Discover and read the best of Twitter Threads about #containership

Most recents (3)

Think Different- in #shipping. A case study rvw 🧵.

We published our first public bullish report on #containership #shipping 2 yrs ago.

Our picks: +386% after 2y, *after* including the big pullback in mid-2022 (1y returns even higher!).

Report: seekingalpha.com/article/437598…

1/6

We published our first public bullish report on #containership #shipping 2 yrs ago.

Our picks: +386% after 2y, *after* including the big pullback in mid-2022 (1y returns even higher!).

Report: seekingalpha.com/article/437598…

1/6

After patiently accumulating #shipping during the 2020 carnage, we shared a conviction sector alert in August 2020 with 5 diversified picks.

This call was *NOT* popular at the time.

+224% in 25 months after after weak trading this summer.

Report: seekingalpha.com/article/436830…

2/6

This call was *NOT* popular at the time.

+224% in 25 months after after weak trading this summer.

Report: seekingalpha.com/article/436830…

2/6

More recently, our exclusive #shipping #research focus shifted to #tankers, where we issued a buy report on 31 January 2022 due to skewed negative sentiment and lopsided risk/reward.

Very few talking tankers back then!

+153% in 8 months.

Report: dropbox.com/s/0ahcpflu74xa…

3/6

Very few talking tankers back then!

+153% in 8 months.

Report: dropbox.com/s/0ahcpflu74xa…

3/6

1 of 5

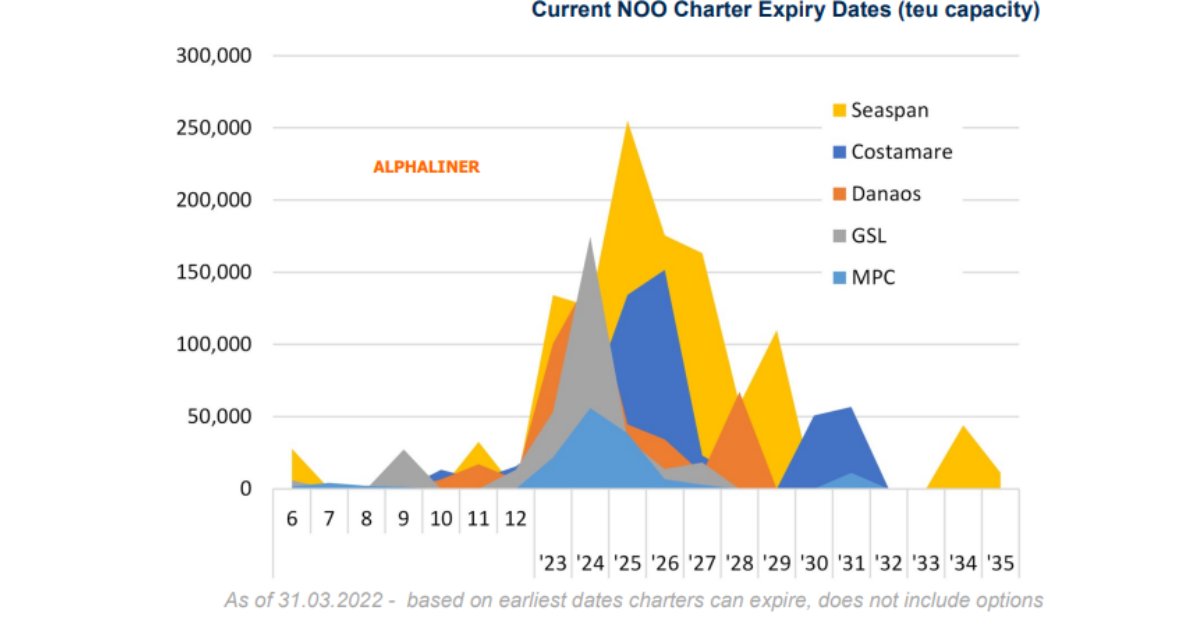

Peak in charter expirations moves to 2025 as non-operating owners lock in more long-term deals

Peak in charter expirations moves to 2025 as non-operating owners lock in more long-term deals

With #containership rates chugging along and $DAC completing a massive #buyback, I thought I'd take a look at their charter book. Nearly half their charters expire in 2H20, meaning they have fair exposure to the improving rates.