Discover and read the best of Twitter Threads about #polycab

Most recents (17)

let me post some 100 #fibbonaci number wonders on long term chart.

Post your chart too with #fibbonaci, make sure chart is clean.

Post your chart too with #fibbonaci, make sure chart is clean.

this is number 1 in list

#ibrealestate

in 2021 it was one of the hot stock - Infact I was also excited took entry at top despite I was seeing Golden ratio rejection.

what happened next is history.

#ibrealestate

in 2021 it was one of the hot stock - Infact I was also excited took entry at top despite I was seeing Golden ratio rejection.

what happened next is history.

the very same stock took eyeball again few months back -- people went gaga

even we went long -- but exited sharp at 61.8%

checkout the result

#Fibbonaci

even we went long -- but exited sharp at 61.8%

checkout the result

#Fibbonaci

#MarketAtClose | #Midcaps continue to outperform, Nifty Midcap Index posts record close

#Sensex, #Nifty & #NiftyBank close with minor gains in a range-bound session

Sensex rises 119 points to 62,547 & Nifty 46 points to 18,534

Midcap Index gains 154 points to 33,967 & Nifty Bank… twitter.com/i/web/status/1…

#Sensex, #Nifty & #NiftyBank close with minor gains in a range-bound session

Sensex rises 119 points to 62,547 & Nifty 46 points to 18,534

Midcap Index gains 154 points to 33,967 & Nifty Bank… twitter.com/i/web/status/1…

#MarketAtClose | #Metal stocks rise on improved global prices, #Hindalco up over 3%

#ApolloHospitals gains another 3% on Friday, up 8% for the week

#HeroMoto continues its positive run, less than 2% away from 52-wk high

#Auto stocks rise after strong sales in May, M&M, #Maruti,… twitter.com/i/web/status/1…

#ApolloHospitals gains another 3% on Friday, up 8% for the week

#HeroMoto continues its positive run, less than 2% away from 52-wk high

#Auto stocks rise after strong sales in May, M&M, #Maruti,… twitter.com/i/web/status/1…

#MarketAtClose | #Pharma stocks see some buying, Dr Reddy’s, Sun, Laurus up over 1% each

New-age cos like #Zomato & #Nykaa see healthy gains on Friday, up 4-8%

4 #Nifty stocks (#BajajAuto, #Britannia, #TaMo, #ApolloHosp) hit 52-week highs today

M&M Fin gains more than 1% to hit… twitter.com/i/web/status/1…

New-age cos like #Zomato & #Nykaa see healthy gains on Friday, up 4-8%

4 #Nifty stocks (#BajajAuto, #Britannia, #TaMo, #ApolloHosp) hit 52-week highs today

M&M Fin gains more than 1% to hit… twitter.com/i/web/status/1…

Stocks which made 52 week high today (1/n):

#AaPlus

#AbbIndia

#ActionConst

#AdorFontech

#AiaEngineering

#AnantRaj

#AndhraRaj

#AndhraCement

#ArmanFinancial

#ArmanHoldings

#Stockmarket

#AaPlus

#AbbIndia

#ActionConst

#AdorFontech

#AiaEngineering

#AnantRaj

#AndhraRaj

#AndhraCement

#ArmanFinancial

#ArmanHoldings

#Stockmarket

Stocks which made 52 week high today (2/n):

#ArrowGreentech

#Arvind

#AurobindoPharma

#AvanceTech

#BajajHoldings

#BampslSec

#BccFuba

#BerylSecuritie

#BhansaliEng

#BharatWireRop

#BhartiAirtel

#StockMarket

#ArrowGreentech

#Arvind

#AurobindoPharma

#AvanceTech

#BajajHoldings

#BampslSec

#BccFuba

#BerylSecuritie

#BhansaliEng

#BharatWireRop

#BhartiAirtel

#StockMarket

Stocks which made 52 week high today (3/n):

#BselInfra

#CanfinHomes

#CclProducts

#CgPower

#ChoiceInternat

#CianHealthcare

#CoforgeLtd

#Comfort

#Craftman

#CredirAccessGr

#CRISIL

#DeshRAKSHAK

#StockMarket

#BselInfra

#CanfinHomes

#CclProducts

#CgPower

#ChoiceInternat

#CianHealthcare

#CoforgeLtd

#Comfort

#Craftman

#CredirAccessGr

#CRISIL

#DeshRAKSHAK

#StockMarket

Stocks which made 52 week high today (1/n):

#AbbIndia

#AiaEngineering

#AndhraCement

#Aptech

#ArrowGreentech

#AurobindoPharm

#BajajConsumer

#BhansaliEng

#BharatWireRop

#Stockmarket

#AbbIndia

#AiaEngineering

#AndhraCement

#Aptech

#ArrowGreentech

#AurobindoPharm

#BajajConsumer

#BhansaliEng

#BharatWireRop

#Stockmarket

Stocks which made 52 week high today (2/n):

#CentumElectron

#ChoiceInternat

#ControlPrint

#CoolCaps

#Cummins

#DalmiaBharat

#DynamicCables

#eMudhra

#EquitasBank

#Stockmarket

#CentumElectron

#ChoiceInternat

#ControlPrint

#CoolCaps

#Cummins

#DalmiaBharat

#DynamicCables

#eMudhra

#EquitasBank

#Stockmarket

Stocks which made 52 week high today (3/n):

#ForceMotors

#GeekayWires

#GravitaIndia

#GujStatePetro

#HindRectifiers

#HindustanMedia

#HuhtamakiIndia

#IDFC

#IDFCFirstBank

#Stockmarket

#ForceMotors

#GeekayWires

#GravitaIndia

#GujStatePetro

#HindRectifiers

#HindustanMedia

#HuhtamakiIndia

#IDFC

#IDFCFirstBank

#Stockmarket

#Learning

Best #intraday setup

If you are struggling to take entry at the right spot, this will be very helpful for you

Read all below messages.

🧵 1/3

Best #intraday setup

If you are struggling to take entry at the right spot, this will be very helpful for you

Read all below messages.

🧵 1/3

Use below mentioned parameters at your charting platform (tradingview).

1. Previous day's close

2.Today's open

3.Previous day, Week & Month High

4.Previous day, Week & Month Low

5.Camerilla pivot level (Only R3,S3)

6.EMA : 9&32

7.RSI

8.Volume

🧵 2/3

1. Previous day's close

2.Today's open

3.Previous day, Week & Month High

4.Previous day, Week & Month Low

5.Camerilla pivot level (Only R3,S3)

6.EMA : 9&32

7.RSI

8.Volume

🧵 2/3

What is Stage Analysis ?

How does it help to filter stocks ?

A thread 🧵

#stocks #stageanalysis

1/n

👇

How does it help to filter stocks ?

A thread 🧵

#stocks #stageanalysis

1/n

👇

There are four main stages in stage analysis: accumulation, Advance, distribution, and Decline. Each stage is characterized by a specific psychology behind the stock's price movements.

2/n

2/n

Key Components Of Stage Analysis

--->Weekly Stock Chart

--->30-Week Moving Average

--->Volume

--->Market Indices(#Nifty #smallcap100)

3/n

--->Weekly Stock Chart

--->30-Week Moving Average

--->Volume

--->Market Indices(#Nifty #smallcap100)

3/n

Magic of IPO Listing High/Base Break-Out

Reasons for BO:

1. Entry of Fund House

2. Delivered as mentioned by Mgmt.

3. New favouring Govt Policies.

4. Need of hours of the product.

Reasons for BO:

1. Entry of Fund House

2. Delivered as mentioned by Mgmt.

3. New favouring Govt Policies.

4. Need of hours of the product.

Types of IPO BO Candidate. Three kinds:

#IPO_Candidate_1 - Premium Listing followed by 15-45% corrections. 2-4x Potential after listing high BO, Time-frame – 1yr. e.g. #INDIAMART #HAPPSTMNDS #MTARTECH #POLYCAB #ANURAS #AFFLE

#IPO_Candidate_1 - Premium Listing followed by 15-45% corrections. 2-4x Potential after listing high BO, Time-frame – 1yr. e.g. #INDIAMART #HAPPSTMNDS #MTARTECH #POLYCAB #ANURAS #AFFLE

My core portfolio and business tracking thread...

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

IT Service oriented

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

Platform

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

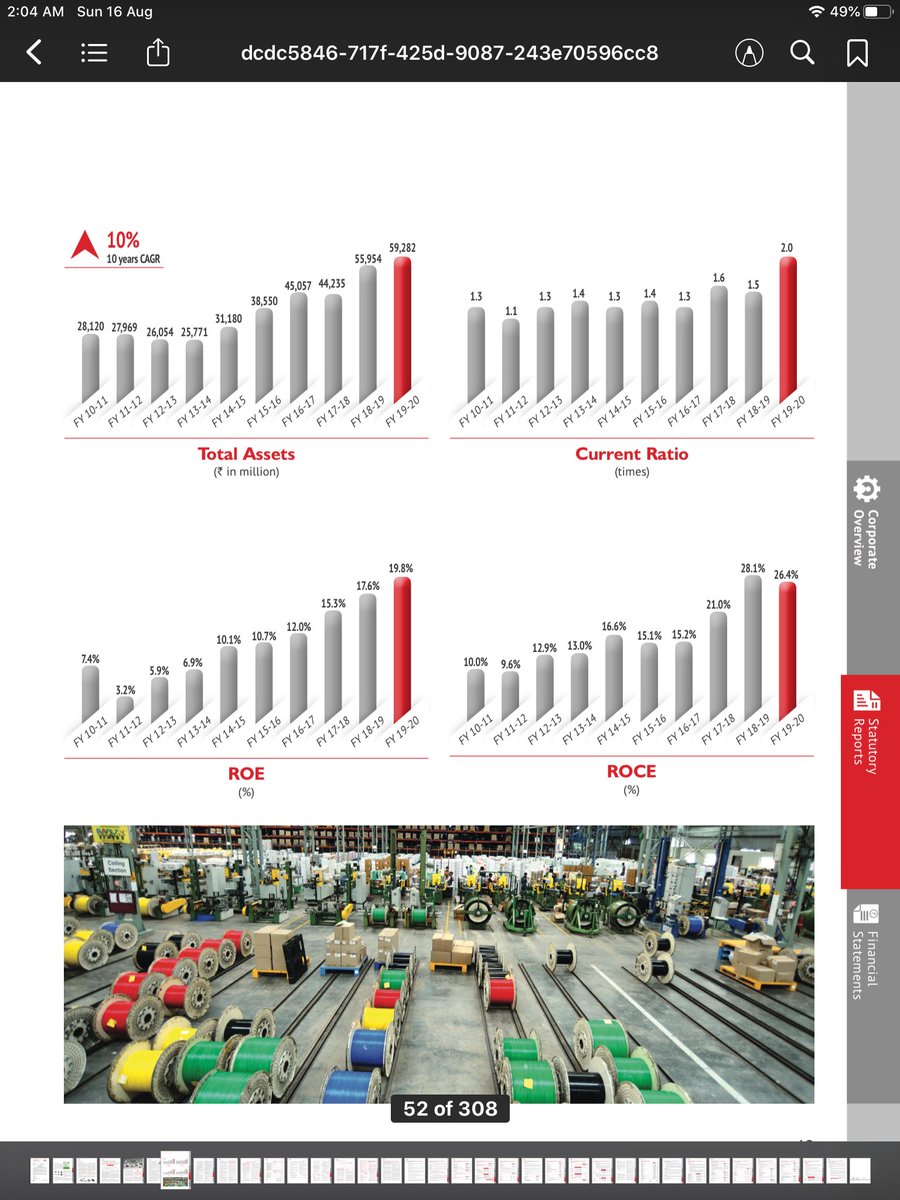

@PolycabIndia #Q3marketupdates #Q3investorpresentations

Q3 earnings presentation

Revenue Q3 27988 mn ,up 12% yoy

9m 58891 mn ,up 12% yoy

PAT 2636mn ,up 19% yoy

9m 6027 mn,up 9% yoy

Net cash Q3 - 1335 mn

Q3 earnings presentation

Revenue Q3 27988 mn ,up 12% yoy

9m 58891 mn ,up 12% yoy

PAT 2636mn ,up 19% yoy

9m 6027 mn,up 9% yoy

Net cash Q3 - 1335 mn

Wires&cables

6% yoy growth

Distribution channel double digit growth

Institutional businesses continues 2 face headwinds

Wires > cables

Housing wires strong momentum

Export 2.9 bn,10.5% overall sales,down 33% yoy due higher Dangote base

Exc Dangote, Aus,Asia,UK 29% yoy growth

6% yoy growth

Distribution channel double digit growth

Institutional businesses continues 2 face headwinds

Wires > cables

Housing wires strong momentum

Export 2.9 bn,10.5% overall sales,down 33% yoy due higher Dangote base

Exc Dangote, Aus,Asia,UK 29% yoy growth

Fast moving electrical goods

Strong 41% yoy growth in total Rev back of consumer demand,distribution, product mix

FMEG mix to sales up 215bps, up 10.8% yoy

Fans took leadership in few geographies

Segment Ebit margin 5.9% in Q3 & 4.7% in 9mnths

Strong 41% yoy growth in total Rev back of consumer demand,distribution, product mix

FMEG mix to sales up 215bps, up 10.8% yoy

Fans took leadership in few geographies

Segment Ebit margin 5.9% in Q3 & 4.7% in 9mnths

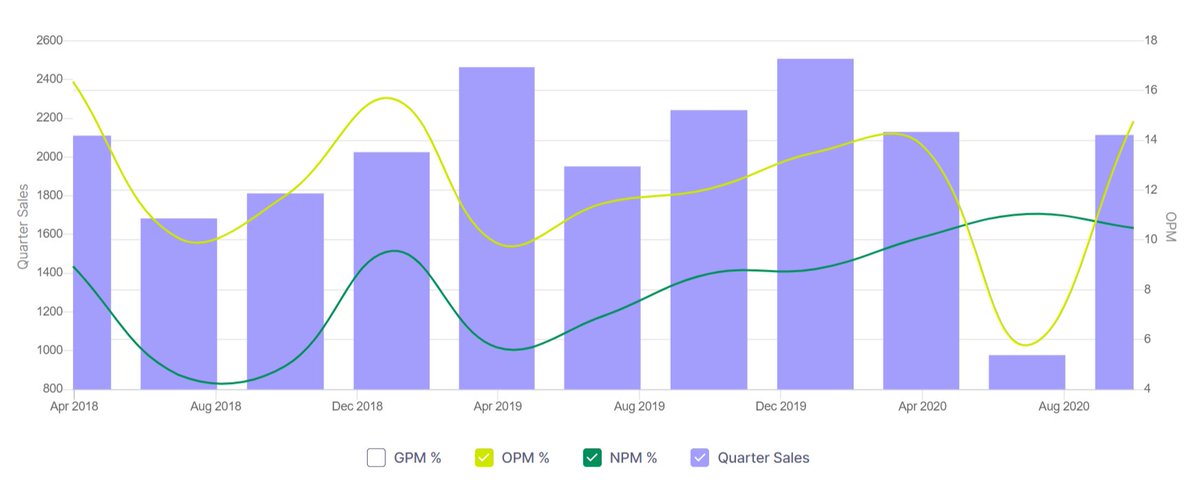

#PolyCab valuation

Pre-Corona quarterly sales : 2200

Corona dip : 50%

Current quarterly sales : 2200

It has healed from the lockdown slump. NPM has improved from 8.64% to 10.48%

Pre-Corona quarterly sales : 2200

Corona dip : 50%

Current quarterly sales : 2200

It has healed from the lockdown slump. NPM has improved from 8.64% to 10.48%

EPS has virtually doubled in 18 months, from 25rs/share in 2019 to 50rs/share now.

ROCE 29%. This is a high growth company.

2030 projected EPS (DCF discount rate 20.12%) : 326rs/share

2030 CMP= 6520 (Median PE (20) x 326)

ROCE 29%. This is a high growth company.

2030 projected EPS (DCF discount rate 20.12%) : 326rs/share

2030 CMP= 6520 (Median PE (20) x 326)

#PLISCHEME #GOI

Approves for 10 sectors On Nov 11

Pharma,Auto,Auto components Telecom,Advanced chemistry cell battery,textile,food products,solar modules,white goods,speciality steel

Aim - make India mfts globally competitive,enhance scale,increase exports,attract investment

Approves for 10 sectors On Nov 11

Pharma,Auto,Auto components Telecom,Advanced chemistry cell battery,textile,food products,solar modules,white goods,speciality steel

Aim - make India mfts globally competitive,enhance scale,increase exports,attract investment

Thread highlighting the importance of reading revenue recognition policies (and also other important ones like depreciation and inventory policies) in the annual report (1/6)

#Polycab Ltd which is the market leader in Wires and Cables segment has a different revenue recognition policy vis-a-vis its peers, whereby they book revenues in P&L on dispatch of goods while its peers recognize revenue when the goods are delivered. (2/6)

👍 Polycab's impressive growth continued into Q3

👍 Revenue rose 24% QOQ

👍 Wires & Cables revenue jumped 21% on the back of one large size export order

👍 Fast Moving Electrical Goods segment sales jumped 34% on the back of strong volume growth

#polycab

👍 Revenue rose 24% QOQ

👍 Wires & Cables revenue jumped 21% on the back of one large size export order

👍 Fast Moving Electrical Goods segment sales jumped 34% on the back of strong volume growth

#polycab

👍 A pick-up in project execution drove the revenue in EPC

👎 Significant jump in advertising & marketing expense hit margins

👍 Lower corp tax rate aided the bottomline

👎 The domestic demand scenario remain sluggish

👍 Eyeing growth thru increased penetration in export markets

👎 Significant jump in advertising & marketing expense hit margins

👍 Lower corp tax rate aided the bottomline

👎 The domestic demand scenario remain sluggish

👍 Eyeing growth thru increased penetration in export markets

👍 Undertaking multiple brand development initiatives to penetrate the domestic market

👍 The ad spends wud remain high, but the economies of scale should aid the margin improvement in coming qtrs

👍 For W&C, the mgt expects the margins to be in the broad range of 11-13 percent.

👍 The ad spends wud remain high, but the economies of scale should aid the margin improvement in coming qtrs

👍 For W&C, the mgt expects the margins to be in the broad range of 11-13 percent.

Polycab CMP 1029

👉 Leader in the Wire & Cable Industry

👉 Domestic Mkt share ~12%

👉 Revenue (W&C 89%, FMEG 7%, EPC & Othr 4%)

👉 In the early stage of transition from a commodity cable manufacturer to a branded consumer durable player

#Polycab

#StockMarket

#stockstowatch

👉 Leader in the Wire & Cable Industry

👉 Domestic Mkt share ~12%

👉 Revenue (W&C 89%, FMEG 7%, EPC & Othr 4%)

👉 In the early stage of transition from a commodity cable manufacturer to a branded consumer durable player

#Polycab

#StockMarket

#stockstowatch

𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗩𝗮𝗹𝘂𝗲 𝗖𝗿𝗲𝗮𝘁𝗶𝗼𝗻

👉 Consistent track record & has delivered a topline growth of >15% in last 4 yrs

👉 Earning growth has outpaced the topline due to richer product mix & an expansion in operating margins

👉 ROC has improved: 16% (FY16) 28% (FY19)

👉 Consistent track record & has delivered a topline growth of >15% in last 4 yrs

👉 Earning growth has outpaced the topline due to richer product mix & an expansion in operating margins

👉 ROC has improved: 16% (FY16) 28% (FY19)

👉 Enjoys a cash-rich B/S & remains well positioned to navigate the cyclical downturn

👉 Strong distribution network (3300+ authorized dealers, ~30 warehouses) to cater >1lakh retail outlets

👉 High degree of backward integration helps to reduce RM price volatility

#polycab

👉 Strong distribution network (3300+ authorized dealers, ~30 warehouses) to cater >1lakh retail outlets

👉 High degree of backward integration helps to reduce RM price volatility

#polycab