Discover and read the best of Twitter Threads about #moneysupply

Most recents (5)

🚨Breaking News: ₹2000 denomination banknote is set to be withdrawn.

However, these notes will retain their status as legal tender.

Let's understand what's going on in a simple way 👇

#2000rs #2000notes #rbi

However, these notes will retain their status as legal tender.

Let's understand what's going on in a simple way 👇

#2000rs #2000notes #rbi

Q. What was the objective of ₹2000 banknotes?

A. The ₹2000 denomination banknotes were introduced in 2016 to address the currency requirement following the withdrawal of ₹500 and ₹1000 banknotes.

Printing of these notes stopped in 2018-19 as the objective was fulfilled.

A. The ₹2000 denomination banknotes were introduced in 2016 to address the currency requirement following the withdrawal of ₹500 and ₹1000 banknotes.

Printing of these notes stopped in 2018-19 as the objective was fulfilled.

Q. Why are ₹2000 denomination banknotes being withdrawn?

A. Most of the ₹2000 notes were issued before March 2017 and have reached their estimated lifespan.

The decision has been made considering these factors and the RBI's Clean Note Policy.

#RBI #moneysupply

A. Most of the ₹2000 notes were issued before March 2017 and have reached their estimated lifespan.

The decision has been made considering these factors and the RBI's Clean Note Policy.

#RBI #moneysupply

Thanks to @GeoffCutmore & @steve_sedgwick for the chat on #SquawkBox this morning!

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

First of all, it's #ValentinesDay and SOMEONE is going to get massacred today when the #CPI is released, so naturally:-

2/x

2/x

Roses are red, violets are blue,

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

Thanks to @steve_sedgwick & @cnbcKaren for having me on #CNBC #SquawkBox this AM.

What did we discuss? Well, #inflation of course!

I prepared some slides for the show which I'm happy to present in this thread.

1/n

#macro #Fed #Yellen #JeromePowell #bankofengland #QE

What did we discuss? Well, #inflation of course!

I prepared some slides for the show which I'm happy to present in this thread.

1/n

#macro #Fed #Yellen #JeromePowell #bankofengland #QE

Are people in denial or is the #centralbank money flood just drowning all the signals?

2/n

#inflation

2/n

#inflation

#Commodities, #freight, #carbon - and a whole lot besides - sure do cost a lot more, these days.

3/n

3/n

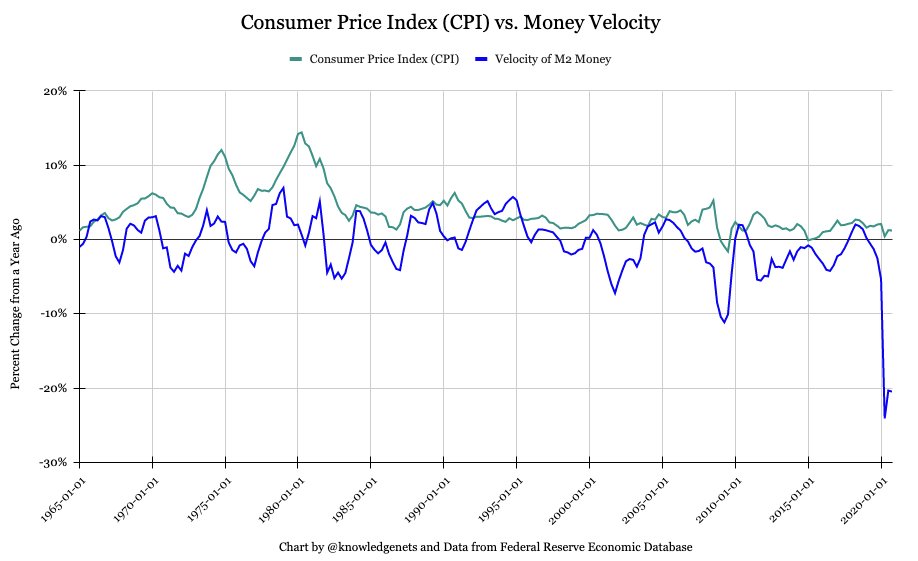

Given the rising concerns and thoughts about the links between expansionary monetary policy, money supply, and inflation, I wanted to share a few opinions on the topic of inflation and the velocity of money:

#inflation #deflation #moneysupply #economics

#inflation #deflation #moneysupply #economics

1) M2 money supply is up about 25% from last year’s levels, which indicates both the massive money creation and the high degree of expansionary monetary policy that was needed to help stabilize America’s economy and financial markets after the outbreak of the coronavirus crisis.