Discover and read the best of Twitter Threads about #Bhel

Most recents (11)

#HAL- From 64 to 130 🚀

#Cummins- From 36 to 66 🚀

#Ipcalab- 21 to 25 🔥2nd target hit till now

#Bhel- 1.95 to 2.2 🔥

#OberoiReality- 17 to 24.5 🎯1st target hit till now

Another great day for us.

All trades were shared in our FREE TELEGRAM CHANNEL: t.me/thetradingcirc…

#Cummins- From 36 to 66 🚀

#Ipcalab- 21 to 25 🔥2nd target hit till now

#Bhel- 1.95 to 2.2 🔥

#OberoiReality- 17 to 24.5 🎯1st target hit till now

Another great day for us.

All trades were shared in our FREE TELEGRAM CHANNEL: t.me/thetradingcirc…

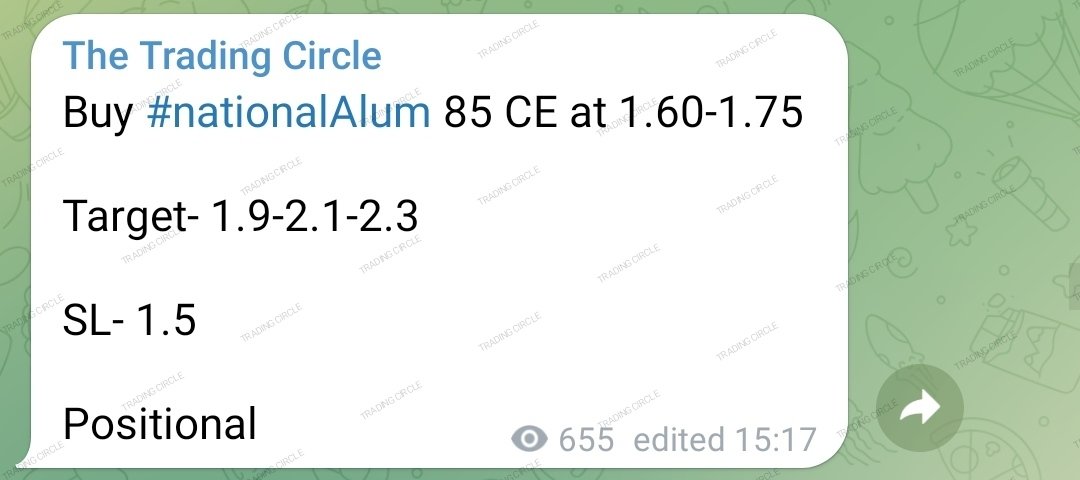

#NationalAlum- SL hit as open gap down.

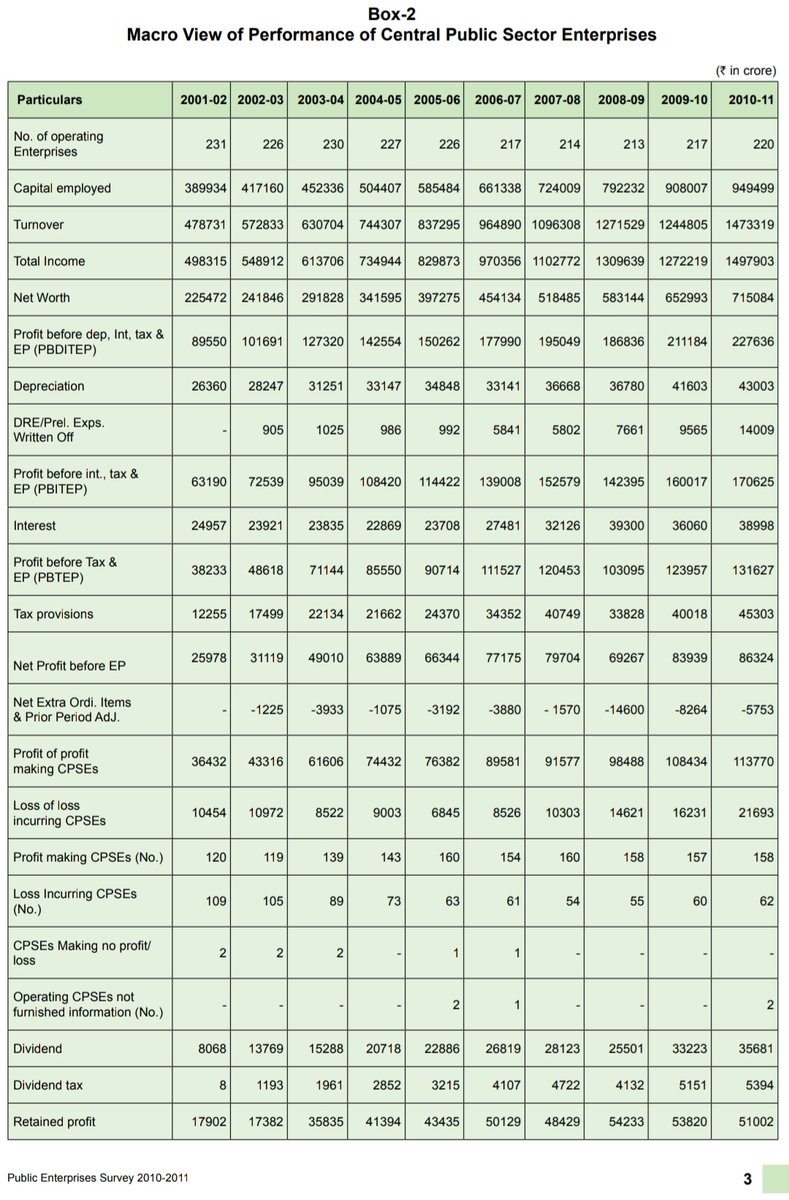

Central Public Sector Enterprises (CPSEs) as on 31.03.2021 (2020-21)

" 255 operational CPSE

Total turnover - Rs 24,26,045 crore

Total profit of 177 CPSE - Rs 1,89,320 crore

(The total profit of profit making CPSEs has increased by 37.53%)

#மத்திய_அரசு_பொதுத்துறை_நிறுவனங்கள்

" 255 operational CPSE

Total turnover - Rs 24,26,045 crore

Total profit of 177 CPSE - Rs 1,89,320 crore

(The total profit of profit making CPSEs has increased by 37.53%)

#மத்திய_அரசு_பொதுத்துறை_நிறுவனங்கள்

The Heikin Ashi Trading Strategy !

A thread for Swing and Positional Traders who love Reversals !

Retweet And Share 🔄

@kuttrapali26 @AmitabhJha3

A thread for Swing and Positional Traders who love Reversals !

Retweet And Share 🔄

@kuttrapali26 @AmitabhJha3

What is Heikin Ashi ?

Go through this Tweet for complete understanding

1/n

Go through this Tweet for complete understanding

1/n

Tools used

1. HeikinAshi charts

2. 200 ema (black)for Dynamic support and reversal point

3. 21 ema(red) for trailing stop loss

4. Volumes

5. Your own confirmations and modification

2/n

1. HeikinAshi charts

2. 200 ema (black)for Dynamic support and reversal point

3. 21 ema(red) for trailing stop loss

4. Volumes

5. Your own confirmations and modification

2/n

ULTIMATE GUIDE TO 21 and 200 Moving Average

SUNDAY THREAD 🔖

A trend Following System That will Help You Improve Trading immensely.

RETWEET AND SHARE 🔄

@kuttrapali26 @AmitabhJha3

#stocks #StockMarket

1/n

SUNDAY THREAD 🔖

A trend Following System That will Help You Improve Trading immensely.

RETWEET AND SHARE 🔄

@kuttrapali26 @AmitabhJha3

#stocks #StockMarket

1/n

Moving averages

EMA and SMA

1. Exponential Moving Average (EMA) is similar to Simple Moving Average (SMA), measuring trend direction over a period of time.

2. However, whereas SMA simply calculates an average of price data, EMA applies more weight to data that is more current

2/

EMA and SMA

1. Exponential Moving Average (EMA) is similar to Simple Moving Average (SMA), measuring trend direction over a period of time.

2. However, whereas SMA simply calculates an average of price data, EMA applies more weight to data that is more current

2/

21 EMA : SHORT TERM TREND

1. Calculates the Average Price of past 21 days

2. A stock above 21 ema is in strong momentum , which will give pullbacks to 21 ema again and again.

3. Stock above 21 ema should never be shorted so as to stay with the trend

3/n

1. Calculates the Average Price of past 21 days

2. A stock above 21 ema is in strong momentum , which will give pullbacks to 21 ema again and again.

3. Stock above 21 ema should never be shorted so as to stay with the trend

3/n

𝗕𝗛𝗘𝗟 𝗱𝗲𝘃𝗲𝗹𝗼𝗽𝘀 𝘀𝘁𝗮𝘁𝗲-𝗼𝗳-𝘁𝗵𝗲-𝗮𝗿𝘁 𝗔𝗶𝗿 𝗣𝗼𝗹𝗹𝘂𝘁𝗶𝗼𝗻 𝗖𝗼𝗻𝘁𝗿𝗼𝗹 𝗧𝗼𝘄𝗲𝗿

To deal with the problem of rising air pollution in urban areas, #BHEL has indigenously designed and developed a state-of-the-art Air Pollution Control Tower (APCT).

To deal with the problem of rising air pollution in urban areas, #BHEL has indigenously designed and developed a state-of-the-art Air Pollution Control Tower (APCT).

The first such APCT is being installed in Noida on a trial basis by BHEL, in association with the Noida Authority. The tower will improve the quality of air in an area of approximately 1 sq. km. around the its installation.

BHEL will work hand in hand with the Noida Authority in the fight against pollution in this area for improving the health of local residents, office-goers and visitors.

🌟Looking forward to #MuhuratTrading?

🙌Check out this thread to see what #Trinkerr Experts chose as their top #DIWALIPICKS! ✨

#StockMarket #stocks

🙌Check out this thread to see what #Trinkerr Experts chose as their top #DIWALIPICKS! ✨

#StockMarket #stocks

✨@MoneyMystery's #DIWALIPICKS for #MuhuratTrading🎁

🌟#InoxLeisure

💫Checkout his complete #Trinkerr portfolio: trin.kr/RwuX

🌟#InoxLeisure

💫Checkout his complete #Trinkerr portfolio: trin.kr/RwuX

✨ @MarketScientist's #DIWALIPICKS for #MuhuratTrading🎁

🌟#ACE

🌟#Borosil

🌟#JBMGroup

🌟#GNFC

🌟#westlife

🌟#AssociatedBreweries

💫Checkout his complete #Trinkerr portfolio: trin.kr/pwiC

🌟#ACE

🌟#Borosil

🌟#JBMGroup

🌟#GNFC

🌟#westlife

🌟#AssociatedBreweries

💫Checkout his complete #Trinkerr portfolio: trin.kr/pwiC

Reason & Psychology Behind my trade #BHEL

~ I saw rounding bottom pattern formation in Daily chart as well as various base formation on weekly chart.

~ Generally, I initiate buy trade after I expect 3rd base formation on weekly chart.

~ I saw rounding bottom pattern formation in Daily chart as well as various base formation on weekly chart.

~ Generally, I initiate buy trade after I expect 3rd base formation on weekly chart.

The advantage of rounding bottom or big base formation is that we can capture the trend 10% to 15% early i.e before breakout

Sometimes risk to reward ratio is far more important than accuracy

I expect these rounding bottom or big base formation may later convert into an uptrend

Sometimes risk to reward ratio is far more important than accuracy

I expect these rounding bottom or big base formation may later convert into an uptrend

~ I have the right to go wrong if goes wrong SL is there to take care of it.

~ I take low of the rounding bottom or big formation as SL on the closing basis.

~ My accuracy is 60% to 65% of this set-up but risk to reward ratio is very high.

~ I take low of the rounding bottom or big formation as SL on the closing basis.

~ My accuracy is 60% to 65% of this set-up but risk to reward ratio is very high.

#Intimation #Concall

12Jun20

#HINDALCO: rmls.co/4y61lk

#IIFLWAM: rmls.co/pjkGqr

#KNRCON: rmls.co/PVM3ol

#DWARKESH: rmls.co/j9nXPl

#SHRIRAMCIT: rmls.co/9EpYVJ

#AFFLE: rmls.co/J971wy

12Jun20

#HINDALCO: rmls.co/4y61lk

#IIFLWAM: rmls.co/pjkGqr

#KNRCON: rmls.co/PVM3ol

#DWARKESH: rmls.co/j9nXPl

#SHRIRAMCIT: rmls.co/9EpYVJ

#AFFLE: rmls.co/J971wy

#Intimation #Concall

12Jun20(contd)

#JSLIIISAR: rmls.co/1vBkVV

#KIRLOSIND: rmls.co/qkDgy3

#KIRLFER: rmls.co/VVl6o9

#JSL: rmls.co/8DB9zl

13Jun20

#GRASIM: rmls.co/8DXnjm

#BHEL: rmls.co/0r297N

12Jun20(contd)

#JSLIIISAR: rmls.co/1vBkVV

#KIRLOSIND: rmls.co/qkDgy3

#KIRLFER: rmls.co/VVl6o9

#JSL: rmls.co/8DB9zl

13Jun20

#GRASIM: rmls.co/8DXnjm

#BHEL: rmls.co/0r297N

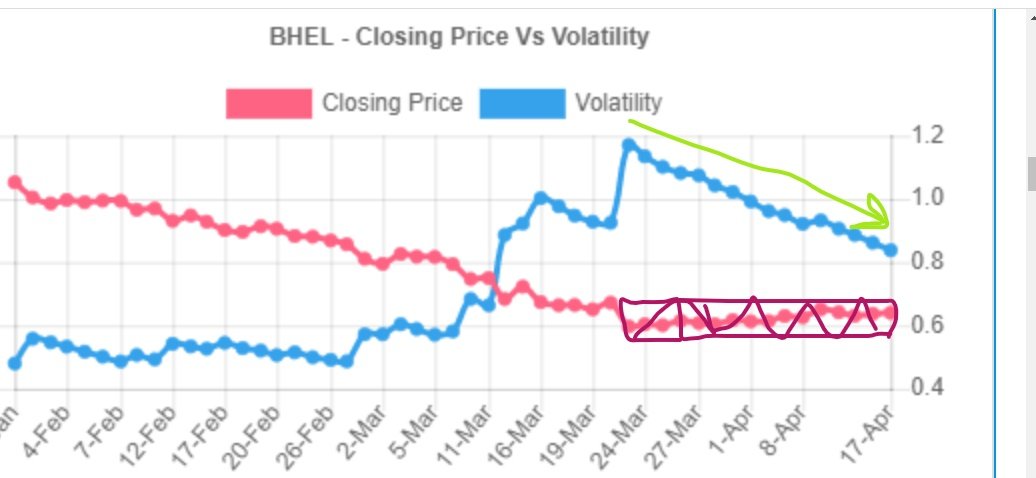

Few observations on #Accumulation pattern in #BHEL

Interesting to see how multiple things add up when price is near inflection point of new breakout. Lets see how it goes.

Interesting to see how multiple things add up when price is near inflection point of new breakout. Lets see how it goes.

Updated chart of #BHEL .... The current pattern do not look like the one made during Sep-Oct 2019. The current move has much more accumulation signals than before. However, now the negation point is 30 SMA. (in previous upmove stock tested 200 SMA.. that probability is high now)

#BHEL #FNO #PSU #STOCKSTUDY #STOCKANALYSIS

It's wonderful Bullish set up.😀

*** Volume, Traded Value & Delivery%...... Up.

*** Consolidation for more than month in a Narrow range.

It's wonderful Bullish set up.😀

*** Volume, Traded Value & Delivery%...... Up.

*** Consolidation for more than month in a Narrow range.

#BHEL now forming a reverse AB=CD pattern. @JainSumeetS @purohitjay @entrepreneur987 @ap_pune Reversal above 183.60