Discover and read the best of Twitter Threads about #SPV

Most recents (6)

Air India were nationalised by Nehru in 1953

Since it's merger with Indian Airlines in 2007-08,Air India never made profit

Accumulated losses at Rs70820Cr till Aug2021,showcase how #AirIndia was bled for decades by corrupt Congress

@narendramodi finally did what had to be done

Since it's merger with Indian Airlines in 2007-08,Air India never made profit

Accumulated losses at Rs70820Cr till Aug2021,showcase how #AirIndia was bled for decades by corrupt Congress

@narendramodi finally did what had to be done

As on Aug 31,2021,Air India had total debt of Rs 61562Cr

About 75% of the debt has been transferred to a SPV,#AIAHL,before handing over airline to Tata Group

Indian taxpayers will no longer have to pay Rs 20Cr per day,to keep loss making #AirIndia flying,thx to @narendramodi

About 75% of the debt has been transferred to a SPV,#AIAHL,before handing over airline to Tata Group

Indian taxpayers will no longer have to pay Rs 20Cr per day,to keep loss making #AirIndia flying,thx to @narendramodi

Congress expectedly attacked the decision,as selling of family silver

What Tata is getting is not a cash cow but an airline which is bleeding &money needs to be pumped in to refurbish obsolete aircraft

No employee to be sacked for 1yr &resizing of staff only after paying VRS

What Tata is getting is not a cash cow but an airline which is bleeding &money needs to be pumped in to refurbish obsolete aircraft

No employee to be sacked for 1yr &resizing of staff only after paying VRS

Was ins Pflichtenheft (#KOAV) der ❤💚💛 für gesundheitlichen #Verbraucherschutz gehört: ... 1/6

@cad59 @Daniela_Behrens @Heiner_Garg @janoschdahmen @Karl_Lauterbach @KatjaPaehle @K_SA @mannelucha @MariaKlSchmeink @NicoleWestig @RonjaEndres @UllmannMdB

#StarkeVerbraucher @vzbv

@cad59 @Daniela_Behrens @Heiner_Garg @janoschdahmen @Karl_Lauterbach @KatjaPaehle @K_SA @mannelucha @MariaKlSchmeink @NicoleWestig @RonjaEndres @UllmannMdB

#StarkeVerbraucher @vzbv

#KOAV-Pflichtenheft 2/6

1) Versorgungsstrukturen in Gesundheit und Pflege sektorenübergreifend planen und Vergütungssysteme angleichen

2) Preiswettbewerb in der GKV durch Qualitätswettbewerb und -transparenz ablösen

3) Gesundheitsförderung zum Kernelement der Versorgung machen

1) Versorgungsstrukturen in Gesundheit und Pflege sektorenübergreifend planen und Vergütungssysteme angleichen

2) Preiswettbewerb in der GKV durch Qualitätswettbewerb und -transparenz ablösen

3) Gesundheitsförderung zum Kernelement der Versorgung machen

#KOAV-Pflichtenheft 3/6

4) #Pflegebedürftige aus der Armutsfalle ziehen, #Eigenanteile substanziell senken und deckeln

5) Zugang zu ambulanten #Pflegeleistungen vereinfachen, pflegende Angehörige endlich besser unterstützen, Arbeit der Betreuungskräfte rechtssicher ausgestalten

4) #Pflegebedürftige aus der Armutsfalle ziehen, #Eigenanteile substanziell senken und deckeln

5) Zugang zu ambulanten #Pflegeleistungen vereinfachen, pflegende Angehörige endlich besser unterstützen, Arbeit der Betreuungskräfte rechtssicher ausgestalten

1/ A quick primer on #SPVs

First an #SPV in the VC context simply means an entity setup to provide financing to startups or to acquire secondary shares in pre-IPO companies.

SPV #structures:

-LLC (common)

-LP

-Series LLC: Alumni Ventures Group

-Series LP: Assure/AngelList/etc

First an #SPV in the VC context simply means an entity setup to provide financing to startups or to acquire secondary shares in pre-IPO companies.

SPV #structures:

-LLC (common)

-LP

-Series LLC: Alumni Ventures Group

-Series LP: Assure/AngelList/etc

2/ Traditionally, #SPVs (special purpose vehicles) were used for structured financing transactions. These entities blew up in the 2009 financial crisis.

Today, it's very common to see SPVs on a Silicon Valley startup cap table. For example, in @Uber's #IPO there were 100+ SPVs.

Today, it's very common to see SPVs on a Silicon Valley startup cap table. For example, in @Uber's #IPO there were 100+ SPVs.

3/ Founders & employees are more active as operator angel investors. The broad swath of Silicon Valley CEOs invest. As a bridge between solo angel investor & full time GP, SPVs close that gap. They offer a chance for future GPs to test the waters. See @jmj @briannekimmel, et al.

While the country was distracted by the holidays, @PowerMinNigeria, Sale Mamman, said he'd suspended the MD of #Nigerian Bulk Electricity Trading Co, #NBET. This is an example of abuse that pervades power in Nigeria. This Minister has no such powers.

energycentral.com/news/nbet-boss…

energycentral.com/news/nbet-boss…

#NBET, @nbetnigeria is an #SPV wholly owned by @NigeriaGov and incorporated since 2010. Its shares are subscribed by the Ministry of Finance Inc (MOFI) & by the Bureau of Public Enterprises, BPE, which is the majority shareholder.

nbet.com.ng/about-us/who-w…

nbet.com.ng/about-us/who-w…

#NBET, @nbetnigeria has a Board of Directors, chaired under its instruments by the @FinMinNigeria. At incorporation in 2010, it was @NOIweala. Currently, it is @ZShamsuna. Before her, it was @HMKemiAdeosun.

thecable.ng/adeosun-board-…

thecable.ng/adeosun-board-…

7. United States decided to label #IRGC terrorists. But who are the real terrorists? Who created, trained, armed & financed the worst terrorist groups in the world?

#Hypocrites #DoubleStandards #Liars #Warlords #USRealTerrorists

#Hypocrites #DoubleStandards #Liars #Warlords #USRealTerrorists

1. United States decided to label #IRGC terrorists. But who are the real terrorists? Who created, trained, armed & financed the worst terrorist groups in the world?

🤨👇🏼

threadreaderapp.com/thread/1116293…

🤨👇🏼

threadreaderapp.com/thread/1116293…

2. United States decided to label #IRGC terrorists. But who are the real terrorists? Who created, trained, armed & financed the worst terrorist groups in the world?

🤨👇🏼

threadreaderapp.com/thread/1121015…

🤨👇🏼

threadreaderapp.com/thread/1121015…

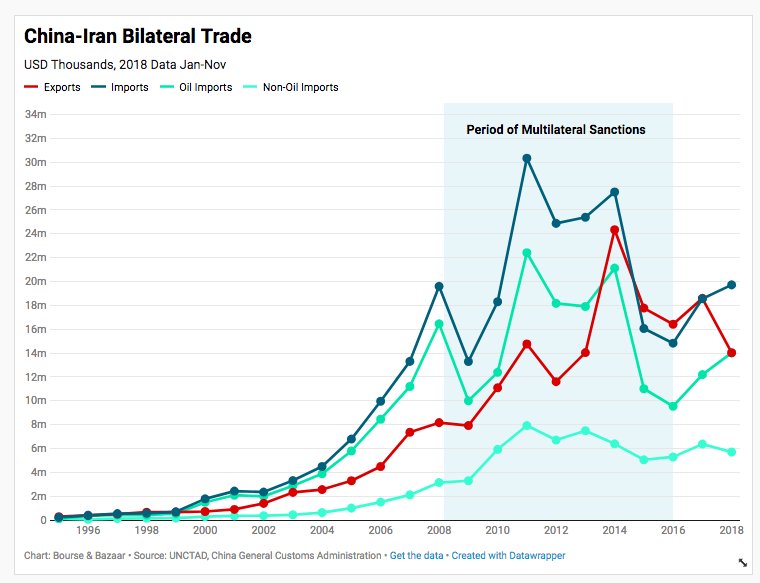

1. The conventional wisdom has been that #China's strategic trade + energy interests would see it defy US secondary sanctions on #Iran. Our new @BourseBazaar report, drawing on recent China-Iran trade data, suggests that the conventional wisdom is wrong.

bourseandbazaar.com/research-1/201…

bourseandbazaar.com/research-1/201…

2. The years when #Iran was under multilateral sanctions were boom years for China-Iran trade. China openly flouted US sanctions by purchasing historic volumes of Iranian oil while exporting a wide range of goods, winning marketshare as European traders pulled back.