Discover and read the best of Twitter Threads about #CPI

Most recents (24)

🇬🇧 UK May Inflation Soars

Headline (+8.7% YoY) and core (+7.1% YoY) beat consensus expectations by +0.3ppt.

As a result, the May MPR forecasts are looking very stale.

Let's dig in!

One (of a couple) 🧵s I'll be putting on BoE/monetary policy...

#CPI #inflation #BoE

Headline (+8.7% YoY) and core (+7.1% YoY) beat consensus expectations by +0.3ppt.

As a result, the May MPR forecasts are looking very stale.

Let's dig in!

One (of a couple) 🧵s I'll be putting on BoE/monetary policy...

#CPI #inflation #BoE

CPI Preview vs Realized CPI

1. #CPI data came out largely in line with our expectations. Our expectations were for a print of 0.17%, while the print came in at 0.10%. Below, we show the composition of our estimates relative to the realized print:

1. #CPI data came out largely in line with our expectations. Our expectations were for a print of 0.17%, while the print came in at 0.10%. Below, we show the composition of our estimates relative to the realized print:

2. Our pre-view note mentioned two factors we would be watching out for. First, we were looking to see whether #motor vehicle inflation remains persistent.

3. Given the industry dynamics we monitor, there was a potential for new cars to see deflation as manufacturing productions alleviate some degree of supply shortages. Nonetheless, #used car inflation likely showed significant potential to re-accelerate this month.

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

Today’s #CPI report for May showed another very firm depiction of where #inflation currently resides in the U.S., with #coreCPI (excluding volatile food and energy components) printing at 0.44% month-over-month and 5.33% year-over-year.

Meanwhile, #headlineCPI data printed 0.12% month-over-month and came in just above 4% year-over-year, with declines in #energy components and some food prices being offset by gains in #shelter and used cars and trucks.

Overall, headline #inflation does appear to be moderating at a faster pace and we believe that the trend in inflation (despite the firmness of core measures in today’s report) is broadly heading in the right direction, relative to the @federalreserve’s inflation target.

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this… twitter.com/i/web/status/1…

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this… twitter.com/i/web/status/1…

May 3-4 #FOMC Example: 2PM initial reaction red and went lower and started consolidate then the circle shows 2:30 starts to spike after the fake break down for a $7-$8 MOVE to upside in under 1 HOUR!

July 26-27 #FOMC Example: 2PM initial reaction you see the red higher wick and falls. Then you see at 2:30 fake out again to downside then RIPPED UP for a $14 POINT MOVE IN 1 HOUR.

The Weekly Recap (05.06.23 ~ 10.06.23) 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

1. We started the week by sharing updates on the latest #construction data. Overall, we noted that residential construction spending improved recently, that also flowed into our GDP Nowcast and real GDP estimate.

2. Next, we provided an update on the latest readings from our Market Regime Monitor and the latest Prometheus Trend Signals.

El peso mexicano opera con una apreciación marginal, por momentos cerca de $17.24 spot, en una sesión sin grandes referencias económicas, pero con los bancos centrales tomando decisiones a partir del miércoles

🧵1/9

🧵1/9

El mercado otorga ahora un 25% de posibilidades a que la #ReservaFederal eleve la tasa de interés en 25pbs. Aunque el restante 75% espera la Fed mantengan sin cambios su tasa de fondeo.

2/9

2/9

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

NEXT WEEK

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

NEXT WEEK

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

NEXT WEEK

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

#RBIPolicy | @RBI’s Monetary policy Committee decides to maintain status quo, policy rate (Repo Rate) is unchanged at 6.50%

@RBI @ShereenBhan @latha_venkatesh @_ritusingh @nimeshscnbc @_prashantnair #RBIPolicy | Policy stance is maintained at Withdrawal of Accommodation with MPC voting in favour of this in the ratio of 5:1

@RBI @ShereenBhan @latha_venkatesh @_ritusingh @nimeshscnbc @_prashantnair #RBIPolicy | MSF & Bank rates unchanged at 6.75%

The Weekly Recap 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

1. We started the week with discussing our view ahead for markets. Our systematic view is that we are headed towards a stagflationary recession.

2. Re 1, we further contextualised our view by sharing our systematic updates on inflation & growth.

1/ Die #Inflation ist zuletzt global gefallen und in der letzten Woche in Europa sogar stärker als erwartet.

Dies wird nun teilweise als das Ende der Inflation gefeiert.

Ist das so?

Ein Thread 🧵der meine Sichtweise beschreiben soll.

Dies wird nun teilweise als das Ende der Inflation gefeiert.

Ist das so?

Ein Thread 🧵der meine Sichtweise beschreiben soll.

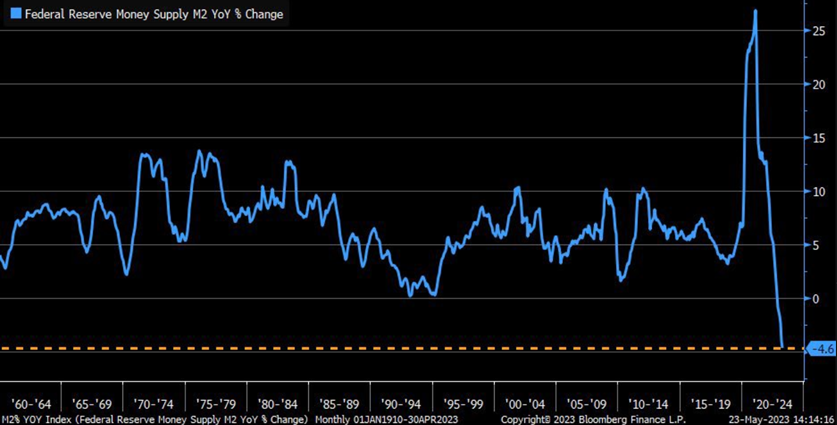

2/ Die fallende Geldmenge ist definitiv ein Argument für eine weiter zurück kommende #Inflation in den kommenden Monaten.

@DiegoFassnacht hat das zuletzt mehrmals angesprochen und erklärt. Vielen Dank!

@DiegoFassnacht hat das zuletzt mehrmals angesprochen und erklärt. Vielen Dank!

3/ Ein weiteres Argument sind die kontinuierlich fallenden Produzentenpreise, die gerne als Vorläufer für den #CPI dienen.

Diesen Zusammenhang verdeutlicht die Graphik von @AndreasSteno eindrucksvoll. Mange tak!

Diesen Zusammenhang verdeutlicht die Graphik von @AndreasSteno eindrucksvoll. Mange tak!

🧵Thread : La qualité vie des libyens, et un aperçu de l'économie libyenne sous Kadhafi,

un article commenté et traduit issu du site Libya SOS

#OTAN #Libye #kadhafi #WarCrimes #WarCriminal #Libya #CPI #Gaddafi

1/?➡️

un article commenté et traduit issu du site Libya SOS

#OTAN #Libye #kadhafi #WarCrimes #WarCriminal #Libya #CPI #Gaddafi

1/?➡️

Quelques informations sur la vie en Libye avec le dirigeant Kadhafi:

1. L'électricité à usage domestique était gratuite

2. Les prêts étaient sans intérêt

3. pendant la période d'étude, le gouvernement donnait à chaque étudiant 2 300 dollars/mois

4. Chacun recevait le

2/? ⤵️

1. L'électricité à usage domestique était gratuite

2. Les prêts étaient sans intérêt

3. pendant la période d'étude, le gouvernement donnait à chaque étudiant 2 300 dollars/mois

4. Chacun recevait le

2/? ⤵️

salaire moyen de la profession étudiée s'il ne trouvait pas d'emploi après l'obtention de son diplôme

5. l'État payait certains travailleurs pour travailler dans certaines professions spécifiques

6. chaque chômeur recevait de l'aide sociale 15 000/an

7. pour les mariages,

3/?⤵️

5. l'État payait certains travailleurs pour travailler dans certaines professions spécifiques

6. chaque chômeur recevait de l'aide sociale 15 000/an

7. pour les mariages,

3/?⤵️

Today’s #CPI report continues to depict #inflation that is just too high for most people’s good, especially the @federalreserve’s.

In fact, the report showed that #inflation remains remarkably sticky, which doesn’t correspond to virtually any practical thinker’s timeline of when it might be expected to start to come down further.

These elevated levels of inflation continue to be remarkably high relative to the many months with which the #economy has now operated with persistently higher #InterestRates.

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

Como dijo también nuestro presidente @lopezobrador_: “Lo mejor es informar con la verdad, la verdad siempre por delante para contrarrestar las campañas de mentiras.”

Reitero nuevamente lo que verdaderamente dice la #NuevaLeyHCTI

➡️ Hilo 1/8

Reitero nuevamente lo que verdaderamente dice la #NuevaLeyHCTI

➡️ Hilo 1/8

1. El @Conacyt_MX se fortalece como Conahcyt, no desaparece.

2. Se garantiza el derecho humano a la ciencia como habilitadora de otros derechos.

➡️2/8

2. Se garantiza el derecho humano a la ciencia como habilitadora de otros derechos.

➡️2/8

3. Estudiantes se benefician; el 100% de las y los aceptados en posgrados públicos tendrán beca directa.

4. Se garantizan #becas directas a especialistas médicos, ingenieros, agrónomos, en TIC, y todas las profesiones prioritarias.

5. Se rescatan los #posgrados públicos.

➡️3/8

4. Se garantizan #becas directas a especialistas médicos, ingenieros, agrónomos, en TIC, y todas las profesiones prioritarias.

5. Se rescatan los #posgrados públicos.

➡️3/8

No se dejen manipular, con mitos sobre la #NuevaLeyHCTI.

1. El @Conacyt_MX se fortalece como Conahcyt, no desaparece.

2. Se garantiza el derecho humano a la ciencia como habilitadora de otros derechos.

➡️1/7

1. El @Conacyt_MX se fortalece como Conahcyt, no desaparece.

2. Se garantiza el derecho humano a la ciencia como habilitadora de otros derechos.

➡️1/7

3. Estudiantes se benefician; el 100% de las y los aceptados en posgrados públicos tendrán beca directa.

4. Se garantizan #becas directas a especialistas médicos, ingenieros, agrónomos, en TIC, y todas las profesiones prioritarias.

5. Se rescatan los #posgrados públicos.

➡️2/7

4. Se garantizan #becas directas a especialistas médicos, ingenieros, agrónomos, en TIC, y todas las profesiones prioritarias.

5. Se rescatan los #posgrados públicos.

➡️2/7

6. Los estudiantes admitidos en posgrados privados también podrán acceder a becas @Conacyt_MX.

7. Colegas investigadores también se benefician, se fortalece el Sistema Nacional de Investigadores (#SNI)

8. Se fortalece el Sistema de Centros Públicos de Investigación (#CPI)

➡️3/7

7. Colegas investigadores también se benefician, se fortalece el Sistema Nacional de Investigadores (#SNI)

8. Se fortalece el Sistema de Centros Públicos de Investigación (#CPI)

➡️3/7

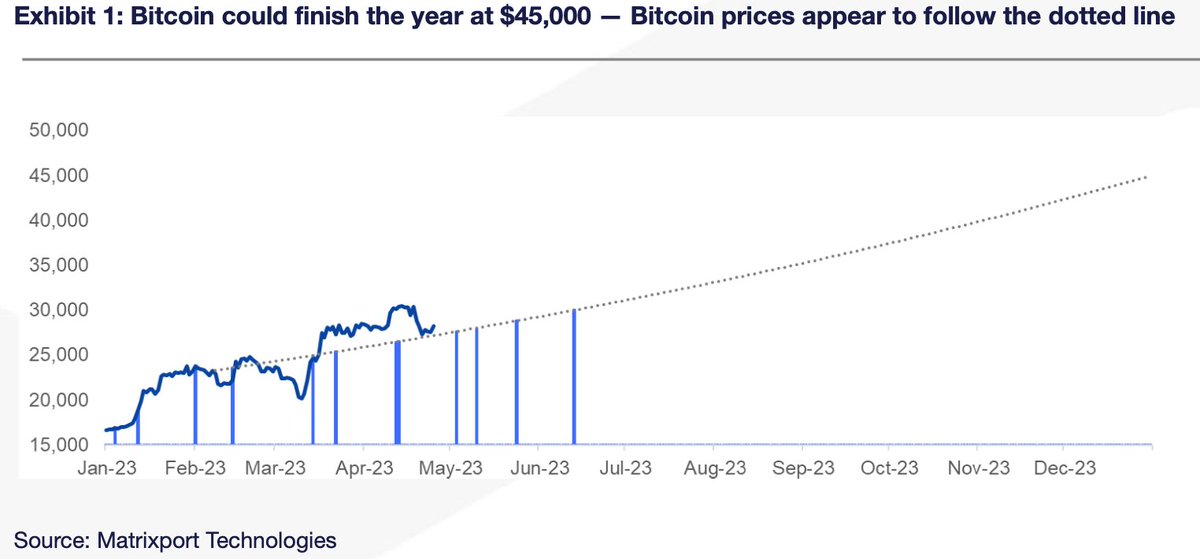

#Bitcoin prices set to reach $45,000 this year, says report - Follow the 'fair value' roadmap for optimal #tradingstrategy ⬇️🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

1/10: Despite recent #volatility, #Bitcoin prices are where they should be according to our #CPI/#FOMC roadmap laid out in Feb.

2/10: Based on the Jan. Effect, #Bitcoin could finish the year around $45k, which seemed optimistic at $22k, but is now achievable.

A short 🧵🪡

1/7

Equity markets remain on a ‘hair trigger’ and today’s wobble probably due to $FRC and regional bank model concerns

👀 on #Fed FOMC 5/3-5/4

- we still expect a ‘dovish’ +25bp

- regional softness one factor

- other is lots of disinflation in pipeline

1/7

Equity markets remain on a ‘hair trigger’ and today’s wobble probably due to $FRC and regional bank model concerns

👀 on #Fed FOMC 5/3-5/4

- we still expect a ‘dovish’ +25bp

- regional softness one factor

- other is lots of disinflation in pipeline

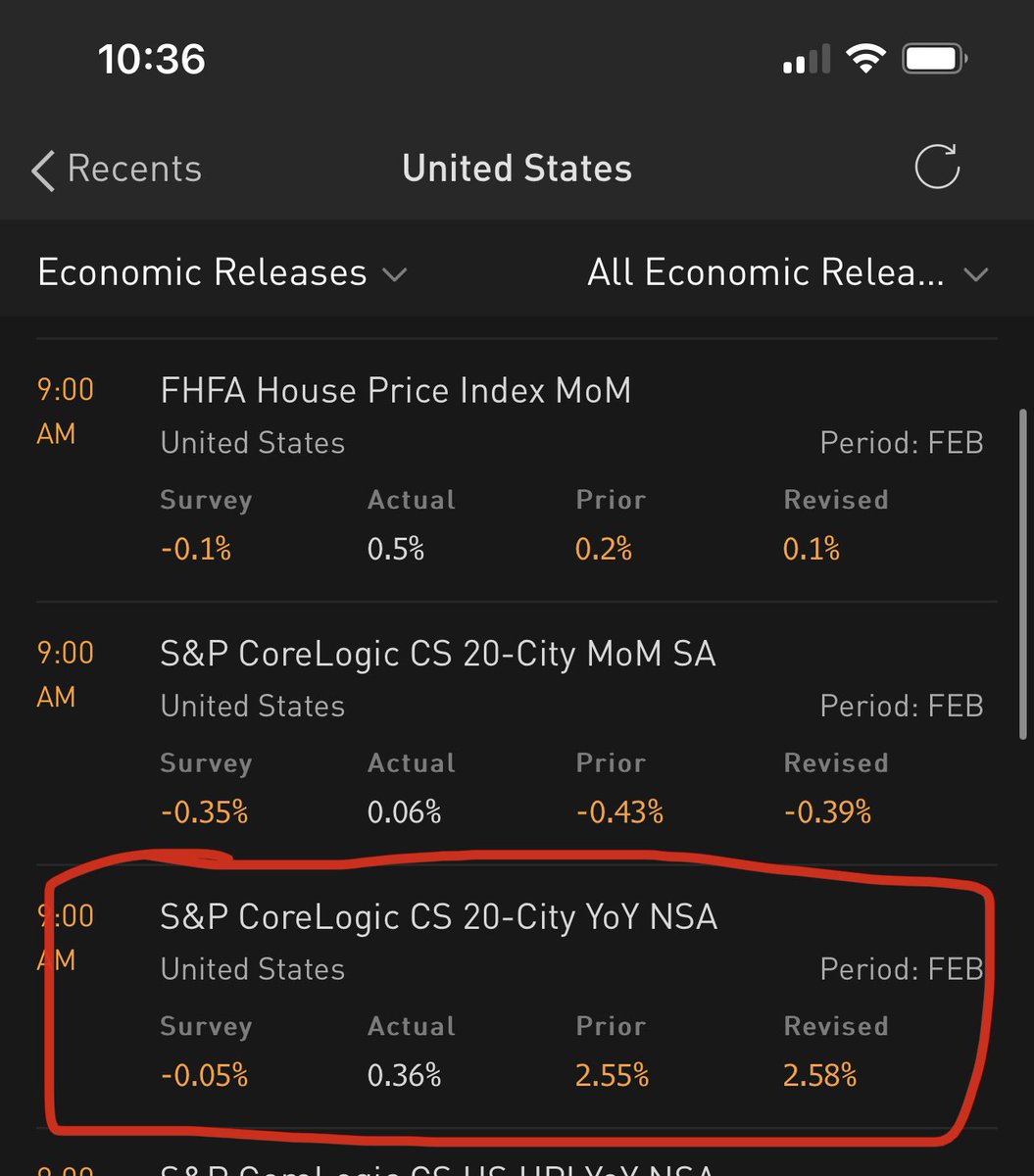

2/7

Case-Shiller showed upside surprise on price (MoM) but arguably as important is home prices went to ZERO YoY

- zero price inflation on homes

- @Redfin rent yoy negative

- Yet, #CPI showing 8.6% yoy gains for housing

CPI lagging real-time measures = disinflation in pipeline

Case-Shiller showed upside surprise on price (MoM) but arguably as important is home prices went to ZERO YoY

- zero price inflation on homes

- @Redfin rent yoy negative

- Yet, #CPI showing 8.6% yoy gains for housing

CPI lagging real-time measures = disinflation in pipeline

Link to 3 (broke somehow)

NEXT WEEK

The Bear's take:

•Upward momentum is lost

•Negative divergences and sell signals from classic indicators

•Big weekly bullish enfulfing candle on $VVIX

•Weekly bearish haramis on major indices

•Inflation is sticky, higher rates coming

• #Recession is here

#ES_F

The Bear's take:

•Upward momentum is lost

•Negative divergences and sell signals from classic indicators

•Big weekly bullish enfulfing candle on $VVIX

•Weekly bearish haramis on major indices

•Inflation is sticky, higher rates coming

• #Recession is here

#ES_F

#WeeklyRecap: Markets Remain Unstable Amidst Encouraging and Concerning Economic Data

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

Mixed data created uncertainty for investors. Inflation may be moderating, but retail sales contraction raises concerns for a potential recession. The Fed may pause its rate hike cycle, which could positively impact the stock market. #Investing #Economy #MarketVolatility

📈 Major benchmarks defy recession concerns, posting weekly gains. DJI up 1.34%, SPX up 1.42%, NDX up 1.18%. #stockmarket #investing

🧵Thread : Assassinat de Mouammar Kadhafi : une opération visant à éliminer le dirigeant libyen, planifiée par l'OTAN

Article traduit et commenté issu du site Libya S.OS - War Diary 2011-12 - 3/12/2011

#OTAN #Libye #kadhafi #WarCrimes #WarCriminal #Libya #CPI #Gaddafi

1/?➡️

Article traduit et commenté issu du site Libya S.OS - War Diary 2011-12 - 3/12/2011

#OTAN #Libye #kadhafi #WarCrimes #WarCriminal #Libya #CPI #Gaddafi

1/?➡️

Il y a quelques jours à peine, la secrétaire d'État américaine, Hillary Clinton, en visite en Libye, avait déclaré: “Nous espérons qu'il [Kadhafi] pourra être capturé ou tué bientôt."Combien de fois avons-nous entendu le ministre des Affaires étrangères d'un pays proclamer

2/?

2/?

que le chef d'un autre devait être éliminé? Un agent français derrière la mort de Kadhafi

Le journal italien Corriere della Serra, a rapporté, citant des sources diplomatiques dans la capitale libyenne Tripoli, qu'un assassin étranger avait tué Kadhafi

corriere.it/esteri/12_sett… 3/?

Le journal italien Corriere della Serra, a rapporté, citant des sources diplomatiques dans la capitale libyenne Tripoli, qu'un assassin étranger avait tué Kadhafi

corriere.it/esteri/12_sett… 3/?

Time to update this chart.

With everything going lately this may be the single most important chart to look at.

What do the latest numbers tell us?

A thread.

#inflation

1/16

With everything going lately this may be the single most important chart to look at.

What do the latest numbers tell us?

A thread.

#inflation

1/16

I made the quoted tweet on Feb 2 which was before Jan employment report, #CPI , #PPI and #PCE when most were still talking about great Dec numbers.

In the meantime most indicators showed higher #inflation numbers but, as I noted beforehand, that is only seasonality.

2/16

In the meantime most indicators showed higher #inflation numbers but, as I noted beforehand, that is only seasonality.

2/16

As I suspected, some took advantage of these seasonality numbers and revisions of SA data (#CPI) to wrongly point to #inflation picking up.

And even worse, the #Fed embraced this false narrative and hiked 25 last week despite the ongoing banking crisis.

3/16

And even worse, the #Fed embraced this false narrative and hiked 25 last week despite the ongoing banking crisis.

3/16