Discover and read the best of Twitter Threads about #drybulk

Most recents (21)

1/

In shipping money is made by finding cheap optionality. It’s an inefficient market that on occasions give you great opportunities.

For me the greatest optionality is now to be found in #drybulk equities.

In shipping money is made by finding cheap optionality. It’s an inefficient market that on occasions give you great opportunities.

For me the greatest optionality is now to be found in #drybulk equities.

2/

Let’s take a look at $gogl. As reported in their previous presentation, they are currently making $8k more than index rates due to premium fleet and scrubber. With a cash break even of 11700 the company only need $4k index rates to survive another day.

Let’s take a look at $gogl. As reported in their previous presentation, they are currently making $8k more than index rates due to premium fleet and scrubber. With a cash break even of 11700 the company only need $4k index rates to survive another day.

3/

Compare that to a forward curve well above 16k/d in 2024 and 2025. Some would argue these forward rates are not sexy, but you are missing the point. With a record low order book and increasing regulations you should not be investing in the sector to collect 10-15% div.

Compare that to a forward curve well above 16k/d in 2024 and 2025. Some would argue these forward rates are not sexy, but you are missing the point. With a record low order book and increasing regulations you should not be investing in the sector to collect 10-15% div.

#Drybulk Thread:

1)

Drybulk is currently showing signs of a beautiful generational setup. With macro volatility increasing rapidly, there is no saying where equities might trade in the next couple of weeks, but this is the time to be prepared.

1)

Drybulk is currently showing signs of a beautiful generational setup. With macro volatility increasing rapidly, there is no saying where equities might trade in the next couple of weeks, but this is the time to be prepared.

2)

Before I lay out the bull case I think it's worth looking back at 2020-2022. I would argue this whole period should be written off as a "one off."

2020 was the beginning of COVID. World shut down. Rates went to zero in Feb and Mar.

Before I lay out the bull case I think it's worth looking back at 2020-2022. I would argue this whole period should be written off as a "one off."

2020 was the beginning of COVID. World shut down. Rates went to zero in Feb and Mar.

3)

2021 everything turned. Congestion and covid inefficiencies reduced supply substantially and rates 🚀.

2022 was the "Chinese lockdown" combined with a crash in Chinese real estate and Vale declining production. So lets look at 2019...This was when the real recovery started.

2021 everything turned. Congestion and covid inefficiencies reduced supply substantially and rates 🚀.

2022 was the "Chinese lockdown" combined with a crash in Chinese real estate and Vale declining production. So lets look at 2019...This was when the real recovery started.

1/ 2022 is on pace to see the lowest level of ship demolition since 2008.

This is into a global merchant fleet that has more than doubled in size over the same period.

High rates have ships out trading longer which means the fleet is getting older... for now.

This is into a global merchant fleet that has more than doubled in size over the same period.

High rates have ships out trading longer which means the fleet is getting older... for now.

2/ Although high shipping rates are likely to keep demolition muted for the balance of 2022, at some point this trend will need to reverse as 22% of the global fleet is now over 15 years old.

3/ Very few of these ships over 15 years old will comply with new IMO carbon efficiency regulations take effect January 1 2023. Costs to retrofit are prohibitive and are likely to result in early retirement of older ships even with high rates.

splash247.com/less-than-25-o…

splash247.com/less-than-25-o…

@kuppy is back in tankers.

🧵

"I think there is more [upside] to be had there. No new supply coming, or negligible, low inventories for refined product around the world, Russia is not supplying refined product, it has to come from further away, it's coming from the MEG, the USG"

🧵

"I think there is more [upside] to be had there. No new supply coming, or negligible, low inventories for refined product around the world, Russia is not supplying refined product, it has to come from further away, it's coming from the MEG, the USG"

"It's leading to much longer voyages [ie more tonne-miles] and also you're having a lot of inter-basin arbitrage. Clean rates, especially on MR's, have gone to decade highs. I think they're gonna stay here for a while, because there's really no deliveries expected for 2023,"

"2022-23 are in the bag in terms of what orderbook looks like. So unless they start ordering, and even then it's [20]24 before new supply comes, meanwhile refined product inventories keep drawing down every month, people start scrambling for inventory."

Updated global fleet age and replacement requirements courtesy of the latest Danish Ship Finance report.

We are going to be hearing a lot more about negative fleet growth in #tankers and #drybulk in the coming years. Strap in for higher rates 🚀

We are going to be hearing a lot more about negative fleet growth in #tankers and #drybulk in the coming years. Strap in for higher rates 🚀

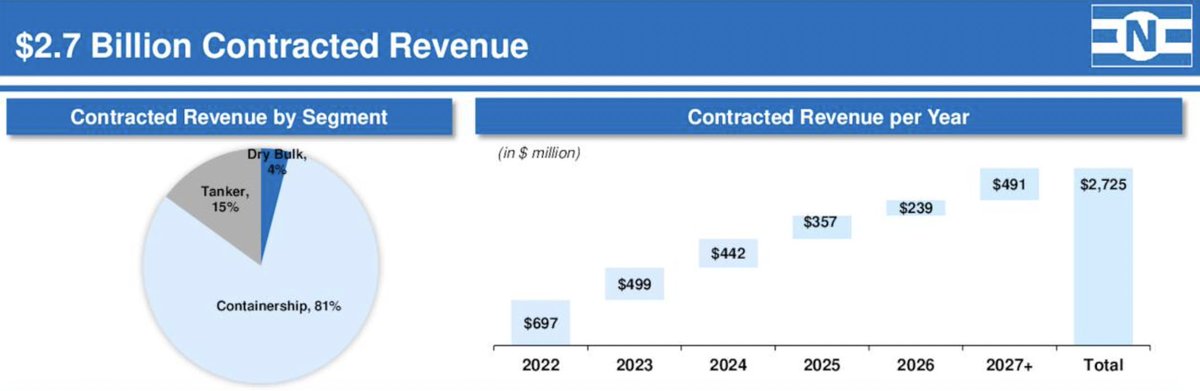

1/ Time for a check-in on $NMM

With clean product tanker rates surging I have seen a lot of enthusiasm and speculation about what this means for EPS going forward.

Updated my model with the latest charters from 20-F and ran a spot rate sensitivity on remaining open/index days:

With clean product tanker rates surging I have seen a lot of enthusiasm and speculation about what this means for EPS going forward.

Updated my model with the latest charters from 20-F and ran a spot rate sensitivity on remaining open/index days:

2/ Unfortunately most of $NMM's product tanker fleet is already fixed for Q2, gradually rolling off charter throughout the rest of the year and into 2023.

It seems more likely to be a tailwind to an already huge contract backlog in containers and strong expectations in drybulk.

It seems more likely to be a tailwind to an already huge contract backlog in containers and strong expectations in drybulk.

3/ Personally I am expecting around $16 EPS and $700M of operating cash flow for 2022 with the way markets are shaping up.

This puts year end net debt and capital leases at around $900M and EV at around $1.8B

This puts year end net debt and capital leases at around $900M and EV at around $1.8B

1/ Below is a 20y chart of oil prices and the Baltic Dry Index.

Aside from being economically sensitive, there are a number of other reasons the two follow each other quite closely.

🧵

Aside from being economically sensitive, there are a number of other reasons the two follow each other quite closely.

🧵

2/ As the oil price rises, ships slow down to achieve better fuel economy and save on fuel costs.

In a high oil price environment, ships will slow until the lowest total cost of operation is found.

This slowing reduces effective capacity and causes charter rates to rise.

In a high oil price environment, ships will slow until the lowest total cost of operation is found.

This slowing reduces effective capacity and causes charter rates to rise.

3/ Both ships and oil also tend to follow the same investment cycle where a boom of investment leads to a supply glut, ensuing bust, and a long period of under-investment which sets up for another period of high rates. Rinse, repeat.

1/ I'm going to pound the table a bit more about and show that shipbuilding capacity is insufficient to replace scrapping let alone accommodate trade volume growth.

But this time we will look at the global aggregate merchant fleet including all sectors.

🧵...

But this time we will look at the global aggregate merchant fleet including all sectors.

🧵...

1/ 15 months ago I penned an article entitled "Welcome to the New Container Shipping Supercycle" questioning the premises of popular conceptions of supply and demand at the time.

Some reflections on what I got right and what I got wrong.

A 🧵...

seekingalpha.com/article/439810…

Some reflections on what I got right and what I got wrong.

A 🧵...

seekingalpha.com/article/439810…

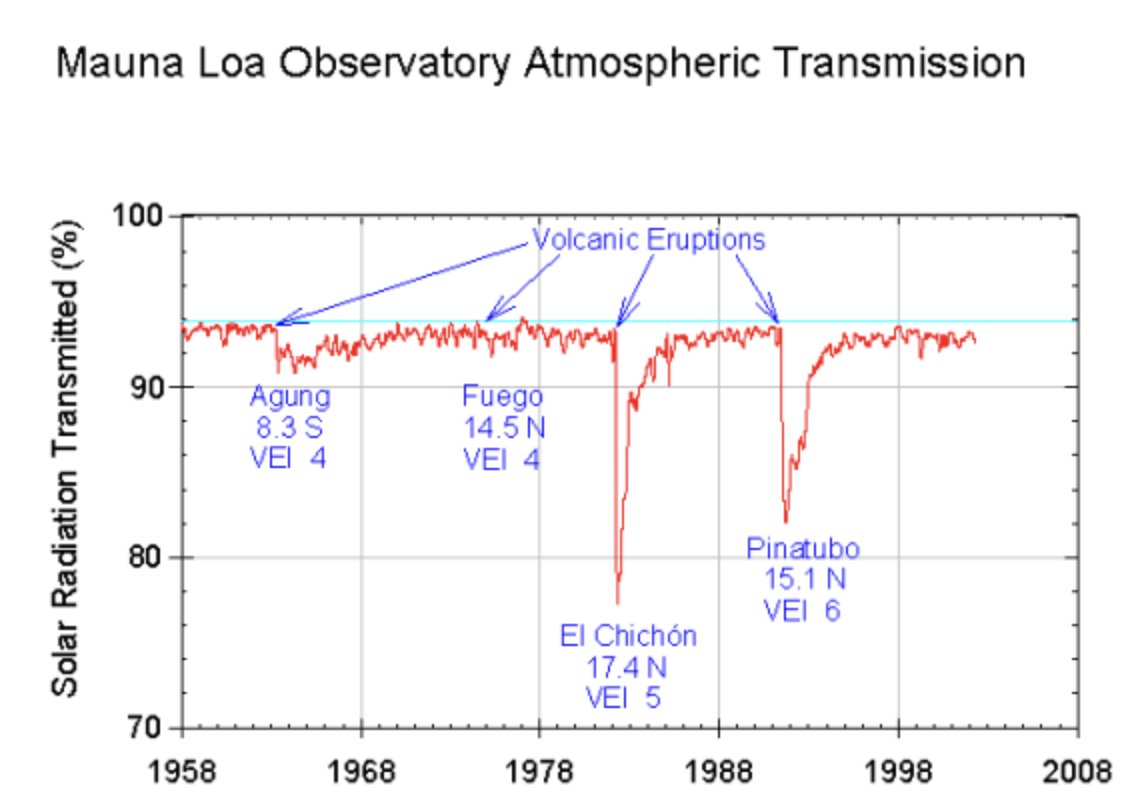

1/ Early indications point to #HungaTonga eruption being comparable in size to the largest eruption in the last century: Mt. Pinatubo in Philippines.

If this is in fact the case, it is likely to have major implications for climate, weather, and markets in coming years.

A 🧵...

If this is in fact the case, it is likely to have major implications for climate, weather, and markets in coming years.

A 🧵...

2/ Leaning on data collected after the Pinatubo eruption in 1991 as the closest modern proxy, we can make some make some reasonable predictions on what impact #HungaTonga may have:

The huge amount of reflective ash released from Pinatubo caused significant global cooling:

The huge amount of reflective ash released from Pinatubo caused significant global cooling:

Finally had a chance to dig into $grin (Grindrod Shipping) financials for Q3.

If you are an investor and haven't read it yet, I highly recommend it. The format and info is different than Q2. Here's what I found interesting...

1/N

If you are an investor and haven't read it yet, I highly recommend it. The format and info is different than Q2. Here's what I found interesting...

1/N

Time to discuss the ugly cousin of 2021.

The cheapest, most attractive risk/reward part of the freight world.

The best value that I see in the whole commodity spectrum(apols #uranium clan).

You might have already guessed it; it’s finally time to talk abt #tankers #OOTT 1/n

The cheapest, most attractive risk/reward part of the freight world.

The best value that I see in the whole commodity spectrum(apols #uranium clan).

You might have already guessed it; it’s finally time to talk abt #tankers #OOTT 1/n

had to keep on producing, floating storage was the only solution leading to a majestic surge in freight rates. As lockdowns eased, floating storage was no longer needed, thus supply came back online while demand was nowhere near 2019 levels. Naturally the mkt collapsed. 3/n

Global shipping fleet in perspective thanks to UNCTAD. New ship order books for #tankers and #drybulk are at decade lows, yet shipyards are full through 2023-end with orders from other sectors. Sure looks like a massive shortage of aggregate shipbuilding capacity coming 2024+

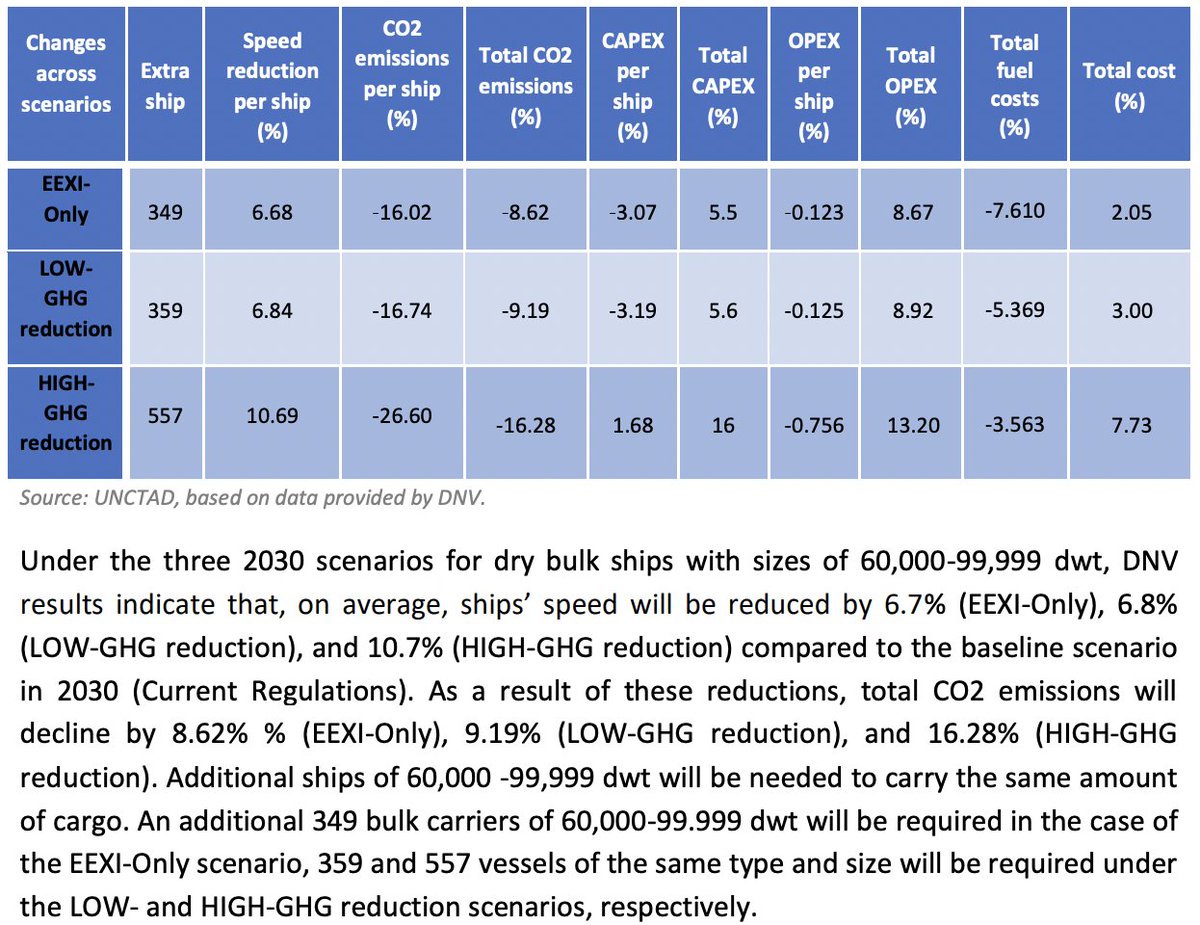

Even with the very weak current IMO regulations, UNCTAD expects the fleet to slow by 6.7% this decade. An extra ~1% of new ship capacity per year will be needed to offset in addition to ~2% per year to replace old ships. Compare this to a #drybulk orderbook of just 5.6% today.

#Drybulk demand grew at a CAGR of 4.7% per year since China was admitted to the WTO. Even if this slows SIGNIFICANTLY to 2.5%, this means to maintain the very tight supply/demand balance we see today, we will need 5%+ of new ship capacity to deliver each year this decade.

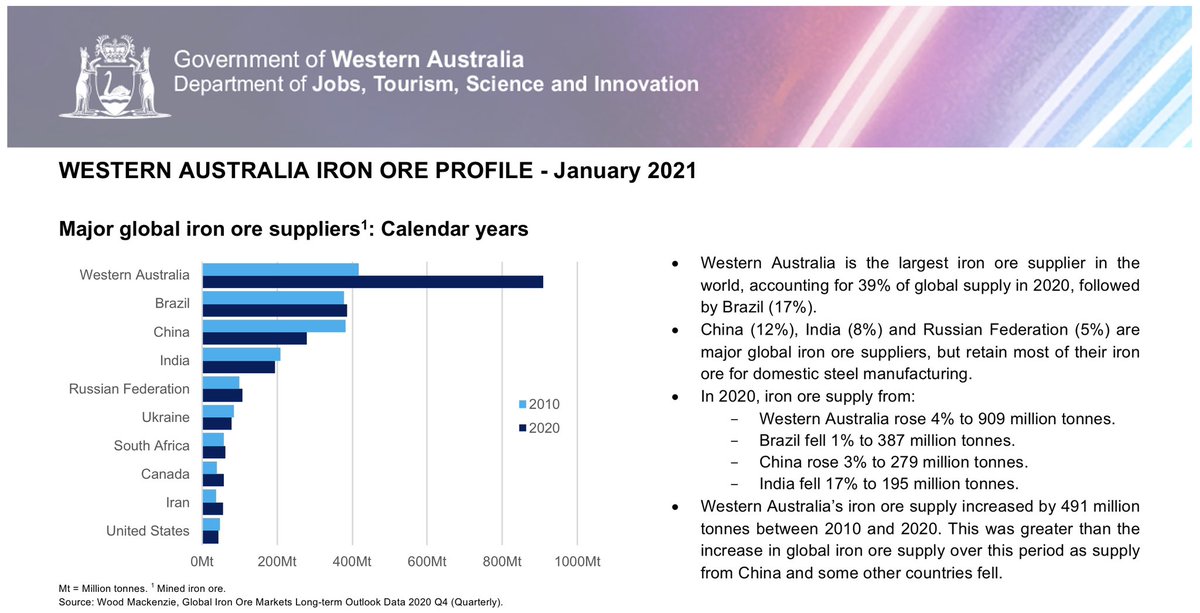

1/ ESG will be a huge tailwind for commodity trade in the coming years. Higher quality ores take significantly less energy to smelt. High quality supplies from further afield will replace lower quality supplies closer to production centers requiring far more #drybulk ton miles

Where are we in the #drybulk cycle?

Note: Baltic Dry Index reflects freight rates evolution in aggregate (routes and vessel types) for the Dry Bulk shipping sector. It’s expressed in points. A long-time perspective allows us to see the different cycles and how cyclical it is.

Note: Baltic Dry Index reflects freight rates evolution in aggregate (routes and vessel types) for the Dry Bulk shipping sector. It’s expressed in points. A long-time perspective allows us to see the different cycles and how cyclical it is.

In Feb 2016, BDI reached its lowest point ever, 291 points (huge imbalance between available vessels and cargo demand). Since that moment there has been a sustained recovery, temporarily interrupted by:

❌ 2019: iron ore supply shock (Brumadinho dam collapse).

❌ 2020: covid-19.

❌ 2019: iron ore supply shock (Brumadinho dam collapse).

❌ 2020: covid-19.

1/8

As we move closer to EEXI and other regulations we will see different narratives emerge. Many think non-eco ships will be useless overnight.

So what are the risks when buying a non-eco 2010 blt Kamsarmax today?

Let's take a look at the fleet in more depth.

#drybulk #EEXI

As we move closer to EEXI and other regulations we will see different narratives emerge. Many think non-eco ships will be useless overnight.

So what are the risks when buying a non-eco 2010 blt Kamsarmax today?

Let's take a look at the fleet in more depth.

#drybulk #EEXI

2/8

Capesize/Newcastlemax/VLOC:

The total number of Capesize+ vessels in the world is 1860.

177 are built 2005 or older. = 9.5% of the fleet.

1124 are built before 2013 = 60% of the fleet.

After 2013 we saw improved energy efficiency and they are often referred to as Eco.

Capesize/Newcastlemax/VLOC:

The total number of Capesize+ vessels in the world is 1860.

177 are built 2005 or older. = 9.5% of the fleet.

1124 are built before 2013 = 60% of the fleet.

After 2013 we saw improved energy efficiency and they are often referred to as Eco.

3/8

Panamax/Kamsarmax:

The totalt number of Panamax/Kamsarmax vessels in the world is 2855.

626 are built 2005 or older = 22% of the fleet

1727 are built before 2013 = 60% of the fleet

Panamax/Kamsarmax:

The totalt number of Panamax/Kamsarmax vessels in the world is 2855.

626 are built 2005 or older = 22% of the fleet

1727 are built before 2013 = 60% of the fleet

1/

I know I spam twitter with bullish tweets about #drybulk. There's a reason why I'm pounding table on this one. This might be the only(!) chance you will get in your life time to participate in a mega cycle. Remember, it's 18 years since the last one started.

I know I spam twitter with bullish tweets about #drybulk. There's a reason why I'm pounding table on this one. This might be the only(!) chance you will get in your life time to participate in a mega cycle. Remember, it's 18 years since the last one started.

2/

Let's start with the demand side.

There's two drivers of demand. Demand for the commodity and supply of the commodity. Infinite demand for iron ore doesn't help if there's no supply to put on ships. But they are connected. ---

Let's start with the demand side.

There's two drivers of demand. Demand for the commodity and supply of the commodity. Infinite demand for iron ore doesn't help if there's no supply to put on ships. But they are connected. ---

I invite you to read my inaugural survey of operating costs In #DryCargo #Shipping. I have ranked six publicly-traded companies.

#drybulk $DSX $EGLE $GNK $SALT $SB $SBLK

seekingalpha.com/article/436971…

#drybulk $DSX $EGLE $GNK $SALT $SB $SBLK

seekingalpha.com/article/436971…

Ok, couple of thoughts on #tankers noise. Here we go:

Bullish thesis:

1) contango for longer. Obviously dead now, no if and but. Dead. If it reappears it'll be a whole new case, for a bunch of different reasons.

2) supply/demand. Nonsense.

Bullish thesis:

1) contango for longer. Obviously dead now, no if and but. Dead. If it reappears it'll be a whole new case, for a bunch of different reasons.

2) supply/demand. Nonsense.

Supply is rising, demand is falling that's a reality. No matter how slow supply is rising when demand is peaked and then falling (secular!) this is a bad combination. Wanna proof? #drybulk. Ok, but how about scrapping?

3) first of all. You need rates to fall below OPEC for some

3) first of all. You need rates to fall below OPEC for some

time and kind of a short-term hopeless consensus to kick this cycle, which is not a good position to be in from shareholders perspective. Secondly it'll take time and has to overcome the supply so that the whole tonnage really starts to contract, not just offsets increase.