#BTC #Bitcoin

Thread 👇

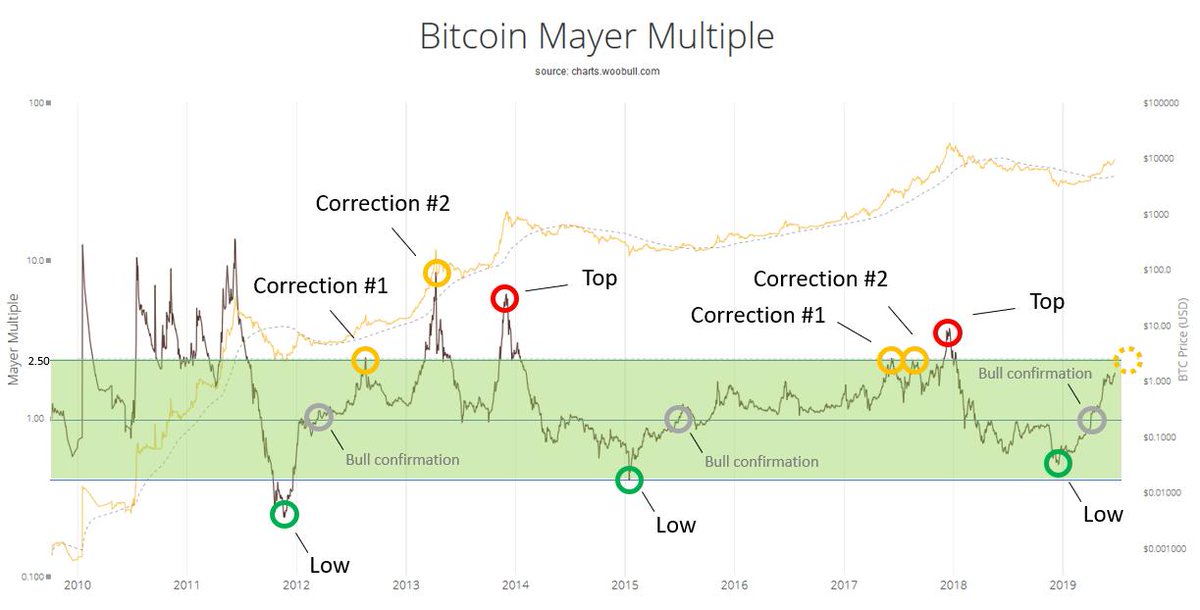

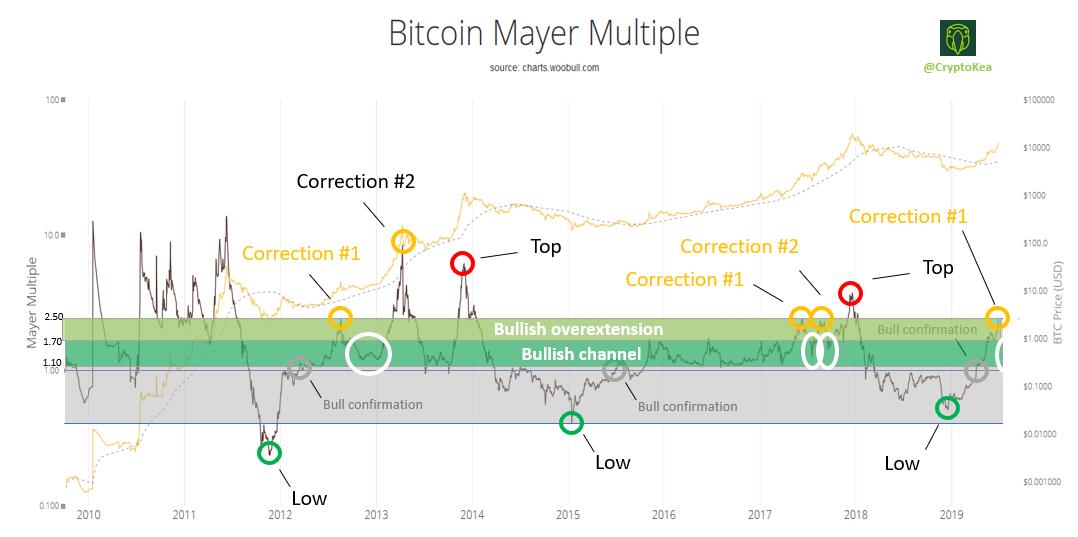

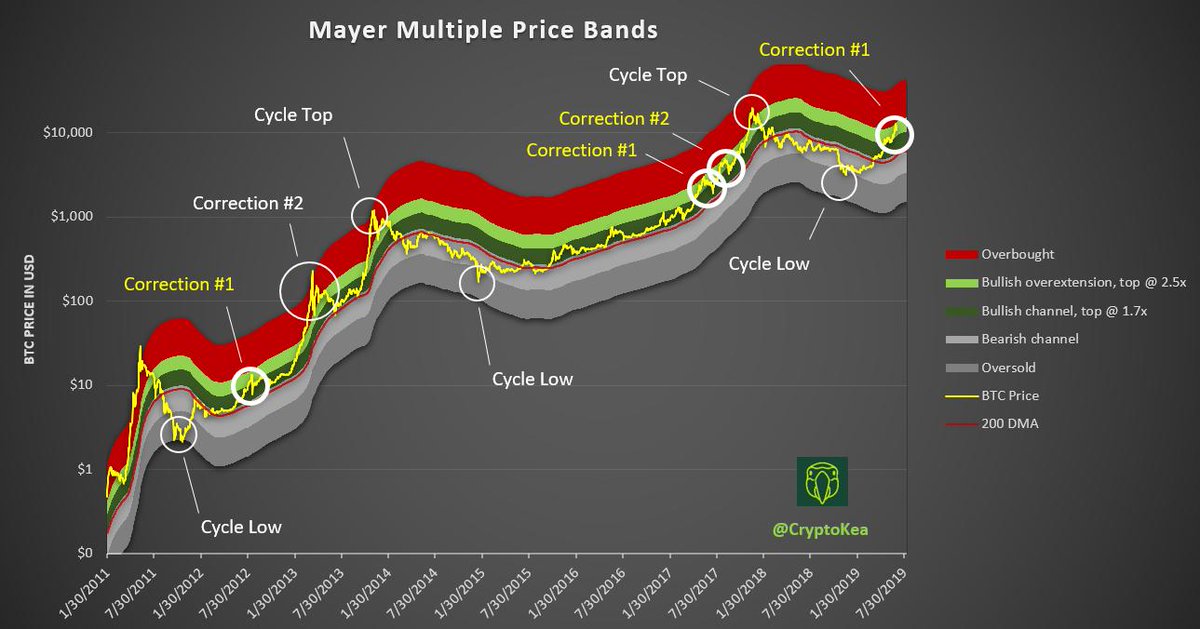

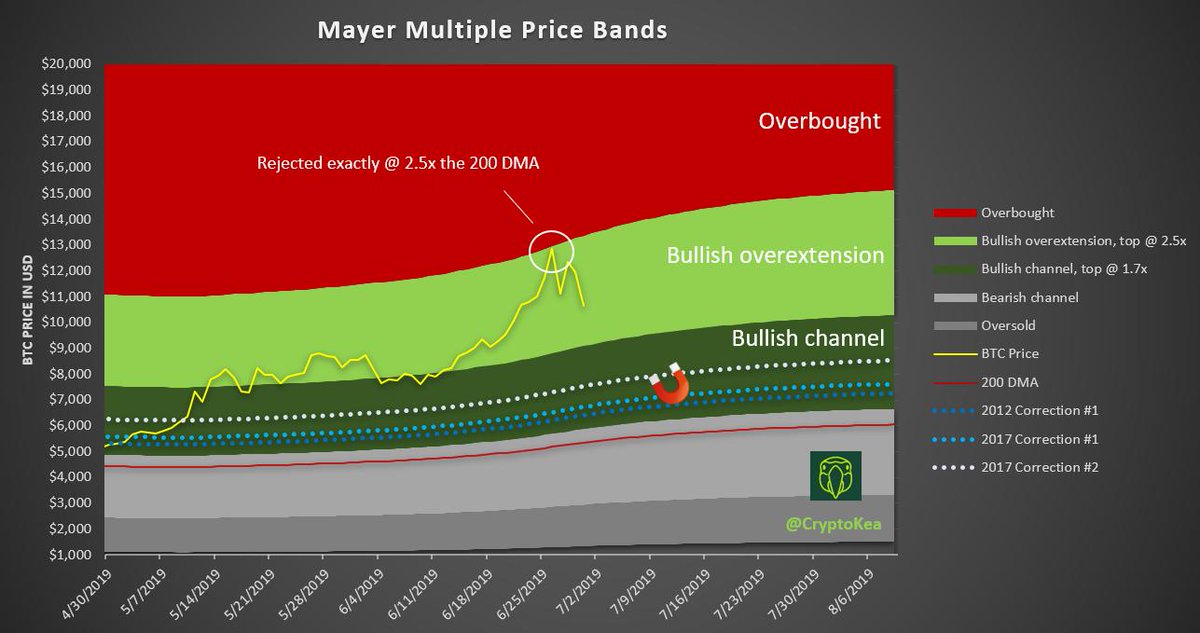

Previous Mayer Multiple signaling and brief explanation of the indicator:

Bullish zone, upper range @ 1.7x (minimum target) = $9,220

2017 Correction #2 @ 1.41x = $7,647

2017 Correction #1 @ 1.26x = $6,833

2012 Correction #1 @ 1.20x = $6,508

The price of #Bitcoin is currently at $11.7k which equals 2x the 200 DMA, slowly getting closer to the first minimum bull

1.7x the 200 DMA (back to bullish zone): $9.891 (minimum)

1.42x the 200 DMA (hitting 2017 correction #2 target): $8.261 (most probable)

1.26x the 200 DMA (hitting 2017 correction #1 target): $7.331