Discover and read the best of Twitter Threads about #RealRates

Most recents (5)

Daily Bookmarks to GAVNet 02/21/2022 greeneracresvaluenetwork.wordpress.com/2022/02/21/dai…

Meet Twist: MIT’s Quantum Programming Language Keeping tabs on data entanglement keeps reins on buggy quantum code

spectrum.ieee.org/quantum-progra…

#QuantumProgrammingLanguage, #DataEntanglement, #QuantumCode

spectrum.ieee.org/quantum-progra…

#QuantumProgrammingLanguage, #DataEntanglement, #QuantumCode

4 Myths That Are Killing Business Today

digitaltonto.com/2022/4-myths-t…

#BusinessMyths, #GreatResignation, #CulturalCompetency, #motivation

digitaltonto.com/2022/4-myths-t…

#BusinessMyths, #GreatResignation, #CulturalCompetency, #motivation

#Dollar (DXY) not driven by #RealRates recently

Since hawkish Jun FOMC, DXY +5.7% v/s 5y US Real yld 23bp lower

Dollar's resilience despite inflation spike in US & despite drop in US real rates further incentivizes foreign investors to buy more $ assets

Since hawkish Jun FOMC, DXY +5.7% v/s 5y US Real yld 23bp lower

Dollar's resilience despite inflation spike in US & despite drop in US real rates further incentivizes foreign investors to buy more $ assets

Basic Maths:

▪️ European investor invests EUR100 ($115 @ 1.1500) in 5y UST at 1.22%

▪️ Gets back ~$122 after 5y

▪️ If converts $ back to EUR at unch 1.1500=>EUR106.25

If $ strengthens to say 1.1000 (w/o FX adjustment despite rocket relative inflation), she gets back ~EUR 111.0

▪️ European investor invests EUR100 ($115 @ 1.1500) in 5y UST at 1.22%

▪️ Gets back ~$122 after 5y

▪️ If converts $ back to EUR at unch 1.1500=>EUR106.25

If $ strengthens to say 1.1000 (w/o FX adjustment despite rocket relative inflation), she gets back ~EUR 111.0

At yesterday’s #FOMC meeting, the Committee revealed more expected tightening and further steps toward #tapering #asset purchases than they had previously. We see these as steps in the right direction.

Yesterday’s @federalreserve statement and press conference suggest that the Committee believes progress has been made toward its goals, but that there’s still some room to go to hit the recently re-defined objective of maximum #employment.

Still, it’s now time to set up for the end of this long-running #EmergencyPolicy-focused movie.

While our February 18th monthly client call argument for rising #RealRates appeared prescient, we were surprised by the magnitude of last week’s #move and would expect a more benign evolution toward #equilibrium going forward.

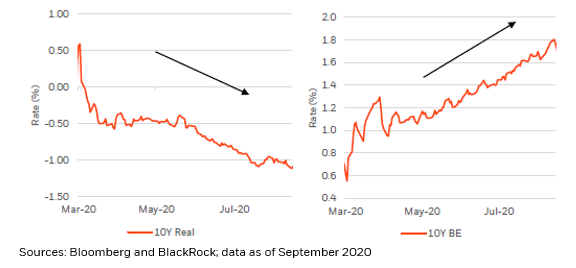

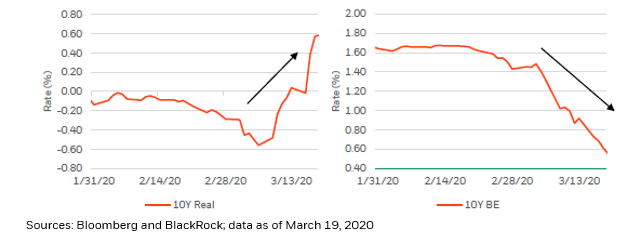

Taking a stab at periodizing the past year: 1) in Feb/Mar 2020 the Covid crisis was priced into #markets, real #rates spiked higher, #inflation breakevens collapsed and #investors scrambled to raise #cash as the #SPX experienced its fastest 30% drawdown in history.

“Banks likely close to peak reserves Morgan Stanley says.”

Via Felice Maranz of Bloomberg News

Via Felice Maranz of Bloomberg News

Agreed. CECL has pulled forward Reserves & Provisioning like never before thanks to Lifetime vs historical Incurred Loss models.

Also thx #RealRates

Also thx #RealRates

U don’t want to be selling solid high quality US Banks at peak lending standards or troughing M2 velocity (rate of change & enabled by #RealRates) close to 1x TBV.. with a potential peak in Reserve build. Lending standards may thaw in late 4Q20 & more importantly 2021 imho.