Discover and read the best of Twitter Threads about #U3O8

Most recents (24)

If you've heard about a global #Nuclear #energy resurgence⤴️⚛️👂🐦 driving demand for #Uranium that's in a deep supply deficit⤵️⛏️ and wonder how U can invest💵🤔 in this tiny #mining #stocks sector famous for spectacular gains🎆💰😃 here's a🧵 on the various ways U can play.🤠👇

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

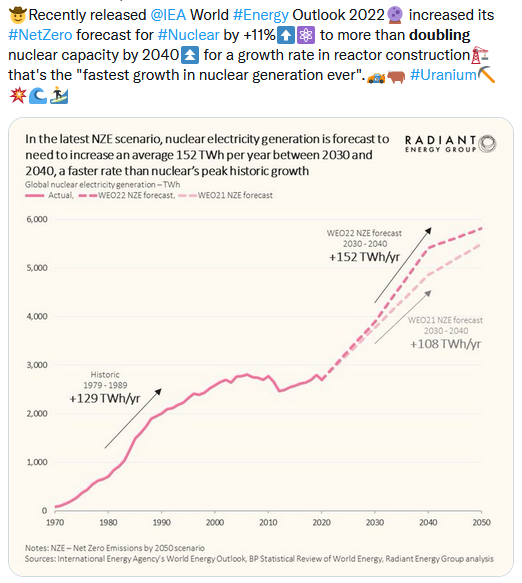

1) The #Uranium #investing opportunity⛏️💰 emerges from an unexpected & accelerating #Nuclear Renaissance🏎️🌅⚛️🏗️ creating unprecedented demand for #U3O8🛒 already in a deep multi-year structural supply deficit⏬ that can only be repaired by far higher #U3O8 prices💲⏫🐂🧵.../2👇

Crunching Numbers with @FootnotesFirst

Thread 🧵1/22

In 2020 @SachemCove presented a "confidential - not-for-distribution" deck on the @MacroVoices podcast. This document has been prepared by Lloyd Harbor Capital Management.

Let's dive in & go back to basics: Math is the Math.

Thread 🧵1/22

In 2020 @SachemCove presented a "confidential - not-for-distribution" deck on the @MacroVoices podcast. This document has been prepared by Lloyd Harbor Capital Management.

Let's dive in & go back to basics: Math is the Math.

2/22

The document starts off with the prejudiced fear narratives common investors absorb or generate when it comes to investing in this sector.

Please take note of how some of those points are similar to the ones used by @ItsWarrenIrwin in his current #Uranium bear thesis.

The document starts off with the prejudiced fear narratives common investors absorb or generate when it comes to investing in this sector.

Please take note of how some of those points are similar to the ones used by @ItsWarrenIrwin in his current #Uranium bear thesis.

3/22

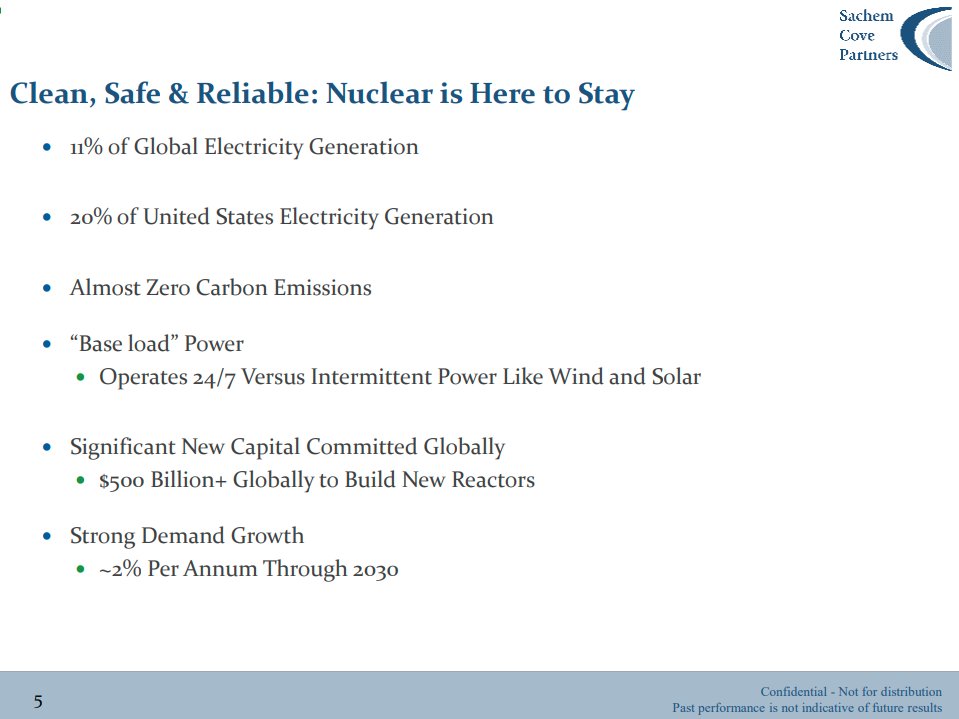

If we pierce through the fear narratives we start seeing the first signs of the #Uranium bull case.

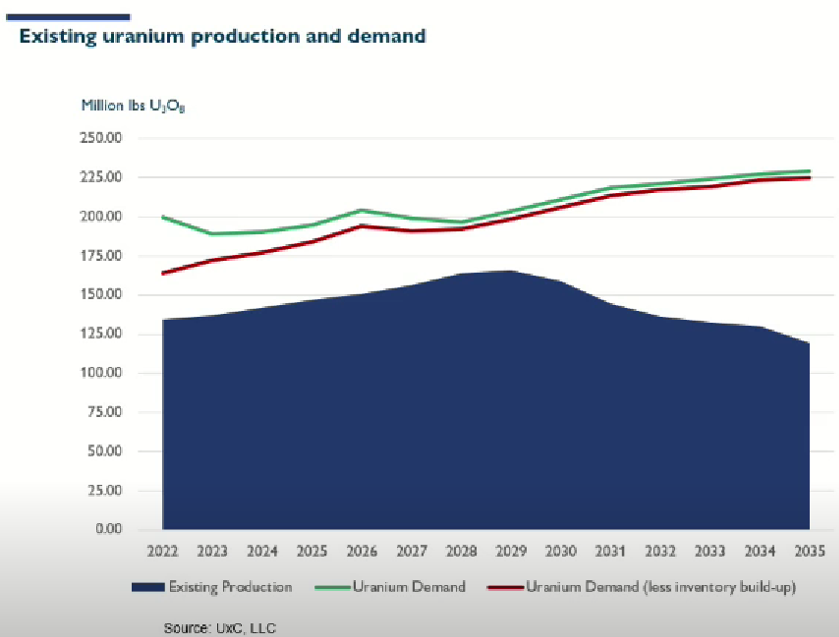

@ItsWarrenIrwin still uses the 2% PA demand growth model. But @FootnotesFirst explains that his models are very conservative & don't include restarts, life extensions, etc.

If we pierce through the fear narratives we start seeing the first signs of the #Uranium bull case.

@ItsWarrenIrwin still uses the 2% PA demand growth model. But @FootnotesFirst explains that his models are very conservative & don't include restarts, life extensions, etc.

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

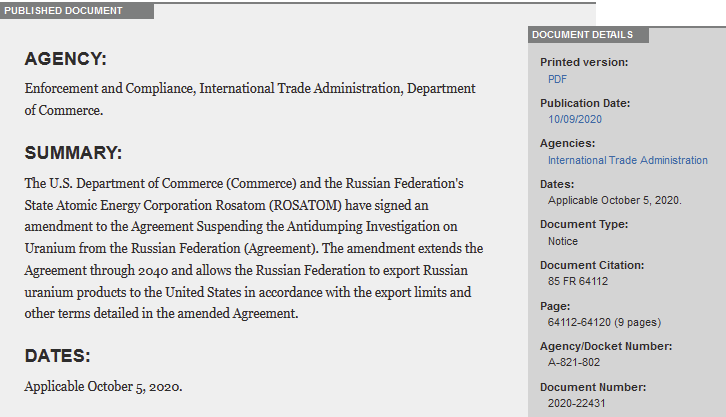

1)#Russia's war on #Ukraine🪖 led to prices for #Uranium Conversion & Enrichment SWU more than doubling in 2022⏫ in a price wave🌊 cascading down #Nuclear fuel cycle towards mined #U3O8⛏️ as per Cantor Fitzgerald👇 as enrichers switch to "overfeeding".🍼🍼 A thread for U!👨🏫🧵👇2

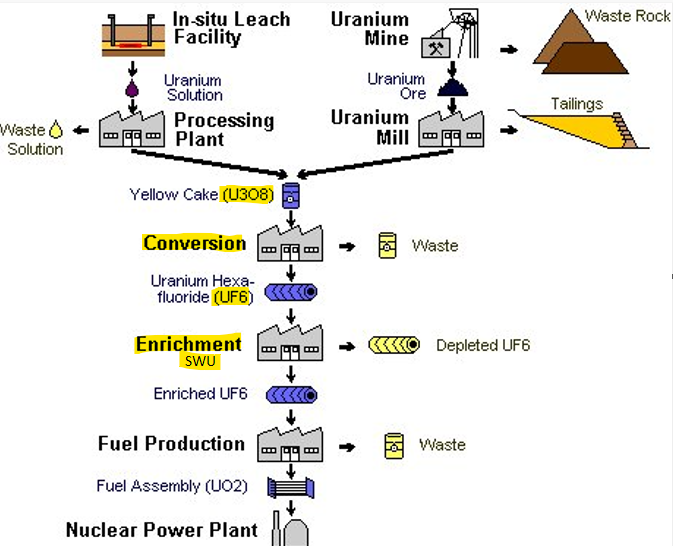

2)#Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

1) The #investing opportunity in #Uranium⛏️💰 emerges from an accelerating #Nuclear Renaissance🏎️⚛️🏗️ creating unprecedented demand for #U3O8🛒 that was already in a deep multi-year structural supply deficit⏬ that can only be repaired by far higher #U3O8 prices.✖️2⃣⏫🐂🧵.../2👇

1) As promised, here's a thread showing how #Uranium requirements for just one typical 1000MW #Nuclear reactor in the West have increased by over 9% since #Russia invaded #Ukraine🪖 pushing up mined #U3O8 feed by nearly 20% in new enrichment contracts.🧾⛏️ Old 2021 model.👇🧵...2

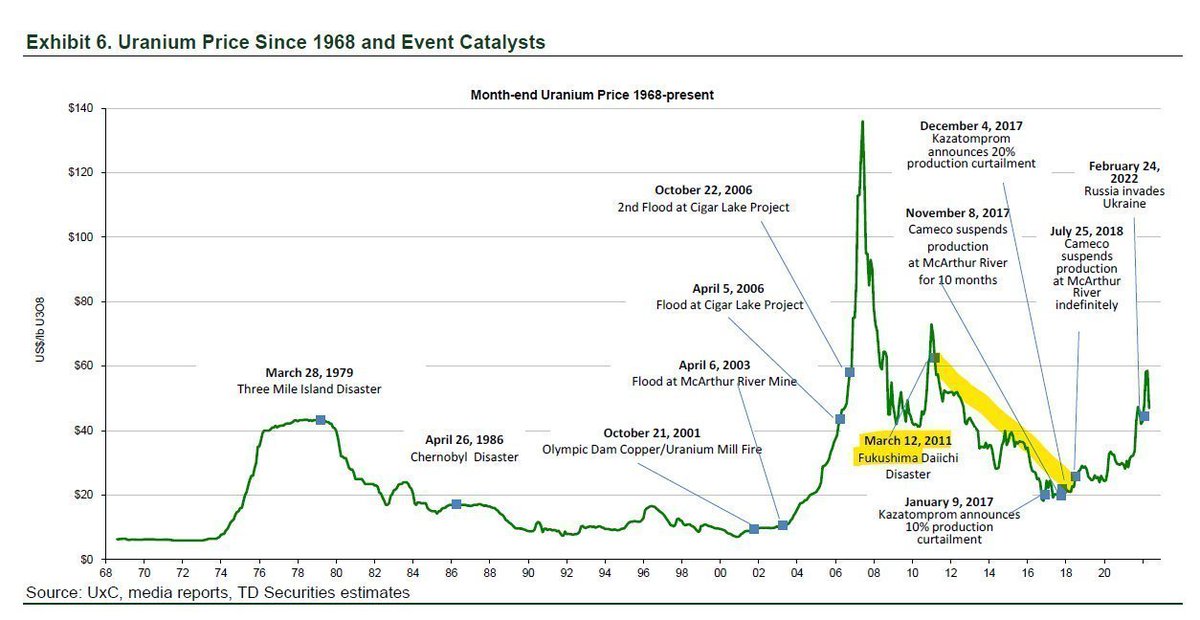

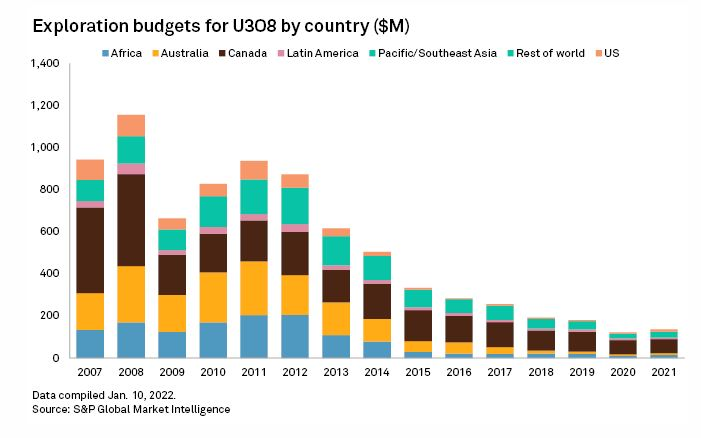

1) The #Uranium #mining #stocks #investing thesis in a nutshell🥜 is that after Fukushima the #U3O8 price sank, new mine projects were cancelled, many mines closed, investment dropped💰⤵️ as investors mistakenly thought '#Nuclear #energy is dying'🪦 but they were wrong!✖️😯../2👇

1) The #Uranium #mining #stocks #investing thesis in a nutshell🥜🧵 is that after Fukushima the price of #U3O8 sank, new mine projects were cancelled, many mines closed, investment dropped 💰⤵️ as investors thought "#Nuclear #energy is dying"🪦 but they were wrong!✖️😯 .../2👇

2) #Nuclear #energy has grown steadily over past decade so that #Uranium demand today is back where it was before Fukushima.🌞⚛️🏗️↗️ A #Nuclear renaissance has been quietly underway for years📈 & has been kicked into high gear by the #ClimateCrisis & #EnergyCrisis.🏎️🏗️⏫ .../3👇

1)On Friday Congress was asked for $1.5 Billion in "emergency" funding for "acquisition and distribution of low-enriched #uranium(LEU) and high-assay LEU(HALEU)"🛒 "to address potential future shortfalls in access to Russian uranium and [#nuclear] fuel services"⚛️⛏️🇷🇺 A 🧵../2👇

1) While market meltdowns🫠 & #Ukraine war FUD😱 may be raining on #Uranium for now⛈️ a huge Shockwave💥 dubbed 'overfeeding'🍼 is already crashing thru the seemingly calm #Nuclear fuel market.🌀⚛️⛏️ I've created a Tutorial👨🏫🧵 to help prepare U to ride the coming wave.🌊🏄💰👇2

2) #Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇3

In 2017 #Kazakhstan cut its #Uranium production to -20% below max permitted levels for 3 years 2018-2020⚛️⛏️⤵️ extended 3 times since thru 2023.➡️ Yesterday they extended cuts thru 2024 at -10% below max levels↗️ as #U3O8 prices still don't signal a return to full production.🤠🐂

Tho #Kazakhstan says it's intending to begin to raise its #Uranium production 18 months from now in 2024🐌 they warned in their H1/2022 results yesterday that they may not be able to increase production in 2024⚠️ due to "significant challenges" created by global supply chains.🚛

Even if Kazatomprom $KAP & its JV partners can increase production in 2024, it's very unlikely any new supply will go to western utilities.⚠️ #Kazakhstan has a deal with #China to fill a 23,000tU (60 Million lbs #U3O8) #Uranium storage facility by 2026, taking all available lbs🇨🇳

1) The #Uranium #mining #stocks #investing thesis in a nutshell🥜🧵 is that after Fukushima the price of #U3O8 sank, new mine projects were cancelled, many mines closed, investment dropped 💰⤵️ as investors thought "#Nuclear #energy is dying"🪦 but they were wrong!✖️😯 .../2👇

Question 4 U @brandon_munro et al re knock-on effects on WNA #Uranium demand figures from overfeeding by enrichers: WNA quotes U demand at 62,496tU (162.5M lbs #U3O8) per 393,744MW #Nuclear capacity = ~413K lbs/1000MW. AFAI can tell, this figure accounts for a SWU surplus...

1) The #Uranium #mining #stocks #investing thesis in a nutshell🥜🧵 is that after Fukushima the price of #U3O8 sank, new mine projects were cancelled, many mines closed, investment dropped 💰⤵️ as investors thought "#Nuclear #energy is dying"🪦 but they were wrong!✖️😯 .../2👇

Many investors didn’t believe it would happen. Well,here it is, intention for 1st #uranium contract with a well advanced developer Global Atomic $GLO (after FCU),after $PDN, $UUUU, $CCJ,Orano&KAP signed add contracts.

Banks were waiting signed contracts to give loan to GLO

(1/3)

Banks were waiting signed contracts to give loan to GLO

(1/3)

Funny here is that due to the disbelief (GLO being able to secure contracts with utilities) of many investors, $GLO share price (2.78 CAD/sh -> EV USD/lb of only 1.28 USD/lb 🤣) is still ridiculously cheap compared to less advanced developers

(2/3) #uranium

(2/3) #uranium

Compared to February 2007(when #uranium price was ~90$/lb),PDN share price valued each #U3O8 of PDN at 23.04 USD/lb, $GLO share price today only 1.28 USD/lb🤣

&GLO is about to increase their resources due to successful drills.

GLO is my Paladin of this cycle

(3/3) #commodities

&GLO is about to increase their resources due to successful drills.

GLO is my Paladin of this cycle

(3/3) #commodities

1/19) #Uranium - a Tutorial👨🏫 walking U thru the #Nuclear fuel cycle, what it is, the stages & issues involved, so U can understand the term that has every Uranium investor smacking their lips today: Overfeeding!😋 Here's a thread that I hope gives U some key insights.🌞⚛️⛏️🧵👇2

2) #Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then loaded into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇3

No way of knowing of course, and in the end, our opinions have no value.

What are the facts we currently have and on which we should base our acts upon instead of mere opinions?

->

#uranium #u3o8 #nuclear #investing #commodities

What are the facts we currently have and on which we should base our acts upon instead of mere opinions?

->

#uranium #u3o8 #nuclear #investing #commodities

-> Broad market is in a downtrend and the expectation is that rallies will be sold

-> #Uranium sector equities are showing momentary relative weakness

-> Spot price is showing relative strength

-> Long term trend in U leaders is mostly fully intact

-> #Uranium sector equities are showing momentary relative weakness

-> Spot price is showing relative strength

-> Long term trend in U leaders is mostly fully intact

Best way for an investor who has no means of timing the market, is to scale back in gently. It is to remember though that the possible downside is still quite large if the sector stays correlated to broad market.

Facts=facts.There can be many reasons for US utility #uranium inventory being at 16months of consumption on average &EU utility inventories at 2y of consumption.They are too low &they can’t run reactors without it,no room to consume more inventory—>EUP & UF6 restocking now!(1/7)

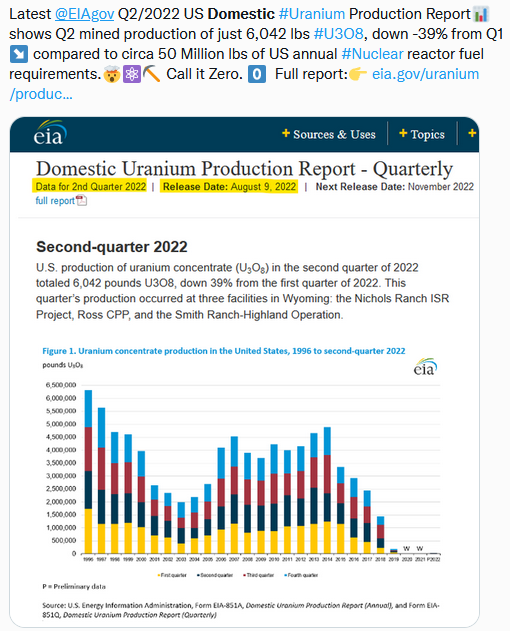

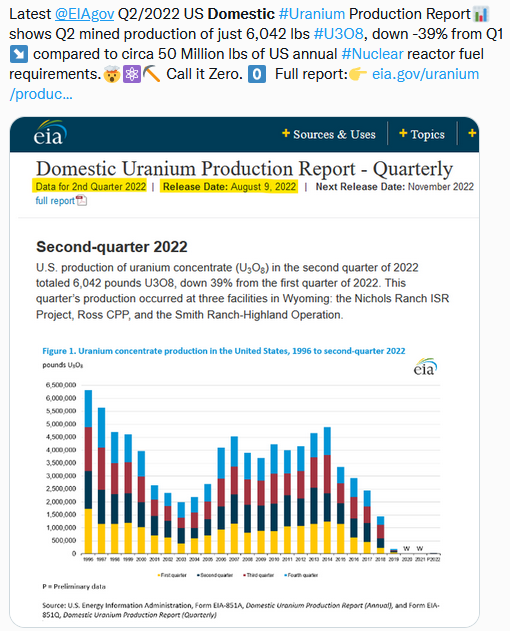

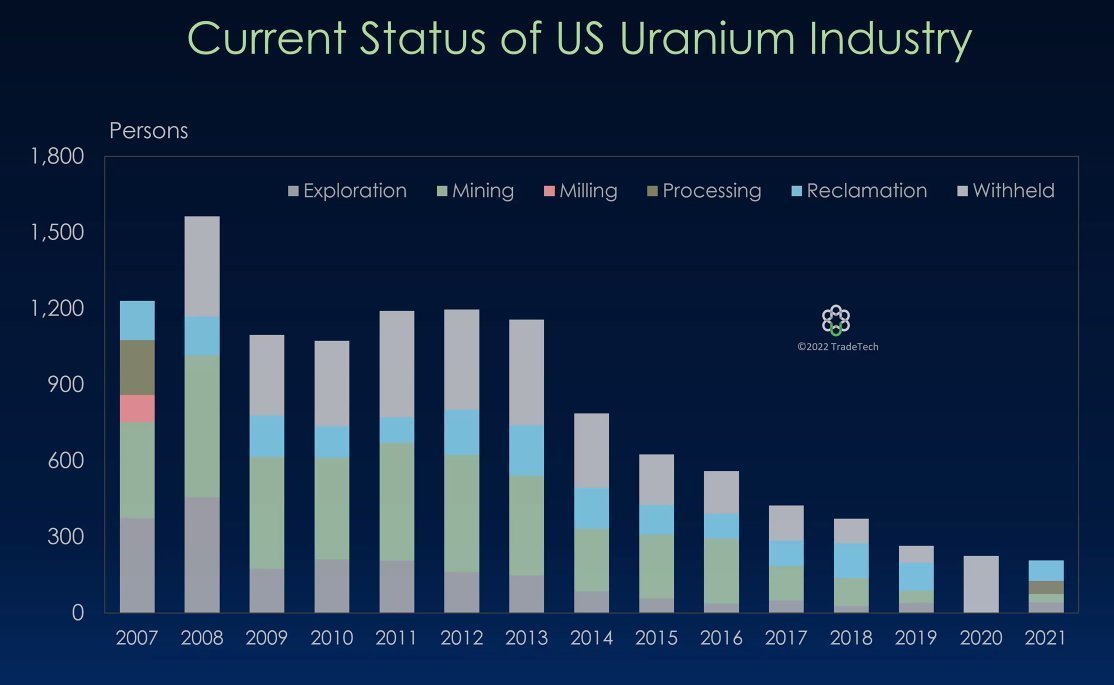

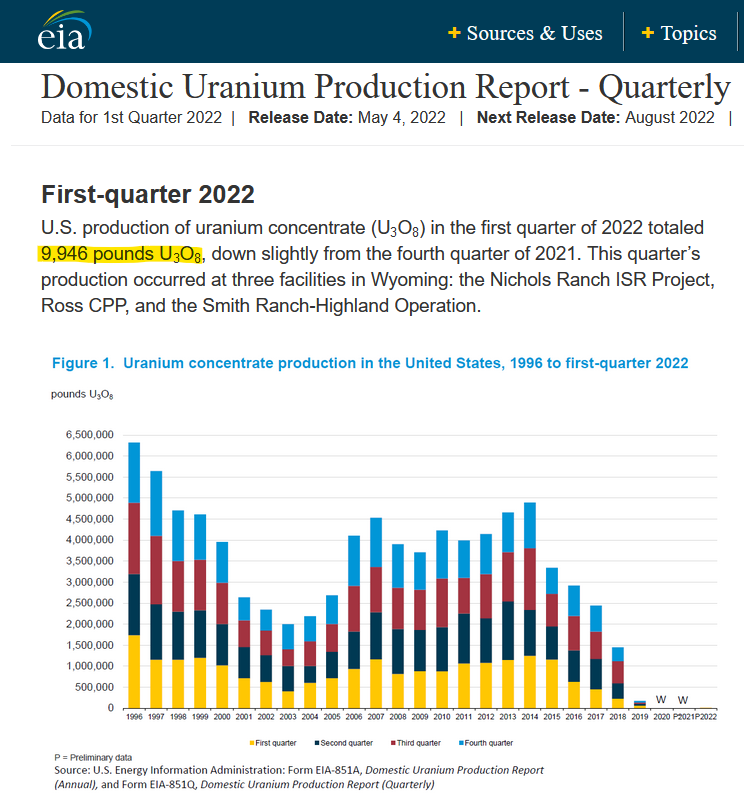

1/10) Prior to last week's #Uranium sector retreat😱 #Nuclear fuel consultants UxC & TradeTech forecasted deep multi-year U supply deficits with 200M lbs demand vs 135M lbs mined #U3O8 supply + 25M lbs of Secondary Supply that will be dropping due to pivot from #Russia⚠️ A🧵4U👇2

2) World #Nuclear Association was reporting 439 operable reactors (392 GW) + 56 more under construction (62GW)⚛️🏗️ with 26 expected to come online this year & next.⚡️🌞 96 more in advanced planning/ordered + 325 proposed🧾 for projected +2.6%/yr growth rate↗️🏗️🤠🐂 #Uranium🧵👇3

3) On Monday #Pakistan announced that a new 1100MW 'Hualong One' #Nuclear reactor built with #China had begun commercial operation⚛️⚡️ which will consume circa 0.5Million lbs of #U3O8 #Uranium per year delivering #CarbonFree #electricity for the next 60+ years.🌞🇵🇰⛏️🤠🐂 🧵👇4

Why has a Western pivot away from #Russia's #Uranium🇷🇺⚛️⛏️⛔️ triggered a chain reaction💥 of higher prices down the #Nuclear fuel cycle from enrichment SWU to conversion?🚀 Let me try to explain in a thread that lays out why #U3O8 & U #stocks are dominoes next in line.⏸️↗️➡️👇2

1) I see @BambroughKevin is saying we could see #Uranium prices skyrocket "2x-3x in just a couple of weeks as #USA is poised to ban Russian uranium".🤯 While impossible to accurately predict "how high"🌜🪐 here's a thread on why U prices would spike on a US/EU or Russian ban.👇2

1) Long before #Russia, world's main enriched #Uranium supplier, sent shock waves thru #Nuclear fuel markets😱 by invading #Ukraine🪖 mined #U3O8 was already in a sustained deficit⬇️⛏️ with demand for #CarbonFree Nuclear surging.⬆️🏗️⚛️ A Uranium #investing thesis thread 4U🤠🐂👇2

1) #Uranium underfeeding/overfeeding🍼👶 what the heck is that?🤔 I'll try to explain in a thread that eliminates as much complexity as possible using a "Vending Machine" as a way to keep it plain & simple 😀🧵⬇️2