Discover and read the best of Twitter Threads about #Reflation

Most recents (24)

Back from a long break. Personal news to be shared soon. As for markets? #Reflation and #BigFlip in the making. Animal spirit is back, supported by lower rates' vol. Definitely a new market regime. 1/n

What is the new regime about? Fed is done with micromanaging of financial conditions. No more, no less. And it makes complete sense for them to finally stop holding the markets' (bearish) hand. However, actions have consequences and markets are what they are. 2/n

September PPI Final Demand +0.4% MoM… last month MoM revised down to -0.2% MoM.. +8.5% YoY.

Core PPI +7.2% YoY v +7.3% YoY in August.

PPI Series Peaked in March 2022 at +11.7% YoY. Core CPI Series peaked in March at +9.7% YoY.

Inflation Deceleration continues..

Core PPI +7.2% YoY v +7.3% YoY in August.

PPI Series Peaked in March 2022 at +11.7% YoY. Core CPI Series peaked in March at +9.7% YoY.

Inflation Deceleration continues..

September CPI… +8.2% YoY vs a recent high of +9.1% YoY in June.

Core CPI +6.6% YoY took out +6.3% YoY high in March.. Core driven mainly by Rents… Rental Appreciation is BLS sticky… But in the Real World appreciation has been cut in 1/2 already.

Energy down big…

Core CPI +6.6% YoY took out +6.3% YoY high in March.. Core driven mainly by Rents… Rental Appreciation is BLS sticky… But in the Real World appreciation has been cut in 1/2 already.

Energy down big…

The Fed’s Michelle Bowman sounding very astute & reasonable… she usually doesn’t get the Media headlines.

Wow… She’s actually addressing Annual SCB Vol…& wants to average out results. 👀 $XLF #Reflation

“Capital & Basel III End Game…Capital should be approached holistically…Capital Requirements should strike an appropriate balance…appropriately address Risk while recognizing the “Costs of Over Regulation”

Calibrating Capital Requirements is not a Zero Sum Game…@siddiqui71

Calibrating Capital Requirements is not a Zero Sum Game…@siddiqui71

Fed H8 Data as of Sep 14…has a minuscule increment in Loan Loss Reserves/Loans of 1.4%…System has $160B in Reserves on Sheet mostly Cards.

So don’t expect any meaningful increase in Net Charge Offs that are still at 22bps as of 2Q22 for the US Banking System.

$XLF #Reflation

So don’t expect any meaningful increase in Net Charge Offs that are still at 22bps as of 2Q22 for the US Banking System.

$XLF #Reflation

Credit Costs… Will Normalize…. Banks have said this ever since Forbearance ended.. you just won’t see anything too meaningful in 3Q22…

Banks have Over Earned on Credit & Under Earned on NII coming into 2022.. NII is now Ripping..

Banks have Over Earned on Credit & Under Earned on NII coming into 2022.. NII is now Ripping..

GSIB Card Books also have 6-8% Loan Loss Reserves that Buffer any future Credit Normalization - that’s totally Normal & Appropriate in Year 3/4 of a Recovery… assuming the Fed doesn’t Shank this Recovery into the Drink or OB.

Hello Turnaround Tuesday!

This equity market keeps giving you opportunities to reduce exposure long side and to add 🩳

Kashkari be damned!

Let's dig into the 🧮!

This equity market keeps giving you opportunities to reduce exposure long side and to add 🩳

Kashkari be damned!

Let's dig into the 🧮!

Asia is the mirror image of yesterday 🪞

🇯🇵↗️ 🇨🇳 ↘️

$NIKK 28196 +1.15%

$SSEC 3227 -0.4%

$TWII 14954 +0.2%

$HSI 19910 -0.55%

$KOSPI 2451 +1.0%

$IDX 7159 +0.4%

Australia ↗️

$ASX 6998 +0.45%

India ↗️

$BSE 59150 +2.05% ⬅️ ♉️

🇯🇵↗️ 🇨🇳 ↘️

$NIKK 28196 +1.15%

$SSEC 3227 -0.4%

$TWII 14954 +0.2%

$HSI 19910 -0.55%

$KOSPI 2451 +1.0%

$IDX 7159 +0.4%

Australia ↗️

$ASX 6998 +0.45%

India ↗️

$BSE 59150 +2.05% ⬅️ ♉️

Europe ↗️ at the open

$DAX 13080 +1.45%

$FTSE 7465 +0.5%

$CAC 6390 +1.1%

$AEX 706 +1.15%

$IBEX 8071 +1.0%

$MIB 22112 +1.25%

$SMI 10976 +0.75%

$MOEX 2310 +0.6% 🪆

$VSTOXX 27.22 🔻

$DAX range = 12679 - 13503 🐻

$DAX 13080 +1.45%

$FTSE 7465 +0.5%

$CAC 6390 +1.1%

$AEX 706 +1.15%

$IBEX 8071 +1.0%

$MIB 22112 +1.25%

$SMI 10976 +0.75%

$MOEX 2310 +0.6% 🪆

$VSTOXX 27.22 🔻

$DAX range = 12679 - 13503 🐻

10 Year not buying it… 2.66%

$XLF #Reflation

$XLF #Reflation

1970s Inflation cohort Comp too tidy… become very Consensus w Recency Bias imho.. 1950s coming out of WWII prolly more analogous cohort to today… coming out of a Recession + ZIRP.

CPI Decelerated hard with No Recession + Markets Ripped once Inflation cooled.

$XLF #Reflation

CPI Decelerated hard with No Recession + Markets Ripped once Inflation cooled.

$XLF #Reflation

The Power of The Dollar 🧵

[a thread for normies -like me]

[a thread for normies -like me]

Long periods of #dollar-strength often ended with massive financial dislocations like the Latin American #debt crisis of the 80s and the Asian crisis of the 90s.

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Although the #USdollar is not itself an asset, cash is.

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

S&P: April Manufacturing

“The rate of overall growth ‘Accelerated’ for the 3rd Month running & was the ‘Sharpest’ since last September.”

$XLF #Reflation

“The rate of overall growth ‘Accelerated’ for the 3rd Month running & was the ‘Sharpest’ since last September.”

$XLF #Reflation

But 2s10s…

So let me see here…Consumer Spending + Manufacturing are Both “Sharply” “Accelerating”….. can someone explain what exactly is weak in the Real Economy? Oh right Powell jams us into Recession coz of Yesterday’s news priced in by 2s10s silly….”It will all end in tears.” Got it.

LOL

People are exhausted - perhaps even inflation by natural extension. TBD.

Any #RateOfChange YoY on Inflation is fighting tough comps for the next 12 months.

Sure, maybe it goes higher with near term inertia….over time that’s not Repeatable Risk Management imho.

$XLF #Reflation

Sure, maybe it goes higher with near term inertia….over time that’s not Repeatable Risk Management imho.

$XLF #Reflation

No they aren’t. They are pretty much flat.. up a bit.. DQs are still the lowest in 50 Years at $JPM

$JPM 30 Day+ Auto & Home DQs Plunging…. Cards up +5bps to 1.09%

NCOs are at 1.37%… & they are reserved at 6.73%… You can drive a truck through that spread… Reserves get burned down before the P&L impact.

$XLF #Reflation

NCOs are at 1.37%… & they are reserved at 6.73%… You can drive a truck through that spread… Reserves get burned down before the P&L impact.

$XLF #Reflation

“Bank of America CEO says consumer spending is healthy despite roaring inflation” @CNBC cnbc.com/2022/04/19/ban…

“Don’t fight the U.S. consumer. They are a very strong force and you can see them very healthy. Their loan balances are down, they have plenty of borrowing capacity and they have plenty of spending capacity.”

- Brian Moynihan, CEO $BAC

$XLF #Reflation

- Brian Moynihan, CEO $BAC

$XLF #Reflation

@Stimpyz1 Don’t be that dude… the one that gets run over by the US Consumer. 🇺🇸

March S&P Global US Services PMI

2002:

March: 58.5

Feb: 56.5

Jan: 51.2

#GrowthAccelerating

$XLF #Reflation

2002:

March: 58.5

Feb: 56.5

Jan: 51.2

#GrowthAccelerating

$XLF #Reflation

The Intelligentsia tell us that the US Economy is “Slowing” it’s really weird coz it’s actually “Accelerating”

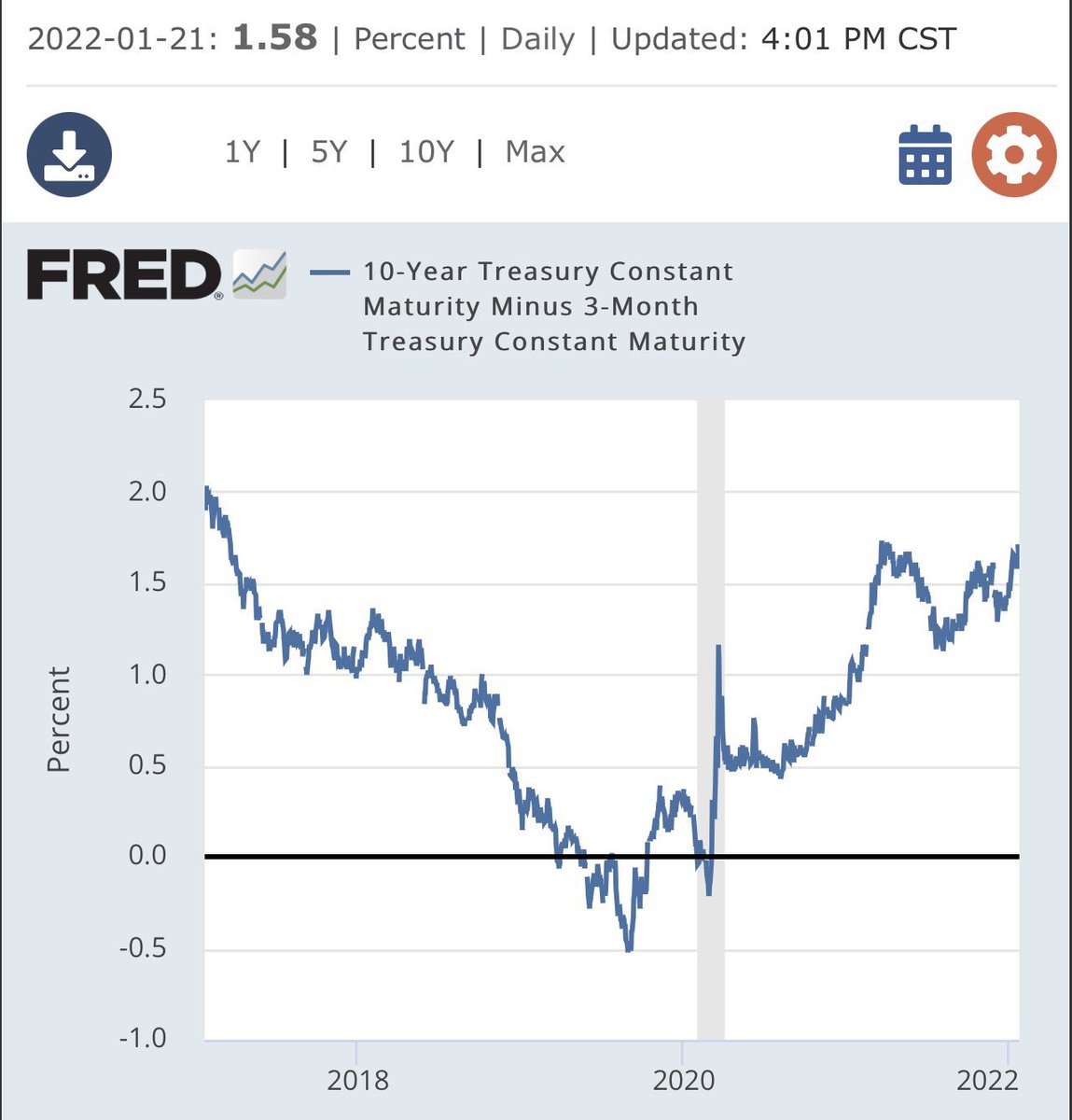

Is the 10Y3M “Steepening” by +40bps YTD missing something? @barryknapp

“US Pvt. Sector Expansion Accelerates as Demand Strengthens & Supply Issues Soften.” -Markit

Is the 10Y3M “Steepening” by +40bps YTD missing something? @barryknapp

“US Pvt. Sector Expansion Accelerates as Demand Strengthens & Supply Issues Soften.” -Markit

“The only thing that we learn from history is that we learn nothing from history.”

- Hegel

- Hegel

Hate to break it to some of these Perma Bears… but the Fed hasn’t run out of Bullets to fight inflation… they can continue to Hike rates & slow down QE or even step up RRP cash disbursements that make the Banking system even more ridiculously liquid.

The act of liquifying Banks in a Post Basel III & Gold Plated (including CCAR etc) world.. & creating M2 doesn’t in & of itself create inflation.. the Regulatory framework pushes money out of Banks on Supply side when it meets an optimal demand function. $XLF #Reflation

10Y +4bps to 1.98%

30Y +4bps to 2.28%

30Y +4bps to 2.28%

Growth rarely Decelerates meaningfully with $ZROZ down to this degree, unless This Time Is Different. Highly Doubt it

$XLF #Reflation

$XLF #Reflation

Margins usually Peak ~Year 3 (+/-) of a Recovery. For instance, Margins Peaked a Decade before the last Credit Cycle ended. Leadership changes…& Cycles usually Sequence.

$XLF #Reflation

$XLF #Reflation

🎯

U nailed it imho….first thing people do is go back to the last episode (2018-2020) w/o a good understanding of the changing contextual backdrop as well as QT mitigants that are currently in place & evolving further.

$XLF #Reflation

$XLF #Reflation

Another big time clue imho… $BAC did a 4.5% Pref Issuance a few days ago… if that ain’t a sign the Market has too much liquidity not sure what is….

$XLF #Reflation

$XLF #Reflation

The question for Investors (longer term horizon) is when do you sell $XLF ?

The answer is when Deposit Betas finally catch up to ~50% or 10Y3M Inverts Investors start to Pay Less & Less for every $1 of earnings power (driven by the Flow Through Rate of Inflation)….

The answer is when Deposit Betas finally catch up to ~50% or 10Y3M Inverts Investors start to Pay Less & Less for every $1 of earnings power (driven by the Flow Through Rate of Inflation)….

Long Term “Investors” who respect the Credit Cycle Started selling $XLF at the Peak of Price/TBV on $BKX in Jan 2018 at 2.1x & also long $ZROZ …as Deposit Betas were Peaking + Cyclicals/Commodity stocks like $CAT etc..

The other natural question that should pop up is…well if the Taper is coming & BKX is 1.8x…why shouldn’t 1 sell now? Won’t the Fed kill the Cycle w QT.. why on earth would 1 wait around… after doubling/tripling money from the March 20 bottom.. why wouldn’t 1 crystallize gains?

From most recent peak:

$XLF -7.5%

$QQQ -13%

YTD:

$HYG -1.8%

$XLF: -2.1%

$LQD -2.7%

$QQQ: -12%

$BKLN Flat

$XLF -7.5%

$QQQ -13%

YTD:

$HYG -1.8%

$XLF: -2.1%

$LQD -2.7%

$QQQ: -12%

$BKLN Flat

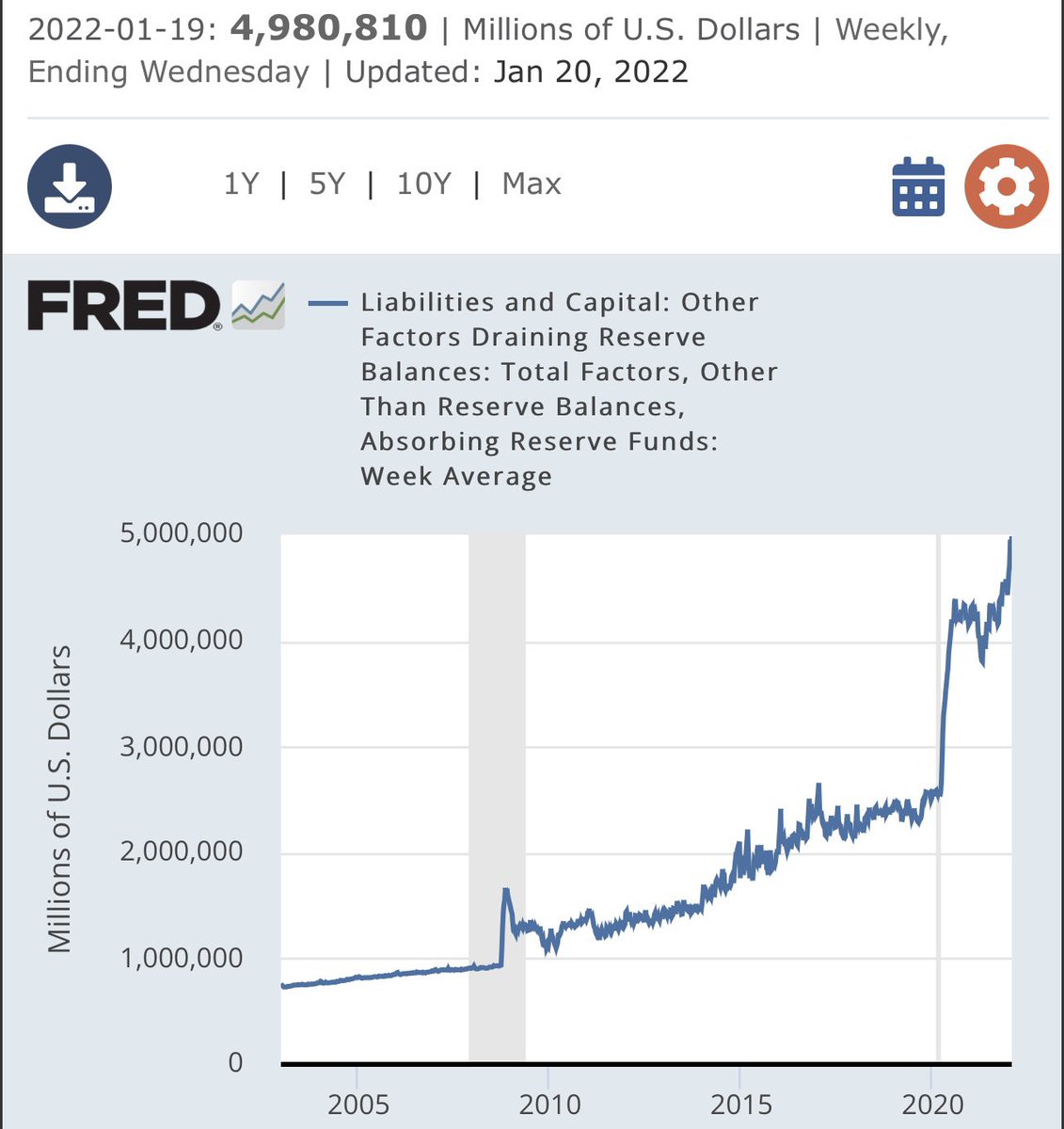

Reserves up to $4.98B as of the 19th

If the thesis is QT is causing the Sell Off… maybe look at Reserves. Market Liquidity is Up… Not Down.

+$129B WoW $XLF #Reflation

+$129B WoW $XLF #Reflation

Bank Liquidity has gonna Bananas… the Wall of Cash is coming…. So are Rate Hikes. $XLF #Reflation

This set up doesn’t exist today…CCCs were widening in late 2018 & 2019….Fuse was lit… now not so much.

CCCs don’t care at all about #TechPetrocks $ZROZ & high duration stuff getting smoked.

$XLF #Reflation 🚀

CCCs don’t care at all about #TechPetrocks $ZROZ & high duration stuff getting smoked.

$XLF #Reflation 🚀

Yield Curve (10Y3M) Steepening, Dr. Copper Ripping, HY Bonds Unch all year at +310bps OAS, CCCs have tightened -12bps this year..& tightened by -18bps in the last 10 days…

$HYG is 4 year effective/spread duration… not terrible… CCCs shorter at 3 yrs & +667bps OAS. $XLF

$HYG is 4 year effective/spread duration… not terrible… CCCs shorter at 3 yrs & +667bps OAS. $XLF

The Yield Curve is Steepening….

Front End of the Curve ain’t anywhere close to a Double Dip Recession.

Maybe the Talking Heads know more than the Bond Markets?

I Highly Doubt it.

$XLF #Reflation

Front End of the Curve ain’t anywhere close to a Double Dip Recession.

Maybe the Talking Heads know more than the Bond Markets?

I Highly Doubt it.

$XLF #Reflation

What’s your Convexity Profile?

What do you make if right & IORB Hikes won’t blast the economy coz of Private Sector De-Leveraging.. & what’s your downside at ZIRP if wrong?

$XLF #Reflation

What do you make if right & IORB Hikes won’t blast the economy coz of Private Sector De-Leveraging.. & what’s your downside at ZIRP if wrong?

$XLF #Reflation

Let’s say PermaBears are right & we have ZIRP forever… Banks have the highest Capital levels in 30+ Years… & can easily payout 100% of earnings at 13% CET1…

Worse case ATM payout machines w 10% All In Yields… Sure beats buying a Massive 10 Year Govt Bubble at 70x P/E imho.

Worse case ATM payout machines w 10% All In Yields… Sure beats buying a Massive 10 Year Govt Bubble at 70x P/E imho.

30% Divy… & 70% Buyback Ratios….in 5 Years…amount of Tangible Book Value Reduction… in a PermaBear ZIRP forever world…+ low credit costs…can easily get u to high Teen ROTCEs… & if we do get Inflation & Rate Hikes don’t Invert the Curve..ROTCEs are gonna Rip w TBVs👆 $XLF

Central Clearing helps not hurts Banks.

It’s gonna help get back > 20%

ROTCEs…blunting GSIB Score requirements, giving path to further Buybacks within context of getting off the ZIRP Floor (NII 👆) while Inflation Rises. $XLF #Reflation

It all starts w tons of XS Capital.

It’s gonna help get back > 20%

ROTCEs…blunting GSIB Score requirements, giving path to further Buybacks within context of getting off the ZIRP Floor (NII 👆) while Inflation Rises. $XLF #Reflation

It all starts w tons of XS Capital.

Banks love $TLT Central Clearing & moving Volume from Triparty to Sponsored FICC that Nets.

$XLF #Reflation

$XLF #Reflation

In simple DuPont terms:

ROTCE = Net Income/Revenues x Revenues/Tangible Assets x Tangible Assets/Tangible Equity

Net Margin x Asset Turnover x Financial Leverage Force Multiplier

Last turn is a Turbo Charger (Now think Central Clearing of $TLT )

$XLF #Reflation

ROTCE = Net Income/Revenues x Revenues/Tangible Assets x Tangible Assets/Tangible Equity

Net Margin x Asset Turnover x Financial Leverage Force Multiplier

Last turn is a Turbo Charger (Now think Central Clearing of $TLT )

$XLF #Reflation

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review - October 2021

1/15

Crude 🚀 along with domestic equities as vol ↘️

The 10/2 curve ↗️ then ↘️ sharply with short-end 🚀

Grains ↗️ with 🌽 &🌾💪🏼

AUD 🦘🔺 and JPY 🈹 🔻

Let’s dig in to the 🧮!

Global Macro Review - October 2021

1/15

Crude 🚀 along with domestic equities as vol ↘️

The 10/2 curve ↗️ then ↘️ sharply with short-end 🚀

Grains ↗️ with 🌽 &🌾💪🏼

AUD 🦘🔺 and JPY 🈹 🔻

Let’s dig in to the 🧮!

Hello Friday and the last trading day of October!

MTD returns

$WTIC +10.37%

$CORN +4.84%

$CRB +4.17%

$COPPER +3.07%

$GOLD +2.60%

$USD -0.97%

$COMPQ +6.92%

$SPX +6.71%

$CAC +4.36%

$DAX +2.85%

$KOSPI -1.93%

$VIX 16.53 -661 BPS

$UST2Y +22 BPS

$UST10Y +5 BPS

Let's dig into 🧮!

MTD returns

$WTIC +10.37%

$CORN +4.84%

$CRB +4.17%

$COPPER +3.07%

$GOLD +2.60%

$USD -0.97%

$COMPQ +6.92%

$SPX +6.71%

$CAC +4.36%

$DAX +2.85%

$KOSPI -1.93%

$VIX 16.53 -661 BPS

$UST2Y +22 BPS

$UST10Y +5 BPS

Let's dig into 🧮!

Asia closed ↔️ on the day #dispersion

$NIKK 28893 +0.25% 🔺

$SSEC 3547 +0.8% 🔺

$IDX 6591 +1.05% 🔺

$TWII 16897 -0.3% 🔻

$HSI 25377 -0.7% 🔻

$KOSPI 2971 -1.3% 🔻

Australia ↘️

$ASX 7324 -1.45%

India ↘️

$BSE 59124 -1.4%

$NIKK 28893 +0.25% 🔺

$SSEC 3547 +0.8% 🔺

$IDX 6591 +1.05% 🔺

$TWII 16897 -0.3% 🔻

$HSI 25377 -0.7% 🔻

$KOSPI 2971 -1.3% 🔻

Australia ↘️

$ASX 7324 -1.45%

India ↘️

$BSE 59124 -1.4%

Europe decidedly ↘️

$DAX 15570 -0.75%

$FTSE 7230 -0.25%

$CAC 6782 -0.35%

$AEX 805 -0.95%

$IBEX 9023 -0.05%

$MIB 26803 -0.3%

$SMI 12081 -0.6%

$MOEX 4150 -0.95% 🪆

$DAX 15570 -0.75%

$FTSE 7230 -0.25%

$CAC 6782 -0.35%

$AEX 805 -0.95%

$IBEX 9023 -0.05%

$MIB 26803 -0.3%

$SMI 12081 -0.6%

$MOEX 4150 -0.95% 🪆

“When interpreting data on Reserves, it’s important to keep in mind the quantity of reserves in Banking System is determined almost entirely by the Central Bank’s actions.

An individual Bank can Reduce their Reserves by “Lending Them Out or Using them 2 Purchase other Assets.”

An individual Bank can Reduce their Reserves by “Lending Them Out or Using them 2 Purchase other Assets.”

“But these actions Do Not Change the Level of Reserves in the Banking System.”

“The general idea should be clear: while an Individual Bank can reduce its level of reserves by “lending to firms or households, the same is not true of the Banking System as a Whole.”

“The general idea should be clear: while an Individual Bank can reduce its level of reserves by “lending to firms or households, the same is not true of the Banking System as a Whole.”

“No matter how many times the Funds are lent out by the Banks or used to make Purchases -Total Reserves in the Banking System do not change.”

“In particular, one can’t infer from the high level of aggregate reserves that banks are hoarding funds rather than lending them out.”

“In particular, one can’t infer from the high level of aggregate reserves that banks are hoarding funds rather than lending them out.”