Discover and read the best of Twitter Threads about #Q3marketupdates

Most recents (23)

#subex #Q3marketupdates #Q3concall #Q3updates

Concall transcript Q3fy21

Rev 93.9 cr ,Ebidta 20.3 cr & PAT 8.5 cr

9mfy21 Rev 275.9 cr up 6% yoy

Interim dividend of 10%

Moved into new corporate office in Bengaluru

In IoT focus on mftng sector,secured 4 new customers in Q3

Concall transcript Q3fy21

Rev 93.9 cr ,Ebidta 20.3 cr & PAT 8.5 cr

9mfy21 Rev 275.9 cr up 6% yoy

Interim dividend of 10%

Moved into new corporate office in Bengaluru

In IoT focus on mftng sector,secured 4 new customers in Q3

ID central (identity analytics solution) launched in Indonesia, 1st customer onboard

NGP platform, next gen platform to revolutionize way telcos operate in OSS & BSS system ,cloud native API based application

Expect more 5g contracts in APAC & ME in coming quarters

NGP platform, next gen platform to revolutionize way telcos operate in OSS & BSS system ,cloud native API based application

Expect more 5g contracts in APAC & ME in coming quarters

Vision to emerge as a leader in digital trust solutions in multi vertical environment

Closed about $28.5mn deals in 9mfy21 ,Q4 to exceed Q3 in deal wins

Tech mahindra partnership around Block chain area

New product offering for Telcos- Augmented Analytics platform

Closed about $28.5mn deals in 9mfy21 ,Q4 to exceed Q3 in deal wins

Tech mahindra partnership around Block chain area

New product offering for Telcos- Augmented Analytics platform

#galaxysurfactants #Q3investorpresentations

:Q2 momentum spilled into Q3

:Speciality segment double digit growth

:Domestic mkt double digit growth

:Interim dividend Rs 14

Vols Q3fy21/20

Performance surfactants 36618/34978

Speciality 21620/19295

Total 58238/54273

:Q2 momentum spilled into Q3

:Speciality segment double digit growth

:Domestic mkt double digit growth

:Interim dividend Rs 14

Vols Q3fy21/20

Performance surfactants 36618/34978

Speciality 21620/19295

Total 58238/54273

Revenue HLs

Q3fy21/20 in crs

Performance surfactants 401/387

Speciality 277/242

Total 678/629

PAT 85/48

9mnths fy21 vols

India mkt up 13.3%

Africa & ME Up 6.3%

ROW down -10.1%

9mnth FHs in cr

PS 1292/1187

Speciality 717/759

Total 2009/1946

PAT 223/168

Q3fy21/20 in crs

Performance surfactants 401/387

Speciality 277/242

Total 678/629

PAT 85/48

9mnths fy21 vols

India mkt up 13.3%

Africa & ME Up 6.3%

ROW down -10.1%

9mnth FHs in cr

PS 1292/1187

Speciality 717/759

Total 2009/1946

PAT 223/168

Truly Indian MNC

:Leading mftr of ingredients for home & personal care industry

:preferred supplier for MNC,Regional & local Fmcg

:205+ product grades

: 7 strategic facilities (5 India,1Egypt ,1 US)

: Extensive R&D capacity

: intellectual property- 78 approved,1e applied

:Leading mftr of ingredients for home & personal care industry

:preferred supplier for MNC,Regional & local Fmcg

:205+ product grades

: 7 strategic facilities (5 India,1Egypt ,1 US)

: Extensive R&D capacity

: intellectual property- 78 approved,1e applied

#sequentScientific #Q3marketupdates #Q3investorpresentations

Strong 🏋️♀️

Q3fy21/20 in cr

Rev 361/317

PAT 37.2/20

EPS 1.52/0.83

9mnth fy21/20

Rev 1014/878

PAT 87.8 /53.1

EPS 3.24/2.18

API Business up 17.2%

Formulations 15.0%

Alivira award best Company in AH India/ME/Africa

Strong 🏋️♀️

Q3fy21/20 in cr

Rev 361/317

PAT 37.2/20

EPS 1.52/0.83

9mnth fy21/20

Rev 1014/878

PAT 87.8 /53.1

EPS 3.24/2.18

API Business up 17.2%

Formulations 15.0%

Alivira award best Company in AH India/ME/Africa

Formulations

EU subdued due operational challenges of Covid

Spain & Germany impacted while Benelux & Sweden reported strong growth

Growth to accelerate with recent launches of CitramoxLA & Halofusol. Tulathromycin launch to reflect from the current quarter

EU subdued due operational challenges of Covid

Spain & Germany impacted while Benelux & Sweden reported strong growth

Growth to accelerate with recent launches of CitramoxLA & Halofusol. Tulathromycin launch to reflect from the current quarter

#solaraactivepharma

#Q3marketupdates #Q3investorpresentations

Best Ever Quarterly Revenue, EBITDA & PAT

Rev 4,350 mn, up 24% yoy & 8% qoq Q3’21 EBITDA 1,085 Mn, up 32% yoy & 8% qoq

PAT 658 Mn, up 59% yoy & 16% qoq

Basic EPS 18.47

#Q3marketupdates #Q3investorpresentations

Best Ever Quarterly Revenue, EBITDA & PAT

Rev 4,350 mn, up 24% yoy & 8% qoq Q3’21 EBITDA 1,085 Mn, up 32% yoy & 8% qoq

PAT 658 Mn, up 59% yoy & 16% qoq

Basic EPS 18.47

API Business

Regulated mkt rev 3110 mn, up 12% yoy

,contributed 72% of Q3’21 rev, decline from Q2 result of robust growth in other mkts

Other mkts rev 1240 mn, up 71% yoy

Rev growth 24% yoy (37% yoy ex-ranitidine) driven by growth in vol, scale up Vizag

New products 9% Q3’21rev

Regulated mkt rev 3110 mn, up 12% yoy

,contributed 72% of Q3’21 rev, decline from Q2 result of robust growth in other mkts

Other mkts rev 1240 mn, up 71% yoy

Rev growth 24% yoy (37% yoy ex-ranitidine) driven by growth in vol, scale up Vizag

New products 9% Q3’21rev

CRAMS

Tracking well to plan ,addition of new customers, solid growth order book

R&D & Ops

Vizag onstream, commercialized as planned in Q3

Filed 3 new DMFs US mkt ,2 EU mkt during Q3’21

Market extensions 6 of existing products across 7 different geographies

R&D 138 mn 3.2% Rev

Tracking well to plan ,addition of new customers, solid growth order book

R&D & Ops

Vizag onstream, commercialized as planned in Q3

Filed 3 new DMFs US mkt ,2 EU mkt during Q3’21

Market extensions 6 of existing products across 7 different geographies

R&D 138 mn 3.2% Rev

@airtelindia #Airtel #Q3marketupdates

Q3fy21 Highlights

Highest ever cons quarterly rev 26518 cr, up 24.2% yoy

India business highest ever quarterly rev 19,007 cr, up 25.1% yoy

Mobile services India rev up 32.4% yoy led by improving realizations,strong customer addn

Q3fy21 Highlights

Highest ever cons quarterly rev 26518 cr, up 24.2% yoy

India business highest ever quarterly rev 19,007 cr, up 25.1% yoy

Mobile services India rev up 32.4% yoy led by improving realizations,strong customer addn

Airtel Business rev up by 9.2% yoy back of strong demand for connectivity and solutions

Digital TV business strengthened leadership position

Cons EBITDA 12178 cr

EBITDA margin at 45.9%, up 464 bps yoy

India business EBITDA 8,589 cr EBITDA margin 45.2%; up 594 bps YoY

Digital TV business strengthened leadership position

Cons EBITDA 12178 cr

EBITDA margin at 45.9%, up 464 bps yoy

India business EBITDA 8,589 cr EBITDA margin 45.2%; up 594 bps YoY

Cons EBIT 4665 cr ,EBIT margin 17.6%

India EBIT margin 12.7%

Cons Net income (after exp items) 854 cr

Industry leading operational indicators, strong business momentum 4G customers up 12.9 mn for Q3 to 165.6 mn

Mobile ARPU 166 vs 135 Q3’20

India EBIT margin 12.7%

Cons Net income (after exp items) 854 cr

Industry leading operational indicators, strong business momentum 4G customers up 12.9 mn for Q3 to 165.6 mn

Mobile ARPU 166 vs 135 Q3’20

#subex #Q3marketupdates #Q3investorpresentations

9mnths fy21

Revenue up 6% ,2758 mn

Ebidta margin 27.3% ,753 mn

PAT (exc exp items) up 101% ,332.5 mn

Products :

Revenue assurance

IOT security

Fraud manag

Identity analytics

Anomaly detection

Network analytics

9mnths fy21

Revenue up 6% ,2758 mn

Ebidta margin 27.3% ,753 mn

PAT (exc exp items) up 101% ,332.5 mn

Products :

Revenue assurance

IOT security

Fraud manag

Identity analytics

Anomaly detection

Network analytics

3 horizon strategy

1 - enhance core areas ( fraud mang,Rev assurance ,Network analytics, partner ecosystem mang)

2 - immediate growth ( IOT security, Analytics center of trust)

3 - long term growth , invest in emerging areas ( Multi-Vertical SaaS)

Crunch metric

IDcentral

1 - enhance core areas ( fraud mang,Rev assurance ,Network analytics, partner ecosystem mang)

2 - immediate growth ( IOT security, Analytics center of trust)

3 - long term growth , invest in emerging areas ( Multi-Vertical SaaS)

Crunch metric

IDcentral

Investment rationale

Leader in Digital Trust space

Making strong inroads in the multi vertical IoT Security space; IoT Security Market to touch $4.5 bn by 2022

Incubating virtual startups within the orgztn

Sticky Revenue Model ,60% annuity/ recurring, >98% customer retentn

Leader in Digital Trust space

Making strong inroads in the multi vertical IoT Security space; IoT Security Market to touch $4.5 bn by 2022

Incubating virtual startups within the orgztn

Sticky Revenue Model ,60% annuity/ recurring, >98% customer retentn

#emamiltd #Q3marketupdates #Q3investorpresentations

Concall highlights

Rural demand remained strong, urban showed pickup

Healthcare portfolio showed good response due to covid

Product penetration of 4% for Boroplus,Balms,Kesh king,etc

Double digit vol growth guidance for Q4

Concall highlights

Rural demand remained strong, urban showed pickup

Healthcare portfolio showed good response due to covid

Product penetration of 4% for Boroplus,Balms,Kesh king,etc

Double digit vol growth guidance for Q4

Manag confident of new launches Boroplus,Emasol

Honey controversy appears to settle down, mkt changing from seasonal to perennial

Fair & Handsome sales showing uptick post rebranding, relaunch

Sanitiser sales witnessing slowdown

Hair oils seeing demand in domestic & ME mkts

Honey controversy appears to settle down, mkt changing from seasonal to perennial

Fair & Handsome sales showing uptick post rebranding, relaunch

Sanitiser sales witnessing slowdown

Hair oils seeing demand in domestic & ME mkts

Q3 sales Zandu segment

Honey up 2.5% ,Chyawanprash 24%

International business up 26% yoy led by growth in ME & SAARC ,new launches contributed 4% to sales in Q3 ,creme21 grew 82%

30+ new product launches Fy21

E comm sales up 3.5x in Q3 ,up 210 bps

MT channel growth 51% in Q3

Honey up 2.5% ,Chyawanprash 24%

International business up 26% yoy led by growth in ME & SAARC ,new launches contributed 4% to sales in Q3 ,creme21 grew 82%

30+ new product launches Fy21

E comm sales up 3.5x in Q3 ,up 210 bps

MT channel growth 51% in Q3

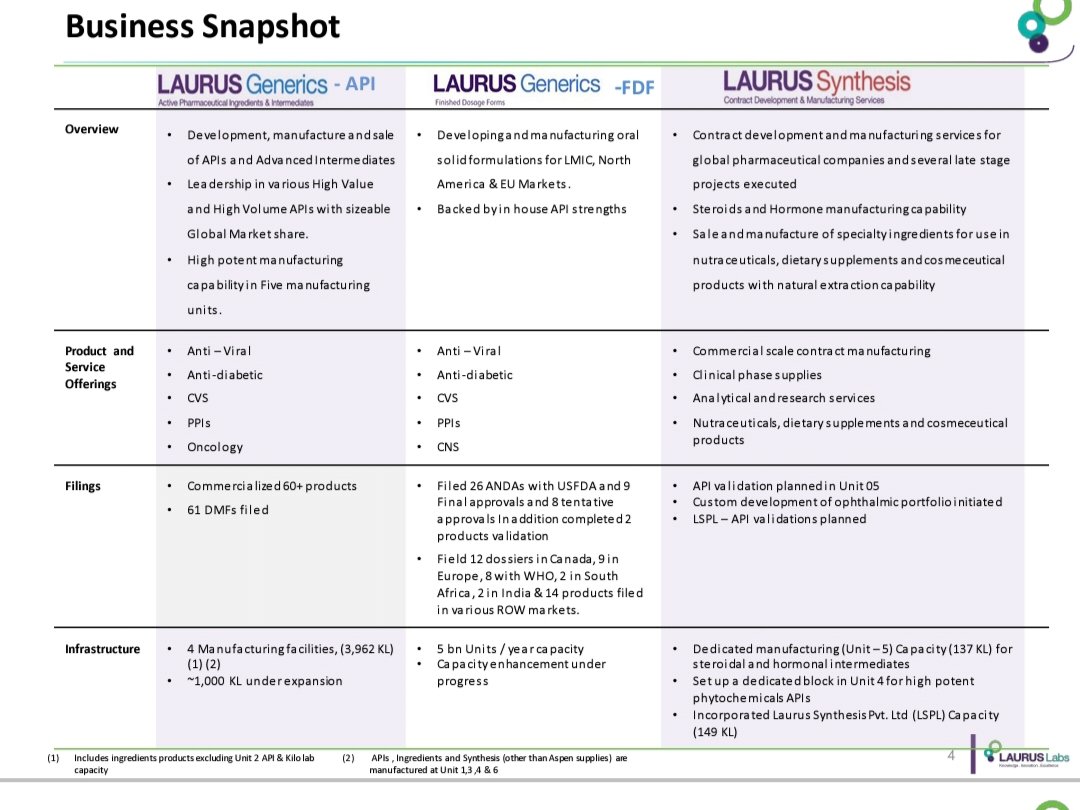

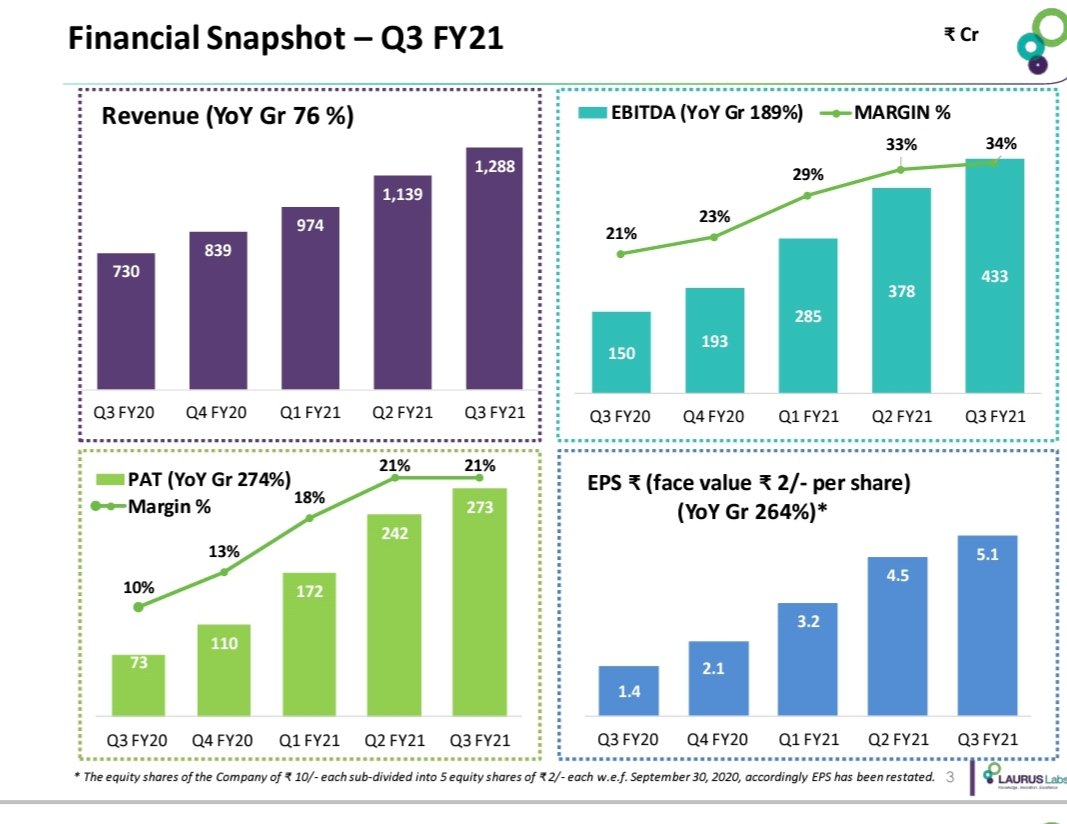

@LaurusLabs #lauruslabs #Q3marketupdates #Q3investorpresentations

Q3fy21/20 in crs

Rev 1288/730 ,up 76%

Ebidta 433/150

PAT 273/73 ,up 274%

EPS 5.1/1.4

Generic API growth 103% yoy

ARVs up 175% yoy

Generic FDF up 47%

Custom synthesis up 63% yoy

Onco API growth 36%

Q3fy21/20 in crs

Rev 1288/730 ,up 76%

Ebidta 433/150

PAT 273/73 ,up 274%

EPS 5.1/1.4

Generic API growth 103% yoy

ARVs up 175% yoy

Generic FDF up 47%

Custom synthesis up 63% yoy

Onco API growth 36%

Generic APIs

ARV,Anti-DM,CVS,PPIs,Onco

Commercialized 60+ products

61 DMFs filed

Generic FDF

ARV,Anti-DM,CVS,PPIs,Onco

Filed 26 ANDAs with USFDA

9 final & 8 tentative approvals

Filed 12 dossiers in Canada, 9 in EU ,8 with WHO,2 in S.Africa, 2 in India

ARV,Anti-DM,CVS,PPIs,Onco

Commercialized 60+ products

61 DMFs filed

Generic FDF

ARV,Anti-DM,CVS,PPIs,Onco

Filed 26 ANDAs with USFDA

9 final & 8 tentative approvals

Filed 12 dossiers in Canada, 9 in EU ,8 with WHO,2 in S.Africa, 2 in India

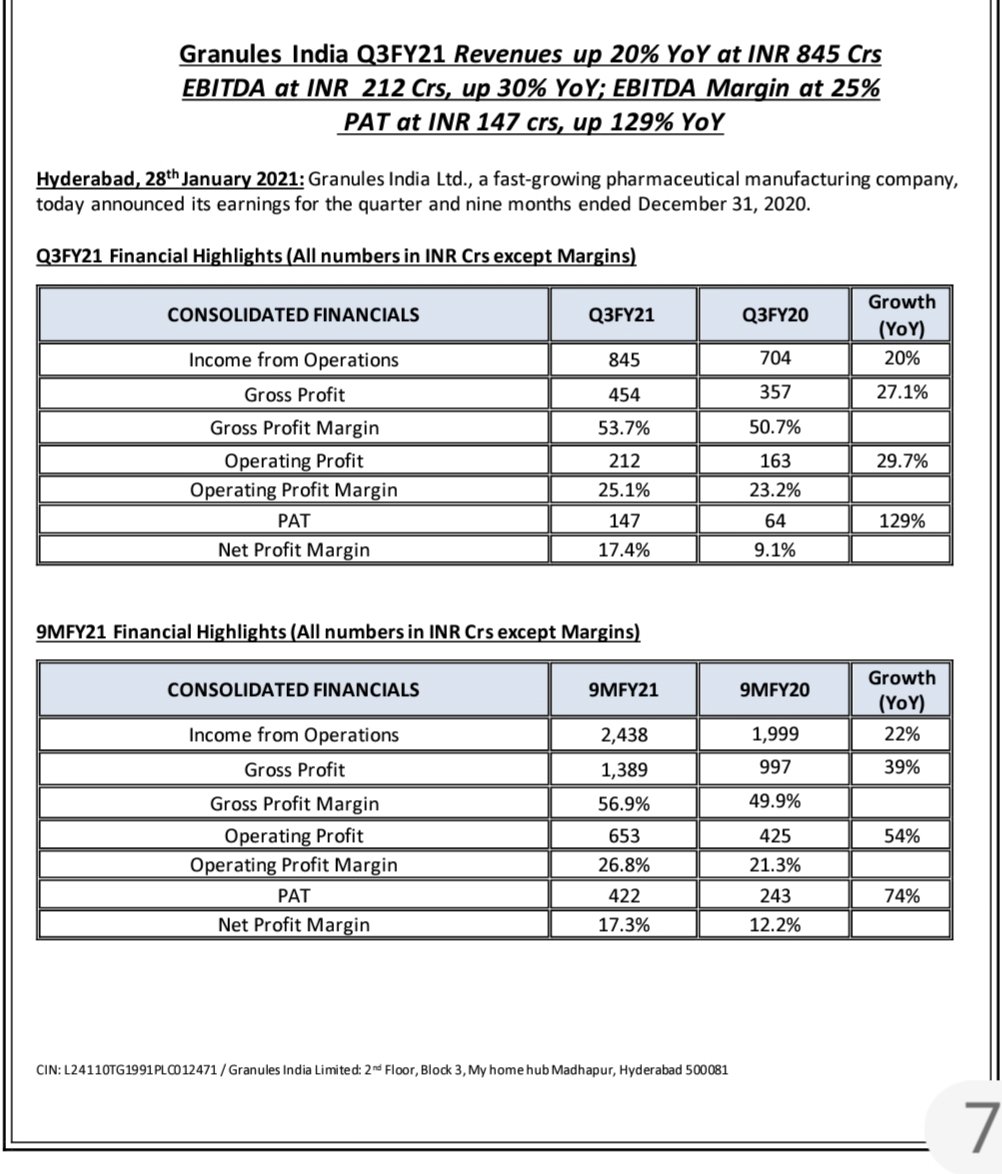

@GranulesIndia #granulesindia #Q3marketupdates #Q3investorpresentations

Q3Fy21 Highlights Revenue from ops up 20% yoy driven by 4 new launches in Q3 & increase in mkt share existing products across the three segments – API, PFI and FD

Q3Fy21 Highlights Revenue from ops up 20% yoy driven by 4 new launches in Q3 & increase in mkt share existing products across the three segments – API, PFI and FD

EBITDA up 29.7% yoy, +190 bps margin expansion yoy on changing product mix with higher contribution from FD and PFI , improved operational efficiencies from higher capacity utilization

PAT 147 cr up 129.4% yoy

Net Debt down 22% yoy

Net debt to EBITDA 0.7x vs. 1.4x as of Q3fy20

PAT 147 cr up 129.4% yoy

Net Debt down 22% yoy

Net debt to EBITDA 0.7x vs. 1.4x as of Q3fy20

ROCE 32.4%, up on account of higher capacity utilization via addition of new modules & equipment with limited capital expenditure

Q3fy21 launched Ramelteon, Dexmethylphenidate HCI and Potassium Chloride ER tablets (Klor-Con), from GPI and Guaifenesin ER tablets from GIL

Q3fy21 launched Ramelteon, Dexmethylphenidate HCI and Potassium Chloride ER tablets (Klor-Con), from GPI and Guaifenesin ER tablets from GIL

#unitedspirits @DiageoIndia #Q3marketupdates

Q3fy21 highlights

Net sales down 3.6%, improved qoq driven by off-trade resilience,trade recovery offset by contraction of business in Andhra Pradesh

Prestige & Above - Net sales down 0.8%

Q3fy21 highlights

Net sales down 3.6%, improved qoq driven by off-trade resilience,trade recovery offset by contraction of business in Andhra Pradesh

Prestige & Above - Net sales down 0.8%

Popular segment sales down 6.7%, led by decline 5.7% in priority states Increased consumer prices, unfav state mix contributed to decline

Gross margin 44.6%, up 24bps versus Q2fy20, driven by benign commodities and continued focus on productivity during Q3

Gross margin 44.6%, up 24bps versus Q2fy20, driven by benign commodities and continued focus on productivity during Q3

EBITDA 384 Crs, down 9.5%

EBITDA margin 15.4%, down 100bps, driven by lower fixed cost absorption, increase in admin expenses

Interest costs 38 crs, down 17% driven by reduced debts and lower interest rates PAT 230 crs

PAT margin 9.2%

EBITDA margin 15.4%, down 100bps, driven by lower fixed cost absorption, increase in admin expenses

Interest costs 38 crs, down 17% driven by reduced debts and lower interest rates PAT 230 crs

PAT margin 9.2%

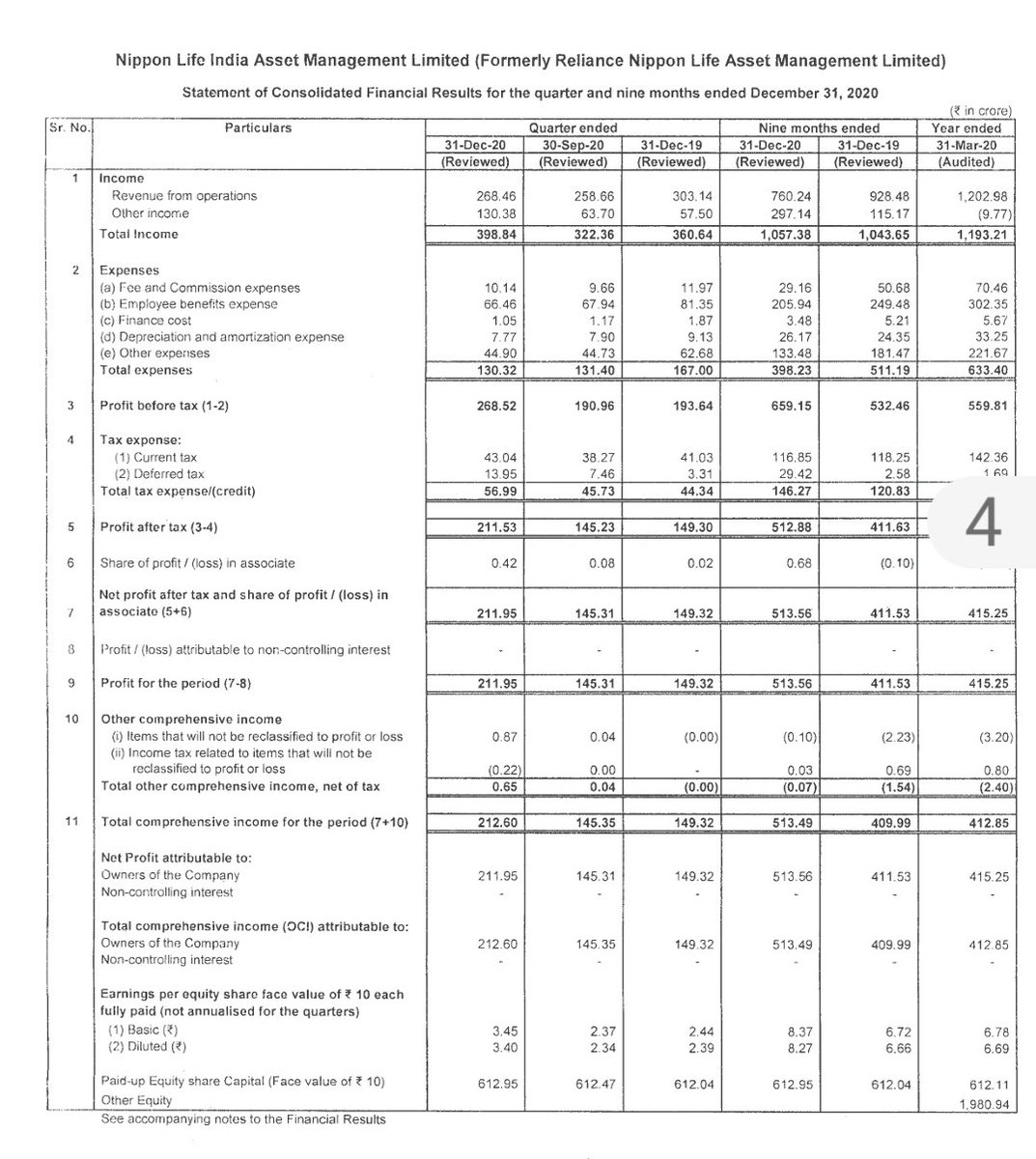

#nipponlifeindia #Q3marketupdates

Business Highlights • Dec'20

AUM 3,52,360 crore ($ 47bn)

Q3fy21 avg AUM 2,13,033 cr($ 28.4 bn), share of Equity Assets rose to 39.1% of AUM vs 38.9% Q3fy20

Dec 20, NIMF has one of the largest retail assets in the Industry, at 58642cr ($7.8 bn)

Business Highlights • Dec'20

AUM 3,52,360 crore ($ 47bn)

Q3fy21 avg AUM 2,13,033 cr($ 28.4 bn), share of Equity Assets rose to 39.1% of AUM vs 38.9% Q3fy20

Dec 20, NIMF has one of the largest retail assets in the Industry, at 58642cr ($7.8 bn)

Retail assets 26% to NIMF's AUM

Dec 20, NIMF garnered AUM 38,753 cr ($ 5.2 bn) from 'Beyond the Top 30 cities' category ,forms 17.5% of NIMF's AUM vis-a-vis 16.0% for the Industry

As on Dec 20, Individual AUM was Rs. 108,182 cr ($ 14.4 bn) contributed 49% to NIMF's AUM

Dec 20, NIMF garnered AUM 38,753 cr ($ 5.2 bn) from 'Beyond the Top 30 cities' category ,forms 17.5% of NIMF's AUM vis-a-vis 16.0% for the Industry

As on Dec 20, Individual AUM was Rs. 108,182 cr ($ 14.4 bn) contributed 49% to NIMF's AUM

As of Q3fy21 NIMF is one of the largest ETF players with AUM of 33,939 cr ($ 4.5 bn) & mkt share 13%

Q3fy21 launched 2 NFOs in the passive category

As of Q3fy21 has 92 lakh investor folios, with annualised Systematic book of approx 8,000 cr ($ 1.1 bn)

Q3fy21 launched 2 NFOs in the passive category

As of Q3fy21 has 92 lakh investor folios, with annualised Systematic book of approx 8,000 cr ($ 1.1 bn)

@ApolloTriCoat

#Q3marketupdates #Q3investorpresentations

Apollo tricoat - 3 steps ahead

Q3fy21/20 in crs

Rev 503/229

PAT 38/18

EPS 12.46/5.93

9m fy21/20

Rev 1006/434

PAT 70/31

EPS 23.24/10.35

Full on ahead not only 3 steps

#Q3marketupdates #Q3investorpresentations

Apollo tricoat - 3 steps ahead

Q3fy21/20 in crs

Rev 503/229

PAT 38/18

EPS 12.46/5.93

9m fy21/20

Rev 1006/434

PAT 70/31

EPS 23.24/10.35

Full on ahead not only 3 steps

50 % mkt share in structural steel tubes 9mfy21,sales vol CAGR 27% fy11-20

Most products with 1500+ SKUs (shapes & sizes)

Highest scale with 10 plants - 2.5 mn ton capacity

Largest sales network 800+ distributors

Lowest cost producer

Premium pricing to peers

50000+ retailers

Most products with 1500+ SKUs (shapes & sizes)

Highest scale with 10 plants - 2.5 mn ton capacity

Largest sales network 800+ distributors

Lowest cost producer

Premium pricing to peers

50000+ retailers

@PolycabIndia #Q3marketupdates #Q3investorpresentations

Q3 earnings presentation

Revenue Q3 27988 mn ,up 12% yoy

9m 58891 mn ,up 12% yoy

PAT 2636mn ,up 19% yoy

9m 6027 mn,up 9% yoy

Net cash Q3 - 1335 mn

Q3 earnings presentation

Revenue Q3 27988 mn ,up 12% yoy

9m 58891 mn ,up 12% yoy

PAT 2636mn ,up 19% yoy

9m 6027 mn,up 9% yoy

Net cash Q3 - 1335 mn

Wires&cables

6% yoy growth

Distribution channel double digit growth

Institutional businesses continues 2 face headwinds

Wires > cables

Housing wires strong momentum

Export 2.9 bn,10.5% overall sales,down 33% yoy due higher Dangote base

Exc Dangote, Aus,Asia,UK 29% yoy growth

6% yoy growth

Distribution channel double digit growth

Institutional businesses continues 2 face headwinds

Wires > cables

Housing wires strong momentum

Export 2.9 bn,10.5% overall sales,down 33% yoy due higher Dangote base

Exc Dangote, Aus,Asia,UK 29% yoy growth

Fast moving electrical goods

Strong 41% yoy growth in total Rev back of consumer demand,distribution, product mix

FMEG mix to sales up 215bps, up 10.8% yoy

Fans took leadership in few geographies

Segment Ebit margin 5.9% in Q3 & 4.7% in 9mnths

Strong 41% yoy growth in total Rev back of consumer demand,distribution, product mix

FMEG mix to sales up 215bps, up 10.8% yoy

Fans took leadership in few geographies

Segment Ebit margin 5.9% in Q3 & 4.7% in 9mnths

@LTI_Global #Q3marketupdates

Conf call highlights

Seeing good traction in BFSI,Media,CPG Retail,Pharma,Mftg services

2large deal wins in Q3fy21 of $278 mn

$204mn Injazat deal in Dec 20 in UAE ,for high tech vertical, to help in cloud adoption ,best shoring ,ERP modernization

Conf call highlights

Seeing good traction in BFSI,Media,CPG Retail,Pharma,Mftg services

2large deal wins in Q3fy21 of $278 mn

$204mn Injazat deal in Dec 20 in UAE ,for high tech vertical, to help in cloud adoption ,best shoring ,ERP modernization

$74 mn deal with a Fortune 500 energy company

Injazat & energy deal revenues to contribute numbers from Q1fy22

Healthy margin growth of 35 bps led by higher utilization, increased offshoring, optimisation in SG&A

- wage hike in Q4 to impact numbers,160 to 170 bps

Injazat & energy deal revenues to contribute numbers from Q1fy22

Healthy margin growth of 35 bps led by higher utilization, increased offshoring, optimisation in SG&A

- wage hike in Q4 to impact numbers,160 to 170 bps

Offshore utilization due to higher growth, manag confident of maintaining onsite at past levels

Investment in SG&A ,Nordics ,data products to drive margin growth going fwd

PAT guidance of 14 to 15% going fwd

Digital business now contributes 44% to revenues, up 9.5% QoQ

Investment in SG&A ,Nordics ,data products to drive margin growth going fwd

PAT guidance of 14 to 15% going fwd

Digital business now contributes 44% to revenues, up 9.5% QoQ

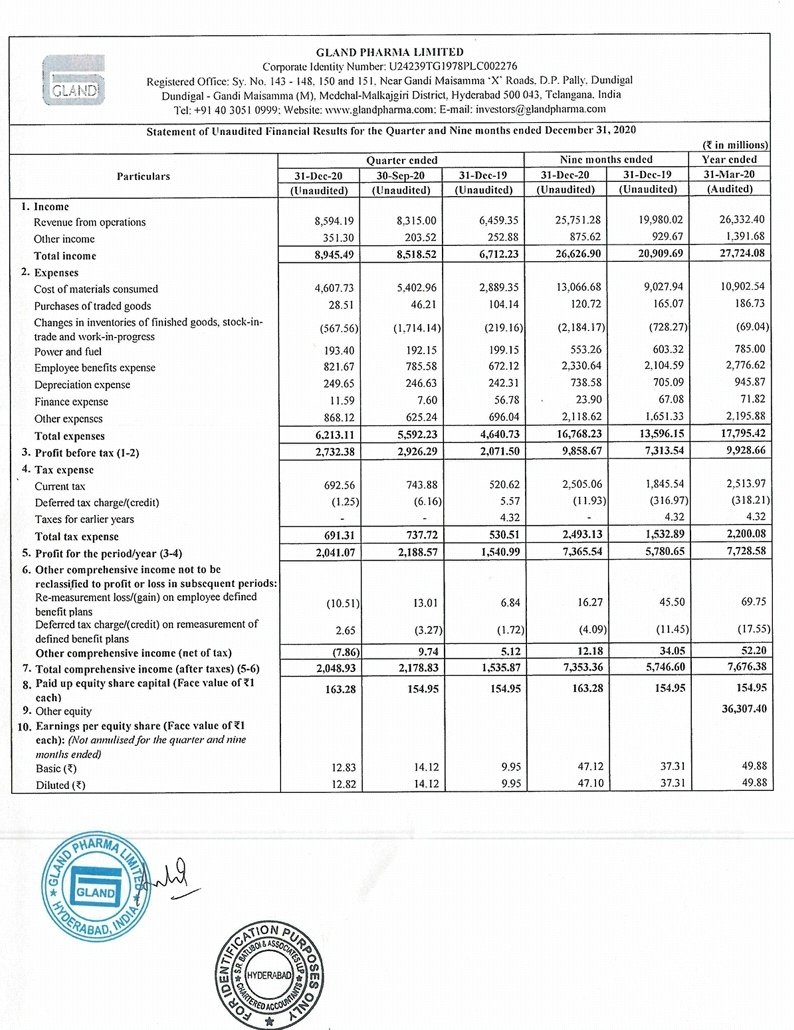

#glandpharma

#Q3marketupdates #Q3investorpresentations

Good show inr in mn

Rev 8945 /6712

PAT 2041 /1540

EPS 12.83 /9.95

9 months fy21 /20

Rev 26626 /20909

PAT 7365 /5780

EPS 47.12 / 37.31

Mkt wise

US 6021 /4853

India 1495 /1193

ROW 1078/413

#Q3marketupdates #Q3investorpresentations

Good show inr in mn

Rev 8945 /6712

PAT 2041 /1540

EPS 12.83 /9.95

9 months fy21 /20

Rev 26626 /20909

PAT 7365 /5780

EPS 47.12 / 37.31

Mkt wise

US 6021 /4853

India 1495 /1193

ROW 1078/413

R&D expenses INR Mn

Q3 fy21 434

Q3fy20 312

9M Fy21 916

9m Fy20 749

Net worth INR Mn

Mar 20 36462

Dec 20 56221

Net cash INR Mn

Mar 20 13202

Dec 20 28128

Capital expenditure

9M Fy20 1342

9M Fy21 1826

CFO

9M Fy20 4244

9M fy21 4056

Q3 fy21 434

Q3fy20 312

9M Fy21 916

9m Fy20 749

Net worth INR Mn

Mar 20 36462

Dec 20 56221

Net cash INR Mn

Mar 20 13202

Dec 20 28128

Capital expenditure

9M Fy20 1342

9M Fy21 1826

CFO

9M Fy20 4244

9M fy21 4056

New launches

9months fy21 - 31 product SKUs (4 mols)

US mkt - Dec 20 ,with partners filed 282 ANDAs, 226 approved, 56 pending

Core mkts (US,EU,Canada,Australia)

9M fy21 17415 mn

Growth 20%

Q3 fy21 6021 mn

Growth 24%

Domestic MKT

9M fy2110 product SKUs

Started Remdesivir mftg

9months fy21 - 31 product SKUs (4 mols)

US mkt - Dec 20 ,with partners filed 282 ANDAs, 226 approved, 56 pending

Core mkts (US,EU,Canada,Australia)

9M fy21 17415 mn

Growth 20%

Q3 fy21 6021 mn

Growth 24%

Domestic MKT

9M fy2110 product SKUs

Started Remdesivir mftg

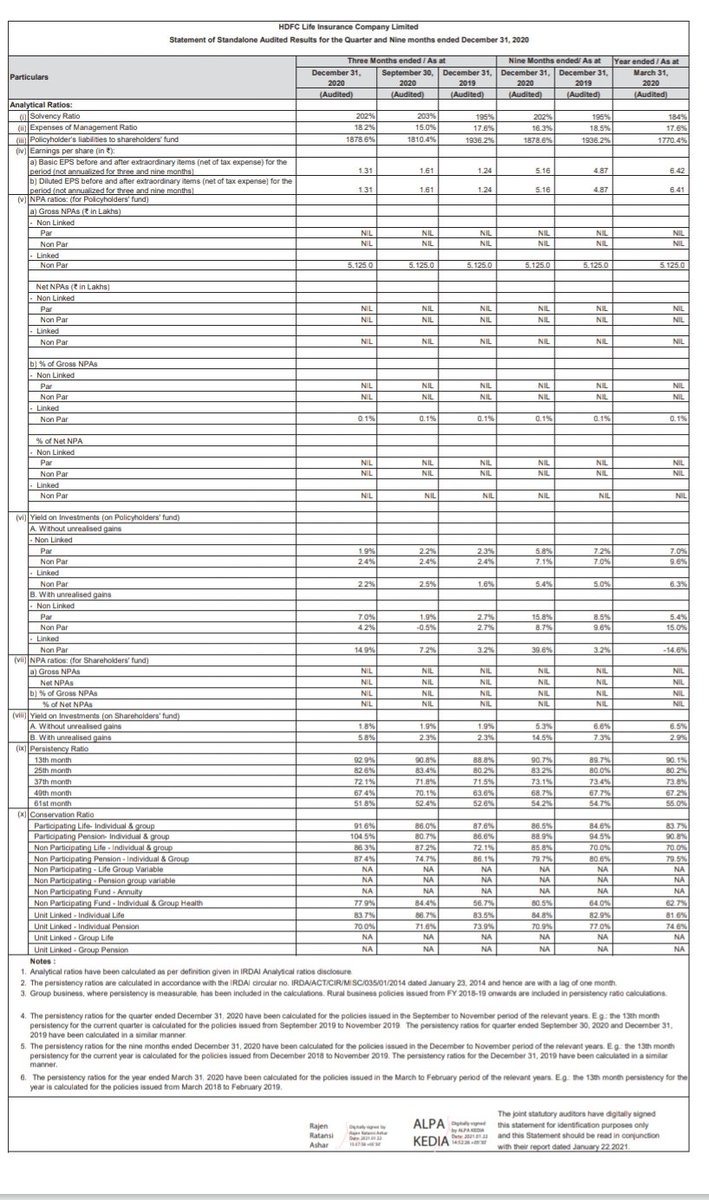

@HDFCLIFE #Q3marketupdates #Q3investorpresentations

Mkt share up 214 bps to 16.4%

NBM at 25.6%

8% Individual WRP growth compared to private industry de-growth of 6%

25.6% New Business Margin on the back of growth, balanced product mix

Mkt share up 214 bps to 16.4%

NBM at 25.6%

8% Individual WRP growth compared to private industry de-growth of 6%

25.6% New Business Margin on the back of growth, balanced product mix

@SyngeneIntl #Syngene #Q3marketupdates

Q3fy21/20 in mn

Rev 5845 /5191

Ebidta 1933 /1735

PAT 1022 /918

9months fy21 /20

Rev 15257/14046

Ebidta 5026/4749

PAT 2443 /2460

Q3fy20 had exceptional gain of 459 mn leading to higher PAT

Good show

High conviction bet

Doubler for me

Q3fy21/20 in mn

Rev 5845 /5191

Ebidta 1933 /1735

PAT 1022 /918

9months fy21 /20

Rev 15257/14046

Ebidta 5026/4749

PAT 2443 /2460

Q3fy20 had exceptional gain of 459 mn leading to higher PAT

Good show

High conviction bet

Doubler for me

#Q3investorpresentations

Collaborated Deerfield discovery & development 3DC to advance integrated drug discovery projects, early target validation to preclinical evaluation

Expanded research facility Genome valley Hyderabad, +90 scientist

Accreditatn NABL fr medical devices

Collaborated Deerfield discovery & development 3DC to advance integrated drug discovery projects, early target validation to preclinical evaluation

Expanded research facility Genome valley Hyderabad, +90 scientist

Accreditatn NABL fr medical devices

Setup new RT-PCR testing facility approved by NABL & ICMR

360clients

20395 mn Rev Fy20

8 Collaborations with top 10 pharma companies

4200 + scientists

3662 mn PAT fy20

400+ patents ( held with clients )

31541 mn capex Mar 20

Integrated services- drug discovery,development,mfg

360clients

20395 mn Rev Fy20

8 Collaborations with top 10 pharma companies

4200 + scientists

3662 mn PAT fy20

400+ patents ( held with clients )

31541 mn capex Mar 20

Integrated services- drug discovery,development,mfg

#bajajfinance #Q3marketupdates Q3 FY21 highlights

New loans booked 6.04/7.67 mn Q3fy20

Customer franchise Q3fy21 46.31 vs 40.38 mn 31 Q3fy20 Company acquired 2.19 mn new customers in Q3fy21 vs 2.46

mn Q3 FY20.

AUM 31 Dec 20 143,550 cr vs 145,092 crore as of 31Dec 19.

New loans booked 6.04/7.67 mn Q3fy20

Customer franchise Q3fy21 46.31 vs 40.38 mn 31 Q3fy20 Company acquired 2.19 mn new customers in Q3fy21 vs 2.46

mn Q3 FY20.

AUM 31 Dec 20 143,550 cr vs 145,092 crore as of 31Dec 19.

Liquidity surplus Q321 14,347 cr vs 11 ,384 cr Q320 Cost of liquidity surplus for Q3 FY21 was ~ 213 crore vs ~ 83 crore in

Q3 FY20

NII for Q3 FY21 ~ 4,296 vs ~ 4,535 cr Q3 FY20

NII for

Q3 down 239 cr vs Q3 20, due to higher

reversal of interest income & cost of liquidity

Q3 FY20

NII for Q3 FY21 ~ 4,296 vs ~ 4,535 cr Q3 FY20

NII for

Q3 down 239 cr vs Q3 20, due to higher

reversal of interest income & cost of liquidity

@ICICILombard

Q3 & 9 months investor presentation

Leading pvt non life insurer since 2004

12 yr GDPI CAGR 12.3%

Mkt share 9 mns 7.2%

Agents 55615

Increasing share tier 3,4 cities

Virtual offices 840

Solvency Dec 20 - 2.76x ( req1.5x)

#Q3marketupdates

#Q3investorpresentations

Q3 & 9 months investor presentation

Leading pvt non life insurer since 2004

12 yr GDPI CAGR 12.3%

Mkt share 9 mns 7.2%

Agents 55615

Increasing share tier 3,4 cities

Virtual offices 840

Solvency Dec 20 - 2.76x ( req1.5x)

#Q3marketupdates

#Q3investorpresentations

In rs billion 9 mfy20 /21

Gross written premium 103.6 / 107.6

GDPI 101.32 /105.25

PAT 9.12 /11.27

ROE 21.8 /22.4%

Solvency ratio 2.18 /2.76x

BV 128.76/159.86

EPS 20.07/24.81

Product mix in %

Motor OD & TP 50/49

Motor GDPI Mix

Pvt car 55.9/57.4

2 wheeler 29.6/27.3

CV 14.5/15.3

Gross written premium 103.6 / 107.6

GDPI 101.32 /105.25

PAT 9.12 /11.27

ROE 21.8 /22.4%

Solvency ratio 2.18 /2.76x

BV 128.76/159.86

EPS 20.07/24.81

Product mix in %

Motor OD & TP 50/49

Motor GDPI Mix

Pvt car 55.9/57.4

2 wheeler 29.6/27.3

CV 14.5/15.3

Advanced premium Dec 31st 20 - 31.97 bn / Sep 20 - 31.6 bn

Health ,travel & PA GDPI Mix 9 mon fy20/21

Individual 22.5 /24.9%

Group others 40 /23.2%

Group employer-employee 37.4 /51.9

Individual health indemnity grew 25.7% for 9 month from 17 at Sep 20

Health ,travel & PA GDPI Mix 9 mon fy20/21

Individual 22.5 /24.9%

Group others 40 /23.2%

Group employer-employee 37.4 /51.9

Individual health indemnity grew 25.7% for 9 month from 17 at Sep 20

@hcltech

#Q3marketupdates

Fy21 guidance

Revenue expected to grow QoQ betn 2-3% in constant currency for Q4fy21

Ebit exptd to grow betn 21-21.5% for fy21

Rev cross $10bn milestone in Cy20 ,delivering 3.6% yoy growth in constant currency, CY20 delivered Ebidta 26.6%,ebit 21.5%

#Q3marketupdates

Fy21 guidance

Revenue expected to grow QoQ betn 2-3% in constant currency for Q4fy21

Ebit exptd to grow betn 21-21.5% for fy21

Rev cross $10bn milestone in Cy20 ,delivering 3.6% yoy growth in constant currency, CY20 delivered Ebidta 26.6%,ebit 21.5%

#hcltech won 13 transformational deals across industry vertical including lifesciences,healthcare ,tech, financial services

Broad based growth driven by Mode 2 & products & platforms

Mode 2 prime driver of growth, up 25% yoy & 10.9% wow in CC,led by traction in cloud& digital

Broad based growth driven by Mode 2 & products & platforms

Mode 2 prime driver of growth, up 25% yoy & 10.9% wow in CC,led by traction in cloud& digital

Products & platforms clocked healthy 9.3% yoy growth in CC on strong new license sales & robust renewals

Ebidta at 28.2% expanded 355 bps yoy

Ebit 22.9% expanded 265 bps yoy,129 bps QoQ

Cy20 operating cash flow $2667 mn & FCF $2407 mn ,up 63.5 & 82.8% yoy

Ebidta at 28.2% expanded 355 bps yoy

Ebit 22.9% expanded 265 bps yoy,129 bps QoQ

Cy20 operating cash flow $2667 mn & FCF $2407 mn ,up 63.5 & 82.8% yoy

@HDFC_Bank #hdfc

#Q3marketupdates

Good show

Standalone profit 8758 cr vs 7416 yoy

NIM up 15.1% 16317 crs vs 14172 yoy

Loan book increased 16% YoY to 10.82 lakh crs & deposits by 19% YoY to 12.71 lakh crs at the end of Dec 20

CASA Dec 20 43% vs 39.5% Dec 19 & 41.6% Sep20

#Q3marketupdates

Good show

Standalone profit 8758 cr vs 7416 yoy

NIM up 15.1% 16317 crs vs 14172 yoy

Loan book increased 16% YoY to 10.82 lakh crs & deposits by 19% YoY to 12.71 lakh crs at the end of Dec 20

CASA Dec 20 43% vs 39.5% Dec 19 & 41.6% Sep20

Provisions 3414 cr vs 3703 qoq vs 3043 crs yoy

Gross NPA 8825 crs (0.81 vs 1.08) vs 11305 qoq, down 21.9 % ,down 189 bps

Net NPA 1016 vs 1756 ( 0.09 vs 0.17% ) down 42% qoq ,down 8 bps

Restructuring under Covid 0.5% of advances

5485 vs 5203 branches yoy

15541 vs 14533 ATMs

Gross NPA 8825 crs (0.81 vs 1.08) vs 11305 qoq, down 21.9 % ,down 189 bps

Net NPA 1016 vs 1756 ( 0.09 vs 0.17% ) down 42% qoq ,down 8 bps

Restructuring under Covid 0.5% of advances

5485 vs 5203 branches yoy

15541 vs 14533 ATMs

CAR at 18.9% against regulatory requirement of 11.075%

Total credit cost ratio 1.25% vs 1.41% Q2fy20 vs 1.29% Q3fy20

Balance sheet size 1654226 cr vs 1395336 Q3fy20

Total credit cost ratio 1.25% vs 1.41% Q2fy20 vs 1.29% Q3fy20

Balance sheet size 1654226 cr vs 1395336 Q3fy20

#gtpl hathway investor presentation highlights

#Q3marketupdates

No.2 MSO India

No.1 in Gujarat, 67% mkt share

No.6 Pvt wireline broadband player

CATV subscriber base 1.8x last 4yrs,Broadband base up 2.3x

Rev CAGR 22% last 4 yrs ,Ebidta Cagr 18%

FCF + last 4 yrs

#StockMarket

#Q3marketupdates

No.2 MSO India

No.1 in Gujarat, 67% mkt share

No.6 Pvt wireline broadband player

CATV subscriber base 1.8x last 4yrs,Broadband base up 2.3x

Rev CAGR 22% last 4 yrs ,Ebidta Cagr 18%

FCF + last 4 yrs

#StockMarket

@Infosys

#Q3marketupdates

Consolidated financial data

Large deal signings- $7.13 bn

Digital CC growth - 31.3%

CC Growth - 6.6% yoy

Operating margin - 25.4%

Increase in EPS - 16.5% in Rupee terms

Revenues

Q3 fy20 / Q3fy21 in $ mn

Digital - 1761/1318

Core - 1755/ 3243

#stocks

#Q3marketupdates

Consolidated financial data

Large deal signings- $7.13 bn

Digital CC growth - 31.3%

CC Growth - 6.6% yoy

Operating margin - 25.4%

Increase in EPS - 16.5% in Rupee terms

Revenues

Q3 fy20 / Q3fy21 in $ mn

Digital - 1761/1318

Core - 1755/ 3243

#stocks

Revenue in % Q3 fy21/fy20

Financial 33.1 /31.5

Hi tech 8.2/ 7.6

Life sciences 7.1 /6.7

By client geography

USA 61.6 /61.3

Europe 24 /24.4

ROW 11.8/11.5

India 2.6/2.8

Number of clients added -139

Number of mn $ clients

1mn $ - 761

10 mn $ 246

50mn $ 60

100 mn $ 29

#TCS

Financial 33.1 /31.5

Hi tech 8.2/ 7.6

Life sciences 7.1 /6.7

By client geography

USA 61.6 /61.3

Europe 24 /24.4

ROW 11.8/11.5

India 2.6/2.8

Number of clients added -139

Number of mn $ clients

1mn $ - 761

10 mn $ 246

50mn $ 60

100 mn $ 29

#TCS

Voluntary attrition down from 15.8% in Q3fy20 to 10% in Q3fy21

FCF in crs

Q3fy20 - 4759

Q3fy21 - 5683

Q3 revenue up yoy by 8.4% in $ ,up 6.6% in constant currency

Digital revenues cross 50% of total revenue

Q3 margin 25.4% ,yoy up 350 bps

Opg margin 24.5%

#Q3marketupdates

FCF in crs

Q3fy20 - 4759

Q3fy21 - 5683

Q3 revenue up yoy by 8.4% in $ ,up 6.6% in constant currency

Digital revenues cross 50% of total revenue

Q3 margin 25.4% ,yoy up 350 bps

Opg margin 24.5%

#Q3marketupdates