Discover and read the best of Twitter Threads about #Cryptotraders

Most recents (11)

Are we heading toward a Bull Run?🐮

After the continued bear market of 2022, the investor sentiment is that the #crypto industry is entering the bull run in 2023.

In today's 🧵, we explore strategies that traders can make a profit from crypto trading in the bull market.

After the continued bear market of 2022, the investor sentiment is that the #crypto industry is entering the bull run in 2023.

In today's 🧵, we explore strategies that traders can make a profit from crypto trading in the bull market.

2/ Bull Run: The price of an asset generally increases, typically for several weeks or months. Traders expect prices to continue to rise & increase in value for the foreseeable future. 📈 This can be an exciting time for investors if they exit before prices start to decline.

3/ ➡️Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals to benefit from market volatility & accumulate assets over time. It spreads out risk, allowing traders to benefit from the bull market without taking on too much risk.

One of the crucial trading practices that experienced traders vouch for is maintaining a trading journal ✍️

In today's 🧵, we explore what a trading journal is and how it helps #traders to stay disciplined and organized.

#TradingJournal #cryptofutures

In today's 🧵, we explore what a trading journal is and how it helps #traders to stay disciplined and organized.

#TradingJournal #cryptofutures

2/ It is important for any trader to have a trading journal to review their trades & identify what works and what doesn't. The planning of futures trades, documentation of existing positions, and recording of emotions are all important aspects of a successful trading strategy.

3/ Components of a trading journal include risk management, trade analysis, trade execution, and strategy execution. By tracking these components, you can get a better understanding of how your strategy is performing. 📈

#cryptotraders

#cryptotraders

Sniff out #CryptoTrading opportunities on #Polygon

Include

- Best-performed tokens in the last 3 days

- What tokens traders bought in 24h

- Top Liquidity added tokens in 24h

(1/4) A short thread🧵

#PolygonNetwork #PolygonGems #MATIC #TradingSignals #Cryptotraders #Altcoins

Include

- Best-performed tokens in the last 3 days

- What tokens traders bought in 24h

- Top Liquidity added tokens in 24h

(1/4) A short thread🧵

#PolygonNetwork #PolygonGems #MATIC #TradingSignals #Cryptotraders #Altcoins

(2/4)

$ROND #ROND is the top 1 gainer on #Polygon, surging 540.70% in 3 days.

$GOVI #CVI rebounded 35.02%.

$SD #Stader ranks #3, +32.58%.

Quick access to ROND indicators👇

bit.ly/ROND-Trading-S…

$ROND #ROND is the top 1 gainer on #Polygon, surging 540.70% in 3 days.

$GOVI #CVI rebounded 35.02%.

$SD #Stader ranks #3, +32.58%.

Quick access to ROND indicators👇

bit.ly/ROND-Trading-S…

(3/4)

A positive Net Buy Value represents stronger buying than selling on DEXs.

Top Net Buy $ Tokens on #Polygon (24h)

$XSGD $303K

$TEL $31.3K

$AAVE $27.2K

$RBW $26.2K

$LDO $26K

$SD $22.3K

$ROND $17.8K

$BAL $16.7K

$GOVI $15.5K

Top 5-mins Net Buy Tokens

bit.ly/Top-Net-Buy-Po…

A positive Net Buy Value represents stronger buying than selling on DEXs.

Top Net Buy $ Tokens on #Polygon (24h)

$XSGD $303K

$TEL $31.3K

$AAVE $27.2K

$RBW $26.2K

$LDO $26K

$SD $22.3K

$ROND $17.8K

$BAL $16.7K

$GOVI $15.5K

Top 5-mins Net Buy Tokens

bit.ly/Top-Net-Buy-Po…

Bringing you today's #DemexSignals

📉 Bear Trade Idea - $ETH / $USD

💡 Rationale: The previous unemployment rate and CPI showed that the job market remains strong and inflation is still hot, which likely means the Feds will continue to be adamant about rate hikes.

Read on. 👇🏻

📉 Bear Trade Idea - $ETH / $USD

💡 Rationale: The previous unemployment rate and CPI showed that the job market remains strong and inflation is still hot, which likely means the Feds will continue to be adamant about rate hikes.

Read on. 👇🏻

With NASDAQ and SPX making new lows, the overall macro trend remains bearish and crypto is likely to follow the downtrend for now with the occasional rallies. With winter coming and inflation possibly increasing, it is possible that recession occurs and the market goes...

...further risk-off, sending ETH back to $1250 or towards $1000 or below.

Bringing you today's #DemexSignals

📈 Bull Trade Idea - $ETH / $USD

💡 Rationale: ETH has again bounced off its $1250 support level and is trading above $1300.

Read on. 👇🏻

📈 Bull Trade Idea - $ETH / $USD

💡 Rationale: ETH has again bounced off its $1250 support level and is trading above $1300.

Read on. 👇🏻

With record levels of puts and shorts, we may see a short squeeze and strong rally towards the mid-term elections on 8 November. The CPI inflation read on 13 October was neutral on the YoY but slightly higher than expected on the MoM, creating a bearish bias that has since...

...been absorbed, signalling strength in ETH and a break towards $1380 is next.

Bringing you today's #DemexSignals

Bear Trade Idea - $ETH / $USD

💡 Rationale: The previous unemployment rate showed that the job market remains strong, which likely means that the Feds will continue to being adamant about rate hikes.

Read on. 👇🏻

Bear Trade Idea - $ETH / $USD

💡 Rationale: The previous unemployment rate showed that the job market remains strong, which likely means that the Feds will continue to being adamant about rate hikes.

Read on. 👇🏻

With NASDAQ and SPX making new lows, the overall macro trend remains bearish and crypto is likely to follow the downtrend for now with the occasional rallies. The upcoming CPI read on 13th October will determine where the market will move next. If inflation remains high...

..., it is possible that ETH exits this range and breaks below the support towards $1000.

Bringing you today's #DemexSignals

Bull Trade Idea - $ETH / $USD

💡 Rationale: ETH is now back at key support around $1250. Although macro markets took a tumble with the announcement of the unemployment rate...

Read on. 👇🏻

Bull Trade Idea - $ETH / $USD

💡 Rationale: ETH is now back at key support around $1250. Although macro markets took a tumble with the announcement of the unemployment rate...

Read on. 👇🏻

..., a bullish divergence is being formed and with record levels of puts and shorts, we may see a short squeeze and strong rally towards the mid-term elections on 8 November.

The CPI inflation read on 13 October will determine where the market goes next, if inflation is lower than expected, it could be the start of another bear market rally.

1/ 🏃🏼♂️Perpetuals Trading Competitions are LIVE from NOW, till 31st Oct, 8AM UTC🏃🏼♂️

⚡️#TopGainers: Compete for the highest profit & loss % ranking

⚡️#TopTraders: Compete for the highest trading volume ranking.

Start trading now!

app.dem.exchange/trade/ETH-PERP

app.dem.exchange/trade/BTC-PERP

⚡️#TopGainers: Compete for the highest profit & loss % ranking

⚡️#TopTraders: Compete for the highest trading volume ranking.

Start trading now!

app.dem.exchange/trade/ETH-PERP

app.dem.exchange/trade/BTC-PERP

Read the rules for #TopGainers: guide.dem.exchange/competition/pe…

Read the rules for #TopTraders: guide.dem.exchange/competition/pe…

Read the rules for #TopTraders: guide.dem.exchange/competition/pe…

🏃🏼♂️ 3 hours to go for the competitions! 🏃🏼♂️

In order to be eligible for the Top Gainers Competition, you must have a minimum initial equity of 500 USDC at the start time.

Head to app.dem.exchange/competition to deposit now, or ensure you have a minimum available balance of 500 USDC.

In order to be eligible for the Top Gainers Competition, you must have a minimum initial equity of 500 USDC at the start time.

Head to app.dem.exchange/competition to deposit now, or ensure you have a minimum available balance of 500 USDC.

Reasons why Demex is the Perp-fect DEX for trading perpetuals. 🦾

We’re not kidding when we say that our perpetuals market is the best in the DeFi space, and our trading competition is a great way for you to test it out.

We’re not kidding when we say that our perpetuals market is the best in the DeFi space, and our trading competition is a great way for you to test it out.

Compete and win from a prize pool of 4000 USDC in our upcoming perpetuals trading competitions running from the 10th to the 31st of October.

Ensure you are eligible to participate! Head over to app.dem.exchange/competition and deposit 500 USDC before the competition start time if you wish to participate in the #TopGainers Competition. 🏃🏼♂️

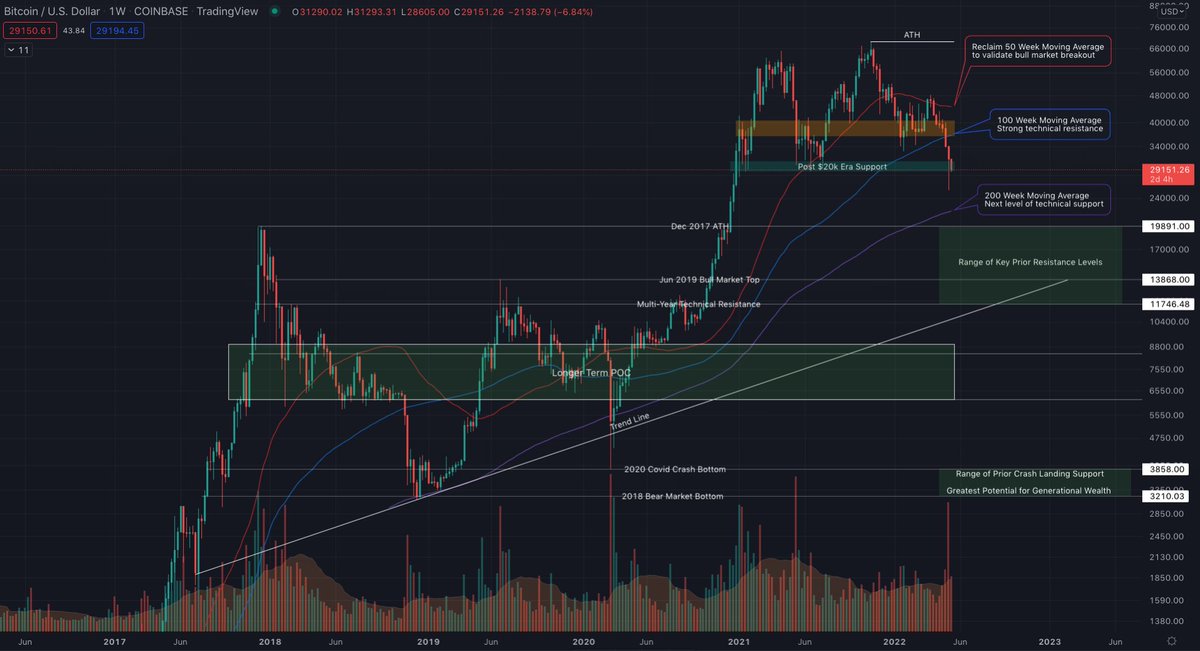

1/ Bear markets are notorious for brutal fakeouts, which is why it's critical to identify targets and invalidations.

Here are key levels to watch in both directions.📉📈

#BTC analysis 🧵

#NFA

More from Material Indicators here... mi1.pw/mitwmay

Here are key levels to watch in both directions.📉📈

#BTC analysis 🧵

#NFA

More from Material Indicators here... mi1.pw/mitwmay

2/In bear markets everyone is looking for a relief rally to exit or add short. Those are good strategies if you can tell the difference between a fakeout and a breakout. #FOMO + failure to identify invalidation levels are why so many people get rekt. #BullTrap #ShortSqueeze

3/ Identifying targets is easy. Determining breakout or fakeout is more challenging, and while there are no sure things, there are some things we can look at to help mitigate risk of getting trapped. To get some perspective, let's start with an ultra wide macro view of #BTC