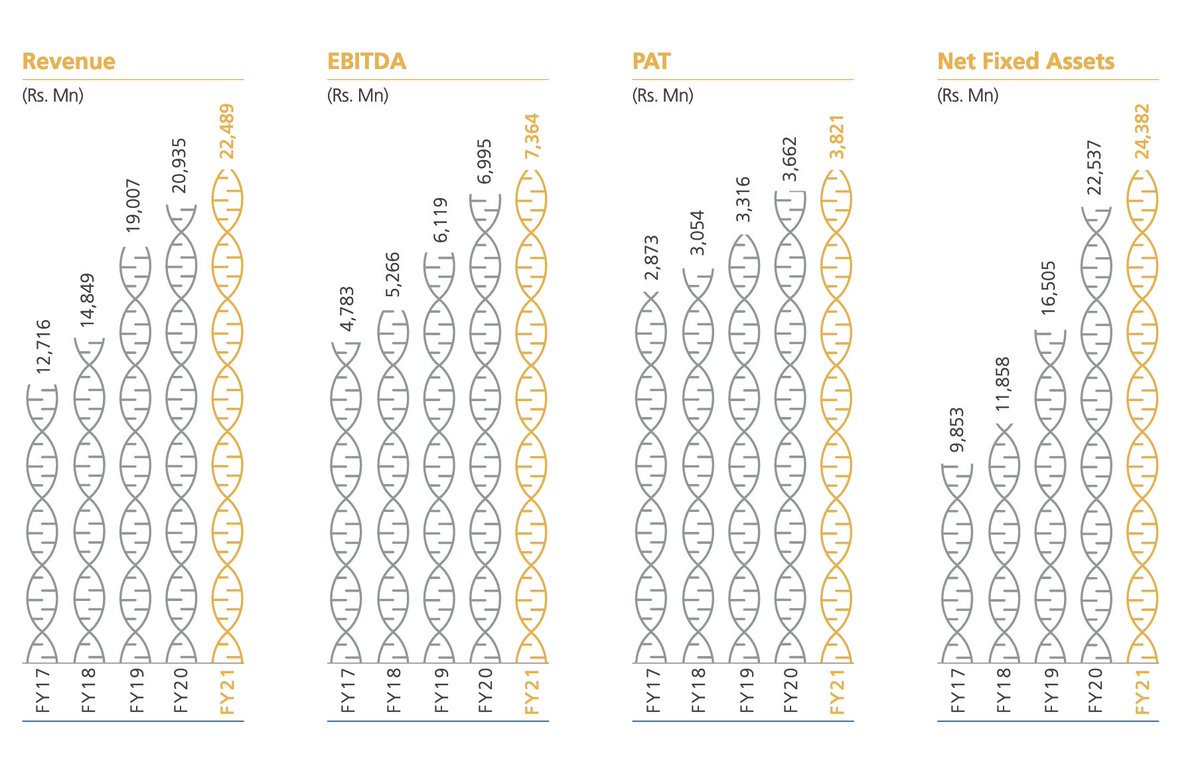

Syngene is delighted to share that we are part of Fortune India’s Top 100 Wealth Creators list for 2021.

The criteria involved being a listed company with a 5-year CAGR of 7.5% plus in terms of market cap, revenue &profit (2017-21).

#FortuneIndia #Syngene #FortuneList #CDMO

1/5

The criteria involved being a listed company with a 5-year CAGR of 7.5% plus in terms of market cap, revenue &profit (2017-21).

#FortuneIndia #Syngene #FortuneList #CDMO

1/5

Those incurring a net loss in any of the 5 fiscals (2016-20) were filtered out. The final 100 were based on firms having revenues of Rs 300 crores or more in FY20.

2/5

2/5

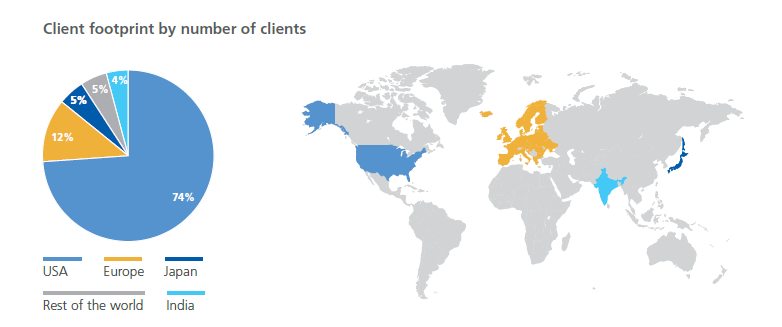

Key to our success has been our growing clientele who regard us more as a strategic partner with flexibility to work across a spectrum of clients -MNCs to start-ups. We also have a consistent client retention rate of 90%.

#strategicpartnership #clientele #USA #Europe #Japan

3/5

#strategicpartnership #clientele #USA #Europe #Japan

3/5

#Syngene - Thread⚡️

An integrated service provider offering end-to-end drug discovery, development, and manufacturing services on a single platform.

25+ years of unparalleled experience

@unseenvalue @AvadhMaheshwar2 @caniravkaria @Jitendra_stock @saketreddy @itsTarH

An integrated service provider offering end-to-end drug discovery, development, and manufacturing services on a single platform.

25+ years of unparalleled experience

@unseenvalue @AvadhMaheshwar2 @caniravkaria @Jitendra_stock @saketreddy @itsTarH

(2/n)

Syngene, a subsidiary of Biocon Ltd, was established in 1993 as India’s first Contract Research Organization.

CRO is a company that provides support to the pharma industry in the form of research services outsourced on a contract basis. CROs are designed to reduce costs.

Syngene, a subsidiary of Biocon Ltd, was established in 1993 as India’s first Contract Research Organization.

CRO is a company that provides support to the pharma industry in the form of research services outsourced on a contract basis. CROs are designed to reduce costs.

#Syngene 🧬 Way Forward:

The year ahead offers positive prospects reflecting the strong fundamentals of the global biopharmaceutical industry against a backdrop of potential further disruption due to the second wave of the pandemic.

The year ahead offers positive prospects reflecting the strong fundamentals of the global biopharmaceutical industry against a backdrop of potential further disruption due to the second wave of the pandemic.

1. The extension of our strategic collaboration with Bristol Myers Squibb until 2030 will provide scope for new areas of R&D within that relationship.

2. We have initiated multiple expansion and capability-building initiatives. The phase-III expansion of the Hyderabad laboratory is ongoing and will offer capacity for an additional 300 scientists.

My core portfolio and business tracking thread...

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

IT Service oriented

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

Platform

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

@SyngeneIntl #Syngene #Q3marketupdates

Q3fy21/20 in mn

Rev 5845 /5191

Ebidta 1933 /1735

PAT 1022 /918

9months fy21 /20

Rev 15257/14046

Ebidta 5026/4749

PAT 2443 /2460

Q3fy20 had exceptional gain of 459 mn leading to higher PAT

Good show

High conviction bet

Doubler for me

Q3fy21/20 in mn

Rev 5845 /5191

Ebidta 1933 /1735

PAT 1022 /918

9months fy21 /20

Rev 15257/14046

Ebidta 5026/4749

PAT 2443 /2460

Q3fy20 had exceptional gain of 459 mn leading to higher PAT

Good show

High conviction bet

Doubler for me

#Q3investorpresentations

Collaborated Deerfield discovery & development 3DC to advance integrated drug discovery projects, early target validation to preclinical evaluation

Expanded research facility Genome valley Hyderabad, +90 scientist

Accreditatn NABL fr medical devices

Collaborated Deerfield discovery & development 3DC to advance integrated drug discovery projects, early target validation to preclinical evaluation

Expanded research facility Genome valley Hyderabad, +90 scientist

Accreditatn NABL fr medical devices

Setup new RT-PCR testing facility approved by NABL & ICMR

360clients

20395 mn Rev Fy20

8 Collaborations with top 10 pharma companies

4200 + scientists

3662 mn PAT fy20

400+ patents ( held with clients )

31541 mn capex Mar 20

Integrated services- drug discovery,development,mfg

360clients

20395 mn Rev Fy20

8 Collaborations with top 10 pharma companies

4200 + scientists

3662 mn PAT fy20

400+ patents ( held with clients )

31541 mn capex Mar 20

Integrated services- drug discovery,development,mfg

Below are few gems in #Indianpharma space…I own #Lauruslabs #Suvenpharma and #Suvenlife..

#Suvenpharma – NCE CRAMS – top end segment in CRAMs

#Suvenlife – Pure play CNS R&D – CNS is most difficult but largest market share in pharma

#Lauruslabs – process Innovation

1/3

#Suvenpharma – NCE CRAMS – top end segment in CRAMs

#Suvenlife – Pure play CNS R&D – CNS is most difficult but largest market share in pharma

#Lauruslabs – process Innovation

1/3

#Thread of the top 3 stocks, sector wise

Industrial Conglomerate

#Siemens

#3M

#Godrej

Pharma

#Caplin

#Granules

#Natco

Electronics

#Dixon

#Amber

#Honeywell

(1/n)

.@dmuthuk .@Arunstockguru .@AnyBodyCanFly .@FI_InvestIndia .@Gautam__Baid .@contrarianEPS .@AswathDamodaran

Industrial Conglomerate

#Siemens

#3M

#Godrej

Pharma

#Caplin

#Granules

#Natco

Electronics

#Dixon

#Amber

#Honeywell

(1/n)

.@dmuthuk .@Arunstockguru .@AnyBodyCanFly .@FI_InvestIndia .@Gautam__Baid .@contrarianEPS .@AswathDamodaran

Health care

#Lalpath

#Kovai

#Narayanahru

Auto

#Eicher

#Maruti

#Hero / #Bajaj / #Escorts (#Tractor)

Auto parts

#Minda

#Motherson

#Subros / #Fiem

Communication & networking

#Sterlite

#Dlink

#Tejas

Chemicals (huge options)

#Kanchikarp

#Kilpest

#Bodal

(2/n)

.@ipo_mantra

#Lalpath

#Kovai

#Narayanahru

Auto

#Eicher

#Maruti

#Hero / #Bajaj / #Escorts (#Tractor)

Auto parts

#Minda

#Motherson

#Subros / #Fiem

Communication & networking

#Sterlite

#Dlink

#Tejas

Chemicals (huge options)

#Kanchikarp

#Kilpest

#Bodal

(2/n)

.@ipo_mantra

Biotech

#Syngene

#Eris

#Vivobio

Transport

#IRCTC

#Interglobe

Real estate

#Sunteck

#Nesco

#Oberoi

Logistics

#Allcargo

#TCI

#Mahindralog

Banking & related

#Creditaccess

#Bajajfinance

#Hdfcbank / #Kotak

Food

#ZYDUSWELLNESS

#Avanti

#Hindfoods

(3/n)

.@VJ_Rabindranath

#Syngene

#Eris

#Vivobio

Transport

#IRCTC

#Interglobe

Real estate

#Sunteck

#Nesco

#Oberoi

Logistics

#Allcargo

#TCI

#Mahindralog

Banking & related

#Creditaccess

#Bajajfinance

#Hdfcbank / #Kotak

Food

#ZYDUSWELLNESS

#Avanti

#Hindfoods

(3/n)

.@VJ_Rabindranath

Superb day for Syngene as well. Very high volume breakout, closed up 5.5%