Discover and read the best of Twitter Threads about #IDFCFIRSTBank

Most recents (12)

let me post some 100 #fibbonaci number wonders on long term chart.

Post your chart too with #fibbonaci, make sure chart is clean.

Post your chart too with #fibbonaci, make sure chart is clean.

this is number 1 in list

#ibrealestate

in 2021 it was one of the hot stock - Infact I was also excited took entry at top despite I was seeing Golden ratio rejection.

what happened next is history.

#ibrealestate

in 2021 it was one of the hot stock - Infact I was also excited took entry at top despite I was seeing Golden ratio rejection.

what happened next is history.

the very same stock took eyeball again few months back -- people went gaga

even we went long -- but exited sharp at 61.8%

checkout the result

#Fibbonaci

even we went long -- but exited sharp at 61.8%

checkout the result

#Fibbonaci

Stocks which made 52 week high today (1/n):

#3MIndia

#ActionConst

#AndhraCement

#ArmanFinancial

#ArrowGreentech

#Arvind

#ArvindSmart

#AshianaHousing

#AsianHotels

#AvalonTechnolo

#BajajAuto

#Stockmarket

#3MIndia

#ActionConst

#AndhraCement

#ArmanFinancial

#ArrowGreentech

#Arvind

#ArvindSmart

#AshianaHousing

#AsianHotels

#AvalonTechnolo

#BajajAuto

#Stockmarket

Stocks which made 52 week high today (2/n):

#Beardsell

#BharatBijlee

#BharatDynamics

#BharatWireRop

#BhartiyaInter

#BirlaCable

#BirlaCorp

#CanFinHomes

#CCLProducts

#CentumElectron

#ChoiceInternat

#Stockmarket

#Beardsell

#BharatBijlee

#BharatDynamics

#BharatWireRop

#BhartiyaInter

#BirlaCable

#BirlaCorp

#CanFinHomes

#CCLProducts

#CentumElectron

#ChoiceInternat

#Stockmarket

Stocks which made 52 week high today (3/n):

#ControlPrint

#Craftsman

#CRISIL

#DalmiaBharat

#DatamaticsGlob

#DeltaCorp

#DevInformation

#DynamicService

#EmkayTaps

#eMudhra

#Stockmarket

#ControlPrint

#Craftsman

#CRISIL

#DalmiaBharat

#DatamaticsGlob

#DeltaCorp

#DevInformation

#DynamicService

#EmkayTaps

#eMudhra

#Stockmarket

Stocks which made 52 week high today (1/n):

#AbbIndia

#AiaEngineering

#AndhraCement

#Aptech

#ArrowGreentech

#AurobindoPharm

#BajajConsumer

#BhansaliEng

#BharatWireRop

#Stockmarket

#AbbIndia

#AiaEngineering

#AndhraCement

#Aptech

#ArrowGreentech

#AurobindoPharm

#BajajConsumer

#BhansaliEng

#BharatWireRop

#Stockmarket

Stocks which made 52 week high today (2/n):

#CentumElectron

#ChoiceInternat

#ControlPrint

#CoolCaps

#Cummins

#DalmiaBharat

#DynamicCables

#eMudhra

#EquitasBank

#Stockmarket

#CentumElectron

#ChoiceInternat

#ControlPrint

#CoolCaps

#Cummins

#DalmiaBharat

#DynamicCables

#eMudhra

#EquitasBank

#Stockmarket

Stocks which made 52 week high today (3/n):

#ForceMotors

#GeekayWires

#GravitaIndia

#GujStatePetro

#HindRectifiers

#HindustanMedia

#HuhtamakiIndia

#IDFC

#IDFCFirstBank

#Stockmarket

#ForceMotors

#GeekayWires

#GravitaIndia

#GujStatePetro

#HindRectifiers

#HindustanMedia

#HuhtamakiIndia

#IDFC

#IDFCFirstBank

#Stockmarket

🚨 "Stellar Q3 Results by IDFC First Bank: Net Profit Doubled"

Key Takeaways of IDFC Bank Q3 Result in this🧵

1) The bank's net profit increased by an whopping 115% to approximately 605 crores in Q3, compared to the previous year.🚀

#IDFCFIRSTBank #IDFCFIRSTB

Key Takeaways of IDFC Bank Q3 Result in this🧵

1) The bank's net profit increased by an whopping 115% to approximately 605 crores in Q3, compared to the previous year.🚀

#IDFCFIRSTBank #IDFCFIRSTB

2) Banks make money by charging more interest on loans they give out than the interest they pay to people who save their money in the banks.

Interest Income = Interest Earned - Interest Expended

IDFC First Bank made 27% more money from interest income compared to last year.

Interest Income = Interest Earned - Interest Expended

IDFC First Bank made 27% more money from interest income compared to last year.

3) When a bank lends more money to customers, the bank has better chance to make more money.

IDFC First Bank loaned 44% more money to customers this time, which is good for the bank's business.

IDFC First Bank loaned 44% more money to customers this time, which is good for the bank's business.

#IDFCFIRSTBank for some EX-Banking fintwit fools who call it one man show and have no analysis on the teams on ground . Ex mckinsey, iit grad leading digital customer excellence team of product managers

Ex Head of data science #zomato, bajaj finserv

#IDFCFIRSTBank FIRST concall was right now. My key takeaways:

1. Credit costs of 2.5% in FY22, 2% in steady state.

In b/w lines: Bank has incremental NIMs of >9% which will support 2% credit costs. 1800cr provisions taken in Q1 represent a very conservative approach

1. Credit costs of 2.5% in FY22, 2% in steady state.

In b/w lines: Bank has incremental NIMs of >9% which will support 2% credit costs. 1800cr provisions taken in Q1 represent a very conservative approach

A 850cr mumbai toll road account slipped into NPA due to covid lockdowns. There were partial payments. Expect it to come out of NPA post covid wave. VI exposure credit costs not included in 2.5% guidance.

2. Runway for growth is long

In b/w lines: Can grow loan book at 25% for a long time. Expecting 18-20% ROE from retail lending alone in steady state. CASA will also continue to grow enough to support retail lending needs. Enough cash right now.

In b/w lines: Can grow loan book at 25% for a long time. Expecting 18-20% ROE from retail lending alone in steady state. CASA will also continue to grow enough to support retail lending needs. Enough cash right now.

My core portfolio and business tracking thread...

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

IT Service oriented

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

Platform

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

#idfcfirstbank is my largest and oldest investment. Thought of creating a thread to explain the business. If you like the thread, please spread the knowledge, retweet. Buckle up, because this is going to be a long one. :D

Quick summary of what a bank does. This enables me to establish a framework under which the analysis of the bank will become very structured.

Money is its raw material.

Money is its raw material.

Bank takes customer deposits, raises money via borrowings (can issue its own bonds, takes loans from other banks etc). This is the input for the bank. Since the bank is liable to pay interest on it, it is also known as liabilities.

1 new chart everyday, it could be from any space ~ equities / commodities / crypto / forex / bonds , etc

Will try to do it daily 🙏💪

Here's the first one 👇

SBI vs BankNifty

Ratio chart has given monthly breakout implying SBI could outperform BN in coming months.

#PB365

Will try to do it daily 🙏💪

Here's the first one 👇

SBI vs BankNifty

Ratio chart has given monthly breakout implying SBI could outperform BN in coming months.

#PB365

IDFC FIRST BANK - 'Always you first.'

My stock pick for the next decade.

Key Reasons:

->Quality & Ethical Management

->Good Sector

->Sustainable Moat(difficult to get new banking license in India)

->Retail Focused Bank

->Available at cheap valuations

#IDFCFirstBank

My stock pick for the next decade.

Key Reasons:

->Quality & Ethical Management

->Good Sector

->Sustainable Moat(difficult to get new banking license in India)

->Retail Focused Bank

->Available at cheap valuations

#IDFCFirstBank

#Thread

Been reading a bunch of Annual Reports last few days. Creating this thread to capture and share interesting tidbits from the ones I am reading this season. Will be updated on an ongoing basis next few weeks.

1/n

Been reading a bunch of Annual Reports last few days. Creating this thread to capture and share interesting tidbits from the ones I am reading this season. Will be updated on an ongoing basis next few weeks.

1/n

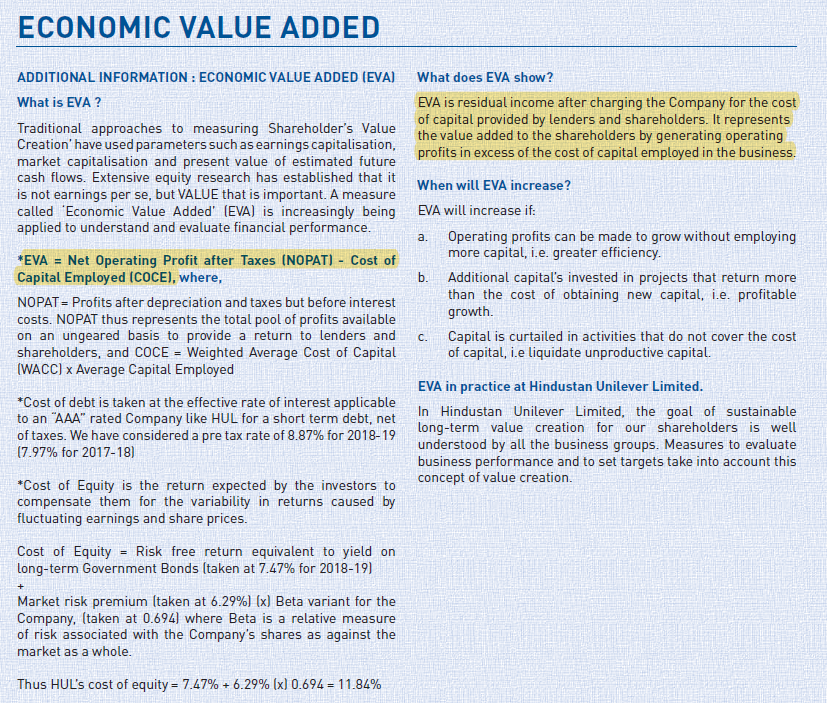

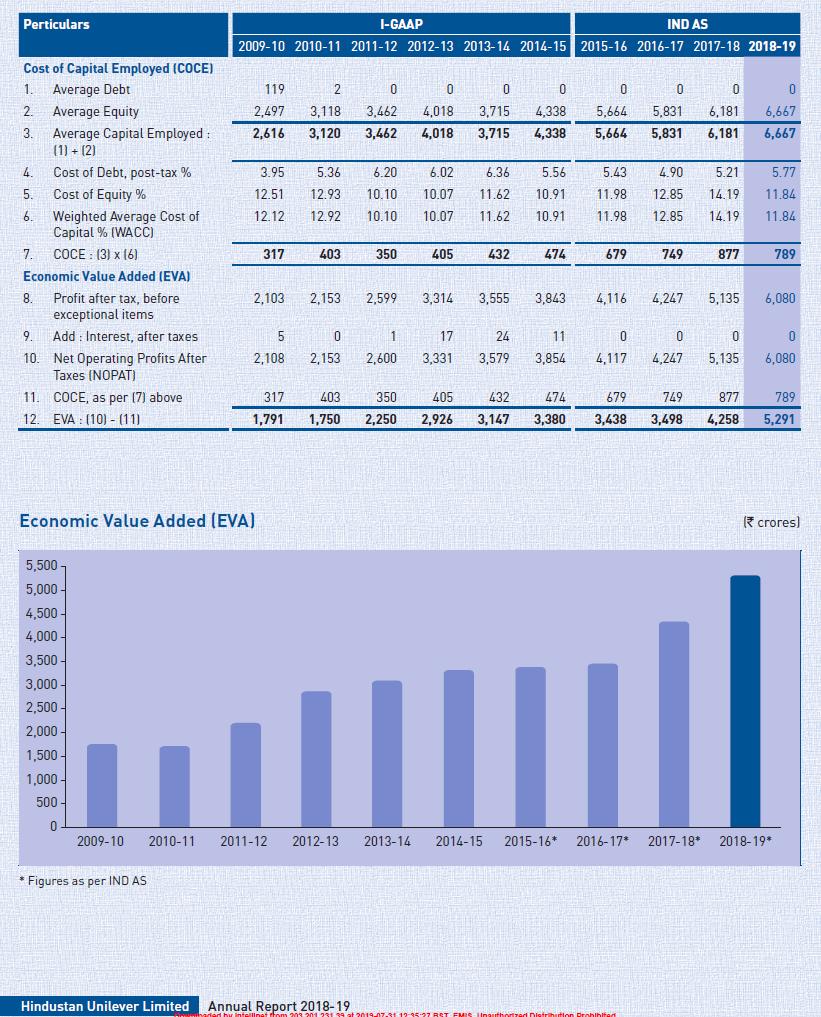

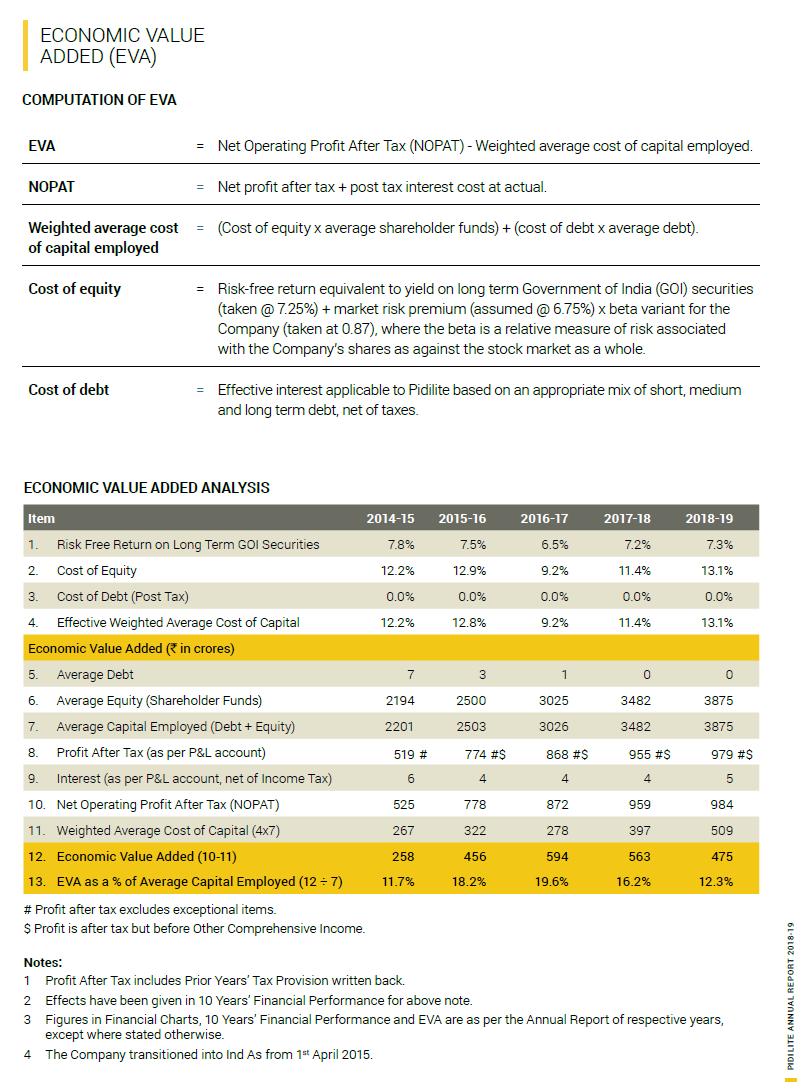

2. Few bluechips have reported their #EconomicValueAdded (EVA), a good measure of shareholder value creation. HUL AR does a great job of explaining details. EVA as % avg capital employed over a period of time can be a good leading indicator. Pidilite also shares EVA details

3. Chairman's letter+MD&A section of top 2/3 key players provide great overview of economy and sector dynamics.

Few suggested section reads are HUL, Kotak, PEL, Sterlite Tech, Everest Ind+Visaka, Godrej Prop, OCCL, Hikal, Aavas, RBL, L&T Infotech, Zydus Wellness.

Suggest more!

Few suggested section reads are HUL, Kotak, PEL, Sterlite Tech, Everest Ind+Visaka, Godrej Prop, OCCL, Hikal, Aavas, RBL, L&T Infotech, Zydus Wellness.

Suggest more!