Discover and read the best of Twitter Threads about #FOMC

Most recents (24)

As was widely expected, the @federalreserve today halted the most aggressive policy rate #HikingCycle since 1980, leaving the Fed Funds range unchanged at 5.0% to 5.25%, a level that appears clear to us to be finally having an impact on the #economy.

We think today’s actions represent a “Hawkish skip,” which implies that #policy makers are seeking more #data before potentially hiking rates again in July, or September.

For our part, we think #ChairPowell’s comments at the press conference made it clear that the #FOMC is seeking to balance increasingly restrictive monetary policy with the high degree of uncertainty around the tightening of #CreditConditions…

#FOMC - ALL YOU NEED TO KNOW:

Have you ever wondered what the Federal Funds Rate is and how it affects the economy?

Let's break it down in simple terms. 🌟 (1/11)

Have you ever wondered what the Federal Funds Rate is and how it affects the economy?

Let's break it down in simple terms. 🌟 (1/11)

1️⃣ Banks rely on deposits from customers to lend money to others.

(2/11)

(2/11)

2️⃣ To ensure stability, regulators require banks to keep a portion of their money in reserve.

(3/11)

(3/11)

🚨 BREAKING: Fed #FOMC Keeps Interest Rate Unchanged at 5.25% 🔥

Here's why you need to pay attention 👇

A thread 🧵

Here's why you need to pay attention 👇

A thread 🧵

1️⃣ FED MEDIAN RATE FORECASTS RISE to 5.6% by End-2023, 4.6% by End-2024.

2️⃣ #FOMC Votes Unanimously for Fed Funds Rate Action.

🚨 BREAKING: Massive Announcement at #FOMC Meeting Today 🔥

What #Bitcoin and #Crypto Traders MUST Know 🚀

A thread 🧵

What #Bitcoin and #Crypto Traders MUST Know 🚀

A thread 🧵

1/ The highly anticipated #FOMC meeting is underway, and it's set to rock the market!

👉 Here's what you need to know 👇

👉 Here's what you need to know 👇

2/ The Fed's interest rate decision is about to be released at 2:00 pm EST, followed by a press conference at 2:30 pm EST.

👉 The outcome could have a monumental impact on the #crypto space!

👉 The outcome could have a monumental impact on the #crypto space!

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this… twitter.com/i/web/status/1…

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this… twitter.com/i/web/status/1…

May 3-4 #FOMC Example: 2PM initial reaction red and went lower and started consolidate then the circle shows 2:30 starts to spike after the fake break down for a $7-$8 MOVE to upside in under 1 HOUR!

July 26-27 #FOMC Example: 2PM initial reaction you see the red higher wick and falls. Then you see at 2:30 fake out again to downside then RIPPED UP for a $14 POINT MOVE IN 1 HOUR.

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

👉 The latest #FOMC minutes just dropped, and it's causing major waves in the #crypto world!

👉 The US Federal Reserve is torn between tightening the screws or hitting the brakes!

👉 The US Federal Reserve is torn between tightening the screws or hitting the brakes!

👉 Some officials want MORE rate hikes, while others, including Fed Chair Jerome Powell, prefer to take a breather.

👉 What does this mean for #crypto? Let's find out!

👉 What does this mean for #crypto? Let's find out!

#FOMC Notes

• Some participants noted concerns that the federal debt limit may not be raised in timely manner, threatening significant financial system disruptions, tighter financial conditions.

• Some participants noted concerns that the federal debt limit may not be raised in timely manner, threatening significant financial system disruptions, tighter financial conditions.

• participants agreed that inflation was unacceptably high, and are declining slower than they had expected.

• participants judged that the banking sector stress would likely weigh on economic activity, but to an uncertain extent.

1/ Officials Saw "Uncertainty" Over Further Rate Increases at May Meeting.

2/ Debt Default Threatens Tighter Financial Conditions, "Significant Disruptions".

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

Today’s #CPI report continues to depict #inflation that is just too high for most people’s good, especially the @federalreserve’s.

In fact, the report showed that #inflation remains remarkably sticky, which doesn’t correspond to virtually any practical thinker’s timeline of when it might be expected to start to come down further.

These elevated levels of inflation continue to be remarkably high relative to the many months with which the #economy has now operated with persistently higher #InterestRates.

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 👇

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 👇

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

HOW TO TRADE #FOMC

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️ 👇🏼

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️ 👇🏼

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

NEXT WEEK

The Bear's take:

•Monthly close on lighter volume

•Negative divergences from classic indicators

•Tough talk from FEDs

•Inflation is sticky, rates ↑

• #Recession is here

• #GDP ↓

•Leading indicators ↓

• #AAPL earnings ↓

•Big #Gamma at 4000

$SPX #SPX

The Bear's take:

•Monthly close on lighter volume

•Negative divergences from classic indicators

•Tough talk from FEDs

•Inflation is sticky, rates ↑

• #Recession is here

• #GDP ↓

•Leading indicators ↓

• #AAPL earnings ↓

•Big #Gamma at 4000

$SPX #SPX

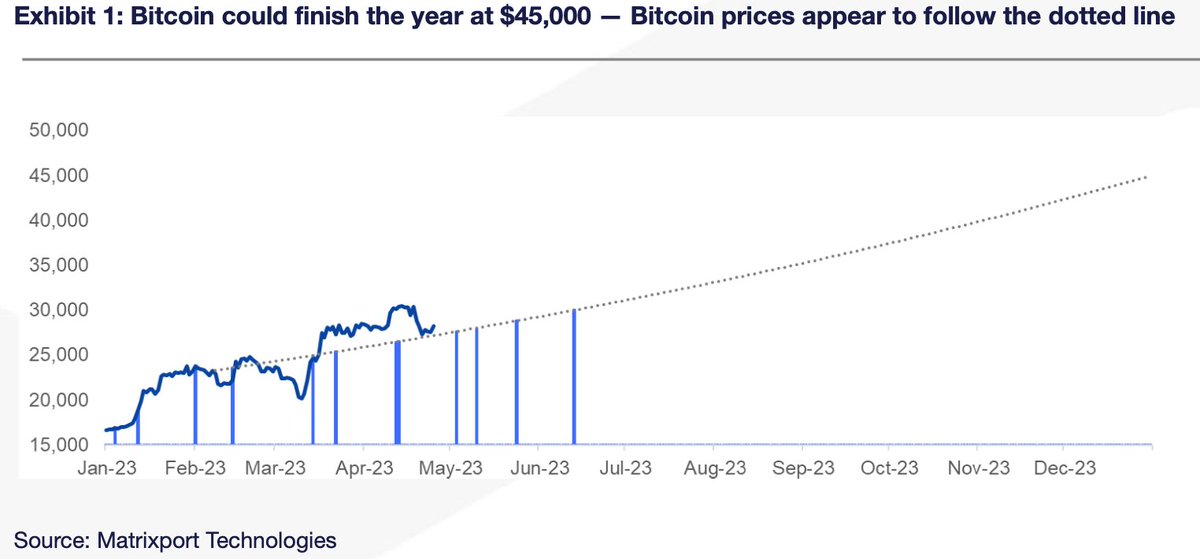

#Bitcoin prices set to reach $45,000 this year, says report - Follow the 'fair value' roadmap for optimal #tradingstrategy ⬇️🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

1/10: Despite recent #volatility, #Bitcoin prices are where they should be according to our #CPI/#FOMC roadmap laid out in Feb.

2/10: Based on the Jan. Effect, #Bitcoin could finish the year around $45k, which seemed optimistic at $22k, but is now achievable.

TODAY we have the #FOMC meeting.

The expectations are 10.7% for no rate hike (0 points) and 89.3% for a 25-point hike. In this thread, we'll explore why and how the Federal Reserve uses interest rates as a tool, other tools and the history behind it, and some examples 👇

The expectations are 10.7% for no rate hike (0 points) and 89.3% for a 25-point hike. In this thread, we'll explore why and how the Federal Reserve uses interest rates as a tool, other tools and the history behind it, and some examples 👇

Before we continue, if you would like to learn more about what the FOMC is doing and the impacted on the market. You can read my thread from yesterday. Just follow the link:

The #Fed uses interest rates as a key tool in managing the US economy. By changing interest rates, the Fed can influence borrowing, spending, and inflation, helping to stabilize the economy and achieve its dual mandate of maximum employment and price stability.

Herkese günaydın öncelikle #ramazan ayımız mübarek olsun🤗bugün #bitcoin ve piyasalar için önemli bir gün.#FED , #enflasyon ve banka krizilerinin arasında kritik bir karar vericek. (kriptoles.com/22-mart-bitcoi…)

+++🧵

+++🧵

#Fed'in #faiz oranlarını 0.25 puan artıracağına ve böylece faiz oranlarının %4,75 ila %5 aralığına yükseleceğine dair yaklaşık %87 oranında bir olasılık hesaplanıyorr. Bu oran son olarak 2007 yılında küresel finansal krizin başlangıcında görülen seviyelere ulaşmıştı.

+++🧵

+++🧵

Wall Street bankaları,#Fed'in faiz oranlarını duraklatıp artırmayacağı konusunda ikiye bölünmüş durumda.Ama çoğunluk 25 bps arttıracağı yönünde düşünüyor.

+++🧵

+++🧵

Wednesday Top Crypto News

Everything you need to know in one short thread…

Everything you need to know in one short thread…

In case you missed it, check out yesterdays thread on crypto market microstructure 👇🏼

Onto the news…In an interview with Bloomberg, Cathie Wood said the current banking crisis, which will only “attract more institutions” to the #BTC market over time.

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 24 FOMC’S (Only One Non-Event Move) 💰

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this… twitter.com/i/web/status/1…

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 24 FOMC’S (Only One Non-Event Move) 💰

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this… twitter.com/i/web/status/1…

If you found this thread helpful please:

• RT the FIRST tweet to share

• Follow @BullTradeFinder on Twitter for more informative ideas

• Sign-up for our FREE newsletter to learn more:

thefinancialbit.beehiiv.com/subscribe

• RT the FIRST tweet to share

• Follow @BullTradeFinder on Twitter for more informative ideas

• Sign-up for our FREE newsletter to learn more:

thefinancialbit.beehiiv.com/subscribe

May 3-4 #FOMC Example: 2PM initial reaction red and went lower and started consolidate then the circle shows 2:30 starts to spike after the fake break down for a $7-$8 MOVE to upside in under 1 HOUR!

The #FOMC meeting is happening TOMORROW, and it could have a big impact on your investments! 💸

With 18% of the market expecting a pause and others anticipating a 25-point hike, you'll want to understand what's going on to make smart decisions. So, let's dive into this 👇

With 18% of the market expecting a pause and others anticipating a 25-point hike, you'll want to understand what's going on to make smart decisions. So, let's dive into this 👇

The FOMC is a group of important people from the Federal Reserve who make big decisions about how money works in the US. They meet ~8 times a year to decide on "monetary policy." Their main tool? Interest rates!