Discover and read the best of Twitter Threads about #TaxtheRich

Most recents (24)

On this #FairTaxWeek, we have a question: Why is @RishiSunak resisting the public call to #TaxTheRich?

Maybe it's because he and his wife are the wealthiest inhabitants of @10DowningStreet IN HISTORY & yet they somehow pay less tax % than the average doctor in London 🧵👇

Maybe it's because he and his wife are the wealthiest inhabitants of @10DowningStreet IN HISTORY & yet they somehow pay less tax % than the average doctor in London 🧵👇

Meanwhile, the UK economy is a shambles. Nearly 30% of children live in poverty & healthcare is a complete mess. But applying a 1-2% wealth tax on assets over £10 million, could raise up to £22 billion annually.

Let's tell the PM that it's not only morally right to #TaxTheRich, but it's also popular! Polls by @YouGov and @PatMillsUK show that: 78% of Brits approve of increasing taxes on the super-rich while the wealthiest support a net wealth tax on those with more than £10 million.

Spoiled, entitled billionaire man-children are buying social media companies/newspapers and television networks and funding politicians and judges

Keeping their taxes low and regulations minimal

While we pay the price

#ResistanceUnited #wtpBLUE #DemCast #DemVoice1 #ProudBlue

Keeping their taxes low and regulations minimal

While we pay the price

#ResistanceUnited #wtpBLUE #DemCast #DemVoice1 #ProudBlue

When we honestly take a close look at all the dysfunction in this country...

Every single issue goes back to bad Republican Economic policies designed solely for the wealthy to gain and the working/middle class to lose

#ResistanceUnited #wtpBLUE #DemCast #DemVoice1 #ProudBlue

Every single issue goes back to bad Republican Economic policies designed solely for the wealthy to gain and the working/middle class to lose

#ResistanceUnited #wtpBLUE #DemCast #DemVoice1 #ProudBlue

We achieved our greatest period of economic security for almost all classes of citizens

under the New Deal policies of FDR

After Reagan, our middle/working class now pays the price for the excesses of the top 1%

#ResistanceUnited #wtpBLUE #DemCast #DemVoice1 #ProudBlue

under the New Deal policies of FDR

After Reagan, our middle/working class now pays the price for the excesses of the top 1%

#ResistanceUnited #wtpBLUE #DemCast #DemVoice1 #ProudBlue

#THREAD

Seriously, in a fair society, how much wealth should wealthy individuals be able to accumulate, hoard, & hide offshore?

And how much income tax should they pay?

A short history of how income tax rates in Britain have changed over the years... 🇬🇧

#TaxTheRich

Seriously, in a fair society, how much wealth should wealthy individuals be able to accumulate, hoard, & hide offshore?

And how much income tax should they pay?

A short history of how income tax rates in Britain have changed over the years... 🇬🇧

#TaxTheRich

Income tax was first implemented in Great Britain by William Pitt the Younger in his budget of December 1798 to pay for weapons and equipment in preparation for the Napoleonic Wars.

Pitt's new graduated ('progressive') income tax began at a levy of 2 old pence in the pound on incomes over £60 (£6,719 as of 2021), & increased up to a maximum of 10% on incomes of over £200. Pitt hoped this would raise £10M, but receipts for 1799 totalled just over £6M.

#PETITION

Jeff Bezos is worth $122 BILLION dollars, while a market trader selling rice in Uganda makes just $80 monthly. Guess which one of them is taxed at 40%?

Join the global call to tax the ultra-rich now.

#TaxTheRich #TaxBillionaires

secure.avaaz.org/campaign/en/ta…

Jeff Bezos is worth $122 BILLION dollars, while a market trader selling rice in Uganda makes just $80 monthly. Guess which one of them is taxed at 40%?

Join the global call to tax the ultra-rich now.

#TaxTheRich #TaxBillionaires

secure.avaaz.org/campaign/en/ta…

In the past few years, the richest 1% of the world have acquired nearly twice as much money as the bottom 99%.

While Elon Musk has paid a true tax rate of about 3% for years, a rice trader in Uganda paid 40%. She makes US$80 each month, while Musk is worth $180 BILLION.

While Elon Musk has paid a true tax rate of about 3% for years, a rice trader in Uganda paid 40%. She makes US$80 each month, while Musk is worth $180 BILLION.

Biden has called for a historic tax on billionaires, and with enough public pressure, he could champion the idea at an upcoming meeting of world leaders. A wealth tax of up to 5% on the ultra-rich could raise enough money to lift 2 billion people out of poverty!

#TaxTheRich

#TaxTheRich

🌍💻Ha habido mucha polémica con la recogida de firmas pidiendo que se pare el desarrollo de las IAs durante un tiempo por ser peligrosas.

Esta petición es del Future of Life, conocido por ser el corazón de la secta del "Longtermism" en Silicon Valley.

Os explico en un hilo

Esta petición es del Future of Life, conocido por ser el corazón de la secta del "Longtermism" en Silicon Valley.

Os explico en un hilo

Es bastante peligroso que esta gente introduzca sus marcos en el desarrollo de la tecnología humana y que sean ellos quienes quieren controlar este desarrollo. Elon Musk, uno de los firmantes, es uno de los fundadores y desarrolladores precisamente de OpenAI.

#Budget2023 makes hefty investments in clean economy, health and affordability but mostly misses the mark on how to pay for it. 1/4

The good news: stock buyback tax announced in the fall financial update and a new tax on dividends in the financial sector will bring over $1 billion a year from rich corporations. 2/4

The bad news: NO expansion the excess profits tax to other sectors as recommended by FINA, NO movement to match Biden's 15% minimum book profits tax to limit corp tax avoidance, AND continuation of huge tax loopholes like 50% discount on capital gains means one thing: 3/4

Farmers in UK have reduced the amount of crops they plant, to adjust for the labor shortage, rather than leave tons of it rotting, some have even given up on some crops! It was never “Project Fear”. it was plain old common sense, but here we are all patriotic and that! 1-2

We are expect to “suck it up”, work harder, get better jobs etc, but that still doesn’t solve the problem of 💩pay for the menial jobs like PICKING THE CROPS! @RishiSunak #MakeItMakeSense #TaxTheRich Companies paying dividends while employees claim benefits is screwed up! 2-2

There is a road map out of this clusterfuck, we could have been on it if the GE had been fair, but let’s just move on! We need to implement the manifesto under @jeremycorbyn leadership, we must #TaxTheRich and stop subsidies to millionaires! We must claim all the backdated tax!

“Wir leben nicht in einer Zeit des Mangels, sondern in einem goldenen Zeitalter des Überflusses inmitten grotesker Armut, des Überflusses inmitten unerträglicher Formen des Zurücklassens.

Wer die Armut bekämpfen will, muss gegen den Reichtum vorgehen…👇

overton-magazin.de/top-story/armu…

Wer die Armut bekämpfen will, muss gegen den Reichtum vorgehen…👇

overton-magazin.de/top-story/armu…

Kein Wunder, dass die Wohlhabenden in der Regel die größten Befürworter der Armutsbekämpfung durch Wohltätigkeit sind, denn um das Problem grundlegend anzugehen, müsste man auch die ungleiche Verteilung der politischen Macht in unserer Welt angehen.

Was zu tun wäre ist klar: #TaxTheRich

Gabriela Bucher, Geschäftsführerin von Oxfam, erklärte dies so:

‚Die Besteuerung der [Über]reichen ist die strategische Voraussetzung für den Abbau der Ungleichheit und die Wiederbelebung der Demokratie.’

Gabriela Bucher, Geschäftsführerin von Oxfam, erklärte dies so:

‚Die Besteuerung der [Über]reichen ist die strategische Voraussetzung für den Abbau der Ungleichheit und die Wiederbelebung der Demokratie.’

After 13 long years of catastrophic Tory misrule...

#PMQs

#JoinAUnion

#EnoughIsEnough

#SupportTheStrikes

#GeneralElectionN0W

#PMQs

#JoinAUnion

#EnoughIsEnough

#SupportTheStrikes

#GeneralElectionN0W

The answer to Britain's multiple crises is obvious: #TaxtheRich

#THREAD

The tax-avoiding Tory-supporting billionaire-owned Mail ALWAYS blames the poor.

While the top 10% of earners pay 53% of all INCOME tax (£208bn of £393bn), the HMRC collected £714.8bn in taxes in 2021/22, & the UK's top 10% own 43% of ALL wealth, the bottom 50% just 9%.

The tax-avoiding Tory-supporting billionaire-owned Mail ALWAYS blames the poor.

While the top 10% of earners pay 53% of all INCOME tax (£208bn of £393bn), the HMRC collected £714.8bn in taxes in 2021/22, & the UK's top 10% own 43% of ALL wealth, the bottom 50% just 9%.

A better way to 'get tough on welfare spending' would be to get tough on the CAUSES of welfare spending. 75% of working-age benefits are spent on: income top-ups for low-paid workers; benefits to help pay rent; & disability, sickness & incapacity benefits.

💰 Salaries are taxed much higher than the typical forms of income and wealth for the richest.

Those are:

💸 Dividends, capital gains and unrealized capital gains, corporate income, inheritance, property and wealth.

ALL of them have much fewer taxes than your salary does.

Those are:

💸 Dividends, capital gains and unrealized capital gains, corporate income, inheritance, property and wealth.

ALL of them have much fewer taxes than your salary does.

🔙 Taxes on the wealthiest were much higher. Over the last 40 years, governments have slashed the income tax rates on the richest.

This means that millions that could be invested to fight #inequality go uncollected.

It is time to #TaxTheRich!

👀 views-voices.oxfam.org.uk/2023/01/how-su…

This means that millions that could be invested to fight #inequality go uncollected.

It is time to #TaxTheRich!

👀 views-voices.oxfam.org.uk/2023/01/how-su…

Ich habe ja versprochen, wenn die ersten 100 in der Liste der #ClimateRevolution41World eingetragen sind, mal einen längeren Thread zu schreiben

Erst einmal möchte ich allen danken, die sich in so kurzer Zeit angeschlossen haben

Die Ursprüngliche Liste hatte ich schon vor 1/×

Erst einmal möchte ich allen danken, die sich in so kurzer Zeit angeschlossen haben

Die Ursprüngliche Liste hatte ich schon vor 1/×

ca. 3 Jahren unter dem Hashtag #Klimarevolution angelegt, in der auch viele engere Freund:innen schon mit gemacht hatten und die auch hier auf Twitter unermüdlich für Gerechtigkeit und eine Zukunft kämpfen,in der alle Lebewesen eine Zukunft haben

Diese Liste hatte etwa 50 2/×

Diese Liste hatte etwa 50 2/×

Mitglieder

Zum Jahreswechsel 2021/22 kam dann ein Discord Kanal dazu, in dem wir auch schon so einiges an aktuellen Themen gesammelt hatten

Dann wurden wir Anfang 2022 alle von #Putlers Krieg überrascht und über viele Monate hin, war dass das alles beherrschende Thema 3/×

Zum Jahreswechsel 2021/22 kam dann ein Discord Kanal dazu, in dem wir auch schon so einiges an aktuellen Themen gesammelt hatten

Dann wurden wir Anfang 2022 alle von #Putlers Krieg überrascht und über viele Monate hin, war dass das alles beherrschende Thema 3/×

The already grotesquely wealthy richest 1% pocketed two-thirds of ALL new wealth ($26 TRILLION) created since the pandemic began.

They own most platforms, press, & media, fund free-market think tanks, & bribe, support, or threaten Govts.

#EnoughlsEnough

theguardian.com/inequality/202…

They own most platforms, press, & media, fund free-market think tanks, & bribe, support, or threaten Govts.

#EnoughlsEnough

theguardian.com/inequality/202…

Food and energy companies more than doubled their profits in 2022, paying out $257 BILLION to already wealthy shareholders at a time when globally, more than 800 million people were going hungry.

#EnoughIsEnough #TaxTheRich

#EnoughIsEnough #TaxTheRich

Only 4 cents in every dollar of tax revenue came from wealth taxes, & around half the world’s 2,700 or so billionaires live in countries with no inheritance tax on money they give to their children. The UK has around 170 billionaires, many of whom have non dom status.

#TaxTheRich

#TaxTheRich

Idag släpper vi vår rapport "Survival of the richest" - en rapport om den globala ojämlikhetens konsekvenser. Och ojämlikheten skenar också här hemma i Sverige🧵

➡️De fem rikaste svenskarna äger mer än vad fem miljoner svenskar gör tillsammans

➡️De fem rikaste svenskarna äger mer än vad fem miljoner svenskar gör tillsammans

➡️Under de senaste tio åren har 61.5 % av all förmögenhet som genererats i sverige gått till den rikaste 1 %. Inget har gått till de fattigaste 50 %. 🧵

➡️Ändå betalar de allra rikaste i världen minst skatt. Skatter på inkomst och konsumtion står för 80 % av alla skatteintäkter globalt. Skatter på förmögenheter står endast för 4 %. 🧵

La #ReformeDesRetraites avec des 🍺 : un fil🧵 à dérouler (ne pas reproduire IRL)

Disons que ça ⬇️

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

c’est le fameux déficit qui « menace » le système

Et c’est pour ça qu’on veut vous faire bosser davantage.

(🍺 = 1 milliard… #inflation #GueuleDeBois)

Disons que ça ⬇️

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

c’est le fameux déficit qui « menace » le système

Et c’est pour ça qu’on veut vous faire bosser davantage.

(🍺 = 1 milliard… #inflation #GueuleDeBois)

Ça ce sont les 2000 aides d’État aux entreprises ⬇️

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

(bordel ça ne rentre même pas dans un tweet les 157 milliards)

cgt.fr/actualites/fra…

🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺🍺

(bordel ça ne rentre même pas dans un tweet les 157 milliards)

cgt.fr/actualites/fra…

Miau. Se enojó el Nepo Baby mayor de Mexico, @RicardoBSalinas

¿Por qué a los ultra-ricos les cuesta tanto reconocer sus injustas ventajas? Fácil: porque su riqueza perdería legitimidad

Van 5 cosas en las que "trabajan arduamente" los Nepo Babies ultra-ricos en MX (y el mundo)🧵

¿Por qué a los ultra-ricos les cuesta tanto reconocer sus injustas ventajas? Fácil: porque su riqueza perdería legitimidad

Van 5 cosas en las que "trabajan arduamente" los Nepo Babies ultra-ricos en MX (y el mundo)🧵

1- Es de Nepo Babies empresarios nacer en familias ricas y heredar:

A los Nepo Babies les cuesta mucho trabajo, pero lo lograron. Nacieron en una familia rica. Tú esfuerzo fue recompensado, Nepo Baby (sarcasmo). 🤡🤡

A los Nepo Babies les cuesta mucho trabajo, pero lo lograron. Nacieron en una familia rica. Tú esfuerzo fue recompensado, Nepo Baby (sarcasmo). 🤡🤡

De hecho, no sólo es Salinas Pliego. Al menos 14 de los 17 multimillonarios mexicanos en la lista de Forbes heredaron grandes riquezas.

Miau. ¿Qué es eso de los Bebés del nepotismo, o Nepo Babies?

[O como decimos en Gatitos Contra la Desigualdad: el talento son los papás (y las mamás)]

Y, ¿Qué tiene que ver con la Meritocracia, de la que siempre hablamos?

Van 5 puntos al respecto: 🧵🧵

[O como decimos en Gatitos Contra la Desigualdad: el talento son los papás (y las mamás)]

Y, ¿Qué tiene que ver con la Meritocracia, de la que siempre hablamos?

Van 5 puntos al respecto: 🧵🧵

1- ¿Por qué les llaman Nepo Babies o bebés del nepotismo?

Imaginen un maratón dónde la mayoría inicia en el kilómetro 0, pero solo algunos comienzan desde el kilómetro 21 (a la mitad). ¿Sería justo?

Imaginen un maratón dónde la mayoría inicia en el kilómetro 0, pero solo algunos comienzan desde el kilómetro 21 (a la mitad). ¿Sería justo?

Ahora imaginen algo más sutil:

un atleta velocista tendrá que esforzarse más para tratar de ganar la competencia si es que, a diferencia de los otros, no tiene el calzado adecuado o está lesionado.

Estas "competencias" tampoco son justas.

un atleta velocista tendrá que esforzarse más para tratar de ganar la competencia si es que, a diferencia de los otros, no tiene el calzado adecuado o está lesionado.

Estas "competencias" tampoco son justas.

#THREAD

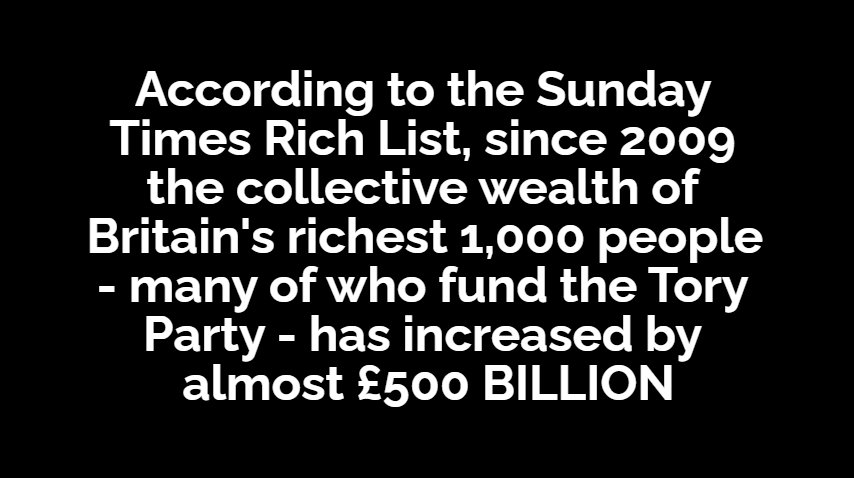

The number of UK billionaires has increased by a fifth - from 147 in 2020, to 177 now - since the onset of the Covid pandemic, according to a report calling for a progressive wealth tax to tackle rising inequality amid the #CostofLivingCrisis.

equalitytrust.org.uk/sites/default/…

The number of UK billionaires has increased by a fifth - from 147 in 2020, to 177 now - since the onset of the Covid pandemic, according to a report calling for a progressive wealth tax to tackle rising inequality amid the #CostofLivingCrisis.

equalitytrust.org.uk/sites/default/…

“The sudden explosion in extreme wealth was in large part due to measures aimed at lessening the impact of COVID on the economy, as central banks pumped TRILLIONS of pounds into financial markets, leading to a stock market boom which effectively lined the pockets of shareholders”

“While Covid-19 saw billionaire wealth rise to levels never seen before, the construction of the economic infrastructure that has enabled this mass accumulation stretches back over the last four decades.”

#EnoughIsEnough

#EnoughIsEnough

🌍💀 Longtermism o Largoplacismo, la ideología reaccionaria que reina y más extendida está en las élites de Silicon Valley.

Con este hilo completo la radiografía que llevo haciendo meses sobre Alt-Right y reaccionarios en el SV.

🧵Hilo

Con este hilo completo la radiografía que llevo haciendo meses sobre Alt-Right y reaccionarios en el SV.

🧵Hilo

VERY HIGHLY RECOMMENDED lnkd.in/eF4j6KsZ lnkd.in/ekjVqn3t Stop here awhile THE SYSTEM HAS FAILED USA UK CA

lnkd.in/ekb8GBDj lnkd.in/eRcbUN58 Show these threads

lnkd.in/ekb8GBDj lnkd.in/eRcbUN58 Show these threads

lnkd.in/epdpte9n UK PUBLIC BACK STRIKERS RATHER THAN MINISTERS ...AFTER PARTYGATE AND THE DISASTROUS TRUSSONOMICS, MANY MORE UK VOTERS NOW SEE THE TORIES AS INCOMPETENT, SERVING THEIR OWN INTERESTS AND OUT OF TOUCH WITH ORDINARY PEOPLE

lnkd.in/epdpte9n EXTRACTS 'Opinion polls on industrial action show a mixed picture at best for the Government.

📢 THREAD ALERT!!

Ever wondered why we need to #TaxTheRich? HERE ARE 9 REASONS FOR A WEALTH TAX

Read the full article by Dr Eduardo C. Tadem, Center for Integrative & Development Studies, University of the Philippines fightinequality.org/blog/tax-rich-…

Ever wondered why we need to #TaxTheRich? HERE ARE 9 REASONS FOR A WEALTH TAX

Read the full article by Dr Eduardo C. Tadem, Center for Integrative & Development Studies, University of the Philippines fightinequality.org/blog/tax-rich-…

Miau. Nos preocupa e indigna la alianza de Airbnb con el Gobierno de la CDMX para atraer “trabajadores remotos/nómadas digitales” extranjeros.

El gob. ignora la gravísima crisis de vivienda en la CDMX, al mismo tiempo que vende la ciudad a los grandes capitales....

🧵🧵

El gob. ignora la gravísima crisis de vivienda en la CDMX, al mismo tiempo que vende la ciudad a los grandes capitales....

🧵🧵

En 2020 y 2021, documentamos las cientos y seguramente miles de personas que fueron expulsadas de la ciudad por la crisis económica y por la especulación de precios de la vivienda. Tristes historias de despojo y expulsión a causa de la falta de regulación del mercado de vivienda.

Ahora, en 2022, el gobierno de la CDMX habla de “Otro modelo de turismo”, que al parecer es permitir la EXPULSIÓN de la gente más pobre de la CDMX que no puede pagar la renta para luego poner esas viviendas en Airbnb...

Miau. Recuerden que HOY miércoles 26 de Octubre a las 8pm (CDMX) es nuestro Live en Instagram sobre mitos de Meritocracia, y un poco más del objetivo de @gatitoscontraladesigualdad

Con motivo a nuestro 4to #AniversarioGatuno, tenemos más dinámicas planeadas.🧵

Con motivo a nuestro 4to #AniversarioGatuno, tenemos más dinámicas planeadas.🧵

Esta semana estaremos hablando de: El mito de la meritocracia.

Les invitamos a participar y a luchar juntxs contra la desigualdad.

Queremos conocer sus perspectivas sobre las siguientes preguntas:

Les invitamos a participar y a luchar juntxs contra la desigualdad.

Queremos conocer sus perspectivas sobre las siguientes preguntas:

¿POR QUÉ LA MERITOCRACIA ES UN MITO?

- Sesga percepciones de reales causas de pobreza y riqueza

- Difunde visión individualista de lo social

- Porque legitima la desigualdad

- Otro? Comente:

- Sesga percepciones de reales causas de pobreza y riqueza

- Difunde visión individualista de lo social

- Porque legitima la desigualdad

- Otro? Comente:

Miau. Siguiendo las sorpresas del 4to #AniversarioGatuno, les pedimos su colaboración participando en la #MichiCoperacha en favor de la lucha Contra la Desigualdad, para seguir creciendo y fortaleciendo nuestras investigaciones y contenidos.

😻landings.afrus.app/gatitos?cc=tw1😻

🧵🧵🧵

😻landings.afrus.app/gatitos?cc=tw1😻

🧵🧵🧵

¿Qué nos permite lograr tu cooperación?

1. Crear más espacios de investigación.

2. Hacer más incidencia y expandir nuestra comunidad.

3. Generar más contenidos y fortalecer nuestro equipo de Karens.

1. Crear más espacios de investigación.

2. Hacer más incidencia y expandir nuestra comunidad.

3. Generar más contenidos y fortalecer nuestro equipo de Karens.

¡Únanse a la #MichiCoperacha y apoyen a la lucha contra la desigualdad!

- Pueden hacerlo donando en el siguiente enlace: landings.afrus.app/gatitos?cc=tw1

- Pueden hacerlo donando en el siguiente enlace: landings.afrus.app/gatitos?cc=tw1