Discover and read the best of Twitter Threads about #FTSE100

Most recents (12)

Morning update:

Yesterday, we got a lot of important economic data and ever since the release, many analysts are wondering what happened. The data we good was far from expectations and is signaling that the #economy is very strong🤔

Yesterday, we got a lot of important economic data and ever since the release, many analysts are wondering what happened. The data we good was far from expectations and is signaling that the #economy is very strong🤔

According to the reported data, #unemployment dropped to 3,4%, the lowest since 1969. Meanwhile, big corporations continue to lay off thousands of employees😂

Recent layoffs:

Amazon: 18,000

Google: 12,000

Sales Force: 8,000

IBM: 3,900

Goldman Sachs: 3,200

SAP: 2,800

3M: 2,500

Pay Pal: 2,000

Wayfair 1,750

Kraken: 1,200

Coinbase: 950

Spotify: 600

Hubspot: 500

And those are just some that we can think of😉 #layoffs2023

Amazon: 18,000

Google: 12,000

Sales Force: 8,000

IBM: 3,900

Goldman Sachs: 3,200

SAP: 2,800

3M: 2,500

Pay Pal: 2,000

Wayfair 1,750

Kraken: 1,200

Coinbase: 950

Spotify: 600

Hubspot: 500

And those are just some that we can think of😉 #layoffs2023

2/6 If a company (or any employer) has a top-to-bottom pay ratio of 100:1, then it values those who work for them on minimum wage (whether outsourced or not) at 1% of the CEO or highest paid employee. #Max12to1

3/6 People might argue that you can’t compare, say, a CEO to an outsourced cleaner because, technically, the cleaner is employed by the outsourcer. But we think if anyone works in the business and breathes the same air as the bosses, they should be counted. #Max12to1

European big indices;

Thread 👇🏻🧵

$FTSE $IBEX $CAC $MIB

Thread 👇🏻🧵

$FTSE $IBEX $CAC $MIB

We shared this last week;

"+ As you can see gray box send rejected again.

+ Now orange box might be support."

We stick to our previous analysis.

Charts don't provide investment advice and targets. Its for study. $FTSE #FTSE100 $LSE #StockMarket

"+ As you can see gray box send rejected again.

+ Now orange box might be support."

We stick to our previous analysis.

Charts don't provide investment advice and targets. Its for study. $FTSE #FTSE100 $LSE #StockMarket

+ The downward trend continues.

+ It is not correct to accept that the rise has begun until the red line is crossed.

+ It is in a state of rejection from the upper channel.

Charts don't provide investment advice and targets. Its for study.

$IBEX #IBEX35 $BME #StockMarket

+ It is not correct to accept that the rise has begun until the red line is crossed.

+ It is in a state of rejection from the upper channel.

Charts don't provide investment advice and targets. Its for study.

$IBEX #IBEX35 $BME #StockMarket

Today is #WorldPopulationDay, which reminds us that while #ElonMusk is determined to contribute to increasing the population, he has also managed to upset the existing one, by backing out of the Twitter deal. Good thing that the markets were more stable, than Musk’s mood. 1/7

Talking about the “impending recession” seems to be the trend. So, it was a surprise last week, when both the #Sensex & the #Nifty went ↑ by almost 3%. Potential reasons? Maybe the cooldown in the prices of #commodities. This helps sectors like #Auto, #Realty, & #FMCG. 2/7

So naturally, both the #NiftyFMCG & #NiftyRealty were ↑ over 5%. #NiftyAuto was also ↑ 3.5%. In fact, every sectoral index was painting the town green. Global indices were also mostly up. The S&P 500 was ↑ 1.94% & the #NASDAQ100 ↑ by 4.6%. 3/7

#Nasdaq futures down 0.85%;

#Dowjones futures down 1.3%;

S&P500 futures down 1%.

#US #futures #stockmarketnews

#Dowjones futures down 1.3%;

S&P500 futures down 1%.

#US #futures #stockmarketnews

Credit Suisse 1/6: Key #StockMarket Themes:

#SP500 strength has extended to the top of its multi-year channel at 4125/30, with the market now seen moving into typical “extreme” territory. Our bias though is for the rally to extend further yet to our Q2 objective at 4200,

#SP500 strength has extended to the top of its multi-year channel at 4125/30, with the market now seen moving into typical “extreme” territory. Our bias though is for the rally to extend further yet to our Q2 objective at 4200,

Credit Suisse 2/6: where we would then be highly alert to signs of a potential top and correction/consolidation.

#Nasdaq100 is not unsurprisingly seeing a pause at its 13880 record high but with a bullish “outside day” & “head & shoulders” base in place we continue to look for a

#Nasdaq100 is not unsurprisingly seeing a pause at its 13880 record high but with a bullish “outside day” & “head & shoulders” base in place we continue to look for a

Credit Suisse 3/6: break to a new record high for a move to our 14000/10 long-held “measured triangle” objective, then our 14380 new revised higher objective.

#Russell2000 continues to struggle though & we remain of the view may be seeing the formation of a “right-hand shoulder”

#Russell2000 continues to struggle though & we remain of the view may be seeing the formation of a “right-hand shoulder”

Credit Suisse 1/5: Key #StockMarket Themes:

The #SP500 rally has extended to our long-held 3900 “measured triangle objective”. With further layers of resistance seen here and stretching up to 3930 our “ideal” base case remains for a cap in this 3900/3930 zone and

The #SP500 rally has extended to our long-held 3900 “measured triangle objective”. With further layers of resistance seen here and stretching up to 3930 our “ideal” base case remains for a cap in this 3900/3930 zone and

Credit Suisse 2/5: for a consolidation/correction phase to then unfold. Big picture though, even if some consolidation is seen we will continue to view this as a temporary pause ahead of a clear break above 3930 in due course.

#Nasdaq100 stays seen on course for our “measured

#Nasdaq100 stays seen on course for our “measured

CS 3/5: triangle objective” at 14000/10.

#Russell2000 has surged sharply higher again & we stay bullish for 2320/34.

#EuroStoxx50 maintains a bullish continuation pattern and we stay bullish for the “pandemic” price gap from last Feb, seen starting at 3762 & stretching up to 3800

#Russell2000 has surged sharply higher again & we stay bullish for 2320/34.

#EuroStoxx50 maintains a bullish continuation pattern and we stay bullish for the “pandemic” price gap from last Feb, seen starting at 3762 & stretching up to 3800

Credit Suisse 1/6: #StockMarket Key Themes:

#Nasdaq100 spotlight remains on the top of its trend channel from last summer, today at 13660 an eventual move above can see “measured triangle objective” at 14000/10.

#Russell2000 has surged sharply higher again and with bond yields

#Nasdaq100 spotlight remains on the top of its trend channel from last summer, today at 13660 an eventual move above can see “measured triangle objective” at 14000/10.

#Russell2000 has surged sharply higher again and with bond yields

CS 2/6: expected to rise further we stay bullish on an outright & relative basis for 2273/77 & eventually 2320/34.

#EuroStoxx50 maintains a bullish continuation pattern & we stay bullish for the “pandemic” price gap from last Feb, seen starting at 3762 & stretching up to 3800.

#EuroStoxx50 maintains a bullish continuation pattern & we stay bullish for the “pandemic” price gap from last Feb, seen starting at 3762 & stretching up to 3800.

Credit Suisse 3/6: #FTSE100 needs to clear 6573 to inject near-term upward momentum.

#Nikkei225 has broken above the 28980/29000 consolidation highs and we stay bullish with our core objective seen at 32115/20.

#ShanghaiComp is still holding our target in the 3466/47 zone and

#Nikkei225 has broken above the 28980/29000 consolidation highs and we stay bullish with our core objective seen at 32115/20.

#ShanghaiComp is still holding our target in the 3466/47 zone and

Still think Brexit's a good idea? Pension funds are evaporating rapidly as the FTSE crashes into bear market territory...

Yet we are alone in the whole world in having a second mega-disruptive event queued up for 1 January 2021, when the Brexit transition period ends! #ftse100

Yet we are alone in the whole world in having a second mega-disruptive event queued up for 1 January 2021, when the Brexit transition period ends! #ftse100

If Boris Johnson and his wreckers had 1/10,000th the brains of Winnie the Pooh, they'd be on the phone to the EU already to request a transition period extension. Then focus on beating the coronavirus and rebuilding the economy, and circle around to Brexit again *next year*.

Added, for the hard of comprehension...

1) Yes, coronavirus is global.

2) Yes, global financial crisis is global.

3) But Brexit is local.

It's all cumulative.

The whole world is suffering 1 and 2. We are the only ones inflicting 3 on ourselves.

Given 1 & 2, let's delay 3!

1) Yes, coronavirus is global.

2) Yes, global financial crisis is global.

3) But Brexit is local.

It's all cumulative.

The whole world is suffering 1 and 2. We are the only ones inflicting 3 on ourselves.

Given 1 & 2, let's delay 3!

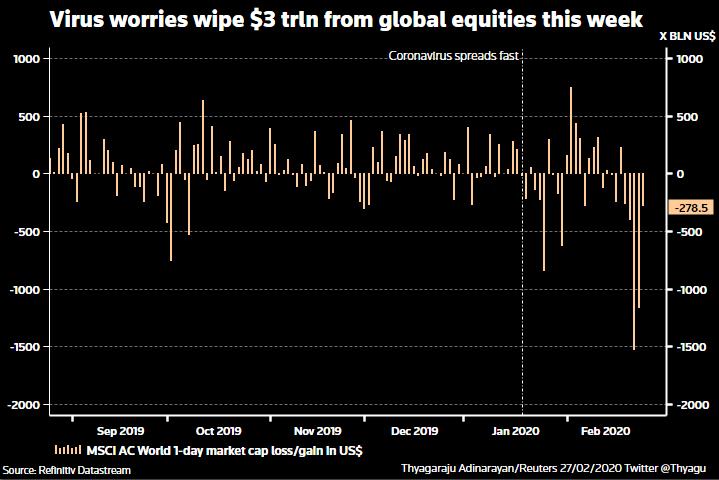

Stocks resumed their plunge, wiping out more than $3 trillion in value this week alone, and U.S. Treasuries yields hit record lows on Thursday (27/2) as the #coronavirus spread faster outside China and investors fled to safe havens. #DataNow

More #DataNow:

🔹Global equities have now fallen for six straight days.

🔹Spot #gold rose 0.5% to $1,649 per ounce and #silver gained 1% to $18.03 an ounce.

🔹Gold hit a 7-year high at near $1,688 per ounce on Mon (24/2)

reuters.com/article/us-glo…

🔹Global equities have now fallen for six straight days.

🔹Spot #gold rose 0.5% to $1,649 per ounce and #silver gained 1% to $18.03 an ounce.

🔹Gold hit a 7-year high at near $1,688 per ounce on Mon (24/2)

reuters.com/article/us-glo…

#Oil prices slide for fifth day to lowest in a year as #coronavirus fears grow. #Brent crude was down $2.29, or 4.3%, at $51.14 a barrel at 10:31 a.m. ET/ 1531 GMT on Thurs 27/2 - just off the session low of $51.13 a barrel. #COVIDー19 #DataNow reut.rs/2I2baAQ

The #UKGovernment #Torture Report Part 5 - The #EE & #UKMail Frame Up

@10DowningStreet @Number10press @conservatives

@EE #BBCNews #DailyMail #ThisMorning #RoyalFamily #Skynews #Channel4 #UKGovernment

@10DowningStreet @Number10press @conservatives

@EE #BBCNews #DailyMail #ThisMorning #RoyalFamily #Skynews #Channel4 #UKGovernment

After the #MetPolice tried & failed to frame me & after ex #MetPoliceUK turned private investigators @Surelock_ tried & failed to frame me & my mum, attempt number 3 was #EE & #UKMail. I had never used @EE but they made me their customer

#SwitchtoO2 #o2 #Vodafone #Three #LBC

#SwitchtoO2 #o2 #Vodafone #Three #LBC

Update on #FTSE100 chart.

Richard W. Schabacker in his Book "Technical Analysis and Stock Market Profits" calls this pattern an INVERTED TRIANGLE.

Richard W. Schabacker in his Book "Technical Analysis and Stock Market Profits" calls this pattern an INVERTED TRIANGLE.

#FTSE100 is getting jittery near previous resistance levels.